Posted on 01/26/2021 9:23:18 AM PST by SeekAndFind

The Fed's most frequent lament is that no matter how many trillions in bonds (and stocks and ETFs) it buys or how much liquidity it forehoses into the market, it just can't push inflation higher.

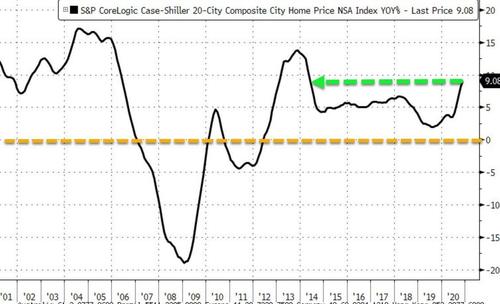

Well, here's an idea: maybe all the central-planning megabrains at the Marriner Eccles building and 33 Liberty Street can take a break from whatever circle jerk they are engaged in right now, and look at the latest Case Shiller numbers which showed not only that home prices surged at the fastest pace in seven years, rising more than 9% compared to a year ago...

... but that for the first time since the financial crisis, the annual price increase in every major US MSA (and according to Case Shiller there are 20 of them) rose by at least 6.8% Y/Y (in the case of Las Vegas) and as much as 13.8% in Phoenix, meaning that the average home prices across all of the US is now rising at 4.5 times the Fed's own inflation target, and even the cheapest US MSA is rising at more than 3 times the Fed's inflation goal.

Why does this matter? Simple: Because if - as Joseph Carson mused last month - CPI measured actual house prices, inflation would be above 3% right now.

For those who missed it, here again is the explanation:

"Actual" consumer price inflation is rising during the recession. That runs counter to the normal recessionary pattern when the combination of weak demand and excess capacity works to lessen inflationary pressures.

The main source of faster consumer price inflation is centered in the housing market. The Case-Shiller Home Price Index posted a 7% increase the last year, more than twice the gain of one-year ago.

The sharp acceleration in house price inflation represents the fastest increase since 2014 and runs counter to the patterns of the past two recessions. During the 2001 recession house price inflation slowed by one-third, while in the Great Financial Recession housing prices posted their largest decline in the post-war period, falling over 12% nationwide.

The consumer price index (CPI) does not show in house price inflation because it uses a non-market rent index to capture the trends in housing inflation. The Bureau of Labor Statistics (BLS) estimates that the non-market rent index has increased 2.5% in the past 12 months, or 450 basis points below the rise in house prices.

If actual house prices were used in place of rents core CPI would have registered a 3% gain in the past year, nearly twice the reported gain of 1.6%.

If aggregate price measures did not exist house prices would be one of the most important measures to gauge inflation and the proper setting of official interest rates. That’s because house price cycles include easy credit/financial conditions, excess demand, and inflation expectations, three key ingredients of inflation cycles.

Rising consumer price inflation is added to the list of unique features of the 2020 recession. Others include an increase in corporate debt levels instead of debt-liquidation and rising equity prices instead of share price declines.

If the 2020 recession has economic and financial features that normally appear during economic recovery what does that imply for the next growth cycle? The debt overhang at the corporate and federal debt should impede the next growth cycle. And if the cyclical rise in housing demand is occurring in recession it can't be repeated during recovery.

The next economic cycle will be filled with unique tipping points, and no one should assume that policymakers can control or offset them.

I could understand if home prices were soaring in the suburbs, or in rural areas, but why would they be soaring in the cities? After last year(Antifa/BLM), I would NEVER consider living in a city.

Its inflation hitting

free money comes at a cost

The PPP was free money to the insiders who knew how to file the right forms to get it

Why do you think Democrats were for it?

My house is worth 200K more then it was last year

Homes in my area sell in days, some in hours of listing, sight unseen

New Yorkers are fleeing the city like the rats that they are

My daughter looked at a house in suburban NJ. It went on the market Friday $485K, she went to look at it Saturday afternoon, there were already 9 offers tendered. It sold for $625K. I didn’t like it anyway.

I can understand Red state cities, but Blue state cities?

Chart is not cities proper, but metro area. For Atlanta, the city proper is on the order of 10% of the metro area population.

There are plenty bailing from the city proper to the suburbs based on what I’m seeing.

That makes more sense.

“Homes in my area sell in days, some in hours of listing, sight unseen”

My niece and her husband sold their home in 4 hours and $85k more than the wanted late last year. 12 people were bidding in it.

WE sold our house 2 years ago 8 hours after we signed the sales contract with the realtor.

Both homes were newer construction, in rural area and all white towns....if that tells you anything.

Yep, January prices up 10% from December, largely due to lumber prices and scarcity of homes for sale.

I still remember when Lying Lyndon Johnson removed silver from the money supply and started printing dollars with nothing to back them.

The prices of houses had been low and suddenly Bankers and real estate companies bought them up at low prices knowing they could resell them at a higher price and pay for them over time with worth less than silver dollars.

Within two years the price of a home shot up by over 30 percent.

Same thing happened under the Carter mis-administration.

My son bought a house in May and paid a fair price for it.

The house across the street, almost identical to is, just sold for about 50k more. There are actually bidding wars on houses here in NH.

We were looking to buy a house in greater Phoenix this summer. We will stay in our rental until the bubble bursts. I am NOT buying at top of market again. Last time I bought a house was at top of market in 2006. It lost 40% of it’s value and NEVER recovered fully.

I could understand if home prices were soaring in the suburbs, or in rural areas, but why would they be soaring in the cities?

Not all cities are being abandoned, mainly the ones with ongoing riots. Liberals tend to stay in cities anyway, it’s part of their personal identification, conservatives tend to move out of them. Which is why the claim that liberals have turned states blue is BS in most cases.

“We will stay in our rental until the bubble bursts.”

I hope that works out for you. My brother has plenty of money but has been renting in Seattle for 20 years because “house prices are too high”.

Both homes were newer construction, in rural area and all white towns....if that tells you anything.

Its how it works here in Jersey

All the towns you would ever live in are 95% or higher white

The property values are insane

And since they got the millenials moving out of the cities, demand is now through the roof

I bought a house in a gated community 4 years ago as a 2nd home, paid 90 grand for the place, 4 bed 2 1/2 baths 2 car garage, needed work but nothing I couldn’t get done, well except the roof, I hired a pro for that. Realtor told me I could get 300K easy for it now and would sell in a few days.

Yes, it’s a bubble.

But, refi to get in on the extraordinarily low rates.

I just did so at 2.25%, 30yrs VA with absolutely no cost.

None.

Can’t beat that with a stick.

Yep, I’m out looking and the competition for even marginal properties is getting out of hand. Thinking just stepping back for a couple of seasons as the market is looking too frothy.

“All the towns you would ever live in are 95% or higher white”

A friend is a real estate agent. She said even the liberals want to only live in white areas. They use code words like “good schools”

My late MIL neighborhood was middle class white. Blacks started moving in about 6-7 years ago. Now it’s grafitt, litter everywhere. The good stores closed up. My wife’s cousin is a teacher in the area and the said the black students destroyed one of the highest ranking schools in the district.. Will not listen or obey authority. Confronational with teachers etc.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.