Posted on 08/20/2019 12:38:57 PM PDT by SeekAndFind

Every quarter, the Federal Reserve Bank of New York releases data on how much household debt Americans are accumulating. Here’s everything you need to know about American debt in Q2 2019.

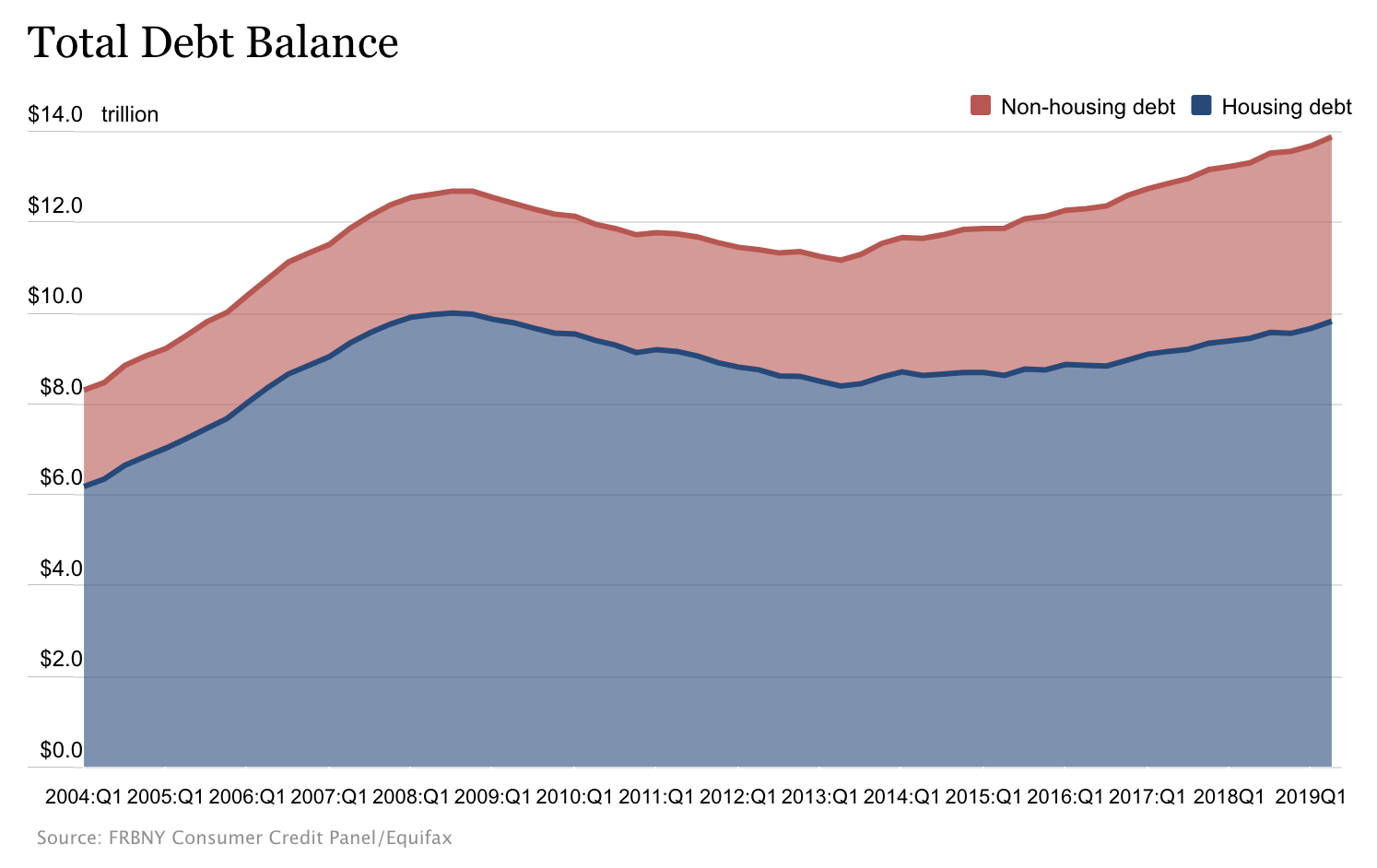

– Total household debt level at $13.86 trillion, up 1.4% ($192 billion) from Q1

– 20th consecutive quarter with increase in debt

– Mortgage household debt rose by $162 billion in the second quarter to $9.4 trillion

– Total mortgage debt the highest it’s been since Q3 2008

– Mortgages and refis increased by $130 billion to $474 billion, the highest since Q3 2017

– $17 billion increase in auto loan balances

– $20 billion increase in credit card balances

– $8 billion decline in student loan balances

– 0.2% increase in 90-days-late credit card balances to 5.2%

– 0.1% fewer mortgages are delinquent—0.9% down from 1.0% in Q1

– Only 10.5% of mortgages in early delinquency (30-60 days late) transitioned to 90+ days delinquent, the lowest rate since 2005

– 232,000 bankruptcies in Q2 compared to 225,000 in Q1

– More student loans are severely derogatory (in danger of repossession or charge-off) than mortgages right now:

– HOUSEHOLD DEBT AND CREDIT REPORT (Q2 2019) (Federal Reserve)

What’s interesting about our National Debt at 22 Trillion?

It’s the same amount the US has already paid out for Reparations. (Great Society)

https://www.heritage.org/poverty-and-inequality/commentary/assessing-the-great-society

That is crazy!

Vote Democrat and they’ll pay for everything.

What about those of us who are living within our means?

We’ve always lived at or below our means. Even though I don’t need to, I still do. I rarely even buy clothes that are not on the clearance rack and absolutely never not on sale.

Never any credit card debt. Small mortgage and a small car loan, because I’m making more with the money invested.

Thanks for your posts/links. BTTT!

I confess I have $20k in low interest credit card debt. It’s my fault, hubby didn’t do it.

But since we have $2.2 million in liquid assets, I’m not worried, the debt is 0.9% of our liquid net worth. I’d dip into the piggy bank to zero out the balance, but hubby wants me to pay it off the hard way, month by month by month. He wants me to feel the pain and I suppose he’s right LOL.

Wife and I were as poor as church mice when we started. Banks wouldn’t loan us a thing. So when we got ahead we never borrowed. Lived in small cracker box house and drove old cars. Embarrassed the kids. But we’re comfortable now with some property to boot.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.