Posted on 01/25/2010 7:20:09 AM PST by blam

If This Isn’t Inflation, Then What Is?

by: Paco Ahlgren

January 25, 2010

Over the last year, I have written extensively about the economic crisis on The Bottom Violation.

I’ve positively flogged the proverbial dead horses of quantitative easing and impending dollar collapse to the point where my arm feels like it’s going to fall off. And many of you have politely — and sometimes not-so-politely — offered to tell me just exactly how wrong I am.

So the debate rages. Are we in an inflationary or deflationary environment? Are asset-classes rising in price, or falling in price? Over the last couple of years, so many of you have taken the time to remind me that the collapse in housing prices alone mandate that we are experiencing massive global deflationary price pressure.

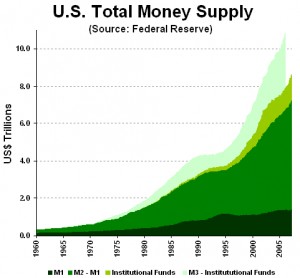

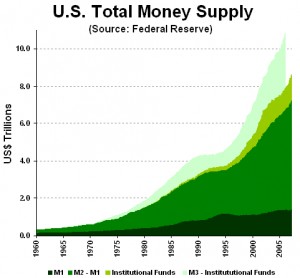

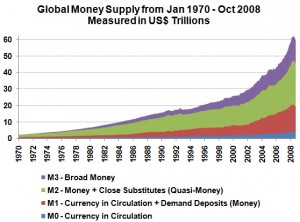

I still disagree, of course; the increase in the money supply — coupled with the lowest interest rates the globe has ever seen — conspire to create an extremely dangerous setting.

Perhaps it’s true that some asset-classes have fallen in value — but that isn’t universal by any means. And perhaps the prodigious increase in the money supply and easing of credit offset some of the falling asset prices, but even if that is true, the balance certainly isn’t sustainable.

And then there’s the velocity of money. “Sure,” you say, “the government is printing more money than ever, but it’s not getting into the economy, because no one is lending.” And that’s true too, but it doesn’t change the fact that banks have to make money somehow, and the way they do that is by lending.

Eventually they will have to start lending, and when that happens, it’s not going to be a quiet slow process; it’s going to be like a tsunami of cash hitting the economy.

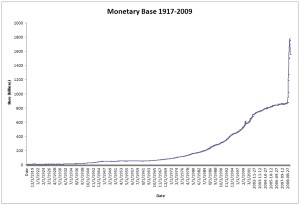

Have a look at this sweetheart of a chart:

Or maybe this one, that’s a little longer-term?

Yep, that line is vertical!

And just in case you thought this was just a “U.S. problem:”

Theoretically, the Fed could pick the precise moment to...

[snip]

Right now they seem to be getting cheap money from the Government, and then lending that money back to the Government at interest.

Or buying stocks with it.

I'm not sure the rest of us need to be involved.

That’s not inflation.

What we’ve got is deflation. Falling salaries. A stock market 40% below its peak. Falling commercial real-estate. 19 million vacant homes.

Shipping and trucking down to Carter-era levels.

Unemployment above 10%.

http://www.dict.org/bin/Dict?Form=Dict2&Database=*&Query=inflation

From The Collaborative International Dictionary of English v.0.48 :

Inflation \In*fla”tion\, n. [L. inflatio: cf. F. inflation.]

[...]

3. Persistent expansion or increase in the general level of

prices, usually caused by overissue of currency, and

resulting in a reduced value of the currency. It is

contrasted with deflation, and is when it occurs to a

very high degree is called hyperinflation. [U.S.]

[1913 Webster +PJC]

From WordNet (r) 2.0 :

inflation

n 1: a general and progressive increase in prices; “in inflation

everything gets more valuable except money” [syn: rising

prices] [ant: deflation, disinflation]

My position = I don't know.

Textbook wise, it’s inflation.

Meanwhile, my son has lived in the same apartment complex for two years now. His monthly rent is $1,100. The leasing company sent him a renewal notice saying that if he will sign a new 1 year lease, his monthly rent will go down to $800 a month.

Most people see that as deflation. They may have their labels goofed up, but a rose by any name...

Bernanke sees deflation today and as a solution he is seeking to massively increase the money supply.

I could be wrong about what he's attempting -- and I'm not saying I agree or disagree with the method -- but I think that's what we're seeing.

One of the selling points for reconfirming Bernanke is that when the economy does start to heat up, supposedly he knows how to "deflate" the money supply in time to avoid "severe" inflation.

Looks like he will get reconfirmed. If Bernanke fails to control inflation at that time, I wonder whom he will blame?

See #9. DO you think Bernanke can and will “adjust” the money supply in time?

In a word, no.

Fact wise.... its the thing that stability is not made of.

Most, just like on this board do not know inflation or deflation and will temper their expectations for that.

Business cannot function unless there is stability. No one can make long range plans in such and environment.

I have had a thought about this that more knowledgeable folks might shoot down. What I think I see now is inflation in assets and but nothing at all in consumer items—maybe deflation.

The huge amount of money floating around is NOT getting to consumers and if it is, much is being used to pay down debt. So consumer goods are not seeing inflation because there’s not much money chasing goods and, consumers’ desire for goods is down.

Take assets by contrast. I know stocks are still down from their high. But the rally since May in equities, gold and bond prices defies any underlying fundamentals. That housing has not fallen further seems unrelated to the fact that an astonishing percent of mortgages are in default but not foreclosed. I think all the excess liquidity is staying in the assets sector and we are seeing liquidity driven inflation (a bubble) there.

But for the funny money, we would be seeing deflation on a significant scale across all asset classes.

The result is the middle class is suffering all the problems of a deflationary recession but the assets it would like to buy (houses especially) are getting further and further out of reach. That means asset prices have to come down eventually.

So, what is inflation?

Inflation is the velocity of money [or the rate of speed which money changes hands]. If the fed prints a trillion dollars and it just sits in the vault it has zero effect on prices. On the other hand, if the fed could get that money into circulation we would have massive inflation. The fed has printed the money, that is the easy part. The hard part is getting the money to circulate. The banks do not want to lend, and nobody is credit worthy enough to borrow.

NO INFLATION!

I wonder if the stock rally is actually due to banks investing in it instead of directly lending. It would be like giving free money to the market and giving it a sense of optimism. It’s going to back fire if it is true.

Stealth socialism of this sort is the plague. We know that a bank deposit always gets reinvested elsewhere to higher interest rates or returns.

What is going on?

I suppose the laundering of this fiat currency is going to occure through increase in promises and salaries to government workers and select union workers.

This is the socialist and immoral debauchery of the currency Lenin was talking about. It is going to happen sooner or later.

The government is going to print out checks to its losers or, if not, Oligarches at best. The banks will be forced to accept it. Then they will convert this money to various assets and inflation will occure because the cheap toys the prowls will buy with it will flood the economy with worthless recycled paper ultimately.

It’s a ponzy scheme. We need to return to some kind of gold standard so as to prevent this sort of cheating. It is too hard to mine for gold to over print it, and this is why gold as a standard is still a good idea.

I agree, and in time we will because there will not be a lot

of other choices. For the time being, there is no inflation

THese curves are astonishing. They look exactly like the pre-dot.com crash figures of early 2001.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.