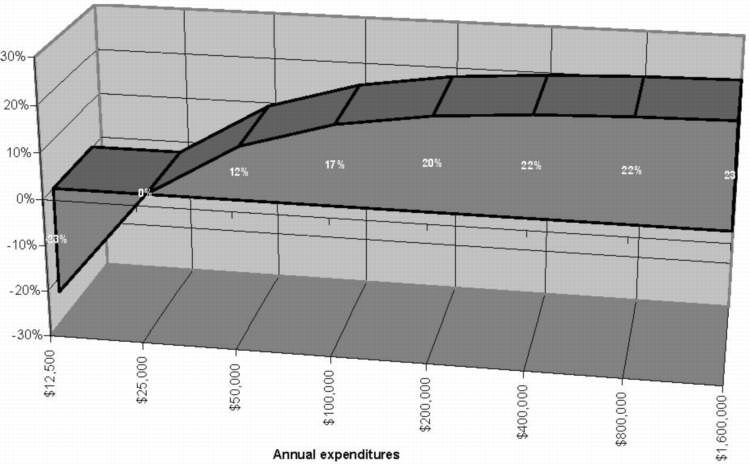

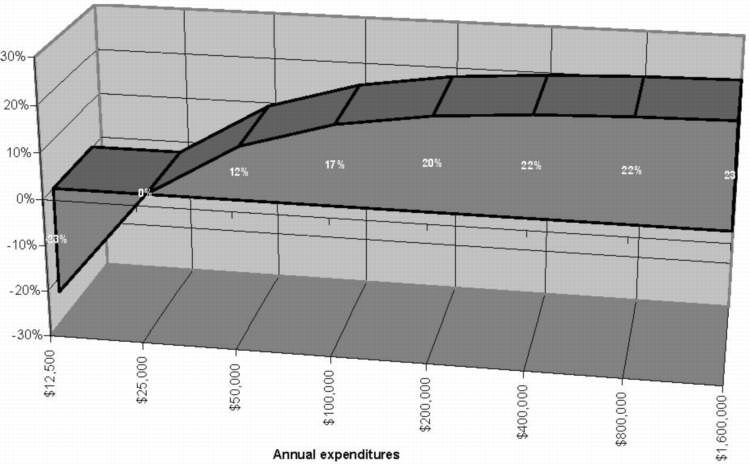

Don't make such statements. Here's the Progressive FairTax chart, based on 100% consumption of income. Keep in mind that the more money you make, your savings rate usually goes up accordingly. Take a look:

If you had $130 dollars income and your tax bracket is 23%, how much do you pay? Answer: $30.

Today if you earn $130,000 taxable income 23% of that will be tax. If you spend $130,000 total on new retail items your tax is 23%.

There's nothing deceptive about it. Every taxpayer will be in the 23% tax bracket when they purchase a new retail product or service.

Don't make such statements. Here's the Progressive FairTax chart, based on 100% consumption of income. Keep in mind that the more money you make, your savings rate usually goes up accordingly. Take a look: