Posted on 05/19/2023 2:12:51 PM PDT by millenial4freedom

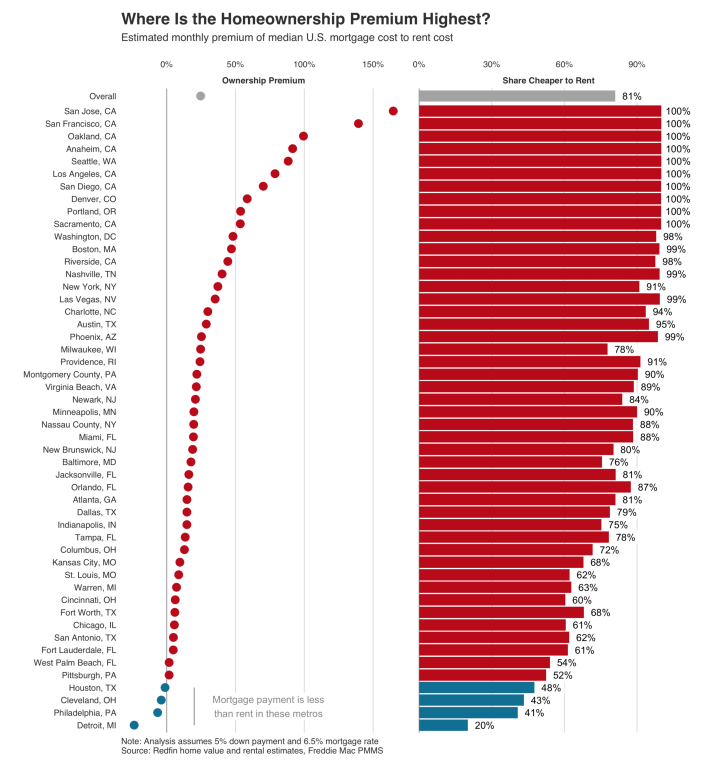

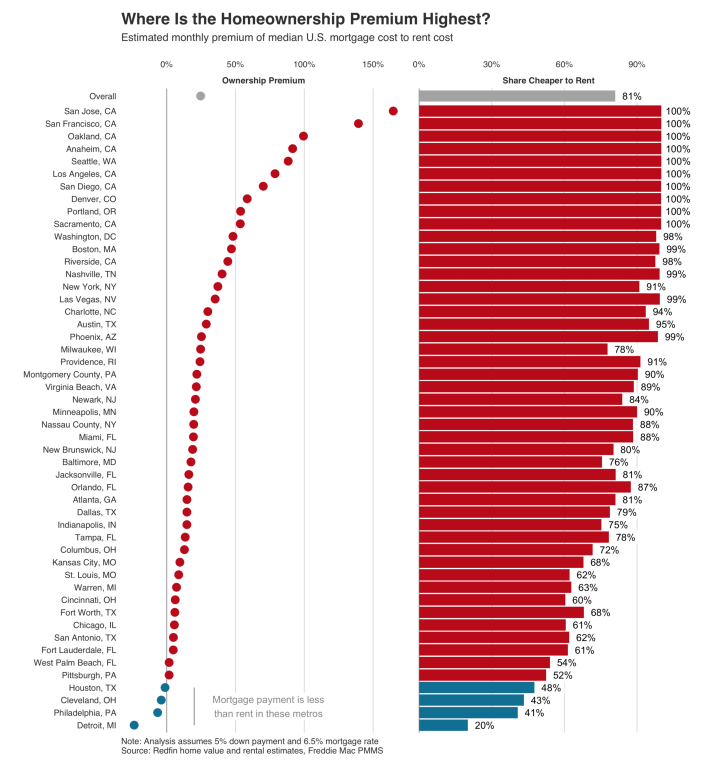

SEATTLE, May 19, 2023--(BUSINESS WIRE)--(NASDAQ: RDFN) — There are just four major U.S. metropolitan areas where it would be cheaper to buy than rent the typical home—that is, the typical home has an estimated monthly mortgage cost lower than its estimated monthly rental cost. That’s according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage.

In Detroit, the typical home is 24% less expensive to buy than rent—the largest discount in percentage terms among the 50 most populous metros. The median estimated monthly mortgage payment for Detroit homebuyers is $1,296, compared with an estimated monthly rent of $1,697. Next comes Philadelphia (7% ownership discount), followed by Cleveland (4% discount) and Houston (1% discount).

(Excerpt) Read more at finance.yahoo.com ...

Cities are as expected

I have no problem with renters.

.

I see info on Zillow that my house would rent for $3800. My mortgage is only $1450.

Wife’s business used to have a rental apartment for employees who had to stay for extended trips. Was $1100 went to $1600. They moved out and it was rented within a few days. Probably close to $2000 now. Crazy.

Houses are still way overvalued and have not given back the huge price spike at the beginning of Covid.

As long as the supply continues to be low and the globalists keep our borders wide open, increasing our population by millions annually, even raising mortgage rates to as high as 10% won’t bring down home prices to pre-covid levels. Both buyers and renters are screwed for the foreseeable future. The only people who are in (relatively) decent shape are owners with fixed low rates or whose property is all paid for.

Ha! It’s much cheaper to buy then rent in the Salt Lake City area and has been for years.

All those illegals don’t have the money to buy houses.

In or around any metropolis area prices are ridiculous. I lived in Los Angeles. Home prices are $1 million+ for a shack or a condo, $2-$3 million for modest home, $4 million and up for a nice home if you want to buy. It’s up 30%-40% since Pandemic which only makes sense because taxpayers subsidized such inflation. In the suburbs, it can be a tad lower (like in the center of the San Fernando Valley) but not dramatically lower.

30 minutes north of L.A. you can buy a decent home for $700,000, or a very nice home for $1.5 million. A lot of them are newer - but not much land generally. Tract homes. But new or fairly new.

Now do the math on the property taxes. $20,000 per year for a $1.25 million house. $50,000 per year on a $4 million home. For people who are in their homes a long time and have a low cost basis (California has Proposition 13 which prevents property taxes from rising more than 2% per year from your cost basis, so if you bought a home in 1988 for $250,000 you are paying $4k a year in taxes, but if you sold it for $2 million the new owner will be paying $30,000 a year in taxes!). So if you own the home or even still paying a refinance on it at that low basis - you never have to sell. You can rent it out for $5k-$10k a month and retire on that income. It costs you one month’s rent to just rent it out.

I’ve got family who are leaving and going to Georgia and Tennessee. They have equity in their homes and lower cost basis to tax but they still can’t justify the property tax, raise 3 kids etc. I’ve got other family been in LA for decades, they have very low cost basis and property tax. The younger generation - it’s impossible to survive.

I am trying to convince the missus we should move to Kentucky. I used to live part time out there. I’ve seen online beautiful property we can buy, and lease space to move our business to would be 66% cheaper than what we are paying now.

It’s definitely cheaper for most younger families to rent out here. They rent from people who bought the houses maybe just a few years or a decade ago. Those landlords have much lower costs and demand for housing makes for premium rental costs.

Like I said above, if someone bought a house 10 years ago the property taxes are 1 month rent. This of course assuming they can afford to move out. Many can, or bought several homes over the years, or are moving out of state or downsizing their empty nests.

With 6% mortgages and 1.5% property taxes, I can’t figure how anyone can afford to live in these areas. I must be spending too much time on the internet.

The cities on the graph are nearly all in coastal states. Meaning people would be better moving elsewhere if they wanted to buy.

We had a similar issue moving to NM from Florida. Our 1000 SF house was worth $500K...until it burned down. We sold the lot for $325K and spent that on a new 3000 SF house in NM.

It doesn’t make sense to live in some parts of the country.

No, but their live in cheap rentals, which puts upward pressure on both the higher priced rental markets and, consequently, the buyers’ markets. Open borders (negatively) affects everyone.

Thought of the same thing here. Even small houses are more than what I paid for this one now.

“All those illegals don’t have the money to buy houses.”

They won’t need any.

Some GOP idiot like Dubya will come up with another ‘American Dream Downpayment Initiative’ handing out your money to the invaders so that they can live the American dream at your expense.

I’d include Democrat progressives except that it’s not news when they hand over the country to the invading 3rd world.

WOW! Comparing mortgages to rents is valid only if the value of your home falls to $0 after you purchase it!!!

All hugely effing dangerous places to live...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.