Posted on 03/12/2023 10:40:08 AM PDT by marcusmaximus

-snip-

SVB would reopen on Monday morning, under the control of the newly created Deposit Insurance National Bank of Santa Clara. Once that happens, insured depositors with up to $250,000 in their accounts will be able to access their money.

But the majority of deposits at SVB were not insured, and it is unclear when those customers will be able to access their money

-snip-

One potential option could be to use the FDIC’s systemic risk exception tool to backstop the uninsured deposits at SVB. Under the Dodd-Frank Act, that move would need to be made in concert with the Treasury Secretary and the Federal Reserve.

Additionally, Bloomberg News reported on Saturday that regulators were weighing creating a special investment vehicle that would backstop uninsured deposits at other banks, which could keep the bank run from spreading in the coming week.

(Excerpt) Read more at cnbc.com ...

Sounds as if all the donations to the DNC by the bank and its customers is about to give them some serious returns.

Only $5.7B out of $211.7B are insured

Ah, more of the Deconstructing of America. Brought to you by the Marxist Socialists of AmeriKa.

I don’t wanna ‘backstop’ a damned thing, especially some overcharging SV tech company that put its money there to pay a bunch of pampered leftist employees. The ‘government’ does’nt ‘backstop’ anything. The American taxpayer does.

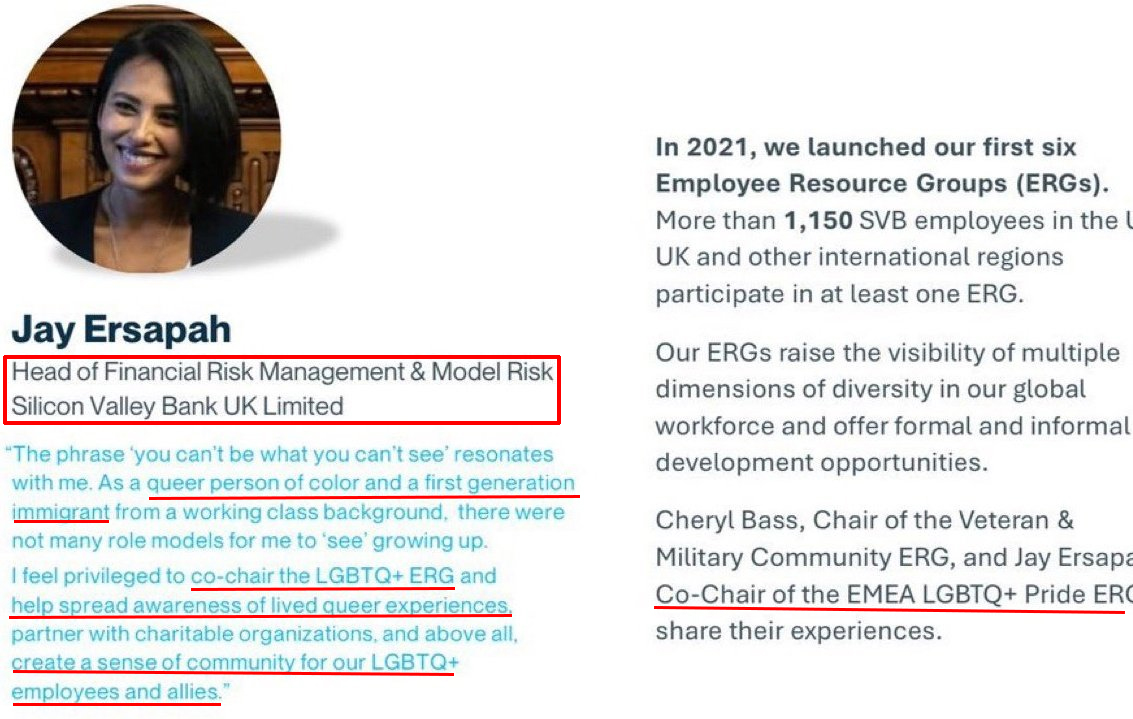

I took a look at that investment team picture. Now it’s obvious what SVB’s problem was.

1. No men dressed in drag.

2. No women of color.

3. No women in burkas.

Let this be a lesson to all other banks. Be more inclusive!

Lot of people believe that bulk of account money (maybe up to 50 to 60 percent) is still existing, but with legal action....it could be two to three years to get that money back. For companies to survive and continue paying employees...they’d need cash flow.

I would imagine some type of massive Biden push...to loan 50-percent of value out, until these people get the final pay-off will occur (figure in the $100-billion range).

For the little guy, figure they will get their $250k very shortly.

A lot of this money is tied into fed bonds....paying at a crappy rate unlike the recent bonds which were much better rate.

“But the majority of deposits at SVB were not insured...”

************

Taxpayers will cover them. Just watch what happens.

There is a simple answer. Any deposits over 250K are charged a fee for insurance.

Anyone with a million dollar house pays more for insurance that a person with a 100K house. Why should it be any different for cash in the bank?

i can figure this out and have not even stayed at a Motel 6.

The government will bail out the depositors which will guarantee that we will have more of the same nonsense.

JPM at 32%

It appears the “powers that be” have been deliberately trying to pump up the value of the bank’s stock over the past couple of months, so they could bail out and leave the poor retail investors holding the bag. This happens often so always be wary if suddenly you see all financial reporters suddenly touting the value of a stock. They will encourage people to buy the stock and push the price up only to bail just before the bad news is revealed. I’ve seen it happen often. The classic “pump and dump”.

FDIC’s systemic risk exception tool

But although the FDIC will be responsible for administering such a program, the

maximum amount of outstanding debt that can be guaranteed is to be determined not

by the FDIC but by the Secretary of the Treasury in consultation with the President.

And, in a significant addition, the law also requires the program to have congressional

approval in the form of a joint resolution—a requirement that essentially means

Congress must pass the equivalent of a law before the program can go forward.59 So

although Dodd-Frank provides for a program similar to the DGP, the law’s requirement

for wider political consent through congressional approval (even though the approval

would have to be considered on an expedited basis) could limit regulators’ flexibility

during a future financial crisis.

Interesting if followed..............................

Indian’s seam to be a disaster at business but experts at diversity ,LOL

Regarding the above.

Many here want a quick fix. An efficient govt that fixes it on Monday.

Remember our Founding Fathers put together an inefficient govt purposely. The market place is part of the answer and the govt makes it worse in their “solution”.

Indians, Chinese, and Koreans dominate at the Ivy League thanks to the “meritocracy” that so many on this site worship.

I’m no expert on these matters, but it seems to me that the easiest course of action from the Federal government would be to have the U.S. Treasury buy all of SVB’s bond holdings out on a dollar-for-dollar basis. SVB’s custodian would then pay out all of the depositors in full, then sell off the remaining assets (cash plus loans on the books) on the open market.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.