To: SeekAndFind

Will the Fed risk knocking down the whole house of cards in an attempt to get Biden reelected (or at least keep him within the margin of fraud)?

2 posted on

04/15/2024 5:43:38 PM PDT by

KarlInOhio

(Democrats' version of MAGA: Making America the Gulag Archipelago. Now with "Formal Deprogramming")

To: SeekAndFind

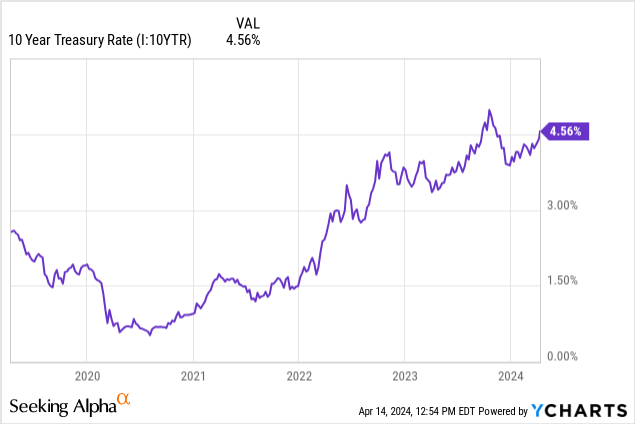

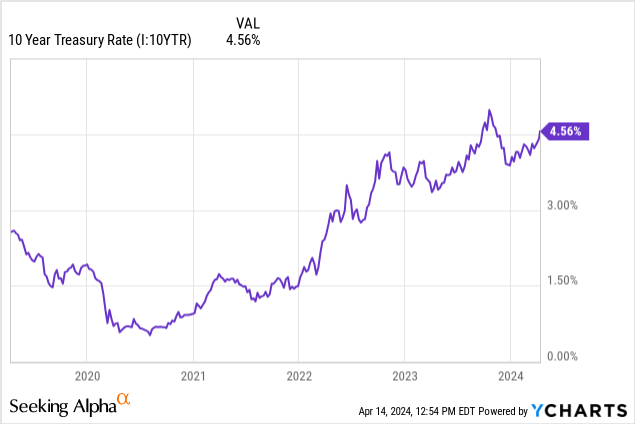

There are theoretical and practical reasons to believe rates should continue to go higher. JPMorgan (JPM) CEO Jamie Dimon recently

highlighted the risk of 6% rates in his annual letter to shareholders. 2024 inflation reports have come in hotter than expected, echoing historical patterns where inflation is hard to stamp out. Theoretically, there are reasons to expect yields to rise as well.

The CBO expects the U.S. budget deficit to be 5.6% of GDP for 2024. This is probably inflated because student loan forgiveness is baked into these and it's doomed in court, but the budget deficits are honestly quite reckless. Sustainable budget deficits are thought to be in the 3%-4% range, which would require immediate tax hikes of about 1.5% to 2% of GDP. What happens when the government wants to spend money without raising taxes to pay for it? They have to borrow the money to do so. This puts upward pressure on yields.

Mainstream economic theory says that

excessive government borrowing will "crowd out" the private sector. To put this in practical terms, the Biden administration needs to borrow many trillions of dollars to finance increased military spending, the green energy transition, and the social programs they want. But doing so without paying for it with tax increases drives up yields, "crowding out" potential homebuyers looking for mortgages, small businesses looking for loans, etc.

To: SeekAndFind

A Black Swan In Plain Sight: The 10-Year Treasury Yield To 6%

A black swan, by definition, is an unseen and unexpected event.

This guy needs metaphor therapy.

To: SeekAndFind

Under Carter mortgage rates topping 18%!

8 posted on

04/15/2024 6:03:03 PM PDT by

Lockbox

(politicians, they all seemed like game show hosts to me.... Sting…)

To: SeekAndFind

After the effective 99.5% tax on earned interest called emergency rates that lasted for a decade-while they took money from those least responsible for the housing meltdown to give it to those most responsible for the meltdown-

6% is a black swan?

The action today-no flight to safety off the ME-along with the end of last week is not good. I hardly think that the world is ending.

But if one is in that camp-

spending freezes, tax hikes and inflation are what is next.

To: SeekAndFind

I'm currently paying off a 30-year fixed-rate mortgage at around 3%.

If mortgage rates rise to 9%, I'm going to call up my bank and offer to pay off the whole balance at 25 cents on the dollar. Someone is getting hosed on this. LOL.

13 posted on

04/15/2024 6:36:13 PM PDT by

Alberta's Child

(If something in government doesn’t make sense, you can be sure it makes dollars.)

To: SeekAndFind

I expect 8%, because the Federal Reserve is not ahead, but trailing.

U.S. Treasury must begin immediately to sell more bonds and notes with higher rates of return for buyers.

U.S. government must cut spending on all:

- Dept. of Education

- DEI ops, dept.’s

- plans and programs to force “affordable housing” where local or county or state residents object

- plans and programs to seize and control land, property zoning

- plan and programs to change from fossil fuels

- DoJ, FBI

- EPA

and cut out regulations that increase costs of agricultural, defense, and transport manufacturing.

18 posted on

04/15/2024 7:42:13 PM PDT by

linMcHlp

To: SeekAndFind

On the front end, watch for retail inventory movement back-log, as a consequence of consumers shutting down. (Essentials only)

As retail traffic stagnates, inventory orders cease, and items go either unordered or stay on the shelves unpurchased.

Symptoms, hourly essential employees with big chain retail having their hours cut back to bare minimum.

24 posted on

04/16/2024 12:01:45 AM PDT by

Varsity Flight

( "War by 🙏 the prophesies set before you." I Timothy 1:18. Nazarite warriors. 10.5.6.5 These Days)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson