Posted on 11/18/2022 1:46:26 PM PST by Kaiser8408a

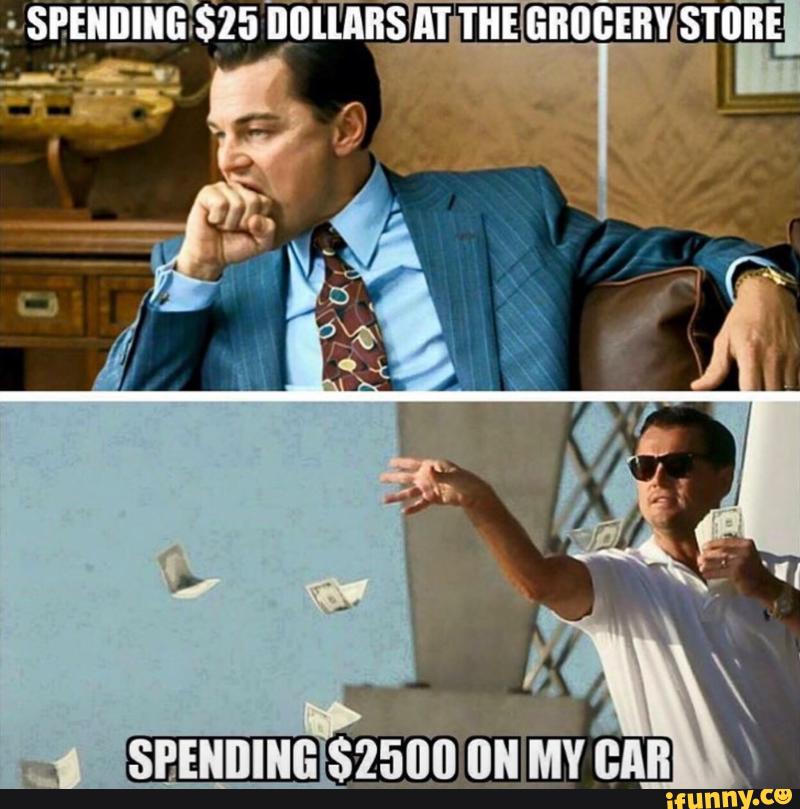

US consumers are feeling that inflation is hot, hot, hot!

There is another Fed Open Market Committee (FOMC) meeting on December 14th and everyone is interested in what The Fed will do. Or how much will The Fed raises rates?

Recent inflation numbers are still terrible (for the US, that is). But slowing, giving Fed officials reason to slow down the pace of rate increases.

But now the Cleveland Fed has introduced a new inflation measure: Indirect Consumer Inflation Expectation index. And unfortunately it shows that consumers expectations for inflation is actually rising rapidly over the past two weeks to over 8%.

I have stopped listening to the various Fed Presidents (like Collins, Bostic and Bullard) babbling about what The Fed will do like so many bobbleheads in a car. I like Fed Funds Futures data. And it is showing a rate increase at the December 14th meeting of 52 basis points (that is, 50 basis points will some investors betting on 75 basis points).

So, consumers think inflation is hotter than the CPI data indicates.

(Excerpt) Read more at confoundedinterest.net ...

The thing about inflation is, that it works like compound interest, in that the original principal amount is constantly being revised UPWARD, and the new principal amount is the basis from which all additional inflation is computed.

Not everybody understands that.

Just ask for our fellow citizens who voted for more of this.

The drooling idiots are finally taking over.

Inflation for the average consumer is well above 8%. The headline number is bogus. A couple years of compounding inflation running into double digits can do enormous damage to peoples’ finances.

People seem to have the misconception that inflation is reversing because the lower headline numbers give the impression that its reversing when its actually continuing to rise at a slightly lower rate.

People living on fixed incomes are going to get squeezed big time.

I think that means, for example, start with $1000 dollars at the beginning of Month A. Then factor an 8% annual rate of inflation (0.666% for Month A), which amounts to $6.67. So at the start of the following Month B it, takes $1006.67% to buy what $1000 would have bought at the beginning of Month A. Now for Month B, factor the same 0.666% rate against $1066.67, not $1000. Then at the end of Month B it takes $1073.77 ($1066.67 + $7.10) to buy what $1000 would have bought two months ago. The differential keeps compounding making actual purchasing power in dollar terms worse than what a flat 8% inflation rate implies.

The differential keeps compounding making actual purchasing power in dollar terms worse than what a flat 8% inflation rate implies.

************

Exactly right. Great example BTW.

Shadow Stats has pegged Consumer Inflation at 17-18% for a number of months, now.

But, who are you going to believe? Brandon? Or your own lyin’ eyes every time you buy food or gas, or open your electric and/or fuel bills?

A dozen store brand eggs here (central-west NJ) cost $1.39 two years ago. The same exact eggs now cost $4.39.

8% my ass.

BUT BUT BUT. It came down. It was 9% so 8% is good news.

All bogus numbers. Reality is up from last year, averaging everything, all my costs have doubled.

So many people do not realize that fact when they talk about inflation. I’m not comparing prices at the grocery store to what they were last month, or even last year, I’m comparing them to what they were two years ago. That tells me how bad inflation has been under the Biden administration. We buy the same things each week (old and set in our ways) and my grocery bill has doubled.

I understand that. What I don’t know is whether a 3% increase in gross domestic product in an 8% inflation rate environment is actually a 5% relative decline?

Hey, not only that, your insulin will be cheaper, too! Even if you don’t need or use it, it’s nice to know somebody is saving $25. That will really offset the $5,000 more per year you are paying for everything. All Hail King Brandon!

“What I don’t know is whether a 3% increase in gross domestic product in an 8% inflation rate environment is actually a 5% relative decline?”

Yes it is.

The “experts” love to lie about this stuff—but you got it correct.

The average consumer is getting crushed—and you just explained why.

“What I don’t know is whether a 3% increase in gross domestic product in an 8% inflation rate environment is actually a 5% relative decline?”

Exactly right (it’s actually a 4.6% decline, but subtracting as you did is close enough...=[1-(1.03/1.08)]). That’s why Brandon reporting the economy is growing is completely false.

The economic terms to describe this are “Real” versus “Nominal” growth. The “Nominal” growth is 3%. The “Real” growth (taking account of inflation) is -5%.

It’s very important to learn Real and Nominal in this era.

Another reason why the stock market makes no sense to me at the moment. Companies are reporting “growth” but I presume most of that growth is not “real” growth just nominal growth - and ultimately if it continues they will just cannibalize their future top lines.

Markets seem to move on theories surrounding the fed rate and the idea that companies are chopping payrolls. Neither of which are reasons to invest especially in zero dividend companies. And frankly I’m surprised that baby boomers haven’t gone almost completely to cash by this point. I mean, they should have when the DJIA went from 12,000 early pandemic to 36,000. Now with inflation, cash is not so attractive the markets seem very frothy to me at 33,000 on the DJIA. Fed is telling everyone that they intend to crash this economy to try to kill inflation but that cycle could take years.

Another weird thing is the real estate market for existing housing. New housing starts are cratering. But our two properties are still showing decent returns and the markets are both forecasting price increases this year. Go figure. Lots of people investing in real estate to fight inflation?

In California the eggs are $4.99 a large dozen and butter is $4.99

The meat dept has a loan dept.

Gas is $5.50 and up for 89 octane.

Inflation is much higher then reported.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.