Posted on 04/15/2024 5:40:50 PM PDT by SeekAndFind

The current scenario of rapidly-increasing valuations without a corresponding increase in profits is unsustainable. Now add in a series of reports that inflation isn't going away as planned, and the market has a problem.

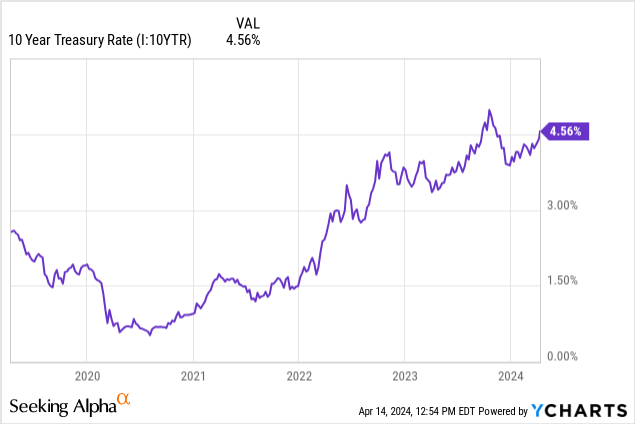

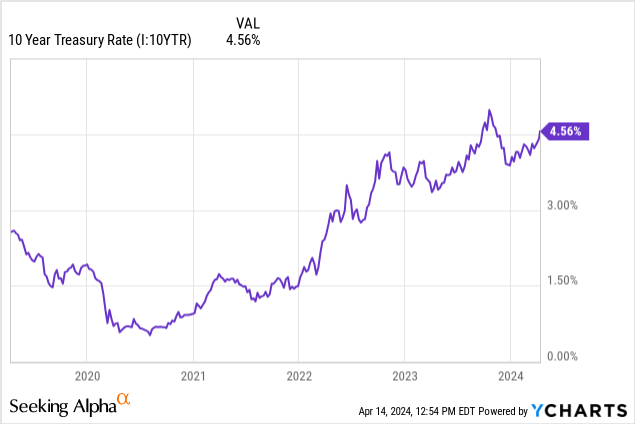

Yields have responded in kind, rallying to more than 4.5% last week as demand for bonds cools and budget deficit-driven Treasury supply continues unabated. In late summer last year, the 10-year yield suddenly rose to 5% after Fitch downgraded the U.S. government's credit. At the time, I compared the effects of rising interest rates to a freight train approaching the U.S. and global economy. This story quieted down this winter with the idea of a Fed pause and likely pivot starting in late October. Now it's back, the Fed can't cut rates with stubborn inflation, and long-term yields are threatening to hit new cycle highs. This has profound implications for housing, autos, banks, tech, and the stock market/economy at large.

(Excerpt) Read more at seekingalpha.com ...

Will the Fed risk knocking down the whole house of cards in an attempt to get Biden reelected (or at least keep him within the margin of fraud)?

RE: Will the Fed risk knocking down the whole house of cards in an attempt to get Biden reelected (or at least keep him within the margin of fraud)?

If the Fed tries to help Biden reelected, then this house of cards collapses.

Neither borrowing money nor printing it is a magic trick.

Our society’s resources are what they are, and politics can only redistribute them in the short run, not fundamentally solve the problem of scarcity. The reason why millions of Americans are struggling with the cost of living is because the government printed too much money during COVID.

And now the reason that millions of Americans can’t buy homes is because the Feds are crowding them out by investing billions in pork-barrel projects in swing states.

What happens next? The government won’t slow down its spending, and they (probably) won’t raise taxes, so yields are liable to hit new highs in 2024. Taken to its logical conclusion, that means the potential for 6% Treasury yields, 9% mortgage rates, and 8% car loan rates.

My investment driven buddies tell me with ten year T bills at six, it seems like a good time to take 2/3rds of everything and park it there.

Look at the institutions that have abandoned their core values just to defeat Trump; journalism, legal, education, and possibly banking. It’s astonishing, really.

Under Carter mortgage rates topping 18%!

After the effective 99.5% tax on earned interest called emergency rates that lasted for a decade-while they took money from those least responsible for the housing meltdown to give it to those most responsible for the meltdown-

6% is a black swan?

The action today-no flight to safety off the ME-along with the end of last week is not good. I hardly think that the world is ending.

But if one is in that camp-

spending freezes, tax hikes and inflation are what is next.

RE: Under Carter mortgage rates topping 18%!

In the 95th Congress (1977-1979), the Democrats had a 292-143 majority in the House and a 61-38 majority in the Senate.

In the 96th Congress (1979-1981), the Democrats maintained control with a 277-158 House majority and a 58-41 Senate majority.

The opposition could not control Federal government spending then.

Today, we still have one branch of Congress under a VERY SLIM Republican control. If Biden wins by cheating in 2024, here’s what to expect based on what we saw the past few years:

In 2020 and 2021, the government borrowed a ton of money, and they had the Fed buy basically all the debt they issued. Printing money and spending it predictably led to runaway inflation.

If you’re in power and want to spend money without raising taxes, you’re bound to increase yields. And if you make your central bank print money to cover the deficits, you’re bound to cause a surge in inflation.

If Congressional control mainstains its status quo, then, the Federal government won’t slow down its spending ( it did not under McCarthy or even Johnson as speaker), and they (probably) won’t raise taxes, so yields are liable to hit new highs in 2024 to 2025.

Taken to its logical conclusion, that means the potential for 6% Treasury yields, 9% mortgage rates, and 8% car loan rates.

We don’t have to go back as far as Jimmy Carter though. During the 1990s, prevailing nominal 10-year interest yields were above 6% for most of the decade, most notably during the dot-com bubble when yields peaked near 7%.

But note, Then, government budget deficits were much lower than today (or nonexistent in some years), and inflation was lower.

Looking at real yields (10-year yields less inflation), we see that the typical inflation-adjusted yield in the 1990s averaged about 3%. This was during a time of SMALLER government deficits. During the dot-com bubble, real yields were closer to 3.5%.

So, Another plausible scenario of 3% inflation plus a 3% real yield would yield an identical result. Given the crazy levels that government deficits are currently at, I think these numbers are conservative if anything.

And I wouldn’t expect the Federal Reserve to be able to rescue this, either. The Fed could easily cut short-term interest rates and steepen the yield curve, but that’s no guarantee that 10-year yields would go down. If rate cuts cause the market to expect more inflation in the future, long-term yields could go up. If the Fed were to reverse its policy of shrinking the balance sheet, inflation would likely break out and surge again. The Fed is more or less stuck letting the market set yields after shattering the public’s trust during COVID. The Feds are in a quandary really.

The main culprit is GOVERNMENT SPENDING. No one has the will in Congress to cut it. NO ONE!

1987 I paid 11%, and that was a good rate.

I would not “park” money with the U.S. Government for more that 90 days, if that!!! 6% for ten years might be nice until the democrats tax your investment return at 50%! And I would not be surprised to see that happen. After all, we can’t make money by investing if others have no money to invest!

If mortgage rates rise to 9%, I'm going to call up my bank and offer to pay off the whole balance at 25 cents on the dollar. Someone is getting hosed on this. LOL.

And the interest from a savings account was like having a part-time job.

“I’m currently paying off a 30-year fixed-rate mortgage at around 3%. “

The SMART thing to do is to pay the minimum every month.

It’s free capital gains.

Of course. LOL.

If people want to support reckless government spending, the leftist globalist/elitist program for America and so on, it makes sense they would buy government debt. But for the rest of us, buying government debt makes no sense as we are just kicking ourselves in the face by doing so, arming and equipping the enemy. Stick to corporate debt (or the debt of saner nations) and let the government figure out how to finance its deficit when most of the public treats it as radioactive.

Don't tell me US debt is the safest investment out there either. Not only do the ratings agencies' downgrades tell a different story, if most of the public stops buying and financing Washington's debt it will hardly be risk-free to hold it.

I expect 8%, because the Federal Reserve is not ahead, but trailing.

U.S. Treasury must begin immediately to sell more bonds and notes with higher rates of return for buyers.

U.S. government must cut spending on all:

- Dept. of Education

- DEI ops, dept.’s

- plans and programs to force “affordable housing” where local or county or state residents object

- plans and programs to seize and control land, property zoning

- plan and programs to change from fossil fuels

- DoJ, FBI

- EPA

and cut out regulations that increase costs of agricultural, defense, and transport manufacturing.

Bond issues are already begging to tank.

Beginning, not begging....

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.