Skip to comments.

Democrats weep crocodile tears about tariffs, but ignore how taxes, regulations, and government spending raise costs

American Thinker ^

| 31 Jan, 2025

| Jack Hellner

Posted on 01/31/2025 5:06:52 AM PST by MtnClimber

Democrats have been screaming about President Trump's tariffs, not knowing much about where inflation comes from.

I have never seen such simple-minded ignorance when I see most of the media and other Democrats talk about the economy, including basic economic knowledge.

Take tariffs.

Democrats just repeat the mantra of how the consumer pays 100% of the tariff and how much the tariffs cause "inflation."

When Trump raised tariffs on China, in his first term, somehow prices didn't rise much if at all. China is a government-controlled economy and they had to eat the tariffs to keep their economy running.

Look at the screams of how much President Trump's threatened 25% tariffs on Colombia were going to cost.

I heard that roses would rise to $90 per dozen if the full 25% tariff was slapped on.

How is it possible for anyone with an ounce of economic knowledge to not know that Colombia is not selling roses for $90 per dozen.

SNIP

Democrats never talk about the inflationary impact on people when they raise taxes, but 100% of taxes are eaten by consumers. This includes income taxes, sales taxes, motor fuel taxes, payroll taxes, cigarette taxes, liquor taxes, gambling taxes, and more, plus all kinds of government fees. Government never seems to get enough but somehow that isn't described as 'greedy.'

Democrats also never talk about the cost increases caused by their regulations -- and they regulate endlessly.

See here:

New record: Biden’s swamp uncorked $1.8 trillion in regulations

(Excerpt) Read more at americanthinker.com ...

TOPICS: Business/Economy; Society

KEYWORDS: inflation; regulations; tariffs; taxes

To: MtnClimber

They are trying to find the straw that breaks the camel’s back.

2

posted on

01/31/2025 5:07:08 AM PST

by

MtnClimber

(For photos of scenery, wildlife and climbing, click on my screen name for my FR home page.)

To: MtnClimber

“They are trying to find the straw that breaks the camel’s back.”

They are trying to break the camel’s back…. Then blame Trump.

3

posted on

01/31/2025 5:11:03 AM PST

by

grumpygresh

( Civil disobedience by non-compliance; jury and state nullification.)

To: MtnClimber

Communists are by definition ignorant about economics. It’s the economics of evil children.

4

posted on

01/31/2025 5:14:08 AM PST

by

HYPOCRACY

(Democracy is dead. Long live the Republic!)

To: MtnClimber

My favorite thing is when liberals say...”Tariffs aren’t paid by foreign countries. They are paid by the American consumers.” (as if they have some idea how economics works)

And then someone asks them...”Who pays corporate taxes?”

Heads explode.

5

posted on

01/31/2025 5:43:22 AM PST

by

nitzy

(I don’t trust good looking country singers or fat doctors.)

To: MtnClimber

democrats are “blind in one eye, can’t see out of the other” when it comes to OUR tax dollars so of course the only thing they see is the gravy train flowing into their personal coffers for “services rendered”, which is how virtually how ALL CONgresscritters think. cutting off their sacred cash cows is how the spendthrifts are forced to learn. if that is even possible.

6

posted on

01/31/2025 5:46:21 AM PST

by

Qwapisking

(Q: know the difference between a petulant 6 y.o. and a liberal? A:age. L.Star )

To: MtnClimber

At the end of the linked article where he talks about of Biden’s Chief economic adviser Jared Bernstein:

“…So he was essentially a social worker with no educational background in economics or finance and no business experience. He worked for a liberal think tank. He was confirmed by the Senate. So Democrats should shut up when they complain about Trump's nominees being unqualified…”

7

posted on

01/31/2025 6:55:10 AM PST

by

rlmorel

("A people that elect corrupt politicians are not victims...but accomplices." George Orwell)

To: MtnClimber

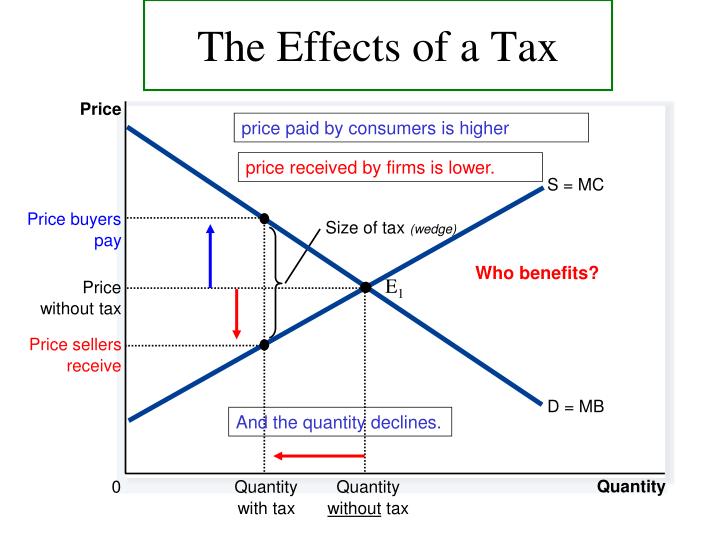

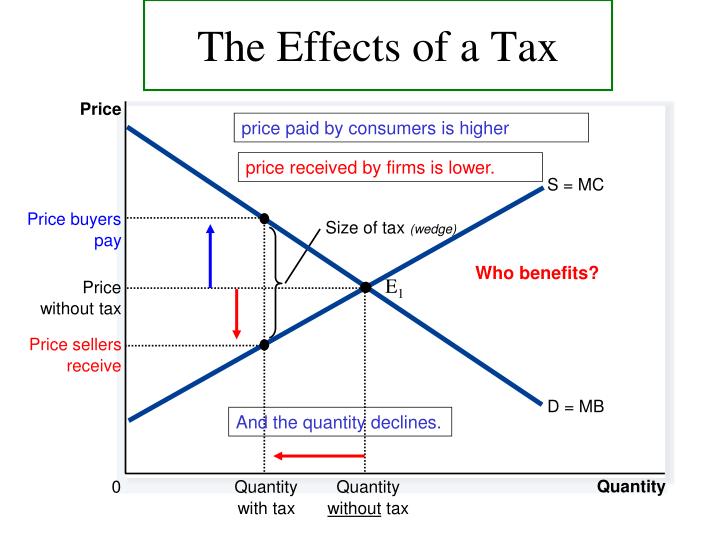

In Economics, Taxes are paid by the producer and consumer both. The amount of the tax is known as a "Tax Wedge" in the graph:

Whenever and wherever a tax is applied, there is "Deadweight Loss", which is the value destroyed in the economy because the tax makes things more expensive, so less commerce is transacted. This is the light gray area in the graph, and both the producer and consumer lose the opportunity of those transactions entirely:

Next, both the Producer and Consumer pay the tax in proportion to the amount of the Tax rectangle in Orange that is above or below the natural untaxed market clearing price (Pe).

Here's an even better picture that shows exactly the amounts paid by each, the "Burden" of the tax on "Consumer" or supplier ("Firm").

The interesting thing about a tariff is who is taxed as the supplier: The Native Supplier or the Foreign Supplier. A tariff is only levied on the foreign supplier, so that they are massively disadvantaged over the native supplier whose products are cheaper, being untaxed.

So, under a tariff taxation regimen, foreign (read: Chinese on average) suppliers are massively harmed, and native (read: American) suppliers are massively advantaged. Make America Great Again, anyone?

Now much of the world (Chinese, Japanese, European, etc.) is already on the "Tax the foreign supplier" bandwagon, mainly harming potential Americ youan exports. This is good for them and bad for us. Trump's tariffs can mainly be seen as returning the favor, and leveling the playing field.

The only true harm to Americans by implementing a tariff regime would come from applying tariffs to imports from countries that do not currently have tariffs on American product, encouraging those countries to start an American Producer tariff regimen. But that is probably a smallish minority of countries by trade volume.

So, a tariff driven tax regimen that DISPLACES American income taxes that only fully harm Americans with a tariff regimen that harms Americans somewhat less by burdening foreign suppliers with tax losses must be counted as a GOOD THING FOR AMERICANS!!!

MAGA!!!

8

posted on

01/31/2025 7:04:05 AM PST

by

Uncle Miltie

(Call Traitor General Milley back into service, bust him to private, courtmartial, convict, hang.)

To: Uncle Miltie

“Americ youan” = American.

Darned phone keyboard!

9

posted on

01/31/2025 7:06:57 AM PST

by

Uncle Miltie

(Call Traitor General Milley back into service, bust him to private, courtmartial, convict, hang.)

To: MtnClimber

To: Uncle Miltie

Thanks, that was a great explanation.

11

posted on

01/31/2025 7:17:03 AM PST

by

MtnClimber

(For photos of scenery, wildlife and climbing, click on my screen name for my FR home page.)

To: MtnClimber

12

posted on

01/31/2025 7:57:34 AM PST

by

aquila48

(Do not let them make you "care" ! Guilting you is how they. control you. )

To: MtnClimber

Chronic deficit spending and huge excess of imports versus exports are “financed” by high inflation, which steals the value of wages and savings. To stop this theft, cut government spending and reduce imports. This is not rocket surgery.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson