Posted on 01/13/2022 5:10:48 PM PST by blam

During an interview with CNBC Thursday afternoon, Hayman Capital founder Kyle Bass joined Jeffrey Gundlach and other astute observers of the market by postulating that the Fed won’t be able to succeed with its planned 4 interest-rate hikes by the end of the year.

“Gundlach said that the Fed could get to 1.5% on the Fed funds rate, which might happen in the next 12 to 18 months. But that would trigger a recession,” he said.

But by the time the Fed gets to the second hike, markets will tank, forcing the central bank to backtrack.

Kyle Bass agrees with Gundlach (and the market): “The Fed can’t raise rates more than a 100-125 bps before they have to stop”

— zerohedge (@zerohedge) January 13, 2022

Speaking during his first CNBC interview of the year, Bass argued that there’s a “huge mismatch, I think, between policy and reality…when you look at the reality of hydrocarbon demand…the reality is that…we’ve been pulling CapEx out of the oil patch because we so desperately want to switch to alternative energy. The problem is you can’t just turn off hydrocarbons. It takes 40 or 50 years to switch fuel sources,” Bass explained.

And as the global economy shakes off the impact of the pandemic, Bass predicted that “the same forces that applied to bring oil below zero [back in April 2020] will apply on the upside. We will get the world reopened by the middle of the year…you can’t just flip on an oil well…the only people funding the oil patch are family offices.”

As demand for oil intensifies, the dynamic will send prices on front-month contracts “well above” $100/barrel”, Bass projected.

“There are so few people out there funding CapEx…if we reopen, you’re going to see numbers that people aren’t ready for.”

Bass’s interlocutors then opted to switch gears with some questions about China. After Wilfred Frost gently accused Bass of being a China bear, Bass insisted that he considers himself a “China realist” before launching into a discussion of China’s real-estate market.

As many investors may have learned from all the reporting about Evergrande and other deeply indebted China developers in recent months, roughly one-third of China’s economy is driven by real estate.

The surge in prices has contributed to China’s demographic nightmare, Bass said. “…the average birth rate of women in China fell below 1.2…you had an aggressive population decline because men can’t afford to buy homes because they’re priced at 20x to 30x their annual income.”

This has become a problem for China’s leaders.

“Xi needs real estate prices down and he needs them to stay down,” Bass said.

As for those who are betting on a bounce in Chinese stocks, Bass characterized this as “a fool’s game.”

As for whether or not he’d ever invest in Chinese stocks again, Bass replied:

“Fool me once but you’re not going to fool me twice…I feel like people who are investing in Chinese equities are breaking their fiduciary duty to their investors.”

Circling back to a discussion about the Fed, Bass pointed to Goldman’s call for 4 hikes this year. When the Fed does deliver on the rate hikes it has led the market to expect, “the curve is going to flatten, the long end of the curve will invert and the Fed” will likely need to throw it in reverse.

“My personal view is they can’t raise short rates more than 100-125 basis points before they have to stop,” Bass said.

Once this happens, a recession in the US will likely follow.

“I think they’re going to have to back away from that plan once they start hiking…that’s my view.

With all this in mind, “there’s no way the stock market goes up this year and it probably goes down pretty aggressively,” Bass concluded.

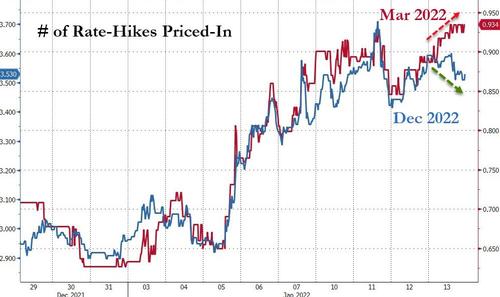

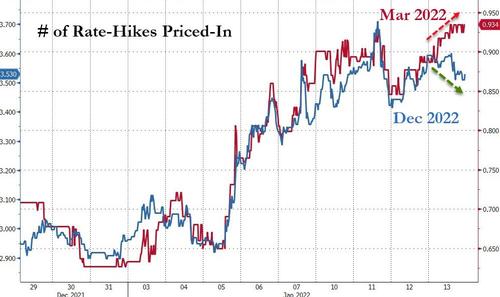

And once the Fed starts hiking rates, this, compounded by surging oil prices “will compound people’s inflation problems.” And that is already very modestly bring priced in… March rate-hike odds are rising to cycle highs but the odds of 4 rate-hikes by year-end are sliding…

So, after more than a decade of easy money policies, 2022 is shaping up to be a difficult year for American consumers.

the entire federal government financing scheme would crash with higher rates

People have to be entirely sick of these Wall St crooks running their mouths.

The guy is probably 100% right. Why? Because all authority has been ceded to a corrupt, private bank that controls everything.

Interest rates should be determined by a central bank so the other banks don’t have to do the math. Each bank should be forced to, or allowed to if that’s the case, to determine the credit worthiness of a client and set the rate themselves. Right now there isn’t much competition in anything. It may seem like it, but at the end of the day there isn’t.

Go to a mortgage broker, refinance and get your rate reduced. They just shop it the 5 or 6 banks that control the mortgage industry anyway. All ends up in the same place.

I don’t like to go down the road, as I think it’s rather childish, but all of these people need to be swinging from gallows.

The Fed will not raise the FFR. They're bluffing.

Hint: Price inflation can, and does, occur in deflationary conditions.

Most people don't correctly understand the money supply. Most economic textbooks teach it wrongly.

Is that just me saying that? No, it's the Bank of England who said it. Our monetary system is no different from theirs.

Oh my gosh the sky is falling, the sky is falling.

I believe it will get into the low 90's, then sink down to the 45 - 55 range, bottoming at 30.

When we took the Volker medicine the national debt was less than $1T. By the end of ‘22 it’ll be what, $40T?

Interest rates are determined by the central bank - through the FFR.

The Federal Reserve should normally only deal in government debt.

Private debt should be left to the marketplace.

FHA 245a loans for those with growing incomes:

https://thelendersnetwork.com/section-245a-loan/

The Zubu brothers?

They owe me money.

Every time people use a credit card they contribute to it.

A credit card purchase creates new money in the economy.

Paying off a credit card destroys money.

If all debts were paid off then there wouldn't be any money.

The Fed is carrying trillions of debt at face value on their balance sheet.

The "slight" problem is that the debt is actually toxic and worth zero.

They can't sell it. They can't give it away. It's no different than the toxic waste at Fukishima.

“If all debts were paid off then there wouldn’t be any money.”

What happens to the money that was paid to the creditors? Does that vanish into thin air?

L

Great question.

Those creditors also have a balance sheet.

If you unravel all debt to where it's all paid off, then there would be no money.

Money is only created through the issuance of debt.

The Bank of England wrote a great paper on it - couldn't believe they actually told the truth.

Private & public entities could compile inflation indexes, such as a Walmart sales price index, a multi-state property value assessment data base or a fast food worker wage index.

Private loan rates might be based on an agreed upon inflation index or mixture of indexes.

If a mortgage loan rate goes from 3.45% to 3.65%, the qualifying monthly loan payment amount need not change if the .2% increase is tacked onto the principal amount.

I’m getting tired of Walmart raising prices at a faster rate than the interest rate on my bank CDs.

Is it time to finally sell gold?

“Money is only created through the issuance of debt.”

Just haul your gold metal into the melting room, Mister Miner.

Melt & mint.

Mister Miner, here is 99% of your metal back in the form of US government gold coins.

“Money is only created through the issuance of debt.”

Hey Junior!

Yup, you, in the diapers!

Joe Biden and his Democrats just sent you an extra $300 again this month.

Hello, Slick, I’d like a couple of rocks....

Wow you better explain that a bit more.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.