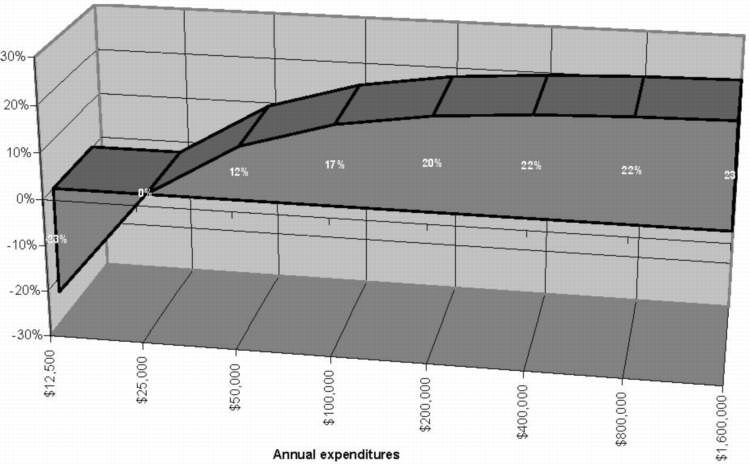

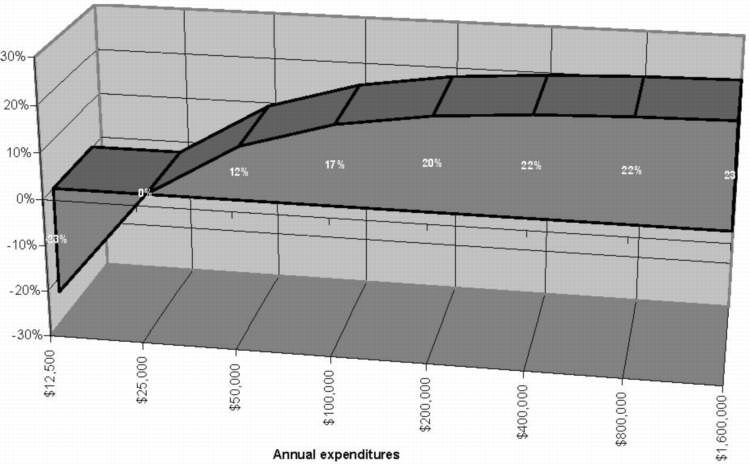

Don't make such statements. Here's the Progressive FairTax chart, based on 100% consumption of income. Keep in mind that the more money you make, your savings rate usually goes up accordingly. Take a look:

Posted on 08/12/2004 3:03:02 PM PDT by NormsRevenge

CARSON, Calif. - John Kerry (news - web sites) said Thursday that President Bush (news - web sites)'s musing about a national sales tax is an insult to financially struggling voters and would amount to "one of the largest tax increases on the middle class in American history."

The Democratic presidential nominee, during a speech at California State University, Dominguez Hills, tried to reverse partisan stereotypes by portraying the Republican president as the tax raiser and himself as a tax cutter.

Kerry said if Bush wants to create a national sales tax without increasing the deficit, people will end up paying at least 26 percent more for purchases on top of state and local sales taxes.

"We know exactly who that's going to hurt," Kerry said . "That's going to hurt small business. It's going to hurt jobs. It's going to hit the pocketbooks of those who need and deserve tax relief most in America."

Bush has suggested that overhauling the tax code would be a second-term priority if he is re-elected. While campaigning in Florida Tuesday, he said replacing the income tax with a federal sales tax is "an interesting idea that we ought to explore seriously."

Kerry seized on Bush's comments even as White House officials downplayed the idea and denied that any such plan is under consideration.

Kerry said Bush has failed to offer a plan for improving the economy in his second term. He said the president's tax cuts have resulted in a tax increase on the middle class because their state and local taxes have been increased to compensate for loss of revenue from the federal government. He said a national sales tax would only further burden the middle class.

"I call it one of the largest tax increases on the middle class in American history," Kerry said. "And this is coming from an administration that has offered almost no new ideas for our economy, and the few ideas that they have offered have only hurt middle class families. This new idea is no different."

Kerry repeatedly invoked the memory of better economic times under another Democratic president, Bill Clinton (news - web sites). He said Clinton's advisers were helping craft his economic plan and that he will be "a champion for the middle class" by cutting their taxes while lowering the deficit.

Kerry said he would offer tax breaks to help pay for health care premiums, child care and college tuition, paid for by repealing Bush's tax cuts for people earning more than $200,000 a year.

"They will go back to paying the same taxes they paid when Bill Clinton was president," Kerry said. "That was a time when every American rich got richer."

Bush campaign spokesman Steve Schmidt said Kerry cannot pay for his tax plan.

"John Kerry's numbers don't add up," Schmidt said. "He has spent his tax hike more times than anyone can keep track of."

He was also fighting Bush campaign's charge that Kerry has a long history of voting for higher taxes during his 19-year career in the Senate.

What does political power have to do with it?

Why would the other 97% of voters, who would be hurt by raising taxes, volunteer to have their taxes raised???

That makes no sense.

What I do see happening, however, is Democrats lobbying year after year to get the poverty line raised until they say the 0% crossover mark should be at $40,000 a year for a family of four or something like that. They'll try to change the definition of poor. But that's howe the game is played, and there will be constraints on the ability to raise such things.

What else do you got???

Sure. A good portion of the population profits when the tax rate goes up.

A "good portion" you say.

Hmmmm.

refer: Poverty 2001 - Poverty Thresholds 2001

&

| ftp://ftp.bls.gov/pub/special.requests/ce/standard/2001/ Table 2. Income before taxes: Average annual expenditures and characteristics, Consumer Expenditure Survey, 2001 |

|

If you had $130 dollars income and your tax bracket is 23%, how much do you pay? Answer: $30.

Today if you earn $130,000 taxable income 23% of that will be tax. If you spend $130,000 total on new retail items your tax is 23%.

There's nothing deceptive about it. Every taxpayer will be in the 23% tax bracket when they purchase a new retail product or service.

"Pushing reform legislation will be difficult," admits Hastert. "Change of any sort seldom comes easy. But these changes are critical to our economic vitality and our economic security abroad."

It got people's attention. So much so that it could become a single issue where if a representative or senator votes "no" on HR25 that they'll lose in the next election. Also, any congressperson that tries to tack on a Bill that would sabotage the bill's passage should be exposed.

Hastert's comments ignited a firestorm on the Internet and talk radio as people discussed the possibility of replacing the federal income tax.

How to sell the NRST.

Eliminate the IRS. Make it the major message.

That's sure to get people's attention. They'll jump with joy having to no longer fear the IRS. Talk about the hundreds of billions of dollars saved each year, time saved too.

Then relate the fact that if we can dump the IRS we can dump other government waste. If you want more from the government you'll need to do one or the other or both the following: Increase the economy so that tax revenues increase and/or -- preferably 'and' -- dump other government waste.

Then explain why people don't know how much government is costing them due to hidden taxes. How people are currently being subjected to class warfare. And how with the NRST they'll know exactly how much government costs them. And how to reduce it. Ay congressperson that votes against HR25 should be voted out of office. Same for any congressperson that tries to sabotage the bill by attempting to attach an outlandish amendment to it. The public needs to be made aware that they have a direct effect on getting HR25 passed. That the have the opportunity to vote against their representative and/or senator if he or she votes against HR25.

When the 2006 mid-term elections come around HR25 would be worthy of being a single issue vote for or against reps and senators.

Don't make such statements. Here's the Progressive FairTax chart, based on 100% consumption of income. Keep in mind that the more money you make, your savings rate usually goes up accordingly. Take a look:

If Bush says in his acceptance speech "If re-elected, I vow to abolish the IRS by the time I leave", he's guaranteed re-election!

Here's my bumper sticker idea:

"Hate the IRS? Vote 4 Bush!"

Here's the weekly FairTax email I just got:

Many of you have been supporting replacing the income tax with a national retail sales tax for years. Finally your hard work is paying off. We are getting a flurry of national press that is not stopping! http://www.fairtaxvolunteer.org/news/index.html. Over 3000 of you have already e-mailed the President and the Speaker.

Let's keep this up. Please e-mail all of the presidential candidates.

Tuesday in Florida, a FairTax member and online petition signer brought up the issue at a political rally for Bush and the President stated, "It's kind of an interesting idea that we ought to explore seriously".

It's clear that the Kerry campaign at best does not understand our proposal or at worst has chosen to misrepresent it.

We believe that all of the Presidential candidates will be responsive to our issue if they understand the FairTax and if they hear from enough of you.

We are asking that all of you send an e-mail today and request they support HR 25 and Senate bill 1493:the FairTax. Explain why it will benefit the lower and middle class.

Read more about that here http://www.fairtaxvolunteer.org/smart/faq.html.

Please e-mail them at:

George W. Bush:

BushCheney04@georgewbush.com

John Kerry:

info@JohnKerry.com

Gene Amondson:

geneamondson@rocketmail.com

David Cobb''s Senior policy advisor:

rensen@gwi.net

Michael Badnarik:

CampaignManager@badnarik.org

Ralph Nader at his website:

www.votenader.org They do not have a public email. You have to go this website and use their contact form.

Please send us an email so we can keep track of how many emails we have gotten in.

Thanks for your help! You are making this happen!

Tom Wright

Executive Director

Americans For Fair Taxation

1-800-FAIRTAX

tom.wright@fairtax.org

P.S.

Please vote in the online polls for the FairTax at:

http://money.cnn.com/index.html

and

http://www.vote.com/category/4075633/activeVotes.html

and

http://moneycentral.msn.com/content/CNBCTV/Promos/P91797.asp

You received this e-mail because you joined our list through our online registration, e-mail newsletter, petition, direct mail effort or phone bank. If you do NOT wish to receive e-mail updates about the FairTax, please pardon our e-mail (and accept our apology). You may reply to this message with the word 'remove' and your original registration e-mail address (bradleytn001@hawaii.rr.com) in the subject line to be removed from our e-mail list.

Contributions to Americans For Fair Taxation are not tax deductible because we lobby for you in Washington, D.C.

Under the NRST, everyone would get the "Poverty Level" rebate.

EVERYONE!

You may have already pondered this but some people reading this thread probably haven't.

Anyways, many wealthy people will chose their privacy/anonymity over signing up to receive the rebate. What would of been a rebate will become in effect, voluntary contributions to the government.

"Anyways, many wealthy people will chose their privacy/anonymity over signing up to receive the rebate."

-- Yup, along with the guy in Montana watching for Black Helicopters. There's nothing saying you have to accept it.

I can see from these numbers where at least 12% of the population (the poverty rate) would profit from the FairTax.

(It would be much easier to see of they had used medians, averages can sometimes skew data. It's obvious that's what's happening here.)

That's a blatant lie.

If you ask me what day of the week it is and I say it is Wednesday -- albeit unbeknownst to me it's actually Tuesday -- do you call me a liar? To lie is to have the intent to deceive. I had no such intent. I merely responded to why the 23% rate isn't deceptive

Are you aware of the Family consumption Allowance every family will get?

Yes. I've been on the tax threads years longer than you've been a registered member. Apparently you didn't think before responding. I assume it was a knee jerk reaction.

"Hate the IRS? Vote 4 Bush!"

That's pretty good. How about:

Delete the IRS -- Vote Bush

Saw a commercial the other day where John Kerry called himself a representative of the middle class. Has he EVER been that poor?

Not in this cosmic lifecycle..

Cliff Cofer, WW-II Vet

Have a look: FairTax INFO!

Sure has been lotsa' tax reform info floating around lately. Looks like it's finally gonna' get a widespread discussion. HOORAY!

Cliff Cofer, WW-II Vet

West Des Moines, Iowa

Nice straw man.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.