Posted on 10/10/2010 6:38:37 PM PDT by Cindy

NOTE The following text is a quote:

www.treas.gov/press/releases/tg894.htm

October 6, 2010 TG-894

Secretary of Treasury Timothy F. Geithner Remarks at the Brookings Institution

As Prepared for Delivery

This weekend, finance officials from around the world will gather in Washington, along with the senior management of the International Monetary Fund and World Bank. The G-20 Finance Ministers and Central Bank Governors meet in Korea later this month, followed by the G-20 Heads of State in November.

I want to outline our objectives for these meetings.

A period of unprecedented international cooperation

Two years ago, the world economy was in the grip of an economic crisis on a scale not seen since the Great Depression.

The United States and its partners in other leading economies, in an unprecedented feat of peacetime economic cooperation, joined forces to launch a powerful, dramatic response.

Together, we put in place a powerful program of financial support – classic fiscal measures of tax cuts and investment, combined with monetary policy actions by central banks, and a variety of creative actions to stabilize our financial systems – to bring the global economy out of freefall and on a path to growth.

We mobilized hundreds of billions of dollars in financial support for and through the international financial institutions for investments in emerging and developing economies.

We committed to keep markets open to trade and investment, and together we honored that commitment in the face of strong political pressure.

We came together to embrace a common framework for reform of the global financial system.

We passed sweeping reforms of the U.S. financial system, and the world's central banks and supervisors reached agreement just two weeks ago on a very tough set of global standards for capital to limit leverage in the major global financial institutions.

These decisions required considerable trust and political resolve. And they have been effective in restarting economic growth and stabilizing financial markets. Global trade is now almost back to pre-crisis levels.

Each of our economies is stronger today than would otherwise have been possible, because of the effectiveness of this joint strategy. And the financial reforms now underway will substantially reduce the risk of damage from future financial crises.

The Growth Challenge

What are the main challenges ahead?

The most important policy question we confront together is how to strengthen the pace of growth and repair, and how to do so in a way that provides the basis for a more balanced and therefore more sustainable global economic recovery.

This is not a challenge that is best resolved by nations acting independently. In the heat of the crisis, we all recognized that our actions would be more powerful if we acted together. Even though the most dangerous part of the crisis is behind us, we are still in a place where we can achieve better overall growth outcomes if we make policy in a cooperative framework.

I want to offer a few suggestions on the policy challenges ahead in three areas: growth, exchange rate cooperation, and reform of the architecture of economic cooperation.

First, on economic growth. The IMF forecasts the world economy will grow at a respectable annual rate of around four percent in 2011. Growth is very strong in many of the major emerging economies. In the major advanced economies, however, output and employment are still substantially below the pre-crisis levels, and the pace of recovery has been slower, with economic growth now running at a pace that is close to potential growth rates and not rapid enough to repair quickly the substantial economic damage remaining from the crisis.

Economic recoveries that follow financial crises are typically slower than those that follow other types of recessions. This is because of the headwinds to growth that are generated by the necessary adjustments in asset prices and in reducing financial leverage. As financial institutions rebuild their balance sheets and households reduce debt and raise savings, spending is slower to recover. Firms, cautious after being burned by the financial panic, are less willing to invest and to hire because of uncertainty about future strength in demand for their products.

Different economies face different challenges and different constraints on the scope for economic policy to strengthen growth. However, concern about the near-term limits to more growth-oriented economic policies are greatly exaggerated. Most of us still have the capacity to take additional actions that would improve both short-run and long-run growth prospects.

The greatest risk to the world economy today is that the largest economies underachieve on growth. We need to continue providing well-targeted support for the recovery in the near term even as we put in place plans to help ensure fiscal sustainability over the longer term.

And for the recovery to be sustainable, there must also be a change in the pattern of global growth. For too long, many countries oriented their economies toward producing for export rather than consuming at home, counting on the United States to import many more of their goods and services than they bought of ours.

The United States will do its part to achieve this adjustment. Private savings have increased significantly, and, as the recovery strengthens, we will bring down our fiscal deficits to a sustainable level.

But as America saves more, countries overly reliant on exports to us for their own growth will need to change their policies, or else global growth will slow and all of us will be worse off. Countries that chronically run large surpluses need to undertake policies that will boost their domestic demand.

The flexibility each major economy has to provide a greater catalyst to growth in the near term or to slow the pace of near-term fiscal restraint depends on the size of its long-term fiscal problems and the credibility of its plans to address those problems over the medium term. Even if the risks to a sustained global recovery look relatively low, it makes sense for policy makers in the major economies to continue to focus on strengthening growth, rather than risking a premature shift to restraint.

That brings me to the second policy challenge: we believe it is very important to see more progress by the major emerging economies to more flexible, more market-oriented exchange rate systems. This is particularly important for those countries whose currencies are significantly undervalued.

This is a problem because when large economies with undervalued exchange rates act to keep the currency from appreciating, that encourages other countries to do the same.

This sets off a damaging dynamic, described first by my former colleague Ted Truman, as "competitive non appreciation." Over time, more and more countries face stronger pressure to lean against the market forces pushing up the value of their currencies. The collective impact of this behavior risks either causing inflation and asset bubbles in emerging economies, or else depressing consumption growth and intensifying short-term distortions in favor of exports.

This is a multilateral problem. It is unfair to countries that were already running more flexible regimes and let their currencies appreciate. And it requires a cooperative approach to solve, because emerging economies individually will be less likely to move, unless they are confident other countries would move with them.

This problem exposes once again the need for an effective multilateral mechanism to encourage economies running current account surpluses to abandon export-oriented policies, let their currencies appreciate, and strengthen domestic demand. This is a necessary complement to the adjustments being undertaken by countries running current account deficits. A cooperative rebalancing of policy in this direction would be better for overall growth.

This issue was well-known to the group of economists who gathered in Bretton Woods, New Hampshire, to refashion the war-ravaged global financial system in 1944. The Articles of Agreement of the IMF, drafted at that conference, contain a now-obscure paragraph calling on the Fund to issue reports on countries with "scarce currencies"--what today we would call countries running persistent surpluses--"setting forth the causes of the scarcity and containing recommendations designed to bring it to an end." That clause now reads like a relic of a bygone monetary era. But the problem it was drafted to address--the threat to global financial stability posed by persistent, large surpluses--is as salient today as it was then.

This brings me to a third issue on the international agenda, the reform of the architecture of economic cooperation.

When the world's leaders met in London in April of 2009 and then in Pittsburgh in September that year to set a strategy for confronting the crisis, they agreed to begin work on a new "Framework" for global growth and to reform the architecture for cooperation.

The Framework, called the "Framework for Strong, Sustainable and Balanced Growth," was designed to create stronger incentives for rebalancing growth, as the world recovered from the crisis, with higher savings in countries like the United States, complemented by reforms to strengthen domestic demand in surplus countries like China, other emerging economies, Germany, and Japan.

Alongside this "Framework" we agreed to give emerging economies a greater stake in the most important institutions for economic and financial cooperation, to increase the resources available to the international financial institutions, and to make the G-20 the centerpiece of cooperation, replacing the role traditionally played by the G-7.

We agreed to pursue these two paths in parallel. Each involved a change in the rights and responsibilities of the major economies, both emerging and advanced.

We have made some progress on the "Framework," but that achievement is at risk of being undermined by the limited extent of progress toward more domestic demand-led growth in the surplus countries and by the extent of foreign exchange intervention as countries with undervalued currencies lean against the pressures for appreciation.

On the governance front, we are now making progress toward agreement on a very important set of reforms to create a stronger IMF. These changes would strengthen the financial position of the Fund, allow it to respond more quickly and forcefully to future crises, and give the fastest growing emerging economies greater weight in the institution and a greater share of seats on the Board.

We want to make sure these changes go far enough in rebalancing rights and responsibilities of the members of the institutions. And for this reason, an agreement to modernize the governance of the IMF needs to be accompanied by more progress in encouraging countries, particularly the surplus countries, to pursue more market-oriented exchange rate policies and policies that will reduce reliance on exports and strengthen domestic demand.

We will be exploring with the other major economies some suggestions on how best to advance these objectives.

I want to conclude by emphasizing that we recognize the special responsibility of the United States for contributing to a more stable global financial system and a more balanced and sustainable pattern of growth.

We have moved aggressively to do our part to help bring the world out of crisis. We are working very hard to repair our financial system, to fix what was broken, and to reduce the future risk of financial crises here at home. We have seen a very significant increase in private savings by households. Our external deficit has fallen sharply, and we are financing at home a much larger share of the fiscal deficits we inherited.

We still have a lot of challenges ahead of us to strengthen growth and to restore fiscal sustainability. And we expect to work closely with Congress in the months ahead on how best to move forward.

###

NOTE The following text is a quote:

www.ustreas.gov/press/releases/tg901.htm

October 9, 2010

TG-901

Statement by Secretary Timothy F. Geithner at the International Monetary and Financial Committee (IMFC) Meeting

As we meet this weekend, we should recognize the recent historic accomplishments of the countries gathered here. Two years ago, the world economy was in the grip of an economic crisis on a scale not seen since the Great Depression.

Together, we committed to and implemented an aggressive, unprecedented response to the crisis. That response calmed markets, stabilized and initiated reforms to our financial systems, and put the global economy on a path to growth.

But we should also recognize that our work is far from done. As the IMF highlights in its current World Economic Outlook, the global economy continues to mend. But we face a series of challenges that require collective will and commitment to meet effectively. The most important of these is how to strengthen the pace of growth and repair, and to do so in a way that provides the basis for a more balanced—and therefore more sustainable—global recovery.

More balanced growth is fundamental

The IMF forecasts the world economy will grow at a respectable annual rate of around four percent in 2011. Growth is very strong in many of the major emerging economies. In the major advanced economies, however, output and employment are still substantially below pre-crisis levels, and growth is now running at a pace not rapid enough to quickly repair the substantial economic damage remaining from the crisis.

The greatest risk, therefore, to the world economy today is that the largest economies underachieve on growth. We must continue providing well-targeted support for the recovery in the near term even as we put in place plans to help ensure fiscal sustainability over the long term.

For the recovery to be sustainable there must also be a change in the pattern of global growth. For too long, many countries oriented their economies toward producing for export rather than consuming at home, counting on the United States to import many more of their goods and services then they bought of ours.

The United States is doing and will do its part to achieve this adjustment towards more balanced growth. We have taken steps to raise national savings. Private savings have increased significantly. And we will bring down our fiscal deficit to a sustainable level as the recovery strengthens. But as America saves more, countries overly reliant on exports for their own growth will need to change their policies, or else global growth will slow and all of us will be worse off.

Countries that chronically run large surpluses need to undertake policies that will boost their domestic demand. And it is critical to see more progress by the major emerging economies to more flexible, more market-oriented exchange rate management. This is particularly important for those countries whose currencies are significantly undervalued.

Each of us has agreed that these adjustments are necessary to the future health and stability of the global economy, and yet global rebalancing is not progressing as well as we believe is necessary. We must collectively make this a priority.

Reforming the IMF

One of the IMF’s core functions is to undertake rigorous surveillance of the international monetary system. In the current environment, the IMF has an important role to play to help ensure that progress toward rebalancing strengthens and that the international adjustment process is permitted to work. It is ultimately the responsibility of countries to act, but the IMF must speak out effectively about challenges and marshal support for action. Meaningful reform of IMF surveillance is a core challenge for the institution.

Specifically, the IMF must strengthen its surveillance of exchange-rate policies and reserve accumulation practices. We recognize that precautionary reserve accumulation is appropriate to a point and may well have helped several emerging market economies cope with the adverse effects of the recent global financial crisis. However, excess reserve accumulation on a global scale is leading to serious distortions in the international monetary and financial system, and is inhibiting the international adjustment process. We look forward to the IMF’s upcoming discussion of reserve adequacy and urge the development of new reserve metrics. An upgrade of the analytical tools for evaluating reserve holdings is long overdue.

More broadly, the IMF must increase the candor of its surveillance. At the same time, the IMF membership must embrace further transparency reforms, such as universal publication of Article IV reports, so that IMF analysis can more freely enter the public domain.

On the governance front, we are now making progress toward agreement on a very important set of reforms to create a stronger, more legitimate IMF. We look forward to reaching agreement on a governance package that will give the fastest growing emerging economies greater weight in the institution and a greater share of seats on the Executive Board. Quota reform should bring us closer to the goal of achieving legitimate IMF representation based on countries’ economic weight in the world. The quota review should also achieve an appropriate rebalancing between the IMF’s quota and borrowed resources, including the New Arrangements to Borrow (NAB).

We want to make sure these changes go far enough in rebalancing both the rights and the responsibilities of the members of the institutions. And for this reason, an agreement to modernize the governance of the IMF needs to be accompanied with more progress by countries, particularly the surplus countries, towards more market-oriented exchange rate policies and policies that will reduce reliance on exports and strengthen domestic demand.

Finally, we welcome recent actions to strengthen the global financial safety net. The reform to the Flexible Credit Line and the creation of the Precautionary Credit Line will give the IMF the necessary tools to respond more quickly and forcefully to future crises.

Strengthening global financial integrity

We must also continue to work together to protect the integrity of the international financial system from abuse by illicit actors. At the request of the G-20 Leaders, the Financial Action Task Force (FATF) launched last year a comprehensive review of countries with strategic deficiencies in combating money laundering and the financing of terrorism (AML/CFT). The FATF’s public identification of 28 countries with strategic AML/CFT deficiencies has already encouraged most of those countries to take concrete steps to strengthen their AML/CFT regimes.

However, there must be consequences when countries refuse to address their weaknesses. Due to the substantial unresolved deficiencies in Iran’s AML/CFT regime and the considerable terrorist financing threat emanating from it, Iran is the sole country subject to FATF’s call on all jurisdictions to apply countermeasures. Maintaining the integrity of the international financial system requires all of us to work together to rigorously implement these countermeasures against Iran.

****

As we gather in Washington, we should look to the challenges ahead with recognition of all we have achieved together over the past two years. Our record of recent accomplishment should remain our mandate for continuing to work together to meet the challenges of growth, rebalancing, and reform. By addressing these challenges together, we can build a better economic future for our countries and for the world.

###

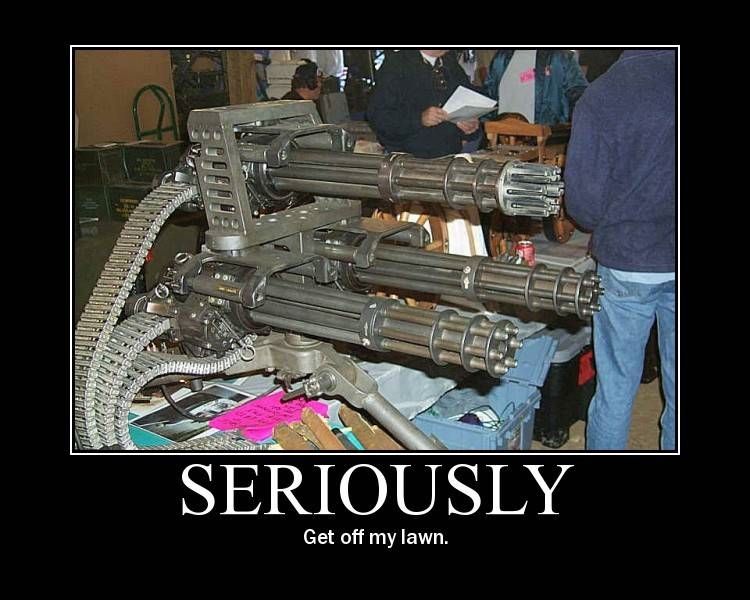

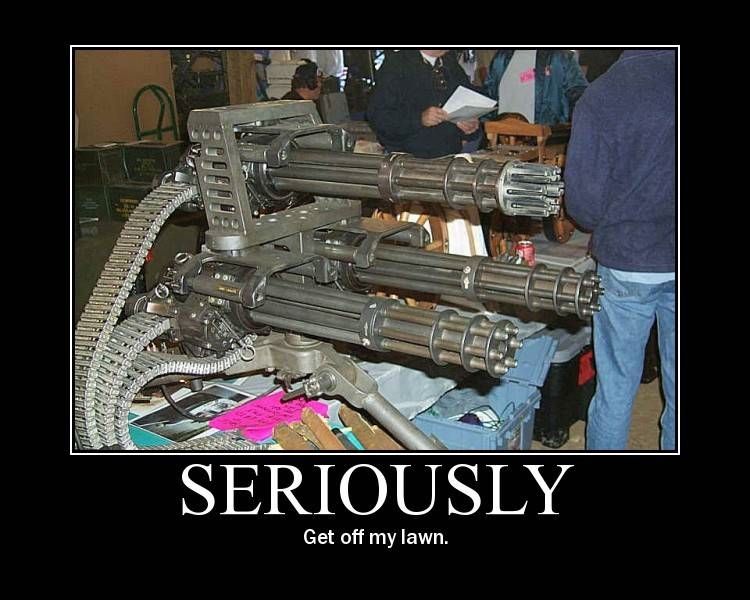

Get off my lawn.

Get off my lawn.

NOTE The following text is a quote:

www.ustreas.gov/press/releases/tg902.htm

October 9, 2010

TG-902

Statement by Secretary Tim Geithner at the International Monetary Fund and World Bank Group Development Committee Meeting

President Obama recently released a new U.S. global development policy, which recognizes that development is a strategic, economic, and moral imperative for the United States. The new policy places a premium on broad-based economic growth, democratic governance and sustainable systems for meeting basic human needs. It also reaffirms the U.S. commitment to the multilateral development banks as vital partners in our global development efforts and recognizes the value of partnership with these institutions, the private sector, and civil society organizations.

As many shareholders continue to face competing demands for domestic resources, our ability to effectively convey the strengths and contributions of the World Bank’s efforts has never been more critical. The World Bank, and the other development banks, for some time have recognized that broad-based, private sector led growth must underpin sound development strategies. In this context, they have financed projects focused on rooting out corruption, developing property rights, supporting the private sector, increasing agricultural productivity, integrating regional economies, and strengthening infrastructure – all of which are force multipliers for economic growth and development. Additionally, our work in the World Bank and in the regional development banks has a longstanding emphasis on performance driven financing, country-led investment plans, and measuring for results. All of these efforts are consistent with the Obama Administration’s new global development policy.

During this period of fragile economic recovery following the financial crisis, we must re-double our efforts to create the conditions for growth as the basis for establishing better opportunities upon which communities and individuals can build their lives. To effectively accomplish this objective, our new global development policy recognizes the need to ensure that every dollar we invest in development has a positive, measurable impact. For each project pursued and funded, we must learn something about how we can be more effective and efficient, and we must maximize results for the poorest.

These principles demonstrate the soundness of the priority that we place on multilateral approaches to development, whether it is through the International Development Association (IDA) or the establishment of targeted multi-donor trust funds, such as the Global Agriculture and Food Security Program (GAFSP) and the Climate Investment Funds (CIFs).

In this 50th year of IDA, the United States continues to view the World Bank as the leading global institution focused on supporting the development needs of the poorest countries, and we rely on the Bank to remain squarely focused on programs and policies to help the most fragile nations grow. Our investments in IDA have and will continue to play a vital role in promoting broad-based growth. We are particularly pleased to support IDA 16’s core focus on results and support for regional projects to foster economic linkages. We think IDA has demonstrated its value well, but there is more that can be done to deepen the results agenda and we will continue to press for progress.

We also welcome the World Bank’s attention to the impact of the global financial crisis on the low-income countries and how IDA can better respond to crises when they affect the poorest. We see strong potential in new tools, like a permanent crisis window within IDA, if they are tightly crafted to work in concert with the tools employed by other institutions, particularly the IMF.

The GAFSP focuses on enhancing agricultural productivity in developing countries as an engine for growth. It fuses multilateral and multi-institutional support. It delivers the strong resource leverage of multiple donors, and the deep capacity and knowledge of multiple implementing entities. GAFSP is strongly aligned with the principles of country ownership and features an inclusive governance structure, as well as a strong voice for civil society. But unless new donors come forward and pool resources for a common purpose, many of the 21 countries currently seeking support will be turned away.

The CIFs use similarly innovative governance structures. Their focus is on scaled up efforts at low-carbon, climate-resilient development in a targeted group of countries. The Clean Technology Fund, for example, has leveraged $4.3 billion in pledged contributions from eight donors to mobilize $40 billion in planned investments in 13 countries for clean energy, energy efficiency, and sustainable transport. These funds are an important part of achieving the global community’s commitment to provide resources approaching $30 billion to address climate change in developing countries over the period 2010-2012.

We are also pleased that the World Bank continues to make progress in actively implementing its reform agenda, guided by the Post-Crisis Directions framework, which will ensure that the Bank works within its comparative advantage. In particular, we applaud the smooth implementation of the unified financial policy, the revised Access to Information Policy, and the continued commitment to improve institutional efficiencies and selectivity through budget discipline. In addition, we welcome the continued engagement on shared global challenges, such as fragile states, food security, and climate change, for which the Bank is uniquely positioned to use its global presence. However, we see room for improving the communication and usability of results by all stakeholders. Working together, we believe that we can utilize the leverage, capacity, and knowledge of the World Bank and its shareholders to make the 21st century a more prosperous and stable one.

###

That FR Post button is seriously powerful.

Note:

The press releases are posted here for archival purposes.

I still can’t believe that a tax cheat is in charge of the Treasury.

Strobe Talbott is the head of Brookings........nuff said

He’s preaching to the choir then.

Should have added a BARF ALERT to the title.

Two years ago, the world economy was in the grip of an economic crisis on a scale not seen since the Great Depression.After I got done laughing at that one, I started to wonder -- what country was Zero elected to preside over? Thanks Cindy.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.