Skip to comments.

Baby boomers are refusing to sell and will age like a fine wine in their homes.

Dr Housing Bubble ^

Posted on 08/15/2017 6:42:18 AM PDT by Lorianne

Older Americans own half of the houses in the market. Many are simply refusing to sell and others have adult “kids” moving back in since they can’t afford a place to rent or buy. It is a Catch 22 and many people are looking at countries like Italy where the number of adults that live at home is enormous. Multi-generational families just don’t coincide with the “rugged American” worldview where you go out on your own and you make it with your own two hands. Of course, many house humpers had mom and dad chip in but that doesn’t make for such a sexy story. In the end, however there are many baby boomers that simply are not selling. This is actually an interesting problem that is not going away.

Refusing to sell

Housing used to be a young person’s game. The U.S. housing market and to a large extent, the economy was driven by home buying and big ticket purchases. But that has definitely changed since the housing market imploded with the 2000s. It has also changed in terms of people marrying later, having fewer kids, and basically preferring to live in city centers versus suburbs. In other words, not a big need for McMansions.

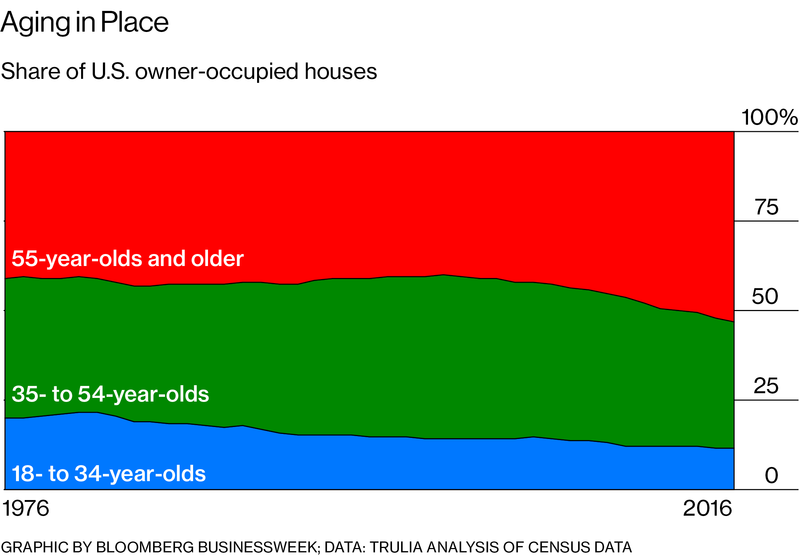

The oldies but goodies are now occupying a larger share of housing:

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

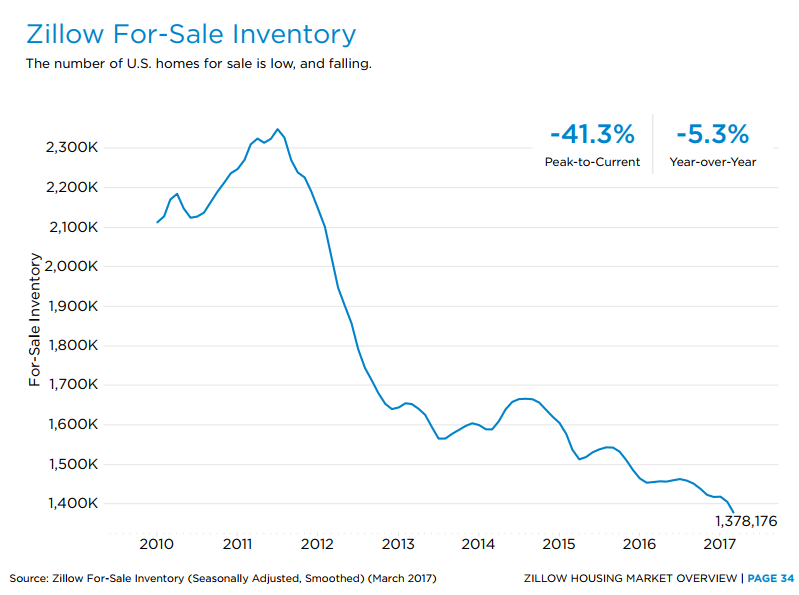

But housing has gotten more expensive across all U.S. metro areas so this is a much larger trend. It has absolutely crushed the available inventory out on the market:

SNIP

TOPICS: Business/Economy

KEYWORDS: babyboomers; elderly; housing; seniors; trends

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-139 last

To: Comment Not Approved

Spent $29,000 on two acres overlooking the valley in ‘92. Built in ‘95 - there was a building slump in the valley in ‘95 to ‘96 so my reclaimed old growth fir package was sold for $1.00 per board foot. Rough now goes for $5.00 BF, S4S is $8.00.

Neighbors just sold a (not as nice) lot for $300,000 this summer...

I did a great deal of the work myself (skilled carpenter).

2 bedroom, 1,450 sq. ft. deck 12’ off the ground.

Things are expensive in the ‘Zone these days, Wife is a RE Broker/Owner.

Happy fun times to you in NZ!

The rain seems to have cleared the smoke - perhaps we can catch a glimpse of the Perseids after 3:00 AM...

121

posted on

08/15/2017 3:04:07 PM PDT

by

BBB333

(The Power Of Trump Compels You!)

To: CodeToad

“The average home in Denver is probably purchased around $180K,”

Are you serious? That seems incredibly low.

.

122

posted on

08/15/2017 3:30:17 PM PDT

by

Mears

To: Mears

123

posted on

08/15/2017 3:36:18 PM PDT

by

Musket

(It's very simple:<i>your quoted text pasted here</i><p> produces Quoted Italic with paragraph break)

To: Texas Eagle

Using your math, you are paying $500 a month for interest, which is tax deductable, so say it really costs you about $400. And you are paying $500 a month for your house (does that include taxes and insurance, which would bring it down to about $250 a month, or are you figuring the full $500 for principal reduction?

Now go take that $500 (or perhaps $250) and see what kind of apartment you can rent with that.

And, if you bought that house in 1989, it has probably tripled in value. If you bought it in 2008, it may, depending on where you bought it, doubled in value.

So for less than the cost of a decent apartment, you have an asset which might have been worth $100,000 when you bought it worth $200 - $300,000 today.

Since the mortgage portion is loaded on the front end (your last payment would be almost all principal, the first payment almost all mortgage) You’ve probably milked most of the tax benefit out of the property if half and half on the p & i. If the taxes and insurance are coming out of the non-interest portion, then you probably should let it ride some more.

On the other hand, if you are living in a $250 - $500 a month apartment, you are building no equity, may not be in a position to itemize (unless you give heavily to your church), and you have to worry about your neighbors.

For most folks, the formula that makes the most sense is a 30 year mortgage than you pay off in 15, and from which you get 8-10 years of tax deductions. Then at the 15 years you own an appreciated property (real estate has certainly outperformed gold or oil over the last decade) with the only burdens being taxes and insurance. (And on the insurance, since you no longer have a mortgage, you can assume the level of risk with which you feel comfortable.)

Take as long to think about it as you need.

124

posted on

08/15/2017 3:44:23 PM PDT

by

PAR35

To: Texas Eagle

“how stupid the whole concept of paying a mortgage to get the tax deduction is.”

Definitely. If you must have a mortgage, that’s one thing. Bur if you can purchase outright, why wouldn’t you?

125

posted on

08/15/2017 3:51:03 PM PDT

by

MayflowerMadam

("Negative people make healthy people sick." - Roger Ailes)

To: Lorianne

We are finally going back to the millennial old concept of multigenerational families living together. Now my son just bought a place and is living there. But when he marries and is starting a family, he gets my house and I get the wonderful roomy suite addition. And my brother gets the other living quarters a little in-law that I built for him.

126

posted on

08/15/2017 3:56:16 PM PDT

by

Chickensoup

(Leftists today are speaking as if they plan to commence to commit genocide against conservatives.)

To: Musket

That makes much more sense——thanks for the link.

.

127

posted on

08/15/2017 4:08:44 PM PDT

by

Mears

To: bravo whiskey

“liquor stores”

I kind of tripped over that. Not on my list of attractive neighborhood features.

128

posted on

08/15/2017 4:27:43 PM PDT

by

steve86

(Prophecies of Maelmhaedhoc O'Morgair (Latin form: Malachy))

To: Lorianne

"Older Americans own half of the houses in the market. Many are simply refusing to sell..."

gee, there i go thinking of myself again...

129

posted on

08/15/2017 4:44:38 PM PDT

by

Chode

(You have all of the resources you are going to have. Abandon your illusions and plan accordingly.)

To: TexasGator

You are ignorant. Probably a boomer. I guess your resume says how many abortions you’ve had. That was in 1973 when you free lovers screwed everything in sight. Sorry the truth stung.

130

posted on

08/15/2017 9:31:19 PM PDT

by

napscoordinator

(Trump/Hunter, jr for President/Vice President 2016)

To: Biggirl

Anybody having free sex in 1973 contributed to abortion becoming the law.

131

posted on

08/15/2017 9:32:37 PM PDT

by

napscoordinator

(Trump/Hunter, jr for President/Vice President 2016)

To: napscoordinator

Let me guess... you were a toddler at that time.

132

posted on

08/15/2017 9:35:20 PM PDT

by

Pelham

(Liberate California. Deport Mexico Now)

To: rstrahan

>> Housing shortage is NOT based on the gray hairs not selling

The trend is no doubt related to the economic instability that plagued the Country for the last 10 years.

We property owners benefit from the sellers’ market, but ultimately we want the young ones to establish personal property investments.

133

posted on

08/15/2017 9:41:00 PM PDT

by

Gene Eric

(Don't be a statist!)

To: Gene Eric; rstrahan

In California it’s due to the millions of foreign nationals, legal and illegal, who have flooded into this state.

134

posted on

08/15/2017 9:51:32 PM PDT

by

Pelham

(Liberate California. Deport Mexico Now)

To: Lorianne

So where are they supposed to go?

135

posted on

08/15/2017 11:14:58 PM PDT

by

Freedom56v2

(Inside Every Liberal is a Totalitarian Screaming to Get Out - D. Horowitz)

To: PAR35

I am not making a rent vs. own argument.

I am making a paying off your mortgage vs. perpetually refinancing your mortgage for the purpose of the tax deduction.

136

posted on

08/16/2017 7:03:23 AM PDT

by

Texas Eagle

(If it wasn't for double-standards, Liberals would have no standards at all -- Texas Eagle)

To: napscoordinator

“You are ignorant. Probably a boomer. I guess your resume says how many abortions you’ve had. That was in 1973 when you free lovers screwed everything in sight. Sorry the truth stung.”

You are one sad dude.

To: Texas Eagle

Well, on that we would agree.

138

posted on

08/16/2017 3:03:46 PM PDT

by

PAR35

To: CodeToad

Excellent except of course if your investment declines by 30%. The ability to live in a home that is owned free & clear won’t decline...at least not for financial reasons.

139

posted on

08/18/2017 2:35:39 PM PDT

by

MSF BU

(Support the troops: Join Them.)

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-139 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

"Older Americans own half of the houses in the market. Many are simply refusing to sell..."

"Older Americans own half of the houses in the market. Many are simply refusing to sell..."