Overlook something?

If savings & investments aren't beating currency debasement a person's losing money just by doing nothing.

If savings & investments aren't beating currency debasement a person's losing money just by doing nothing.

Posted on 05/02/2025 9:30:32 PM PDT by where's_the_Outrage?

When we hear money experts talking about how the accumulation of debt seriously hinders our ability to build wealth or comfortably retire, they’re usually talking about high-interest debt, like that associated with credit cards. Usually, they’re not talking about mortgage debt, which many money experts go so far as to call “good debt.” Why?

Mortgage debt is sometimes called good debt because it’s associated with an investment that is expected to appreciate in value over time. Additionally, the vast majority of mortgages in the U.S. (92%, according to the Federal Reserve Bank of St. Louis) are fixed-rate, meaning the interest rate remains the same over the life of the loan and don’t, for example, change when inflation goes up.

The general consensus may be to not be in a hurry to pay off your mortgage — unless, of course, you have a ton of excess cash and are already well ahead of your retirement savings goals. Rachel Cruze is one of the few famous financial experts who doesn’t agree with this thinking. And actually, her father, fellow financial expert Dave Ramsey, doesn’t either. They both passionately argue the importance of paying off your mortgage ASAP. Why does Cruze, in particular, believe you should pay off your house early?

In a recent video posted to her social media channels, Cruze shot down the common retort she hears when advising people to pay off their mortgage early. They say something along the lines of, “But why not invest that cash in the market and make 10, 11% returns on it?”

This argument seems to make sense if you locked in a low-rate mortgage for, say 2% or 3%. But there’s a flaw in it that Cruze sums up perfectly in her reply.

(Excerpt) Read more at msn.com ...

Unfortunately that is true. Property taxes should be unconstitutional.

A 10% annual rate of return means there is some significant risk associated with it.

Do not mistake good fortune for wisdom.

Lol.

So my military retired pay was going toward the mortgage. We paid extra and the house was debt free in 15 years vs 30. I have taken that military retirement (which is completely mine now), and using that in my investments. It feels great knowing I’m completely debt free and all my cash and investments are mine. Pay it off as early as possible!

It’s worth noting that the primary risks for banks involve their roles as both lenders AND borrowers.

Overlook something?

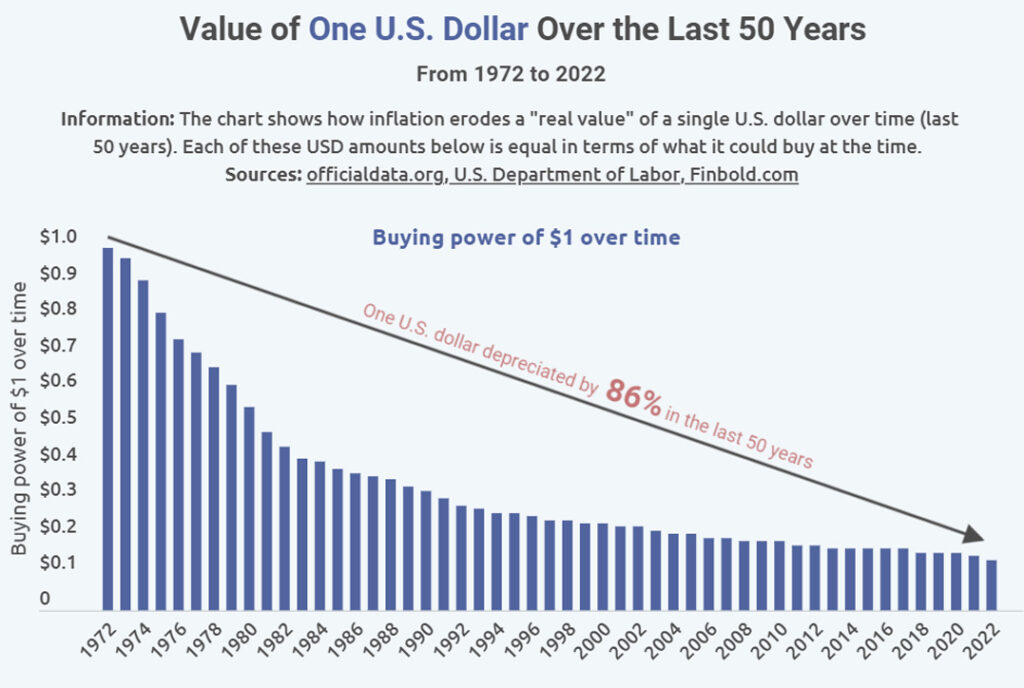

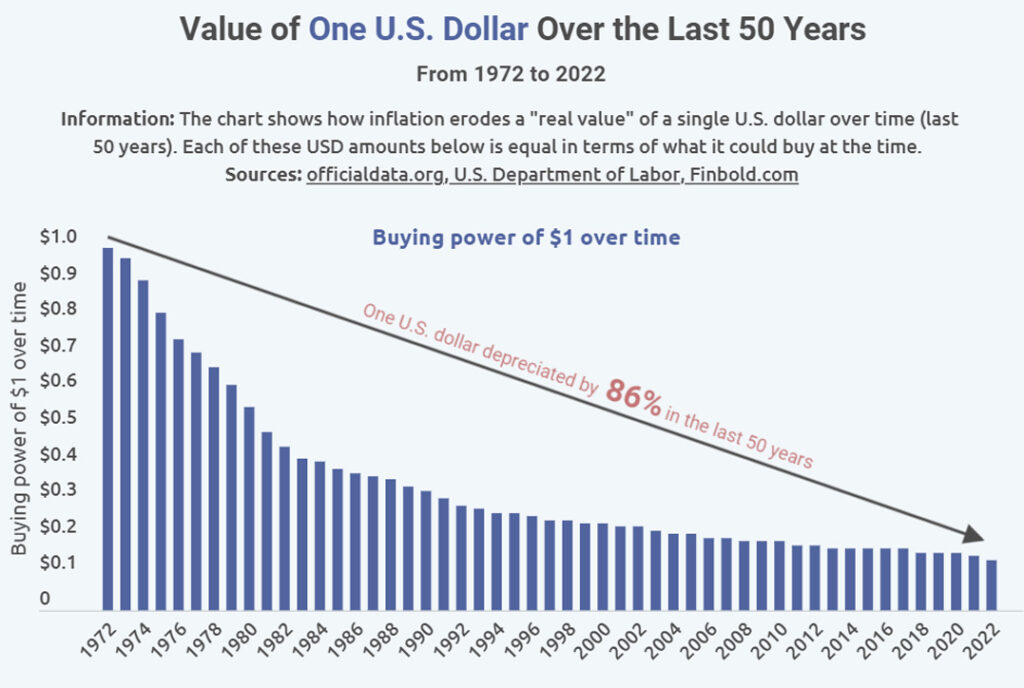

If savings & investments aren't beating currency debasement a person's losing money just by doing nothing.

If savings & investments aren't beating currency debasement a person's losing money just by doing nothing.

At the end of the day added return requires added risk.

No chart can change that reality.

Your bank thanks you for getting them out of a bad investment and taking the loss for them. However, they won't return the favor if the situation is ever reversed.

Muni’s can be excellent investments. However, for those who wouldn’t benefit from the deductions, there are many types of government agency bonds. Some of these carry the full faith and credit of the federal government. Many have been around six percent lately.

Banks generally won't negotiate on a sub-rate mortgage unless they are still holding the note. This is rare for conforming mortgages which are usually sold off by the bank days after the closing.

One of my occasional criticisms of the Ramseys...advising people to pay off their mortgage early.

In Dave Ramsey's defense, paying off a mortgage early is only recommended once all other debts are paid off and saving for retirement and child educations is well under way (Baby Step 6 of 7). However, Dave Ramsey was a realtor and this seems to occasionally cloud some of his otherwise good advice.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.