Posted on 11/20/2024 9:07:02 PM PST by SeekAndFind

With steadily increasing home prices and stagnating wages among lower-wage workers, home ownership for many Americans has become increasingly unaffordable.

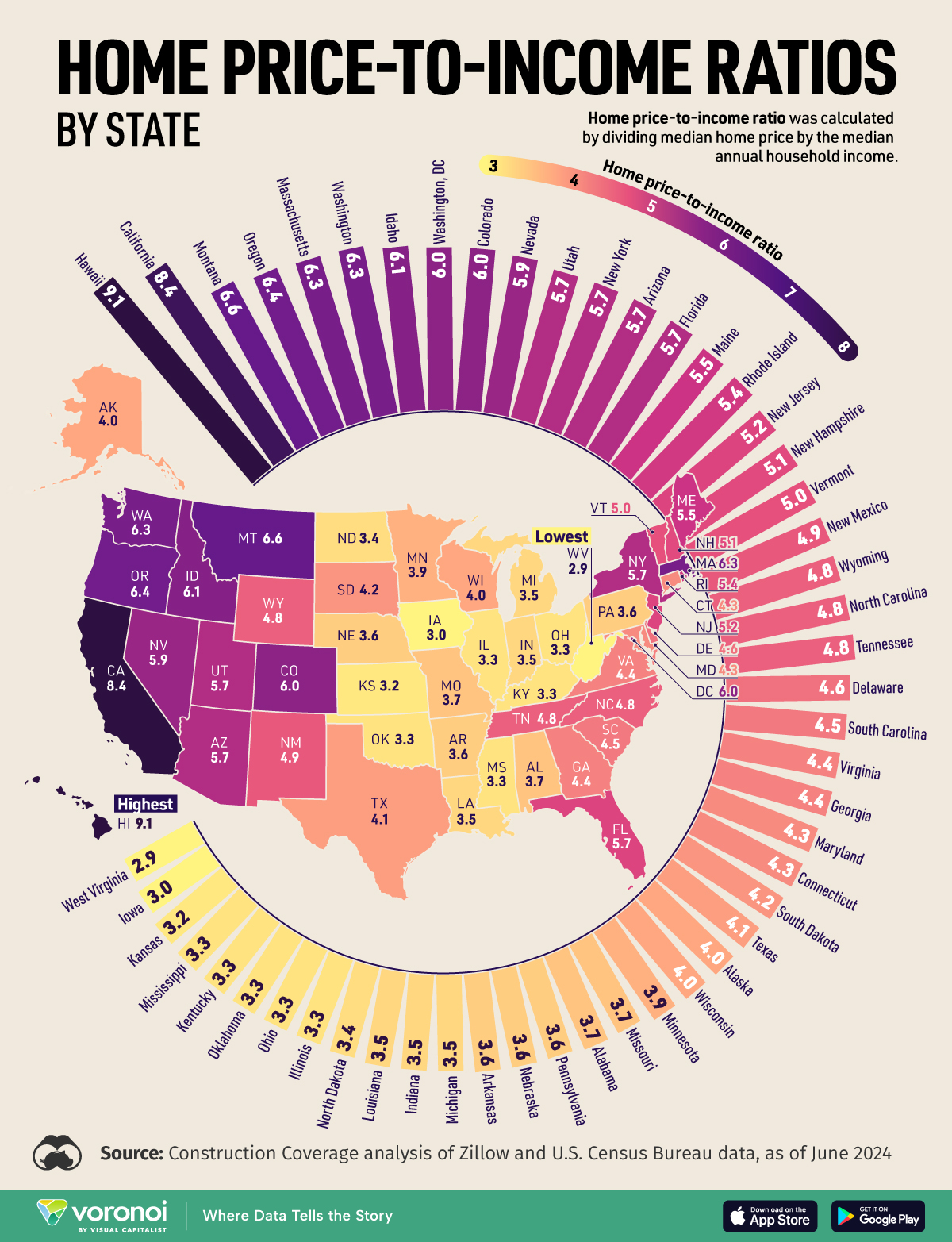

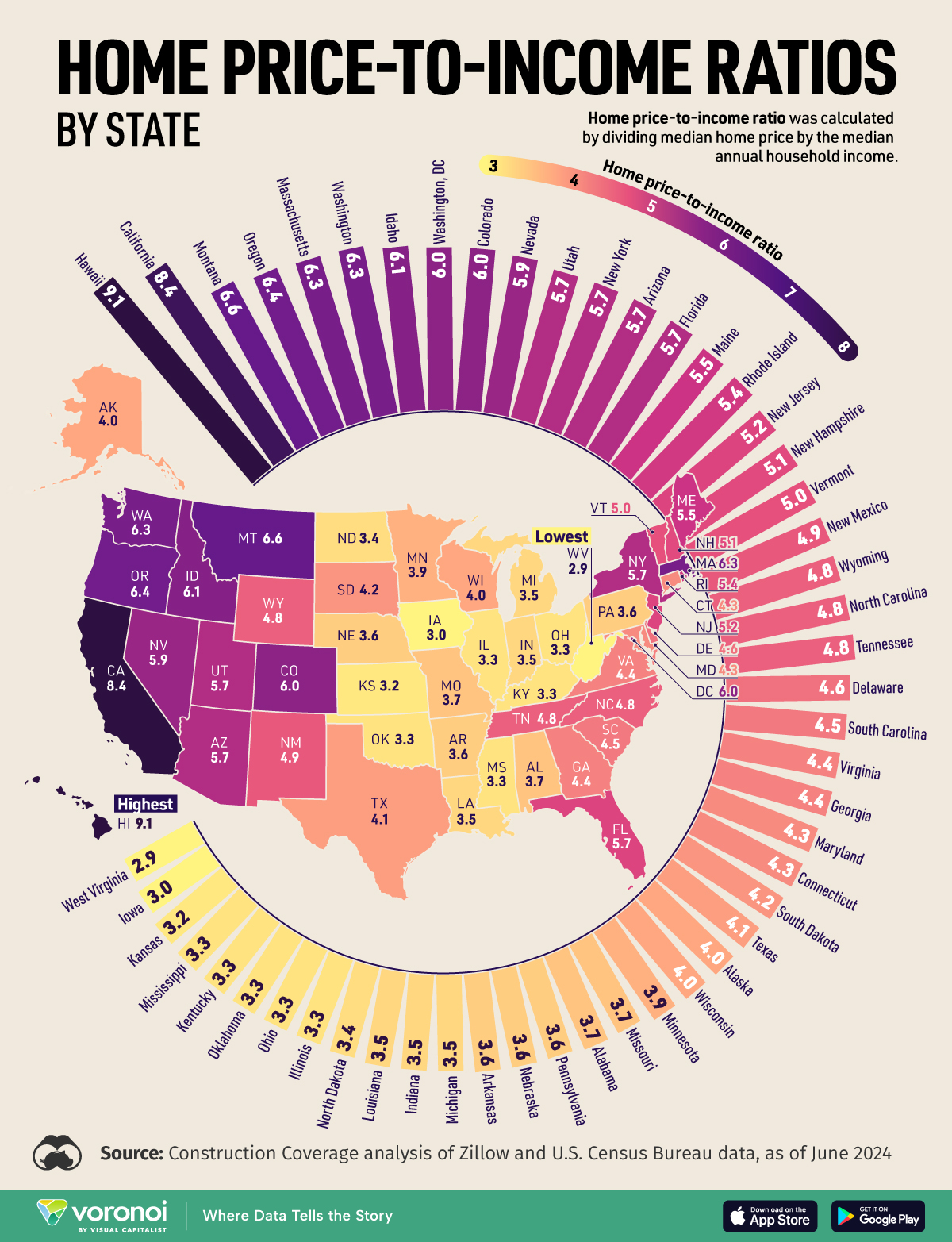

The home price-to-income ratio measures the relationship between the median home price and the median household income. This metric is often used to gauge housing affordability, accounting for variations in the cost of living.

This map, via Visual Capitalist's Kayla Zhu, shows home price-to-income ratio of each U.S. state, using data from a Construction Coverage analysis of Zillow and U.S. Census Bureau data as of June 2024.

The table below shows the home price-to-income ratio for each U.S. state, where Hawaii (9.1) and California (8.4) at the top—both well over the national average of 4.7.

| Rank | State | Ratio |

|---|---|---|

| 1 | Hawaii | 9.1 |

| 2 | California | 8.4 |

| 3 | Montana | 6.6 |

| 4 | Oregon | 6.4 |

| 5 | Massachusetts | 6.3 |

| 6 | Washington | 6.3 |

| 7 | Idaho | 6.1 |

| 8 | Washington | 6 |

| 9 | Colorado | 6 |

| 10 | Nevada | 5.9 |

| 11 | Utah | 5.7 |

| 12 | New York | 5.7 |

| 13 | Arizona | 5.7 |

| 14 | Florida | 5.7 |

| 15 | Maine | 5.5 |

| 16 | Rhode Island | 5.4 |

| 17 | New Jersey | 5.2 |

| 18 | New Hampshire | 5.1 |

| 19 | Vermont | 5 |

| 20 | New Mexico | 4.9 |

| 21 | Wyoming | 4.8 |

| 22 | North Carolina | 4.8 |

| 23 | Tennessee | 4.8 |

| 24 | Delaware | 4.6 |

| 25 | South Carolina | 4.5 |

| 26 | Virginia | 4.4 |

| 27 | Georgia | 4.4 |

| 28 | Maryland | 4.3 |

| 29 | Connecticut | 4.3 |

| 30 | South Dakota | 4.2 |

| 31 | Texas | 4.1 |

| 32 | Alaska | 4 |

| 33 | Wisconsin | 4 |

| 34 | Minnesota | 3.9 |

| 35 | Missouri | 3.7 |

| 36 | Alabama | 3.7 |

| 37 | Pennsylvania | 3.6 |

| 38 | Nebraska | 3.6 |

| 39 | Arkansas | 3.6 |

| 40 | Michigan | 3.5 |

| 41 | Indiana | 3.5 |

| 42 | Louisiana | 3.5 |

| 43 | North Dakota | 3.4 |

| 44 | Illinois | 3.3 |

| 45 | Ohio | 3.3 |

| 46 | Oklahoma | 3.3 |

| 47 | Kentucky | 3.3 |

| 48 | Mississippi | 3.3 |

| 49 | Kansas | 3.2 |

| 50 | Iowa | 3 |

| 51 | West Virginia | 2.9 |

Despite Hawaii and California ranking in the top five for median income (adjusted for cost of living), both states also consistently rank first and second respectively when it comes to median home prices.

Hawaii and California also rank second and third, respectively, when ranking states by the highest salary needed to live comfortably for a single working adult.

According to ATTOM, Hawaii has the highest median house prices in the U.S., at around $852,000.

The Aloha State’s limited land availability, strict housing regulations, and high demand for housing in a desirable climate, are some contributing factors to its high home prices.

Californian cities Los Angeles, San Jose, Long Beach, and San Diego are the top four large U.S. cities with the highest home price-to-income ratios.

Home prices in California have reached unprecedented highs due to a persistent imbalance between high demand and limited supply, which is exacerbated by strict zoning laws, geographic constraints, and a robust economy attracting high-income residents.

To learn more about housing affordability, check out this graphic that shows the top 10 global markets by median price-to-income ratio.

Bookmark.

Why the hell is Montana so expensive?

This is a comfortable old place in a small, rural TN town with some great neighbors. Because I didn't go for a McMansion (actually, this old place was described as a "mansion" by the appraiser when I bought it), if I lost my job tomorrow I would still wake up the next morning with a smile.

No one wants to live in flyover country.

I scratched my head at that one too. A friend bought a nice ten acre farm there with a house and outbuildings a couple of years ago for under 500k. Seemed like a good deal.

Then why are so many people moving there?

Home sales are dropping but the prices never go down.

I live in Hawaii.

Been here 24 years.

Payed cash for my house when I moved here.

I don’t know how they figure costs, but I know my land alone

is worth 3 times what they say my house is worth.

based on what my new neighbors pay for raw land of a similar size to mine, which is developed.

It is true Hawaii is mostly un-affordable for locals.

That is due to regulations decreed by local politicians.

Don’t get me wrong I don’t want the hi density CA style housing tracts I grew up in.

But locals should have better access to local lands that Hawaii homelands just sit on.

A ratio can be a useful metric, but to understand it you need either the numerator or the denominator, otherwise information is lost. I have a feeling the answer to your question is in part that Montana may not be that expensive but that the average income is low. Combine this with new home construction costs and that out west, lots of land is restricted government land or the infrastructure is not in place to easily build or what is being built is geared for rich Hollywood types who need a second or third home to sink their millions into. The average Joe can’t keep up with those economic pressures.

Is your address "1313 Mockingbird Lane," by any chance?

Regards,

Was that at an auction of impounded properties, held by the County Assessor in the district of Puna?

Regards,

I don’t understand what the numbers mean. What does 5:7 mean?

Maybe not that far from it. :)

Gazillionaires flooding the really nice parts.

Income isn’t very high.

The last time I was in Montana (Red Lodge) it was pretty clear the people around me were not from there. They mostly seemed to be from the west coast and very wealthy. Given Montana’s sparse natural population it would only take a few thousand building their mansions to skew a housing and land market.

Compare that with West Virginia. When I’m there I meet locals and the housing and land are cheaper. I would take Huntington WV over Red Lodge any day.

I wondered that about Montana too

I wondered that about Montana too

During the Plandemic people flooded into Bozeman and Big Sky mainly, although all the towns near a ski area in the state saw triple digit appreciation over a two year period.

Remote work is the main culprit.

Also “Yellowstone” the show has increased interest, and Costner keeps running around talking about the mountains and how great it all is...without mentioning that most of the production is done in and around Park City.

Houses that sold for $300K in 2018 now sell for $650-700K, in a state that has virtually no manufacturing jobs, just construction and hospitality. Thus the adverse price to earnings ratio.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.