Posted on 11/01/2025 7:15:36 PM PDT by SeekAndFind

Americans are always worrying about debt: their own and their government’s.

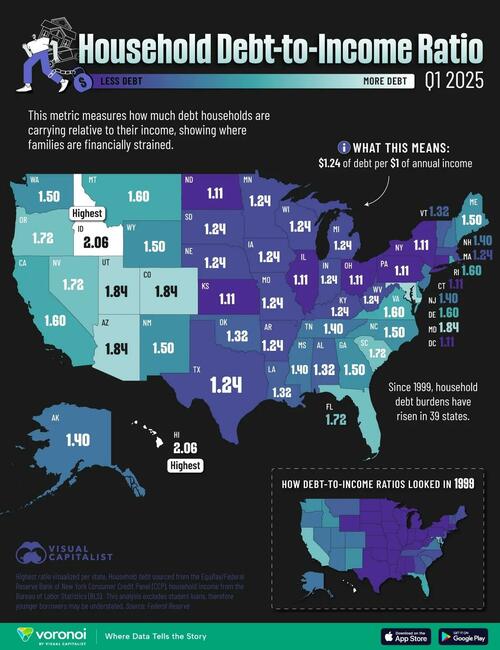

This visualization, via Visual Capitalist's Pallavi Rao, maps each state by their household debt-to-income ratios (DTI) in Q1, 2025, revealing which states carry the heaviest burdens and which ones keep borrowing in check.

Data for this visualization comes from the Federal Reserve. The highest ratio is visualized per state.

ℹ️ Debt includes mortgages, autos, credit cards, etc., and excludes student loans. Income is based on unemployment insurance-covered wages, as reported to the Bureau of Labor Statistics.

Two states share the top spot: Idaho and Hawaii both post a DTI of 2.06, meaning households owe just over twice their annual after-tax income.

| Rank | State | State Code | Debt-to-Income Ratio (2025) | Debt-to-Income Ratio (1999) | 1999–2025 Change |

|---|---|---|---|---|---|

| 1 | Idaho | ID | 2.06 | 1.50 | 0.56 |

| 2 | Hawaii | HI | 2.06 | 2.06 | 0.00 |

| 3 | Arizona | AZ | 1.84 | 1.40 | 0.44 |

| 4 | Colorado | CO | 1.84 | 1.40 | 0.44 |

| 5 | Utah | UT | 1.84 | 1.40 | 0.44 |

| 6 | Maryland | MD | 1.84 | 1.72 | 0.12 |

| 7 | South Carolina | SC | 1.72 | 1.32 | 0.40 |

| 8 | Nevada | NV | 1.72 | 1.40 | 0.32 |

| 9 | Oregon | OR | 1.72 | 1.40 | 0.32 |

| 10 | Florida | FL | 1.72 | 1.60 | 0.12 |

| 11 | Delaware | DE | 1.60 | 1.11 | 0.49 |

| 12 | Montana | MT | 1.60 | 1.32 | 0.28 |

| 13 | Rhode Island | RI | 1.60 | 1.32 | 0.28 |

| 14 | Virginia | VA | 1.60 | 1.40 | 0.20 |

| 15 | California | CA | 1.60 | 1.72 | -0.12 |

| 16 | Wyoming | WY | 1.50 | 1.11 | 0.39 |

| 17 | Georgia | GA | 1.50 | 1.24 | 0.26 |

| 18 | Maine | ME | 1.50 | 1.24 | 0.26 |

| 19 | North Carolina | NC | 1.50 | 1.24 | 0.26 |

| 20 | New Mexico | NM | 1.50 | 1.50 | 0.00 |

| 21 | Washington | WA | 1.50 | 1.50 | 0.00 |

| 22 | Mississippi | MS | 1.40 | 1.11 | 0.29 |

| 23 | New Hampshire | NH | 1.40 | 1.24 | 0.16 |

| 24 | New Jersey | NJ | 1.40 | 1.24 | 0.16 |

| 25 | Tennessee | TN | 1.40 | 1.24 | 0.16 |

| 26 | Alaska | AK | 1.40 | 1.32 | 0.08 |

| 27 | Alabama | AL | 1.32 | 1.11 | 0.21 |

| 28 | Louisiana | LA | 1.32 | 1.11 | 0.21 |

| 29 | Oklahoma | OK | 1.32 | 1.11 | 0.21 |

| 30 | Vermont | VT | 1.32 | 1.24 | 0.08 |

| 31 | Arkansas | AR | 1.24 | 1.11 | 0.13 |

| 32 | Indiana | IN | 1.24 | 1.11 | 0.13 |

| 33 | Iowa | IA | 1.24 | 1.11 | 0.13 |

| 34 | Kentucky | KY | 1.24 | 1.11 | 0.13 |

| 35 | Massachusetts | MA | 1.24 | 1.11 | 0.13 |

| 36 | Michigan | MI | 1.24 | 1.11 | 0.13 |

| 37 | Minnesota | MN | 1.24 | 1.11 | 0.13 |

| 38 | Missouri | MO | 1.24 | 1.11 | 0.13 |

| 39 | Nebraska | NE | 1.24 | 1.11 | 0.13 |

| 40 | South Dakota | SD | 1.24 | 1.11 | 0.13 |

| 41 | Texas | TX | 1.24 | 1.11 | 0.13 |

| 42 | West Virginia | WV | 1.24 | 1.11 | 0.13 |

| 43 | Wisconsin | WI | 1.24 | 1.11 | 0.13 |

| 44 | Connecticut | CT | 1.11 | 1.11 | 0.00 |

| 45 | District of Columbia | DC | 1.11 | 1.11 | 0.00 |

| 46 | Illinois | IL | 1.11 | 1.11 | 0.00 |

| 47 | Kansas | KS | 1.11 | 1.11 | 0.00 |

| 48 | New York | NY | 1.11 | 1.11 | 0.00 |

| 49 | North Dakota | ND | 1.11 | 1.11 | 0.00 |

| 50 | Ohio | OH | 1.11 | 1.11 | 0.00 |

| 51 | Pennsylvania | PA | 1.11 | 1.11 | 0.00 |

In Hawaii’s case, elevated housing costs push mortgage balances sky-high. In Idaho, a surge of migrants since 2020 has driven up home prices and left many newcomers with large, fresh mortgages.

Rounding out the top five are Arizona, Colorado, and Utah (all 1.84). Once again, fast-growing markets where rising prices and younger populations translate into higher leverage.

ℹ️ Related: Hawaii has the fifth-lowest homeownership rate in the country.

At the other end of the spectrum, Pennsylvania, Ohio, and North Dakota come in at just 1.11.

Many low-debt states share three traits. They have lower housing costs, older homeowner bases with significant equity, and slower population growth that tempers new borrowing.

However, even high-income states like Connecticut and the District of Columbia can land in this cohort thanks to well-paid residents who keep balances in check.

The gap underscores how regional housing dynamics, more than incomes alone, dictate household debt.

Finally, due to how this ratio is calculated, younger households’ true burden may be understated (student loan exclusion).

At the same time, the income measure is unemployment insurance-covered wages wages (not total personal income), which can overstate the ratio in high-capital-income areas (e.g., states with finance-heavy metros).

If you enjoyed today’s post, check out Visualizing Government Debt-to-GDP Around the World on Voronoi, the new app from Visual Capitalist.

Arizona used to be an affordable state (except gasoline). But wages are also lower than other states with big league cities. The costs, especially housing, went up. The wages . . . not so much.

Who knew Idaho had so many deadbeats?! But maybe something wacky is going on there that is skewing the stats.... like maybe a lot mortgage debt for high-end homes for multimillionaires in and around Sun Valley/Ketchum... versus mediocre incomes statewide?

What is up with Idaho? Farmers?

That doesn’t mean they are deadbeats. Was there something catastrophic thst occurred?

Surprised Idaho is so high and Florida is so low.

Mighty suspicious that the ratios are not more granular (i.e. continuous across the 50 states), but “happen” to work out to only 9 discrete values. What are they hiding?

Larry Craig and The Big Potatoe?

County by County would be better.

Farming is the only business that banks will loan advances on crops not even planted yet for fertilizer, seed, machinery, processing facility construction, transportation, and the guy borrowing $9.7 million (this year) never even graduated high school. He’s done amazingly well considering that stacked deck.

I’ve lived in Hawaii 25 or so years now.

I lived in WA state for 21 years or so.

I grew up in Southern CA.

These states all have High housing costs,

High food costs, and

High energy costs.

Y’all want to know what the common factor is?

They are all run by rich Democrats.

Rich Democrats that get elected by ignorant

poor people that have been promised

an un-earned handout.

>> County by County would be better.

10-4

I was wondering if the debt ratio was so high depending on when farmers were questioned. Does that make sense?

>> County by County would be better.

Oh look! All “Visual Capitalist” is doing is repackaging a plot from the Fed. And on the FRB site, they DO have the data graphed by county:

https://www.federalreserve.gov/releases/z1/dataviz/household_debt/county/map/#state:all;year:2025

The Fed data isn’t actual ratio numbers per state or county either, just that stupid range. So my earlier question is more appropriately for them: what are THEY hiding?

He didn't like the prices he was getting on steers one fall. He got tired of pencil shrink and shady auctions. So he bought the auction facility, co-op, and surrounding feed lots. Cash.

About 90% of farmers are slaves to this system of debt. The other 10% are kings and need nothing from anyone.

Right on!

bkmk

The king of kings is Archer Danial Midland. The largest producer of ethanol in the USA which they use to poison gasoline into an inferior product. This crap gasoline is subsidized by the American Taxpayer, see below per AI.

"There is no longer a federal 45-cent-per-gallon tax credit for ethanol blending; it expired in 2011, but the government still supports the industry through other means, such as the Renewable Fuel Standard (RFS) mandates and infrastructure incentives for high-blend pumps. Additionally, a separate federal tax credit exists for retailers selling higher ethanol blends like E15 (15% ethanol), with amounts varying by year and blend level, and this credit is set to expire on December 31, 2028."

Oddly I do not blame Archer Danial Midland. This is on a corrupt congress, lobbyist with skin in the game and crazy environmental commie nuts."

Alcohol is not gasoline. It has two purposes, one is in chemical synthesis and the other is to put in fired oak barrels and lovingly cared for over many years by those boys up in Tennessee and Kentucky. I always suspected they took a sample now and then, "Just to make sure it was aging properly!"

GREAT!

Thank you...

I’ll note that some “Res” Counties have no data.

“Alcohol is not gasoline.”

Better than Methanol, but still total kr@p.

Put your money in to support alcohol-free gas in the US.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.