Posted on 07/29/2020 7:25:45 AM PDT by Diana in Wisconsin

Covid-19 continues to unleash economic havoc across the world. The financial destruction being caused by the pandemic is shattering already fragile household budgets. In the deep levels of this fog, Millennials continue to face extra layers of pressure from this crisis. This has come in the form of massive levels of student debt, a higher proportion of gig work and retail work, and ultimately no financial cushion of wealth. While some older generations have made it a sport to bash Millennials, they forget that many decades ago a one-income household was enough to purchase a home or that you could work a blue collar job and support a family. Today, blue collar work might keep the lights on but forget about buying a home in most large cities in the U.S. You also have the added layer of the cost of college. A generation ago, you could work summer jobs on a paper route and pay your way to school. Good luck doing that today when some colleges charge $60,000 a year just for a 4-year degree. Many Millennials are being caught in a two-recession trap.

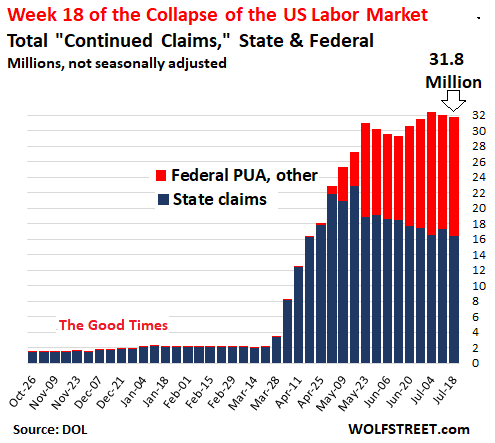

First, the economy has not recovered and we are still at high levels of unemployment. Take a look at the latest figures:

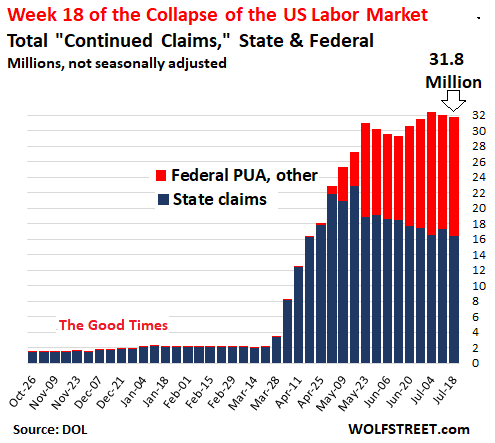

31.8 million people continue to collect unemployment benefits. That is an astronomically large number. But when you look at what jobs are being impacted the most, those in retail, food services, and gig work much of this is done by younger workers:

Retail trade and accommodation and food services are heavily filled with younger workers. These industries require face-to-face interaction for the most part and do not provide a good venue for working from home arrangements – which a large number of white-collar jobs allow (and most require a college degree – see student debt above for this Catch 22). So a vicious cycle emerges here. In order to break into the corporate world, you need a college degree. But not any degree, a degree in a highly sought-after field from a good school (keep in mind there are over 4,000 colleges and universities in the U.S. and many are not worth the money they charge). A 17 or 18 year old has a hard time deciphering the long-term ROI on a college degree but many colleges are happy to stick a person like this into a $60,000 a year degree for general education undergraduate courses. And many this year will not get the in-person experience in the fall.

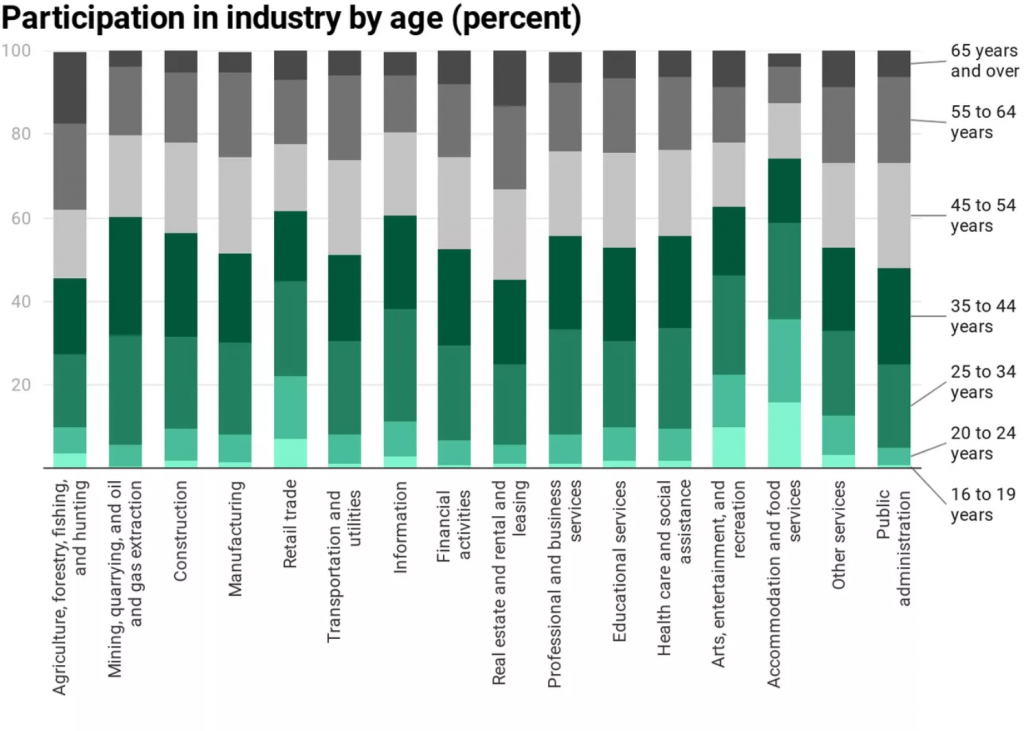

Going back to the impacted fields, these also employ the highest number of Americans:

Therefore the unemployment figures are off the charts if we really measure them correctly. The unemployment insurance claims paint a very grim picture. Many Millennials graduated college into the Great Recession of 2007 to 2009 and never really recovered since then. This “booming” economy recently was largely driven by inflated asset values (Millennials own relatively little stock and real estate which are the top drivers of wealth) so missed out on this latest bull run. Even now, the stock market is doing relatively well given the reality that we are in a deep depression and the economy is operating on crutches. But hey, you can drive a fancy Tesla (bought with debt), order a box of toys from Amazon (on a credit card), and do it all from your iPhone (financed by your cell provider). There is nothing wrong with these companies or their products but they do not represent the majority of the economy.

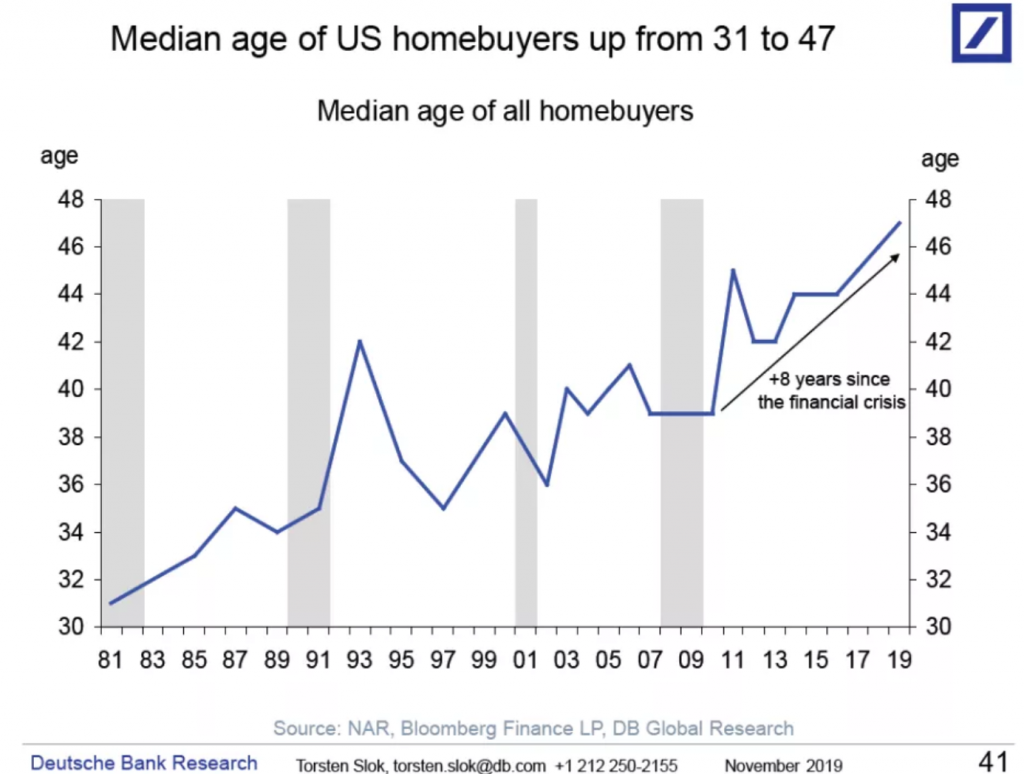

And speaking of wealth building, the biggest asset to build wealth for American families is housing. And Millennials keep falling further behind on this one:

In 1981, the median age of a home buyer was 31. Today it is 47. People usually bought homes when they felt ready to settle down and start a family. Today, many simply do not have that security (see previous jobs of younger Americans) and yet somehow older generations berate Millennials. The irony is many go off on Millennials via digital platforms run and operated by Millennials.

Why is this important?

This pandemic is hitting people hard across all age ranges, but younger people are facing a much tougher economic situation. Recessions are wealth destroyers and Millennials are now living through two of the worst recessions in the last 100 years. And as America gets older and many will rely on Social Security and Medicare, older generations should be working hard to ensure there is a good economy for young workers so they can pay taxes to support the needs that are coming downstream. Given how poorly we prepared for this pandemic with fair warning, we need to get on the same page and start planning now for this next phase.

I guess you don't know about H-1B visas. No American white boys needed/wanted.

“Every generation before todays spoiled brat generation had it tougher but made the best of what they had and built a better life”

As a baby boomer I can tell you my generation had it easy compared to what millennials are going through.

My first job out of college I was paid $28kper year as a field rep -early 80’s. 100% company paid full benefits including a real company paid retirement plan not a stupid azz 401k the employee funds 99%, company car and the co paid all insurance, gas and maintenance 100%

With bonuses I made $35k my first year and bought my first house at age 24.

My niece is basically in the same line of work. Field rep. Has to use her own car, $8000 deductible health insurance plan and she still pays $900 for it because she added her husband. No retirement plan and now since she is working from home her company just sent them a letter making them all 1099 subcontract labor with zero benefits.

Most? That's a joke. 50% of small business go out of business. In the US there are a whopping 4 million owners ( out of 330 million) of "small" businesses with more than 1 employee. That is NOT MOST.

“heartless for pointing out the solutions to all the problems?

If you CHOOSE to live in a liberal hell hole, you will pay for that”

You are clueless.

The cost of EPA environmental regs was the excuse to off shore ( 1 of many excuses ) and not the reason.

They will have to learn to code.

“I don’t even want to talk about the public schools in those places...”

Yep those cheaper homes are cheap for a reason. Rotten school system no parent would ever want to send their kids

You should come check out my little town. It’s very affordable out here in Podunkville. We live near a big city, so if someone needs to find a big time job, they can drive 30 - 45 minutes to get there. That is, if they’re not having to work from home these days. We also have decent schools and very little crime. Practically utopia.

Welcome to Fairtytale Texas.

I know and you think people in the 1990’s made $25K/yr ( in 2020 dollars ) writing c code. English majors who were software testers made $50K/yr with benefits in 1995. You are an idiot and fool that makes money of the misery of the US IT workers.

Sorry, but that’s one of those myths you hear about that is just not true or is a distortion of the truth.

It’s actually rare for a business to go bankrupt. What usually happens to those that fail is that the person running it ends up working longer hours for less than they did with they worked for someone else and they give up and go back to working for someone else. That is what creates the 50% fail myth.

The truth is many people who start businesses have misconceptions that doom them. The primary one being that the boss sits on their butt and lets everyone else work! The people who start businesses that think that are the ones who give up and go back to work for someone else.

True, but the ability to do so depends on where you live.

I also am in a one-income family (mine). We live in a rancher in a not-so-nice neighborhood. So I can manage the mortgage payment.

Most importantly, he went to university at home. He never lived on campus. He drove daily to the University of NH. Saving about $8-10K/ year in dorm/housing cost.

His daughter and my son were classmates throughout their entire lives. Meanwhile, there is a guy in my office whose daughter went to two different private colleges. She finally transferred in her junior year to UNH Durham. She graduated with a BA in ENGLISH. She is currently working at a summer camp as a counselor.

$20k in student debt is certainly manageable.

My son graduated with a BS in Operations Research (from Cornell). I’m not sure how much student debt he has, but he has a good job in Manhattan.

My daughter graduated from Univ. South Carolina (nursing program) and had almost no debt. Got a really good scholarship.

Bullsqueeze.

I remember all the foreign students I ran into in the engineering program I was in (both undergrad and graduate). I also remember the foreign profs and TAs too.

Certainly ran into a number of them when I started working.

I started in the early eighties in the military at $30k per year and came off active duty 16 years later at $60K per year. I later retired from the reserves but have yet to see a retirement check. I went into industry and now earn 3x my exit pay and hold two other part time jobs. I have funded my own retirement with at least 15% of my income for the past 30 years or so. Hard work and service is not difficult to do when one has motivation. Good jobs are plentiful when you have skill and good attitude.

As to health care, Obama care screwed us all on that. Plans went from decent to crap after ACA went into effect. So now I just use minimal plan and fund an HSA to cover the deductables.

Few if any companies these days offer company funded retirement plans, and those were put in place decades ago as incentives to hire in, necessary for the company to attract good labor, not something that should have been seen as an excuse not to save and plan your own retirement.

Advice to people who cant afford nice things, cut up your credit cards and start living within your means and save at least 15% of whatever you make. If you started funding your Roth IRA or 401K at age 24 you can retire very comfortably at 60-65. 401k’s are not stupid-azz.

My grandparents lived through the great depression and gave birth to my parents coming out of the depression and going into WWII. I am so blessed both those generations didnt think like you.

While there are a number of small businesses in a broad range of industries that perform well and are continuously profitable, 20% of small businesses fail in the first year, 50% go belly up after five years, and only 33% make it to 10 years or longer, according to the Small Business Administration ( SBA )

Not great at all.

Back in the day all of those Iranians et al foreigners went home after they graduated. Those were the days.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.