Skip to comments.

Mapped: U.S. Credit Card Delinquency Rates by State (2025)

Visual Capitalist ^

| 12/09/2025

| Bruno Venditti

Posted on 12/09/2025 9:18:00 PM PST by SeekAndFind

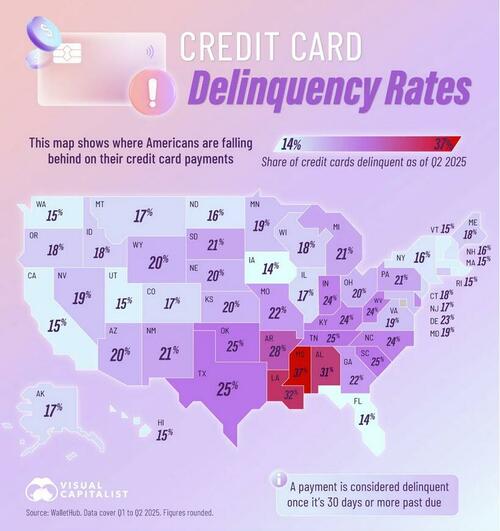

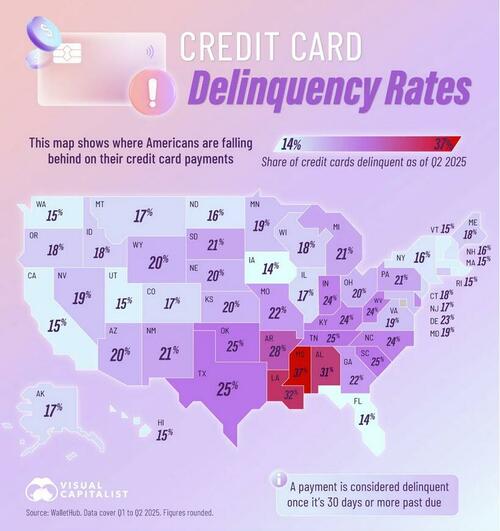

The map, via Visual Capitalist's Bruno Venditti, highlights how credit card delinquency varies widely across the U.S. in 2025.

These figures represent the share of credit card accounts that became 30 or more days past due from Q1 to Q2. The data for this visualization comes from WalletHub.

Southern States Lead in Delinquencies

The Deep South stands out with the nation’s highest delinquency rates. Mississippi tops the list at 37%, followed by Louisiana at 32% and Alabama at 31%.

These levels are far above the national norm and suggest elevated financial pressures, including lower median incomes and higher reliance on revolving debt. Several neighboring states—Arkansas, Oklahoma, Tennessee, and South Carolina—also exceed 25%.

| Rank | State | Credit Card Delinquency (Q1-Q2, 2025) |

|---|

| 1 | Mississippi | 36.69% |

| 2 | Louisiana | 32.11% |

| 3 | Alabama | 30.52% |

| 4 | Arkansas | 28.11% |

| 5 | South Carolina | 25.49% |

| 6 | Oklahoma | 25.43% |

| 7 | Texas | 24.77% |

| 8 | Tennessee | 24.62% |

| 9 | North Carolina | 24.19% |

| 10 | Kentucky | 24.07% |

| 11 | Indiana | 23.92% |

| 12 | West Virginia | 23.71% |

| 13 | Delaware | 22.76% |

| 14 | Georgia | 22.40% |

| 15 | Missouri | 22.26% |

| 16 | New Mexico | 21.37% |

| 17 | Pennsylvania | 21.08% |

| 18 | Michigan | 20.89% |

| 19 | South Dakota | 20.64% |

| 20 | Wyoming | 20.23% |

| 21 | Kansas | 19.76% |

| 22 | Arizona | 19.72% |

| 23 | Nebraska | 19.71% |

| 24 | Ohio | 19.66% |

| 25 | Maryland | 19.45% |

| 26 | Minnesota | 19.17% |

| 27 | Virginia | 19.09% |

| 28 | Nevada | 18.58% |

| 29 | Idaho | 18.42% |

| 30 | Wisconsin | 18.35% |

| 31 | Maine | 18.27% |

| 32 | Connecticut | 18.16% |

| 33 | Oregon | 17.87% |

| 34 | Montana | 17.17% |

| 35 | Alaska | 16.90% |

| 36 | Colorado | 16.85% |

| 37 | Illinois | 16.58% |

| 38 | New Jersey | 16.57% |

| 39 | North Dakota | 16.26% |

| 40 | New Hampshire | 15.59% |

| 41 | New York | 15.53% |

| 42 | Rhode Island | 15.21% |

| 43 | California | 15.08% |

| 44 | Washington | 14.99% |

| 45 | Utah | 14.94% |

| 46 | Hawaii | 14.90% |

| 47 | Massachusetts | 14.68% |

| 48 | Vermont | 14.67% |

| 49 | Iowa | 14.36% |

| 50 | Florida | 13.99% |

Midwestern and Northeastern States Remain More Stable

Most states across the Midwest and Northeast report delinquency shares between 15% and 21%. These levels reflect more stable household budgets and stronger credit profiles.

States like Iowa (14%) and Minnesota (19%) show some of the lowest delinquency rates, pointing to higher financial resilience.

Western States Show Mixed Patterns

The Western U.S. presents a more mixed landscape. California, Washington, Utah, and Hawaii all sit near the lower end at around 15%, suggesting relatively healthy consumer finances despite high living costs.

Meanwhile, states like Arizona and Nevada land closer to 19–20% in late payments.

If you enjoyed today’s post, check out The United States of Unemployment on Voronoi, the new app from Visual Capitalist.

TOPICS: Business/Economy; Society

KEYWORDS: creditcard; delinquency

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

To: SeekAndFind

Whites and liberals are more restrained.

2

posted on

12/09/2025 9:31:09 PM PST

by

nwrep

To: SeekAndFind

Correlate the delinquency rate with black population.

3

posted on

12/09/2025 9:48:45 PM PST

by

pierrem15

("Massacrez-les, car le seigneur connait les siens" )

To: nwrep

The ELITES live in the states that are not affected, the middle class are suffering and unless Trump turns this around FAST we will lose the house and the senate!! Trump can give all the happy talk he wants people are not getting financially better!! I work at Home Depot and NONE of our stores are meeting sales plans, Black Friday weekend was busy HOWEVER sales after that weekend are very slow NOT a typical holiday season in any way!!! People got way behind financially with the Biden admin HOWEVER they are NOW looking at it as Trump’s fault just the way things are!!!

To: Trump Girl Kit Cat

🎯

Release the Tariff funds, or lose.

5

posted on

12/09/2025 10:00:10 PM PST

by

Varsity Flight

( "War by 🙏 the prophesies set before you." ) I Timothy 1:18. Nazarite warriors. 10.5.6.5 These Days)

To: pierrem15

Some of the states with the higher black populations have the highest delinquency rates, as well as some of the lowest. The % of black population of Florida is more than double that of Kentucky, for example, as well as states like Wyoming, & South Dakota. West Virginia has one of the lowest minority populations of any state.

Did you bother to look any of that up before making that statement? What was your purpose in making said statement?

To: SeekAndFind

It seems our confederate states are a little in the arrears.

7

posted on

12/09/2025 10:19:40 PM PST

by

Bullish

(My tagline ran off with another man, but it's okay... I wasn't married to it.)

To: Republican Wildcat

Probably a knee-jerk “dem folks”

8

posted on

12/10/2025 1:35:31 AM PST

by

Cronos

To: Trump Girl Kit Cat

I agree with everything you posted except for it being Trumps fault. I place the blame squarely on CONgress shoulders. They’re too busy trying to vote on condemning one thing or another instead of working on what’s best for Americans.

I don’t think this is fixable at this point in our country. If the criminals in DC don’t get off their collective asses and start actually doing things for the people who are citizens of this once great country, then this country will cease to exist. This will be partly due to republicans staying home. I can’t blame people for staying home when the BS artists who promised to fix things don’t even make an attempt other than posting propaganda on social media to get a rise out of people.

9

posted on

12/10/2025 3:05:23 AM PST

by

TermLimits4All

("If you stand for nothing, you'll fall for anything.")

To: TermLimits4All

The only way to fix it is for the Rs to lose. When the Ds completely trash the economy some new Rs with real ideas and teh BALLS TO IMPLEMENT THEM will move to the front. Of course, this is assuming that the Rs get it together before it’s too late.

Term limits, full public financial disclosures starting day 1 of the campaign and in place throughout their term are a start. Time to put out the trash. Example: Cornyn keeps getting elected, but I know NO ONE who has actually voted FOR him.

10

posted on

12/10/2025 3:19:03 AM PST

by

Semper Vigilantis

(Always remember - the cold war was US against a bunch of countries with 'Democratic' in their name.)

To: SeekAndFind

Seems like lots of red states experiencing pressures. Maybe this is affecting the voting?

11

posted on

12/10/2025 4:16:00 AM PST

by

virgil

(The evil that men do lives after them )

To: SeekAndFind

delinquency shares between 15% and 21%. These levels reflect

more stable household budgets households at the edge of disaster and

stronger credit profilesbetter targets for the degenerate bloodsuckers who run this legal usury racket.

Fixed it.

To: Trump Girl Kit Cat

the middle class are suffering and unless Trump turns this around FAST we will lose the house and the senate!!That, I am afraid, is a done deal.

Privatized money creation (credit cards) has sunk the ship.

To: Trump Girl Kit Cat

Been screaming this for some time now but the True Believers whine and cry “Trust the Plan” Trump has it all in his master plan so unless he is planning which some stories are indicating this that he is planning on devaluing the current Dollar by backing it with Gold backed dollars the Middle Class is cooked and dead and gone...

To: SeekAndFind

It’s not surprising that delinquency rates are higher in low-income states and lower in high-income states. But, a few states have alarmingly high rates.

To: SeekAndFind

16

posted on

12/10/2025 4:48:46 AM PST

by

Ken Regis

(I concur )

To: SeekAndFind

States like…Minnesota (19%) show some of the lowest delinquency rates, pointing to higher financial resilience.Thats because Minnesotans raided the State and Federal treasuries and everybody got some.

To: SeekAndFind

This is also a demographic map.

18

posted on

12/10/2025 5:23:07 AM PST

by

UnwashedPeasant

(The pandemic we suffer from is not COVID. It is Marxist Democrat Leftism. )

To: Republican Wildcat

a) it does correlate partially with the map (a county by county one would probably correlate more closely);

b) it correlates with my experience as an occasional landlord running credit checks. Very nice black people with good jobs but lunatic credit histories. A woman paying 19% interest on a car loan, a young couple where the guy had a good union job but their credit history showed getting one credit card, maxing it out, then getting another and doing the same and so on.

In general, a lack of impulse control manifested in many other ways disproportionately in the black community. Are there whites who do the same? Of course, just like there are white criminals. But not so many proportionately.

19

posted on

12/10/2025 5:39:39 AM PST

by

pierrem15

("Massacrez-les, car le seigneur connait les siens" )

To: Trump Girl Kit Cat

Good to hear from you, Ma’am. Take care.

20

posted on

12/10/2025 5:40:44 AM PST

by

nwrep

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson