Posted on 07/03/2023 9:10:50 PM PDT by SeekAndFind

According to the International Energy Agency, the transportation sector is more reliant on fossil fuels than any other sector in the economy. In 2021, it accounted for 37% of all CO2 emissions from end‐use sectors.

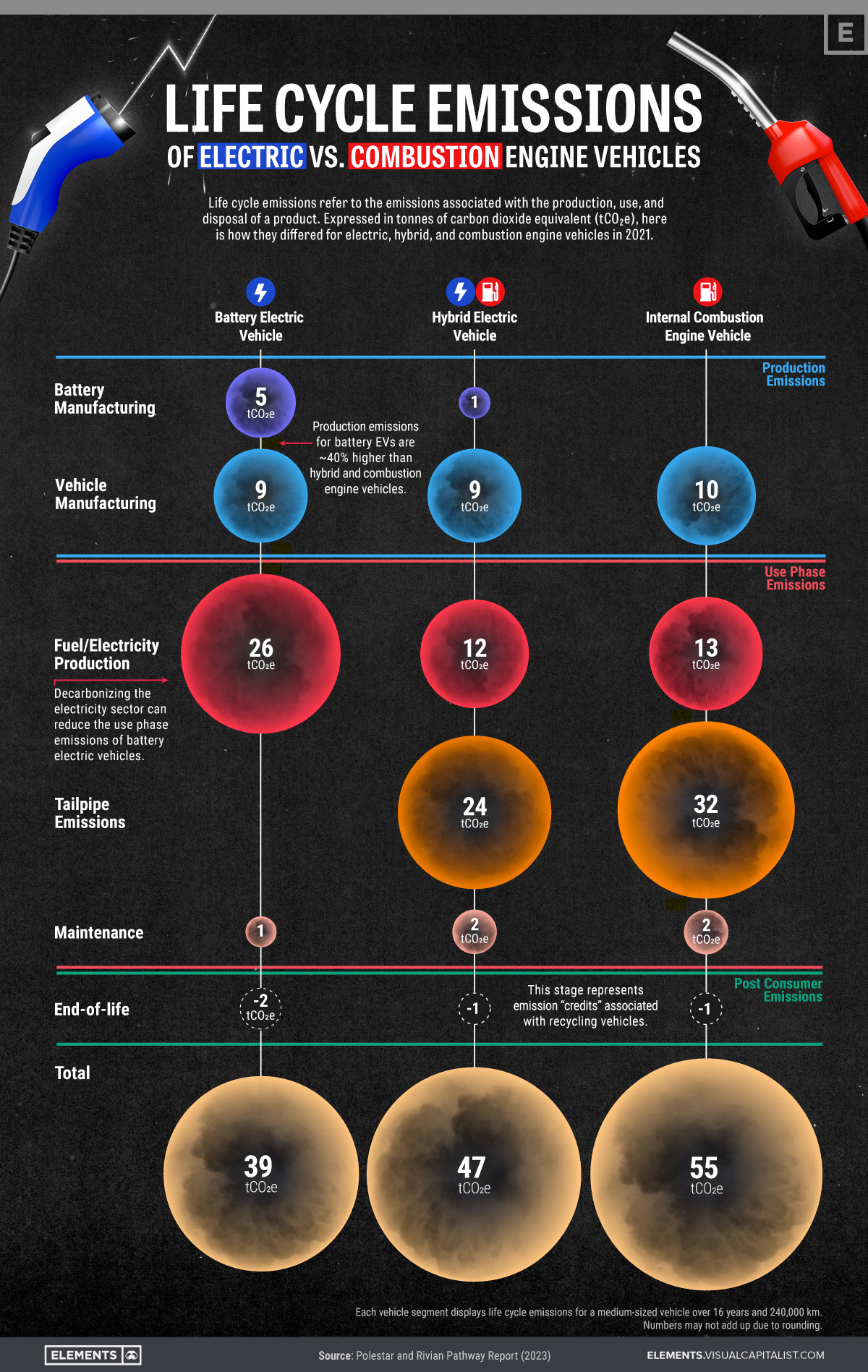

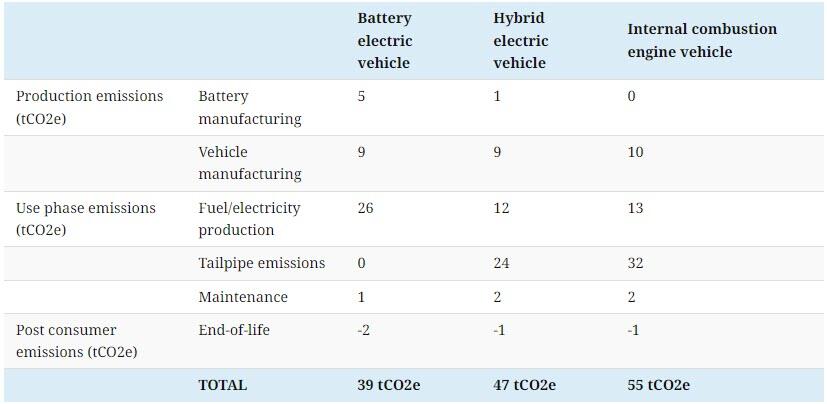

To gain insights into how different vehicle types contribute to these emissions, the above graphic visualizes the life cycle emissions of battery electric, hybrid, and internal combustion engine (ICE) vehicles using Polestar and Rivian’s Pathway Report.

Life cycle emissions are the total amount of greenhouse gases emitted throughout a product’s existence, including its production, use, and disposal.

To compare these emissions effectively, a standardized unit called metric tons of CO2 equivalent (tCO2e) is used, which accounts for different types of greenhouse gases and their global warming potential.

Here is an overview of the 2021 life cycle emissions of medium-sized electric, hybrid and ICE vehicles in each stage of their life cycles, using tCO2e. These numbers consider a use phase of 16 years and a distance of 240,000 km.

While it may not be surprising that battery electric vehicles (BEVs) have the lowest life cycle emissions of the three vehicle segments, we can also take some other insights from the data that may not be as obvious at first.

As we move toward a carbon-neutral economy, battery electric vehicles can play an important role in reducing global CO2 emissions.

Despite their lack of tailpipe emissions, however, it’s good to note that many stages of a BEV’s life cycle are still quite emission-intensive, specifically when it comes to manufacturing and electricity production.

Advancing the sustainability of battery production and fostering the adoption of clean energy sources can, therefore, aid in lowering the emissions of BEVs even further, leading to increased environmental stewardship in the transportation sector.

True that. But again this backs up the whole free market angle. In my case it makes sense to do the “inefficient” way with an EV because I have a large solar system at home to make us 80% energy independent, an independence that’s extended onto the road with the EV at least for local driving (including 200 mile round trip getaways). I can’t drill my own oil or natural gas, nor can I mine my own coal — if I could I would because those energy sources are better than solar. The best way to harness the one energy source I can harvest on my own is to be almost completely electric in my energy consumption. That’s important to me (and a small but growing number of conservatives like me who want to wean ourselves off of things government controls too much, including energy). But it’s evidently not important to you. A free market would let us each get what we want.

To be fair, I argue this more on an EV forum (mostly liberals) than I do among conservatives because the liberals are usually the ones trying to force others to do as they do (ban ICE cars and drive only EV’s). They need to hear more than conservatives the sermon to live and let live with no government interference. They speak with blanket generalizations and try to make every ICE car as horrible as a Yugo when they say ICE cars should be banned. When we argue back with our own generalizations we’re in effect falling for their trap and helping them create a polarized environment that can be settled only by making government bigger.

I know it's pushing battery cars, but I'm saying that if the metric is looked at via per capita miles driven, the argument falls apart due to more charging cycles vs fill-ups.

Hybrids win, perhaps for now if EV distances improve or electrical grid emissions are reduced in the future.

-PJ

Notice they didn’t include mining for the battery elements. Just, “production”, which makes me think the manufacturing of the actual battery and not harvesting the materials.

I remember articles back in the stone age, where they were talking of mining Methyl Hydrate, and using it for fuel.

From what I remember about the cons was, the potential mass venting of methane into the atmosphere, and the possible explosions.

Excuse my ignorance, but isn’t methyl hydrate compressed, and basically frozen in the Earth and under the oceans? I figured it didn’t make sense, then I woke up to the fact that scientists are 95% social activists, 4% politicians, and 1% into science.

How do you figure out you are 80% electricity independent? The panels are highly subsidized. I am sure you are selling electricity back to the grid during peak sunshine days, and then drawing if back at night. Without the selling of power when it is not needed, and the subsidies, what is the true amount of “Juice” you use? What is the true savings?

I'm not selling power to the grid. I haven't for the 2+ years I've had solar because I don't want to pay the solar fee. If you like micro details on that, see my post at https://freerepublic.com/focus/news/4127577/posts?page=51#51. I'm currently in the process of applying to sell power to the grid (a new thing since I made that post) mainly because there's an optional variable fee based on each month's total demand (highest amount of kW pulled from the grid that month, even if just for a few minutes). That fee for me is much smaller (based on querying the inverters' telemetry data over the past 12 billing periods and using a C# app to model all of the optional rate plans the power utility offers, including the one for power buy back with each of the two fees to choose from). After paying that demand fee, I'll be paid only about 1/4th of the real rate they charge us (the stated rate they charge us plus the riders they add to each kWh, largely the fuel cost the power company pays for coal and natural gas and uranium that they pass onto customers the pain the Dims cause the power company, plus a 4% tax). For example, from June to September the buy-back rate is 4.26¢/kWh, even though on my June statement they charged a real world 16.5846¢/kWh (well above their stated rate of 12.4384¢ per kWh detailed at https://www.alabamapower.com/content/dam/alabama-power/pdfs-docs/Rates/FD.pdf). In solar lingo, Alabama doesn't do "net metering" (no "subsidized rate" to pay me per kWh what I pay them per kWh).

I am sure you are selling electricity back to the grid during peak sunshine days, and then drawing if back at night.

I rarely pull at night because I have 92kWh of battery storage. That doesn't always allow me to go through the whole night without pulling from the grid. But it usually does.

How do you figure out you are 80% electricity independent?

Because for me it's about the data. It's always about the data. Especially for a large project such as this to try to protect our retirement finances from the Dims' stupid energy policies and the sky high inflation rate for energy costs. My inverters give a nice data export recording the various inputs and outputs of power at 5-minute candles. I made a small C# app to import that into a homemade SQL Server database. (It's a quasi-retired code jockey thing.) When I get a power statement I enter 5 data points from the bill (# of kWh pulled that month, meter reading date, main cost, tax added, and total cost) into a new record in a table for power bills. I then run a script with SELECT statements to join the power bill records with the telemetry records from the inverters. I can tell you that since I upgraded the solar equipment 10 months ago (August 31st) I've used 17,895.6 kWh (the load for the house, including charging the EV). Yet in that time I've pulled only 3,844.6 kWh from the grid, which is 21.5% of the power needed (the remaining 78.5% was saved by using solar and battery power). That average will keep increasing between now and the 1-year anniversary of the solar upgrade (Aug 31) because the remaining 2 months are summer months (good for solar, thus boosting the average). For example, in the June billing period I saved 93%. Using the aforementioned real world 16.5846¢/kWh rate I was being charged per kWh in June, and the fact that my inverters recorded me pulling 1739.7kWh less than I consumed (the 93% power saved), that means the solar saved me $288.52 on my June bill.

I made all of that data process two years ago when I wanted to know if Phase I of the solar installation (May 2021) did as well as I expected before I converted my 2 nat gas appliances to electric (which I did in the fall of 2021). I predicted it would produce 50% to 60% of all the power we consumed: the result was 58.5% on the 1-year anniversary of installing solar. That let me know both that the various components worked as expected, that I knew how to account for the varying average peak solar hours per day as the daylight and weather changes per month, and that, perhaps equally important, I understood our power consumption habits so I could choose the equipment to buy and configure them for our specific needs and wants.

So I implemented Phase II to have the full solar equipment I wanted (only after Phase I proof of concept) and since it was time to replace my wife's old ICE crossover anyway, I replaced it with an EV crossover (June 22). I expected the upgraded solar to provide 80% to 90% of all of our power (before I realized my wife and I would drive 26K miles per year LOL) and it looks like we're on track to be in the low 80's% (even with charging the EV for about 23K miles per year local miles, not counting charging the EV if we take it on a trip).

What is the true savings?

As of this month (July 2023) the overall energy project has saved my cash flow $1,400 more than it has cost me. Saving my cash flow = saving my retirement investments, the #1 reason for doing it. This is because most of the upfront cost has been put into the HELOC. Whenever the HELOC payment + car payment + power bill (avg $75/month power bill) equals more than what I was paying in year 2019 for energy costs, I pull the difference from the HELOC (which increases the balance of the HELOC). There are times I couldn't put the extra costs into my HELOC (thus it cost me in cash flow/retirement investments). But most of the time I could use the HELOC to pay the extra costs (thus avoiding sky high energy costs saved my cash flow / retirement).

In the past 12 months I've saved $3,855 in energy costs (power + natural gas + gasoline at the pump, after removing some overlap such as some of the natural gas costs I avoided resulted in some power cost added now that my house is all electric, same for avoiding gasoline cost at the pump added some but not much to my power cost). Keep in mind that 2 of those months were before my solar upgrade in Aug 31, so my 12 month total savings will increase a lot in the next 2 months (as I replace last July and August smaller savings before the upgrade with the upcoming July and August larger savings from after the upgrade). From then on my 12 month total savings will increase each month however much energy costs go up year over year. The present projection is for the breakeven of my costs is to be March 2032 (9 years from now, 10 years of owning the EV and upgrading the solar). That is the point when my total savings beyond my year 2019 style budgeting will equal the debt left in the HELOC. Every year when I get the tax refund with the tax credits (which I hate because all the credits did was artificially inflate my upfront costs, much like government "help" inflates college tuition and medical costs and everything else government "helps" us with), I pay down the HELOC balance. This will continue until April of year 2025 -- the last year I'll get the solar tax credit for the year 2022 upgrade, since the solar tax credit is not refundable, but carries forward to future tax years until I use up all the credit with my yearly tax liability (a little IRS tax lingo). Basically the EV tax credit and solar tax created artificially inflated my costs, and it's taking 2 and a half years before the tax credit gives that back to me. But the Dims expect us to be grateful for that. Oh well, it is what it is, so I count it as the cost of trying to be more independent from the Dims' stupid energy costs.

The car payment will end in 3 years (4 year car loan) and I'll quit having to pull from the HELOC each month to make my budget still feel like I'm experiencing year 2019 energy costs (so our Roth IRA's can keep growing without having to pull extra to pay for energy). When the car is paid off, the year 2019 energy costs portion of my budget will be hardly touched by my small power bill, with the excess that month paying down the HELOC balance. Which makes the HELOC payment go down (kind of like the minimum payment of a credit card goes down as you pay down the balance). Basically, the cost of saving on energy (the HELOC payment) will go down year after year, while the money I save (the energy costs I avoid) will go up (in my future calculations I assume only a reasonable 3% inflation rate in energy costs, obviously if the Dims keep getting their way and we keep experiencing 19% YOY increases in nat gas and power rates, my payback period will be sooner).

Methyl hydrate and methyl alcohol (wood alcohol) are one and the same compound, JFTR.

Thanks for the reply. You, I believe. Nobody holds that much info in their mind without living it.

I have friends in CA that have been bragging for years about their selling power back exceeding purchase price. Not all days, but enough to swell them with the pride of being better that me. Thanks again for the details, I will look through it and see if I can understand it.

It’s been a while since I saw articles on it. You are correct of course. I mistated the substance, it is Methane Hydrate.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.