Posted on 11/01/2025 7:15:36 PM PDT by SeekAndFind

Americans are always worrying about debt: their own and their government’s.

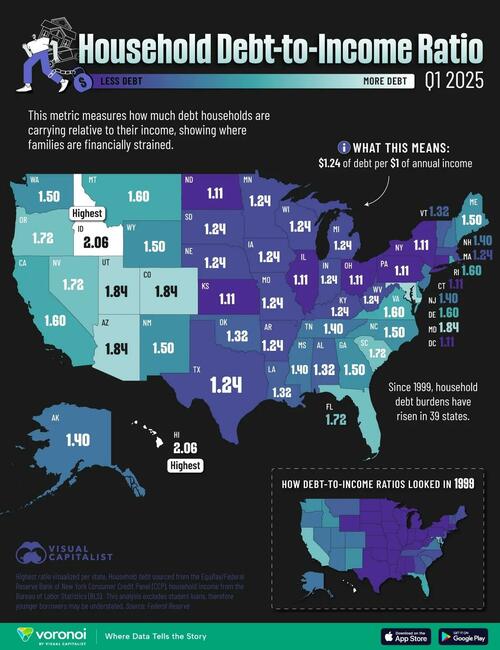

This visualization, via Visual Capitalist's Pallavi Rao, maps each state by their household debt-to-income ratios (DTI) in Q1, 2025, revealing which states carry the heaviest burdens and which ones keep borrowing in check.

Data for this visualization comes from the Federal Reserve. The highest ratio is visualized per state.

ℹ️ Debt includes mortgages, autos, credit cards, etc., and excludes student loans. Income is based on unemployment insurance-covered wages, as reported to the Bureau of Labor Statistics.

Two states share the top spot: Idaho and Hawaii both post a DTI of 2.06, meaning households owe just over twice their annual after-tax income.

| Rank | State | State Code | Debt-to-Income Ratio (2025) | Debt-to-Income Ratio (1999) | 1999–2025 Change |

|---|---|---|---|---|---|

| 1 | Idaho | ID | 2.06 | 1.50 | 0.56 |

| 2 | Hawaii | HI | 2.06 | 2.06 | 0.00 |

| 3 | Arizona | AZ | 1.84 | 1.40 | 0.44 |

| 4 | Colorado | CO | 1.84 | 1.40 | 0.44 |

| 5 | Utah | UT | 1.84 | 1.40 | 0.44 |

| 6 | Maryland | MD | 1.84 | 1.72 | 0.12 |

| 7 | South Carolina | SC | 1.72 | 1.32 | 0.40 |

| 8 | Nevada | NV | 1.72 | 1.40 | 0.32 |

| 9 | Oregon | OR | 1.72 | 1.40 | 0.32 |

| 10 | Florida | FL | 1.72 | 1.60 | 0.12 |

| 11 | Delaware | DE | 1.60 | 1.11 | 0.49 |

| 12 | Montana | MT | 1.60 | 1.32 | 0.28 |

| 13 | Rhode Island | RI | 1.60 | 1.32 | 0.28 |

| 14 | Virginia | VA | 1.60 | 1.40 | 0.20 |

| 15 | California | CA | 1.60 | 1.72 | -0.12 |

| 16 | Wyoming | WY | 1.50 | 1.11 | 0.39 |

| 17 | Georgia | GA | 1.50 | 1.24 | 0.26 |

| 18 | Maine | ME | 1.50 | 1.24 | 0.26 |

| 19 | North Carolina | NC | 1.50 | 1.24 | 0.26 |

| 20 | New Mexico | NM | 1.50 | 1.50 | 0.00 |

| 21 | Washington | WA | 1.50 | 1.50 | 0.00 |

| 22 | Mississippi | MS | 1.40 | 1.11 | 0.29 |

| 23 | New Hampshire | NH | 1.40 | 1.24 | 0.16 |

| 24 | New Jersey | NJ | 1.40 | 1.24 | 0.16 |

| 25 | Tennessee | TN | 1.40 | 1.24 | 0.16 |

| 26 | Alaska | AK | 1.40 | 1.32 | 0.08 |

| 27 | Alabama | AL | 1.32 | 1.11 | 0.21 |

| 28 | Louisiana | LA | 1.32 | 1.11 | 0.21 |

| 29 | Oklahoma | OK | 1.32 | 1.11 | 0.21 |

| 30 | Vermont | VT | 1.32 | 1.24 | 0.08 |

| 31 | Arkansas | AR | 1.24 | 1.11 | 0.13 |

| 32 | Indiana | IN | 1.24 | 1.11 | 0.13 |

| 33 | Iowa | IA | 1.24 | 1.11 | 0.13 |

| 34 | Kentucky | KY | 1.24 | 1.11 | 0.13 |

| 35 | Massachusetts | MA | 1.24 | 1.11 | 0.13 |

| 36 | Michigan | MI | 1.24 | 1.11 | 0.13 |

| 37 | Minnesota | MN | 1.24 | 1.11 | 0.13 |

| 38 | Missouri | MO | 1.24 | 1.11 | 0.13 |

| 39 | Nebraska | NE | 1.24 | 1.11 | 0.13 |

| 40 | South Dakota | SD | 1.24 | 1.11 | 0.13 |

| 41 | Texas | TX | 1.24 | 1.11 | 0.13 |

| 42 | West Virginia | WV | 1.24 | 1.11 | 0.13 |

| 43 | Wisconsin | WI | 1.24 | 1.11 | 0.13 |

| 44 | Connecticut | CT | 1.11 | 1.11 | 0.00 |

| 45 | District of Columbia | DC | 1.11 | 1.11 | 0.00 |

| 46 | Illinois | IL | 1.11 | 1.11 | 0.00 |

| 47 | Kansas | KS | 1.11 | 1.11 | 0.00 |

| 48 | New York | NY | 1.11 | 1.11 | 0.00 |

| 49 | North Dakota | ND | 1.11 | 1.11 | 0.00 |

| 50 | Ohio | OH | 1.11 | 1.11 | 0.00 |

| 51 | Pennsylvania | PA | 1.11 | 1.11 | 0.00 |

In Hawaii’s case, elevated housing costs push mortgage balances sky-high. In Idaho, a surge of migrants since 2020 has driven up home prices and left many newcomers with large, fresh mortgages.

Rounding out the top five are Arizona, Colorado, and Utah (all 1.84). Once again, fast-growing markets where rising prices and younger populations translate into higher leverage.

ℹ️ Related: Hawaii has the fifth-lowest homeownership rate in the country.

At the other end of the spectrum, Pennsylvania, Ohio, and North Dakota come in at just 1.11.

Many low-debt states share three traits. They have lower housing costs, older homeowner bases with significant equity, and slower population growth that tempers new borrowing.

However, even high-income states like Connecticut and the District of Columbia can land in this cohort thanks to well-paid residents who keep balances in check.

The gap underscores how regional housing dynamics, more than incomes alone, dictate household debt.

Finally, due to how this ratio is calculated, younger households’ true burden may be understated (student loan exclusion).

At the same time, the income measure is unemployment insurance-covered wages wages (not total personal income), which can overstate the ratio in high-capital-income areas (e.g., states with finance-heavy metros).

If you enjoyed today’s post, check out Visualizing Government Debt-to-GDP Around the World on Voronoi, the new app from Visual Capitalist.

|

Click here: to donate by Credit Card Or here: to donate by PayPal Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794 Thank you very much and God bless you. |

There is like a 100 year supply of sheep's wool in warehouses around the world. It worse than useless, it's a cost driver in the wrong direction.

>> The largest producer of ethanol in the USA which they use to poison gasoline into an inferior product.

Heh... I always suspected that. But the Erf has a fever and poisoned gasoline is a vital part of the cure. Or something.

>> If someone could raise sheep designed to just shed their wool coats

Someone does! They’re called “hair sheep”.

>> This is on a corrupt congress

Corn state senators would commit seppuku before they would vote to repeal ethanol requirements. Ernst and Grassley, lookin’ at YOU...

>> Put your money in to support alcohol-free gas in the US.

Our Wally World has it at the pump. It’s all I buy for our small engines. Pricey, but easy on the engine (and the oil & gas industry).

I run all my small engines on alcohol free gasoline. It cost more but is much cheaper than throwing away my chain saw etc. My 4 cycle lawn mower works just fine with the alcohol 10% as does my car. Two cycle engines do not like it. It kills them.

mark

Hair sheep are only adapted to tropical and sub Sahara kinda places. They would die out on range in cold climates.

How is Illinois that low? Rural areas?

That is also how I read AZ.

We also have many home owners who own two homes.

Renters pay the mortgage on one.

I was considering a move to Idaho (Moscow area) and found the housing prices through the roof in a small college town, and for substandard, ugly homes. I’m in Texas, and could have almost twice the home here for the prices they charge in ID. And more property too.

Hair sheep do well in Texas.

When I was there it were californicators snatching up every scrap of land. Biden also dumped off bus loads of illegals and spread them around under cover of darkness,

Looks like the highest debts are where the Californicators went. Probably by driving up the cost to the locals.

And Arizona-New Mexico

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.