Posted on 09/20/2022 8:43:38 AM PDT by SeekAndFind

Investors are running scared.

Chalk it up to the August CPI reading, which prompted a brutal sell-off on Wall Street last Tuesday. Stocks suffered their largest one-day drop in more than two years.

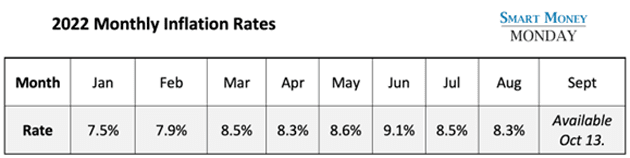

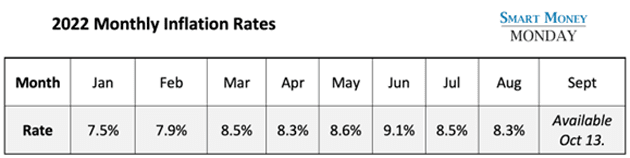

Why? The market took a “glass half empty” view of positive news: The headline inflation rate decreased from 8.5% in July to 8.3% in August.

As you can see, inflation has continued to trend downward since peaking in June:

Click to enlarge

Readers, this is good news. And it’s part of why our inflation nightmare could end within six months. Let me explain…

The CPI core rate is what really sent markets into a frenzy.

The core rate excludes volatile energy and food prices. It rose from 5.9% to 6.3% as rents jumped, along with other goods and services.

The Fed sees the CPI core rate as a major indicator of underlying trends. So, it&rsquorsquo;s no surprise the media obsess over it too. Maybe you’ve seen some of the alarmist, click-bait headlines. Same as it ever was, fear sells… but I’m not buying it.

Don’t get me wrong: The latest CPI report isn’t worry-free. And yes, the headline number of 8.3% year over year is still high. But overall, inflation is easing. That’s nothing to scoff at, even if it’s happening slower than consumers would like.

I always like to look under the hood, and there’s something a lot of people are missing. This missing link explains why, even though the core rate rose, inflation has in fact turned the corner.

Inflation will be flat within six months, and housing will play a pivotal role in taming it.

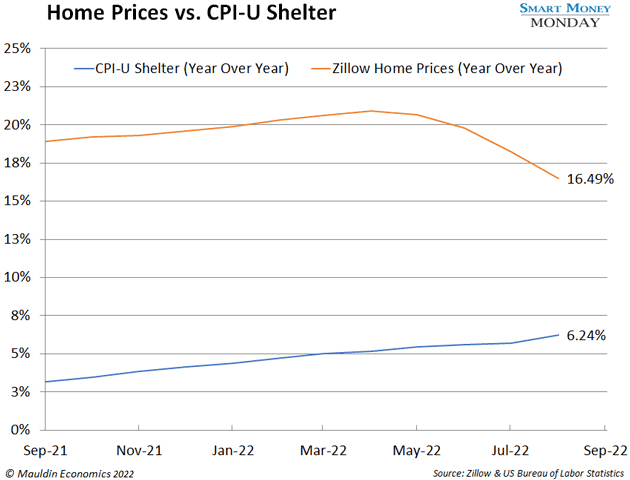

See, housing prices are a lagging indicator. Government inflation data uses historical prices to track housing, not current prices. So it takes time to see changes.

The CPI-U tracks prices of a few big chunks of daily life, like food, energy, and airline tickets. Those are all easy to calculate—it’s not hard to pinpoint the price of a dozen eggs or a gallon of gas.

Calculating the CPI-U’s housing component, or “shelter,” gets a little trickier. But it’s critical since it makes up a third of the index. That’s a huge chunk.

The CPI-U’s shelter data includes two numbers: rent and owners’ equivalent rent (OER). Rent is self-explanatory. It’s what renters currently pay each month based on their leases.

The other component, OER, is where things get dicey. That’s because OER is hypothetical. It involves homeowners’ estimates of what their houses would rent for.

The government tries to approximate this figure. And, as you may have guessed, its methods get a bit wonky. It pulls in a few factors such as rent, property values, and income to approximate this value. Basically, there’s a lot of guessing involved.

Meanwhile, one look at Zillow shows that home prices are indeed coming down.

We all know that home prices skyrocketed during the COVID mania. That’s easy to see when you look at the Zillow Home Value Index (ZHVI). The index rose an average of 19.6% year over year from August 2021 through July 2022. But the CPI-U’s shelter calculation only rose 4.5%, on average, during that same period.

Housing prices have started to cool based on the Zillow index, as you can see in the chart below. And compared to July 2022, home prices are basically flat. But the CPI-U’s August shelter reading is the highest it’s been since April 1986.

Click to enlarge

Simply put, the government’s housing data is based on old numbers. Inflation is cooling more than you think—it’s just not showing in the official data yet.

As inflation continues to ease, I’m confident the Fed will pump the brakes on interest rate hikes. After all, the whole point of hiking rates is to fight inflation. That pivot will help push stock prices back up.

Again, this is going to take some time. But I expect more accurate housing prices to make their way into the government data by early 2023.

My take: Inflation will be close to flat come next March. This will be a major shift that calms panicked investors and quiets recession fears. Once that happens, expect to see the next bull market kick into high gear.

Stock price data is provided by IEX Cloud on a 15-minute delayed basis. Chart price data is provided by TradingView on a 15-minute delayed basis.

“Inflation is easing!” said no one who has been to a grocery store, hardware store, or needed a repairman.

Once we get past the Midterms and get into the early parts of 2023 and things just go utterly to garbage, get back with us, Mr. Thompson Clark.

Sort of sounds like that other promise of ‘Two Weeks!’

when covid started, or was started.

It will ease when Trump is back in the WH.

I guess this guy forgot about our NG and Oil is being shipped to the EU, and will continue throughout the winter, raising our energy prices up for heating, electricity production, farming and transportation. That is the main driver of inflation as it affects all products.......and people except the elites.

Gas is back up over $5.00 a gallon here in northern CA.

Just paid $5 for a loaf of bread. $5.25 for a dozen eggs. $4.85 for a gallon of milk. These prices are insane. I just thank god that I don’t have to worry about these prices. How are people who don’t have a good job doing it?

Yeah, another 6 months and Biden will have everything broken and running backwards with no hope of recovery. Thats when he will officially hand us over to Putin.

> expect to see the next bull market kick into high gear <

This is an interesting article. It’s always good to get different viewpoints. But I suppose that a guy who writes for a site called “Equities” would always try to find reasons to be pro-stocks.

Or am I being too cynical?

Don’t worry about inflation. Inflation will disappear as soon as the economy is dead.

Gas is back up over $5.00 a gallon here in northern CA.

Just paid $5 for a loaf of bread. $5.25 for a dozen eggs. $4.85 for a gallon of milk. These prices are insane. I just thank god that I don’t have to worry about these prices. How are people who don’t have a good job doing it?

Well you need to move out of California then. Here in Texas:

GAS $2.85 Gallon

Bread $2.35 Loaf

Eggs $3.52 Dozen

Milk $3.15 Gallon

I don’t believe this.

When inflation figures are quoted, they are, as the author states, year over year. And the numbers lately have been startling, of course.

But to use a banal (and made up) example, if your gas was $2 two years ago and now it’s $5 and six months from now it’s $4.75 does this put you in a celebratory mood? What about if in three years it’s still $4.75 or hallelujah! $4.45 are you in a permanent state of joy? The assumption is made that if YOY inflation recedes, no matter what heightened plateaus food and gas get to, it’s OK as long as they stay there.

Yes, I believe that human beings are or can be enormously adaptable, but if your income does not keep up with the glorious new plateaus of double the former altitude, vast swaths of the population will not be able to keep up.

The checks in the mail, people. Don’t go casting your vote like the economy sucks.

Even if inflation flatlined right now the food and energy prices are already through the roof. I expect after the midterms the gas prices to start climbing fast again. Noticed that first during the re-installment of obozo in 2012. About six months before the election the gas prices stop going up or even dip down to help the rats. After the election BOHICA.

Three stock picks - one down big, one up big and one flat. So draw your own conclusions from that record.

Another fraudulent article.

The headlins says “will.” In the article that becomes “could,” the mother of all weasel-words.

“Inflation is cooling more than you think” That’s what he wants us to think.

Next March I want an apology from the author of the article.

RE: Noticed that first during the re-installment of obozo in 2012. About six months before the election the gas prices stop going up or even dip down to help the rats.

What’s this? You mean Democrats have the power to control how prices will trend? What is this magical power that they have?

And if they can control prices, why not keep them down permanently?

The Fed sees the CPI core rate as a major indicator of underlying trends.

Hell of a smoke screen we’ll be lucky not to be in depression by 2023 nothing is on the up tick as long as oil is on the freeze list so is everything connected to it.

Hmmm good economic news and what a coincidence!

’Right before mid-terms, who would have “thunk it”?

Deflation isn't as great a situation to have as people might imagine.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.