Posted on 06/03/2022 9:53:23 PM PDT by blam

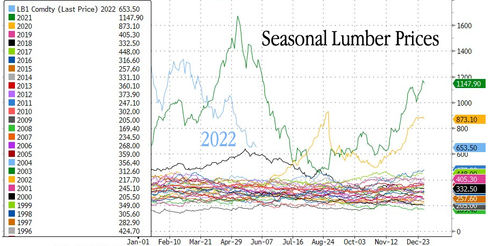

Lumber prices have been halved since the Federal Reserve embarked on its most aggressive interest rate tightening campaign in decades as the pandemic boom in housing slows.

Lumber contracts trading on the CME crashed to $653 per thousand board feet, down 51% from a high in late February of $1,336. The decline in wood prices occurred about two weeks before the Fed began hiking interest rates in mid-March.

The Fed is expected to continue raising rates this summer. Interest rate probabilities show the Fed could hike by 50bps at three of the next FOMC meetings to suppress consumption and get inflation under control ahead of the midterm elections. However, that’s going to be a challenging task, which may cause a hard landing in the economy.

Fed Chair Jerome Powell’s pursuit of finding the neutral rate has already unleashed a rate shock in the housing market, with the 30-year fixed-rate mortgage shooting up more than 200bps this year, from 320 bps to 557 bps. This has crushed activity for refinancing houses (remodeling) and sent mortgage applications (home construction) plunging, a sign the housing market is cooling.

Signs of a slowdown in construction are already materializing: “Buyers don’t have the same mentality of having to go out and buy 10 when they only need five,” Ash Boeckholt, co-founder and chief revenue officer at online wood-products marketplace MaterialsXchange, told WSJ.

A monthly survey from John Burns Real Estate Consulting of building-products dealers shows only 12% had tight lumber inventories in April, down 61% from last year. Lumber is a leading indicator and suggests higher prices and soaring interest rates have helped fix shortages that were stoked during the pandemic lockdowns of easy money and robust demand for housing.

Lumber is still double the price of the three-decade trend of $359. Matthew Saunders, who leads John Burns Real Estate Consulting, said that prices are expected to stay above pre-pandemic levels despite improving supply chains and falling demand for wood.

“We believe that they will trade above long-term averages for the balance of the year. However, in the short term, lumber is down more than 50% from the most recent peak. The market is trying to determine where the new price equilibrium compared to slowing demand and increased supply,” Josh Goodman, vice president of inventory and purchasing at Sherwood Lumber, told GlobeSt.com.

Another sign lumber demand is declining is directly from one of the largest wood producers in North America, Canfor Corp, who reduced operating schedules at sawmills in Western Canada. Since March, Canfor has operated sawmills at 80% of production capacity.

On the retail side, traders and analysts have noticed slumping demand for lumber at Home Depot and Lowe’s as consumers shift away from home-improvement projects to spending money on vacations.

The Fed will frontload interest rate hikes this summer which could pressure lumber prices even lower. Perhaps, if some readers have been waiting to build a deck or fence and didn’t want to pay crazy COVID prices, now could be the time to build (despite paying high labor costs).

Nobody said they were going anywhere.. d;^)

“The president’s economic plan, as we see it, is working.”

WH PoS Karine Jean-Pierre, 6/1/2022

since the Federal Reserve embarked on its most aggressive interest rate tightening campaign in decades

Since their plan is to attempt to derail the US economy and put millions in a bread line, of course they claim it’s working. It’s just not working for the good of the Republic, though.

Just got a sheet of plywood. It’s 2x what it was 3 yrs ago.

Unicorn!!! Don’t forget the Unicorn 🦄

I just made a simple shelf to put a CPU, Modem and Router on. 1 pine 1 x 12 x 6 and 1 pine 1 x 3 x 6 cost $33 freaking bucks !!!!

I use to buy “cheap” osb for crating metal parts. For years it was $5 plus or minus a dollar. It went from that to $68 a sheet seemingly overnight.

Yup.

All according to plan.

Yikes 😳

these price swings wreak havoc on builders and construction loans...

No-nothing out of touch affirmative action hire.

It’s going to get much worse; watch for the housing bubble to burst this Summer, as milled wood becomes all but unaffordable, and building comes to a near halt. A lot of related industries and cottage industries will be severely affected. Noah would be PO’d that his Ark isn’t getting completed. Heh.

This is saying costs for lumber have gone down 51% due to FED raising rates. That means mortgages are higher cost and it will adversely affect the housing market. The insanely inflated real estate bubble is about to burst. I hear most brokers are expecting this to happen in last quarter of this year.

Go look at a chart of lumber prices for the last 2 years. Wildly swinging up and down for a variety of reasons.

Yes. I sell wood product for a Wisconsin company. Pricelist was withdrawn 2 yrs ago and they quote per daily costs.

And that’s not even painted/stained.

Yup

Well I guy that was My project for the decade...

guy=guess

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.