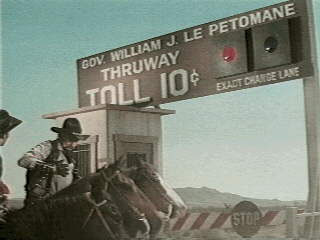

But they better bring a "sh!tload of dimes." ;)

Posted on 06/02/2007 12:08:00 AM PDT by JohnHuang2

The nation's transportation experts have identified their top three priorities: a national freight network, urban congestion and connecting new urban centers with the interstate system. The American Association of State Highway and Transportation Officials, meeting in national conference last month, heard futurists predict that the cost of meeting the transportation needs would be $3.1 trillion over the next 25 years. State and local governments are turning to "public-private partnerships," or PPPs, to produce the funding.

The city of Chicago was happy to partner with a Spanish-Australian group that paid $1.83 billion for a 99-year lease to operate the Chicago Skyway. The same outfit paid Indiana $3.85 billion to operate the Indiana Tollway for 75 years. The same Spanish company has partnered with a Texas firm to give the state of Texas $7.2 billion to build and operate the first leg of the Trans-Texas Corridor. And Pennsylvania's Gov. Rendell is expecting a bid of between $15- $18 billion for the Pennsylvania Turnpike.

Most states have already enacted or are considering legislation to authorize this PPP financing of public infrastructure.

(Column continues below)

Public opposition to PPP financing encouraged the Texas Legislature to adopt a two-year moratorium on the state's PPP projects. The governor's veto, however, along with threats from the U.S. Department of Transportation, forced the Legislature to pass a watered-down compromise bill that blocks only future PPP projects, but allows the current Trans-Texas Corridor to go forward.

Public opposition to PPP financing encouraged chairman of the House Transportation & Infrastructure Committee James Oberstar and Transit Subcommittee Chairman Rep. Peter DeFazio to issue a May 10 letter to governors and state transportation officials that warned about rushing into PPPs that did not fully protect the public interest.

"We don't need their advice, frankly," said Indiana Gov. Mitch Daniels. He said the letter was "nothing but congressional posturing." Daniels' criticism was typical of the response from state officials.

National Surface Transportation Policy and Revenue Commission Vice Chairman Jack Schenendorf told the conference attendees the federal program no longer has a sense of mission, which has led to competition among the states for federal funds and to the proliferation of "earmarks" for local political advantage.

Regardless of the finger-pointing, the fact remains that driving in urban areas is a nightmare, and driving on the interstate system is like playing tag with 18-wheelers – and it's getting worse, not better. The people want relief, but not at the expense of bondage to PPPs.

Officials claim transportation revenues from traditional sources are barely adequate to maintain existing roads and do not provide for future construction. If this contention is true, the next question to be answered must be: Is this the result of inadequate fuel tax rates, or have the revenues from fuel taxes been siphoned off for other purposes?

This question directed at transportation officials produces an incredible array of slippery answers. Legislators, at every level of government, should insist that transportation taxes be spent on nothing but transportation. If transportation taxes are used exclusively for transportation needs and the revenue is inadequate, then a tax increase is required to meet the needs of the people.

Realistically, with gas prices above $3 per gallon, no politician will suggest increasing the gasoline tax, when it is so much easier to sell off a highway to a PPP and reap billions in new money – without having to ask the voters for a tax increase.

The voter still pays; he just won't have a vote. And the price he pays will be more. Toll roads built or operated by PPPs must pay a profit to the shareholders of the firms that put up the money. If the state builds and operates the infrastructure, that profit does not have to be built into the price, and therefore, the voter saves a bundle.

Infrastructure sales to PPPs are the hottest ticket in town. It's going to take a monstrous effort by the people to reverse this trend that is clearly rushing across the nation like a tidal wave. Transportation officials see PPPs as the answer to their revenue problems. Legislators tend to "go along" with the budget committee, unless they are peppered by contacts from their constituents.

Texas voters tried valiantly to put a moratorium on the sale of the Trans-Texas Corridor to Cintra-Zachry, the Spanish-Australian PPP that wants to pay $7.2 billion to the state. They succeeded in the Legislature, but threats from the governor and the federal government ignored what the people want.

In every state and every community, someone is planning, right now, to sell public infrastructure to a public-private partnership. Chances are better than good that the PPP has its roots in another country. This can't be good for America.

bump.

Selling out America ping.

Realistically, with gas prices above $3 per gallon, no politician will suggest increasing the gasoline tax, when it is so much easier to sell off a highway to a PPP and reap billions in new money – without having to ask the voters for a tax increase.

Yer gettin’ good at that whole hitting the nail on the head thing!!! ;-)

Spooky!

All governments are whores. They will sell anything and everything for a few dollars to grasp in their sweaty little hands RIGHT NOW.

I say whore away. Sell it all. After collecting the bucks, nationalize it all and send the furriners packing.

lamb’s a bit extreme.

Thanks for the ping!

You’re welcome. :-)

So, where in the @#$% does it all go???

I believe most companies that pursue these leases tend to be foreign-owned companies with a lot of cash to invest, looking for something relatively stable in the U.S. This enables them to take advantage of a weak U.S. dollar today that will rise and fall over the course of the lease (thereby offering opportunities to engage in different types of transactions depending on whether the U.S. dollar is strong or weak at any given time). The tax laws in the home countries of these foreign firms may be favorable to this kind of arrangement, too.

That's quite an assumption. How do you know where the money is coming from? The Chinese and the Arabs are invested in most of the world markets. A lot of these consortiums don’t have that good a track record managing projects in this country.

They'll come a time (maybe already has) when globalization, as much as some of you worship it, will come back to bite us in the ass.

I believe you are correct in the tieing of the feduciary aspects of these deals to the long-term profit and influence these companies gain when they enter into deals like this...

But for all of the good that “may” come from something like this, it doesn’t mean squat if it puts at risk the population and other infrastructure if you do not address the security and soveriegnty issues...

To this point none of this has been seriously addressed...

But they better bring a "sh!tload of dimes." ;)

Well maybe it’ll be a quarter by then...Right???

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.