Posted on 05/13/2013 5:08:26 AM PDT by blam

U.S. Economy Staring Into The Abyss! Only Gold Is Worth Buying

Stock-Markets / Financial Markets 2013

May 12, 2013 - 07:38 PM GMT

By: Robert M Williams

"Behind every great fortune there is a crime." - Honore de Balzac (1799-1850)

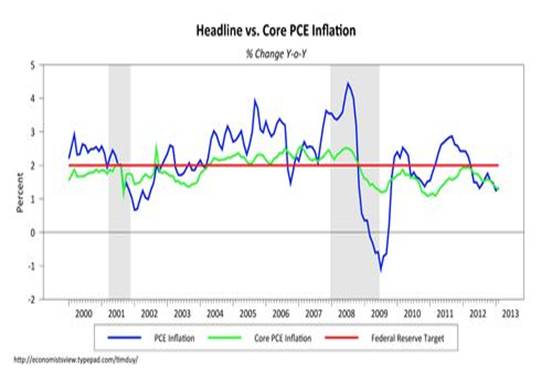

A number of important figures are now talking about the possibility of increasing the US Federal Reserve’s quantitative easing given the “decline in inflation.” In March we heard comments from Fed Presidents Eric Rosengren and Narayana Kocherlakota calling for QE well into 2014 while Chicago Fed President Richard Evens thought the Fed needed to do more. Then in April the St. Louis Fed President James Bullard came out on a number of occasions saying inflationary pressures may be growing too weakly and if they soften further, the central bank may have to boost its asset buying to bring price pressures back up to more desirable levels. They all share one thing in common, they are worried about a decline in the rate of inflation as seen in this chart:

With the Fed's preferred inflation target trending down, these gentlemen think it seems a little silly to start talking about ending the asset purchase program when in fact you might need to increase it.

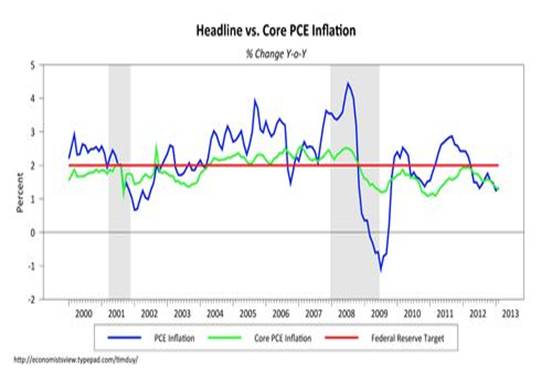

What’s all the noise about? Quite simply the Fed missed the boat and the much-heralded expert on the causes of the Great Depression, Ben Bernanke, will be responsible for the deflationary spiral that is now gripping the nation. That’s right! The man famous for saying that he has helicopters and a printing press, and knows how to use them, has let the wolf in the door. The fact that everybody is still on inflation watch even though inflation left the building a long time ago, is an effort to ‘sing the bull to sleep.’ The media constantly drags out experts to tell us that current central bank policy will lead to higher inflation, or even hyperinflation. We had inflation, but we don’t have it anymore! Now we have deflation and everybody is in denial. Typically the experts will point to the expansion of the monetary base and, relying on past performance, assume that high inflation is a logical consequence:

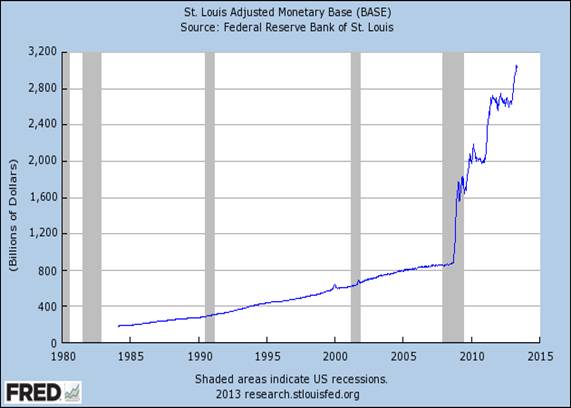

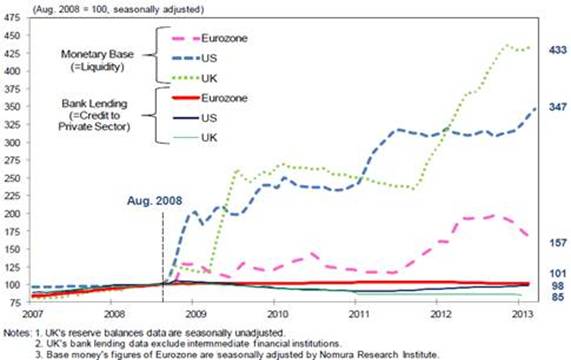

Without a doubt there was a brutal expansion in the monetary base beginning in 2008, but that’s less than the whole story. The problem I see is that the money never made it out of the banks that received it. You can see that

in the following chart showing the growth in the monetary bases of the EU, UK and US. They’ve all expanded to various degrees, but there is little or no growth in bank credit:

Most people understand that the economy will never grow if people don’t have access to credit, and this is especially true for small and medium sized businesses. The small and medium sized businesses are the mainstay of the US economy producing most of the growth and jobs we need to advance.

What happens to all of this money? The domestic banks deposit these funds back into their respective central banks to earn risk free interest. What do the central banks do with the money? They finance their respective government’s debt. Think of this as owning your own candy store and you are constantly eating your profits! The fact that the politicians have access to a printing press has convinced then that they can spend whatever they want with no consideration as to whether or not the debt will ever be productive. That’s how you end up with a chart that looks like this:

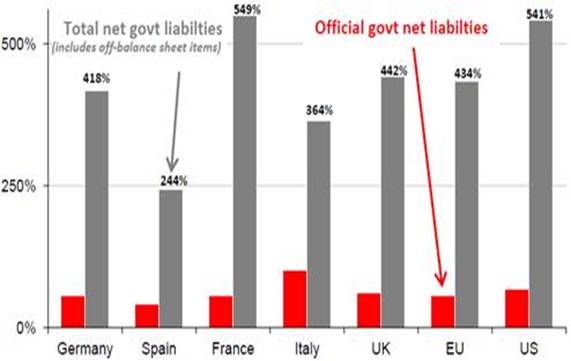

Source: Societe Generale Cross Asset Research

If you look at total government liabilities as a percentage of GDP, you’ll see that the western world is completely out of control. Surprisingly the biggest offenders are not the ones you hear about in the media (Spain and Italy); instead it’s the US and France with Germany not all that far behind.

That brings us to the real problem. Debt is everywhere, more than US $1.3 quadrillion in a world worth approximately US $80 trillion. To make matters worse debt has taken on a life of its own and we’re now to the point that no amount of printing can allow the Fed to catch up to the growing debt. That’s the problem in a nutshell, debt can now outrun the printing press and that’s why you’ll see deflationary pressures grow.

(snip)

(More charts and a conclusion at the site of this article)

"The gist: The Fed is seriously thinking about how it might begin the QE wind-down process. "

Look for a “runup” prior to the dive into the abyss.

It’s like erecting a ladder next to the cliff. The cliff itself just isn’t high enough for some people to fall off of - they have to climb higher.

You mean how the Fed is gonna quit ordering transferable scrip in electron form to the tune of $85 Billion per month for the last umpteen months to buy its own T-bills to ‘equitize’ what they spend on corrupt programs and propping up the market?

I don’t have the resources to buy precious medals of the market kind. I paid off my house, all my debts, my resources are liquid. I don’t have enough to dabble in a metal market that costs a bunch to get into and is problematic in its disposal.

My only dabbling in commodities is Iron/steel, wood, leather, brass, copper, and lead.

——The domestic banks deposit these funds back into their respective central banks to earn risk free interest. ——

They are being paid now for losses that will occur when the inflation really begins and loans financing the debt decrease in real value.

Has anyone actually seen the gold at Fort Knox?

na.... sea shells are where the real action is!

Sea Shells have been used as currency for most of human history, and are extremely undervalued currently!

You know what they say buy low and sell high!

I am placing a “strong buy” on sea shells.

Gold may be worth owning, but it’s not that easy to spend. Need a loaf of bread and a half gallon of milk? How does 7/11 make change for that Krugerrand?

What type of gold do you recommend buying? US Mint coins? Krugerands? Maple leafs?

I might suggest that lead and brass in a certain form might even be a better investment for your long term security.

LLS

Dont forget toilet paper.....THE primary currency of the post-SHTF world.

No Magpul products?

:-)

LLS

My wife convinced me to by the 1/10 oz gold coins since they are actually affordable ($145.00) recently.

Buy one a month and you have an oz. of gold at the end of the year. We gave up 4 magazine subscriptions and an Easton PRess book a month subscription to make up the difference in spending on the family budget.

When I was a young boy and lived with my mom and grandpa in a three room house with only electricity, a well, a coal burning stove - AND an outhouse...there was a bucket with water and a bunch of corn cobbs in it...guess what it was for?

Let's be glad gold's not money. If it were then we'd be dealing with 32% inflation since last Oct.

I bought Krugerrands in the early 90's (I retired at the end of 1994) and most recently I've been accumulating 'junk' US silver coins. (both are legal currency...if that's worth anything.)

Fractional gold coins and 1 oz silver coins are not expensive and if you want to sell them, coin shops are begging for people to sell them gold and silver. And when fiat money is useless you will wish you had some Mercury dimes and Walking Liberty halves.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.