Posted on 09/06/2009 12:32:50 PM PDT by BGHater

We would like to believe that the economy is going to go roaring right back to steady 3%-4% growth. But we still haven't seen compelling facts to support that view.

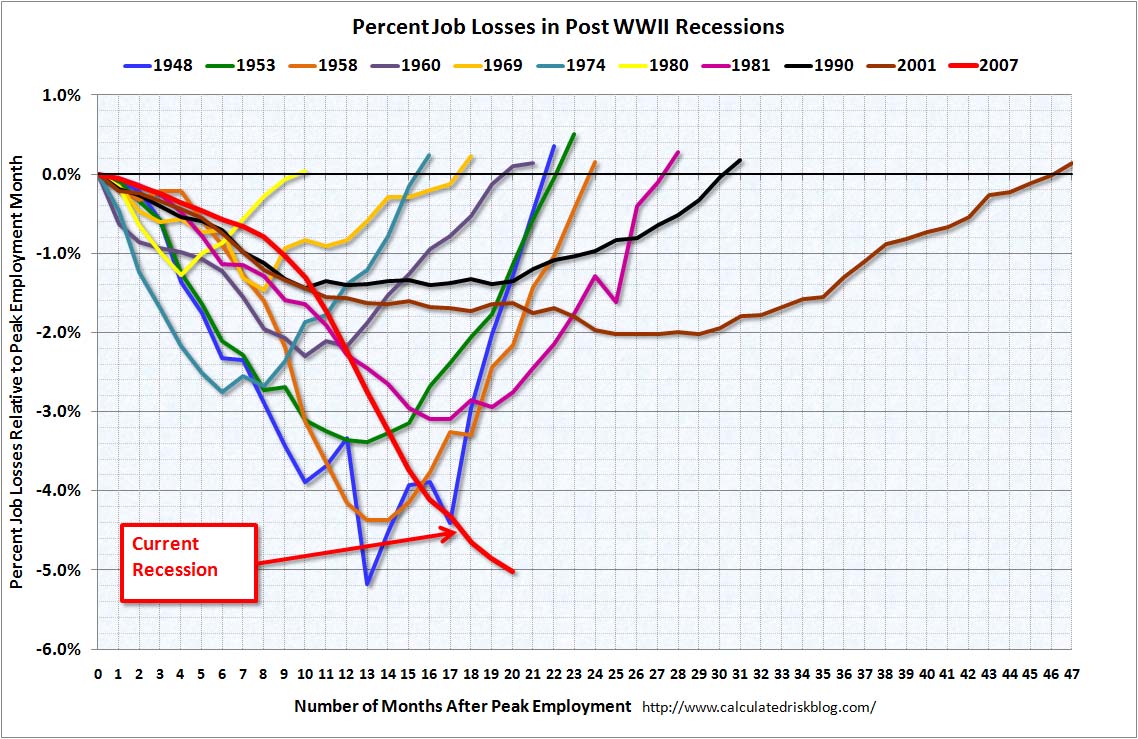

The bullish argument is that this is simply the way economies recover. And the stimulus-fueled rebound of Q2 and Q3 has certainly been v-shaped (see chart --which will continue up and to the right in Q3).

But this argument does not explain how consumer spending is going to quickly rev back up to sustainable 3%-4% growth in the face of massive debts, 10% unemployment, huge government deficits, tight credit, and a weak housing market--or that, if consumer spending does not recover, where else the spending is going to come from.

The bearish case, meanwhile, is that this recession is different--a deleveraging recession--and that full recovery will take years. The key element of this latter view is ongoing weakness in consumer spending. To wit:

With that as the backdrop, we just don't see how we quickly return to the Old Normal--with a couple of 5%-7% growth years first to make up for lost time.

We're all ears, though. If you have any good theories, please send them along.

In the meantime, here's the latest thinking from John Mauldin, who is (almost) as bearish as ever. Specifically, he's predicting that the economy will be back in recession by early next year.

(Excerpt) Read more at businessinsider.com ...

Yo America! How's that hopey changey thing workin' out for ya? I hope you still have those colorful, "collector's edition" Obama quarters. You're gonna need 'em.

I don’t think it’s out of the first one yet.

Looks like a u shaped recovery

Which is a distinct possibility.

Surprise, surprise. Socialism doesn’t work.

Well Christmas is right around the corner so that will give us some indication...Unless we are all working for the government in the next year, I would say things will recover very slowly over the next 18 months, possibly longer.

Let’s cut the BS. The economy will never recover until employment turns around. Then it will take years to get back to the 5 or 6 percent range. Americans working, spending, and relief from taxes is the only way for real meaningful recovery. Leaving Americans in the tank is not recovery and regulation that destroys our living standards will finish us.

Double W ...so blame it on dubbya

Most people I talk to and with “skin” in the game thank the other shoe is ready to fall. That is why most of my money is still on the sidelines regarding the stock market.

We’re still IN recession...in spite of the garbage the media is trying to feed us about that.

Maybe I was asleep but when did it stop being in one ?

401k / 0bambi = 40.1k

This Christmas season should take out all the weak retailers that are hanging on and hoping for change. By next summer, the commercial real estate and jobs picture ought to be real sunny.....

hh

Whoever thought this ecomomy was sprouting green shoots was smoking red bud.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.