Posted on 03/27/2025 10:06:51 AM PDT by SeekAndFind

Last week we shared some charts on the utter failure and folly of federal intervention in education for K-12.

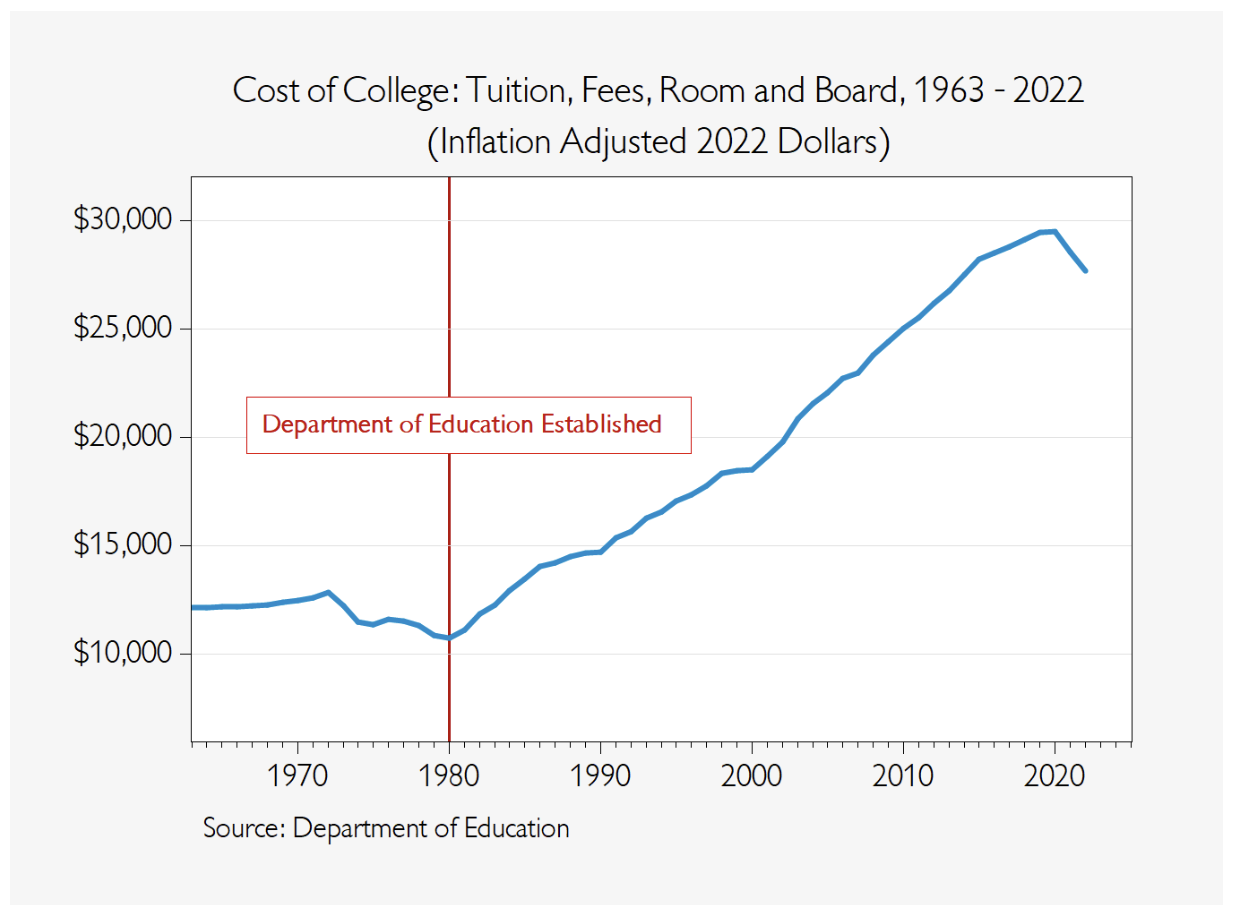

An even bigger failure has been the $1.5 trillion student loan boondoggle. As even more federal dollars have flowed into higher education in grants and (largely forgivable) loans. This is the result:

We got a lot of praise and criticism from readers for our call to impose an excise tax on university tax-free endowments above $1 billion. But what is clear is that almost none of these treasure chests of wealth are being used to make college more affordable. Shameful.

That’s Econ 101. The more dollars chasing a product, the more the price goes up.

“As even more federal dollars have flowed into higher education in grants and (largely forgivable) loans.”

The forgivable part bothers me. A break for Teachers, but not for someone taking coursework in STEM. Loans for a Dr. forgiven if he practices medicine in certain parts of the country. Various exceptions for careers deemed preferred or persons given preferential treatment based on skin color. Student loans are otherwise not forgiven, not even in bankruptcy (you can escape a degree in teaching kindergartners how to color, but not a degree in electrical engineering). To be clear, I’m not asking for loans to be forgiven, but rather to remove the absurdities of ‘forgiveness’ justification.

However, if we do consider ‘forgiving’ any student loans, one criteria might be how much the person has contributed in taxes, and how little they have been a drain on taxpayer dollars. It would more aligned with a ROI calculation.

Duh. The Captain Obvious headline of the day.

“.....a huge transfer of wealth from young Americans to University administrators and professors....”

Exactly!

It is/was a racket and I am shocked none of medias (theirs or ours) focus on that.

There should be a special assessment on all university endowment funds and/or operating surplus until these loans are liquidated.

A great example is boob jobs and lasik eye surgery. Both cosmetic (not paid for by insurance), and the prices have actually dropped over the years due to competition. Like the market is supposed to work.

Duh...

It’s called creating an artificial floor.

If the colleges all know, that every person walking in the door is guaranteed $X in student loans per year at a minimum, then there is absolutely no incentive for any college to charge less than $X per year, EVER.

Same thing happens with section 8... If Section 8 voucher is worth $Y dollars for a 2 bedroom apartment, then there is no reason any landlord would charge less than $Y dollars for a 2 bedroom apartment. Even if they have no intention of accepting section 8.. they know if they had to they would get at least that much for the unit, so you have created an artificial floor.

How else can they afford to pay their bb players 3 million a year,like byu,unless they make the student nurses and medical students pay more.

Like food stamps, the taxpayer subsidies of colleges are for the schools, not the students. It's just less obvious when they pretend it's for the students.

Yeah, but laser boob surgery stays stubbornly expensive.

Institutions need skin in the game toward the success of their students.

Duh.

That’s a great contrast.

Although I wouldn’t say that Lasik eye surgery is purely cosmetic, it still serves your example well. If insurance doesn’t cover it, the eye surgery clinics wouldn’t need to lower their rates to compete with other clinics. They’d just send the $67,000 bill to medicare or anthem or bluecross and everyone thinks they are happy. The healthcare consumer is too dumb or too oblivious to realize that’s why their rates are going up every year. But if you quote $67,000 for Lasik to the guy working at the local oil change shop, he is walking out the front door.

Guaranteed, like day follows night!

I’m sure those indoctrination camps are the biggest lobbyists for student loans, I mean, giveaways.

and we don’t need a pHD in economics from Princeton to realize that :)

Put more money in people’s pockets and the price of things they purchase goes up. Funny how that happens.

The price of ANY item will ALWAYS be what people are willing and able to pay for it + any subsidies.

Thus as the government increases subsidies more and more and more.. the price simply goes up and up and up. Because in the end what is left after that is all people could ever and can afford.

The government has driven up the cost of college this way, and INSURANCE has done the same with healthcare costs. That small amount you pay out of your pocket that insurance doesn’t cover.. yeah.. that’s all it would have cost total without insurance subsidies distorting the price.

covid.

Ya don’t say.

“It is/was a racket and I am shocked none of medias (theirs or ours) focus on that.”

Yes. The student loan program may be an even bigger income transfer program than Obamacare. And at least Obamacare subsidizes poorer people and taxes more well to do people (I’m not supporting it, just noting the facts).

But the student loan program takes money from poorer young people and gives it to very well-heeled university professors and university administrators. Reverse Robin Hood.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.