Posted on 06/03/2022 9:53:23 PM PDT by blam

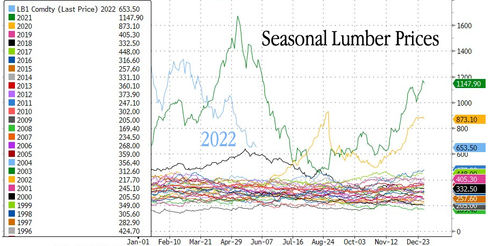

Lumber prices have been halved since the Federal Reserve embarked on its most aggressive interest rate tightening campaign in decades as the pandemic boom in housing slows.

Lumber contracts trading on the CME crashed to $653 per thousand board feet, down 51% from a high in late February of $1,336. The decline in wood prices occurred about two weeks before the Fed began hiking interest rates in mid-March.

The Fed is expected to continue raising rates this summer. Interest rate probabilities show the Fed could hike by 50bps at three of the next FOMC meetings to suppress consumption and get inflation under control ahead of the midterm elections. However, that’s going to be a challenging task, which may cause a hard landing in the economy.

Fed Chair Jerome Powell’s pursuit of finding the neutral rate has already unleashed a rate shock in the housing market, with the 30-year fixed-rate mortgage shooting up more than 200bps this year, from 320 bps to 557 bps. This has crushed activity for refinancing houses (remodeling) and sent mortgage applications (home construction) plunging, a sign the housing market is cooling.

Signs of a slowdown in construction are already materializing: “Buyers don’t have the same mentality of having to go out and buy 10 when they only need five,” Ash Boeckholt, co-founder and chief revenue officer at online wood-products marketplace MaterialsXchange, told WSJ.

A monthly survey from John Burns Real Estate Consulting of building-products dealers shows only 12% had tight lumber inventories in April, down 61% from last year. Lumber is a leading indicator and suggests higher prices and soaring interest rates have helped fix shortages that were stoked during the pandemic lockdowns of easy money and robust demand for housing.

Lumber is still double the price of the three-decade trend of $359. Matthew Saunders, who leads John Burns Real Estate Consulting, said that prices are expected to stay above pre-pandemic levels despite improving supply chains and falling demand for wood.

“We believe that they will trade above long-term averages for the balance of the year. However, in the short term, lumber is down more than 50% from the most recent peak. The market is trying to determine where the new price equilibrium compared to slowing demand and increased supply,” Josh Goodman, vice president of inventory and purchasing at Sherwood Lumber, told GlobeSt.com.

Another sign lumber demand is declining is directly from one of the largest wood producers in North America, Canfor Corp, who reduced operating schedules at sawmills in Western Canada. Since March, Canfor has operated sawmills at 80% of production capacity.

On the retail side, traders and analysts have noticed slumping demand for lumber at Home Depot and Lowe’s as consumers shift away from home-improvement projects to spending money on vacations.

The Fed will frontload interest rate hikes this summer which could pressure lumber prices even lower. Perhaps, if some readers have been waiting to build a deck or fence and didn’t want to pay crazy COVID prices, now could be the time to build (despite paying high labor costs).

Now the housing bubble will burst.

Still 50% more expensive than before Covid.

Most think prices will return until the 4th quarter but who knows with this regime in charge.

Looks like I’ll be waiting another year before building my wood shed again. Oh well.

I guess I need to replace my car’s gas tank with a pot belly stove.

(guess I need to replace my car’s gas tank)

You just need a solar panel!

And some magic dust!

/liberal logic

Hooray! Biden has figured out how to lower inflation - tank the entire economy. And we have 2 1/2 more years of this nonsense.

And remember, this is intent, not incompetence.

Notice how they're trying to blame it on the citizens, instead of the bonehead politicians.

“Still 50% more expensive than before Covid.”

Yup, pine 8’ 2x4 was about $2.25, now about $4.50. They did hit $8 at the peak.

My house hit a new record high 2 days ago. I’m sure part of that is due to the prices of new homes being built nearby. If lumber costs an extra $50k or $100K, that goes into the house sales price. My existing house benefits due to those higher comps nearby.

There’s a saying among commodity traders - “High prices are the cure for high prices.” When the price goes up steeply, demand drops off, and that makes the price start falling.

Obumbler’s third term...

$50-100,000? Bidenflation lumber costs that much?

Precisely. Drooling Dementia Joe isn’t calling any shots here.

Price per thousand board feet during the last year.

$1500, down to $400 (bottom during covid), up to $1300, and now $800.

So with framing typically being the largest single cost, you catch the wrong part of that price cycle and it can get very ugly. I had a neighbor who was building a new home and he said 6 months ago, the his builder was quoting him an extra $80 grand over a quote over a quote he had gotten 2 years ago, due to lumber prices.

Lumber prices have crashed????

Someone forgot to tell Home Depot and Lowes.

Was at Lowes 2 days ago and checked on the prices of 2X4’s and 2X6’s just to see what they were. A 2X6X8’ was over $14/each. A clear top quality 2X4X8’ was over $9/each.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.