Posted on 02/22/2009 8:51:52 PM PST by TigerLikesRooster

No end yet in sight for recession

GDP expected to be revised lower to show biggest loss since 1982

By Rex Nutting, MarketWatch

Last update: 10:41 a.m. EST Feb. 22, 2009

Comments: 1472

WASHINGTON (MarketWatch) -- The U.S. economy is still getting worse, even as Washington's policy makers scramble to find the formula that will revitalize credit markets and consumer spending.

The economy will probably provide some more bad news over the coming week, with little prospect that the Federal Reserve chairman or the Treasury secretary will do much to bolster spirits.

The news from the flow of economic data should be disheartening. The estimate for fourth-quarter gross domestic product is likely to be revised lower to show at least a 5% annualized decline. Fresher data on housing, manufacturing, the jobs market and consumer confidence are expected to show little or no improvement. See Economic Calendar. All the economic data "are on track to show that that the recession ... is getting worse with the floor yet to be seen," wrote Lori Helwig, an economist for Bank of America/Merrill Lynch.

The week's biggest report, the GDP revision on Friday, could be ugly. Economists were expecting GDP to fall 5% when the first estimate came out last month, but were pleasantly surprised with a minus 3.8% reading. Still bad, but not horrendous.

However, it looks like they were right in the first place.

(Excerpt) Read more at marketwatch.com ...

Looking for the floor so soon?

Ping!

The Obama adminisration’s solution is massive spending on liberal social programs while raising taxes on business and “the rich”. See you on the welfare line.

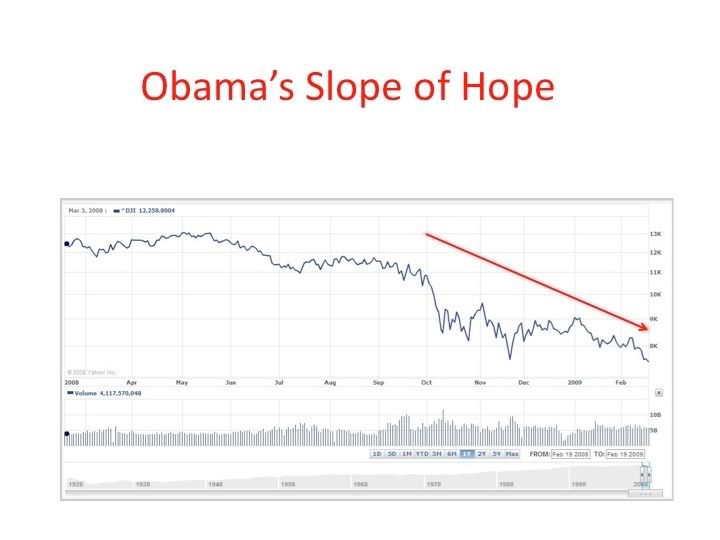

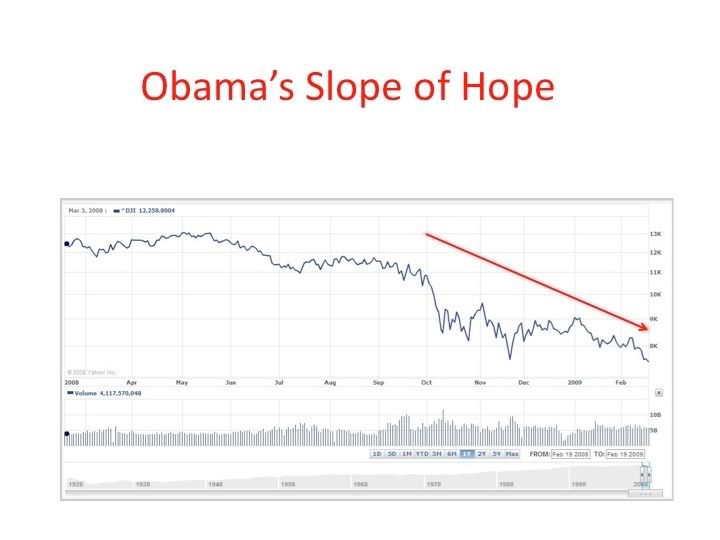

How low can it go?

The lower it goes, the better for Obama.

In fact, the -5% figure is a street estimate of a revision not yet released.

Raising taxes on the two groups (rich & companies) most able to open up overseas headquarters...and thereby dodging all taxes...is always counter-productive.

Allegedly, it cures all ills.

What, having President Hopey-Changey himself, threatening catastrophe on national TV, with various and sundry Democrat lunatics running around screaming about nationalizing the banks isn’t helping?

Color me shocked.

This article reads like an O’bama speech.

And according to the two books on FairTax by Neal Boortz and Rep. John Linder, that's why American citizens and companies have offshored somewhere between US$10 and US$16 TRILLION to lower their income tax burden. This much liquidity if returned back to the USA to operate in our financial system would end the recession faster than an F-22A Raptor doing a high-speed turn.

Yea. Most economists are still singing from the post-WWII economic history.

In recessions declared by the NBER since WWII, the recession has been called (on average) 8 months after it started, and the bottom of the recession was seen nine months after the start of the recession.

We’re in a situation where the start was called 11 months after the start, and it will probably last at least two years. The current projection from the Fed is that we won’t see any recover start before Q1 2010.

Correct, but if we back out the inventory build and the infusion into the banks from TARP, we get back up to -5% PDQ. It isn’t a difficult estimation to make...

It is obvious you are not a Democratic advisor to the Obama Administration.

Good advice: unwelcome and unwanted.

Reality is what we say it is. Perception = reality. Until reality bites.

F-22A Raptor partially caused our recession. I thought its name was the dead albatross?

a) Make GWB's tax cuts permanent.

b) Scrap any possibility of a carbon tax.

c) Revisit Porkulus and cut the pork out of it.

That would be a good start if they want to actually pull us out of the recession.

d) Boot Fwank and Doody out of the finance and banking committees, and improve the quality of mortgages issued by Fannie Mae and Freddie Mac.

What kind of moron expects to read that the bottom is here, the recession is going to end soon?

0bummer is attacking Energy next (read: C02). You can’t have an economy without Energy.

So, we’ll go for another long leg down in the market.

0-Bummer!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.