Posted on 05/18/2022 1:50:44 PM PDT by blam

Yep, we went there and unleashed the ‘deer in headlights’ image…

While most blinkered investors ignored last week’s record surge in revolving consumer credit (i.e. credit card spending), this week’s Walmart and Target earnings brought it home to the rest of the country that the “American consumer is strong” or “consumer has best balance sheet ever” narrative imploded, crashing on the shores of a gigantically lopsided and divided national aggregate that hides the reality that most of America is unable to pay the ‘cost of living’ under Bidenomics 40-year-high inflation without resorting to the plastic. Additionally, we are hearing more investors coming around to the idea that Powell’s comments were anything but ‘less hawkish’ – he unequivocally put 75bps back on the table with his ‘if things do not go as planned, we will do more’ comments… it just seems like nobody wanted to hear that yesterday!?

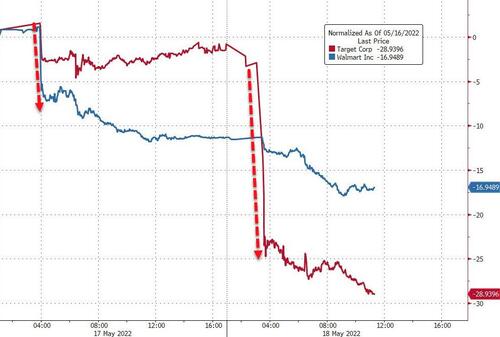

TGT and WMT are a bloodbath this week (-29% and -17% respectively in the last two days – worst drops since 1987)…and to pile on the ‘recession’ trade, Disney’s CFO warned that “growth in per capita parks spending will slow”..

Source: Bloomberg

NOTE – these are not widely held hedge fund names – they are, however, extremely widely-held ETF and passive investor names… when do the passive hand-sitters, reach for the mouse and end the pain?

That ugly realization appeared to finally hit home today as Housing data confirmed the signals from the retailers, sending stocks and bond yields plunging lower (and the yield curve dramatically flatter) as stagflationary themes are becoming base case for many.

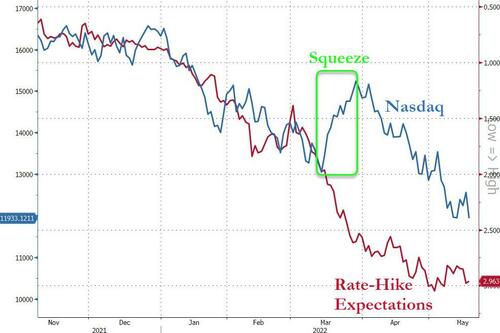

Nasdaq was the biggest loser today but chatting with some more ‘seasoned’ traders, almost everyone said a similar thing – this is the calmest major selloff they have ever seen, no panic puke, just slow and steady derisking (again perhaps signaling a VWAP seller and more passive investor unwinds)

Stocks have almost unwound all of the dead-cat bounce from last week (remember that bounce was triggered when the S&P 500 hit a drawdown of 19.99% – just shy of the bear market trigger)…

The S&P lost its 4,000 pin once again…

Stocks still not ‘pricing in’ The Fed…

Source: Bloomberg

Staples & Discretionary were (unusually both) monkeyhammered today…

Source: Bloomberg

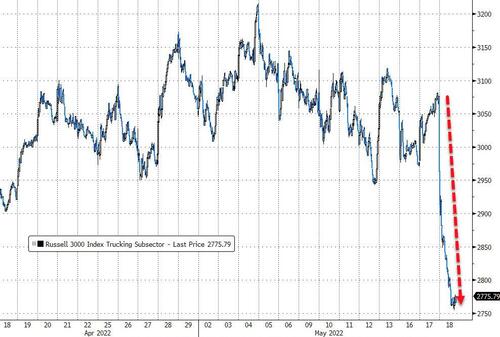

Trucking stocks were clubbed like a baby seal (to their lowest since Feb 2021) after the Target comments on Transportation costs…

Source: Bloomberg

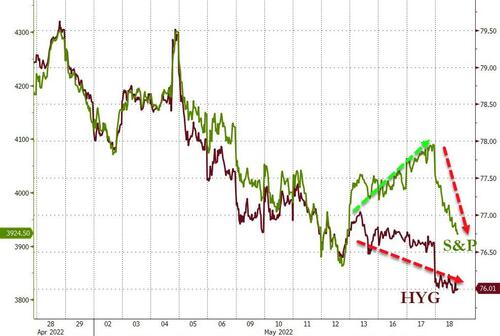

Equity markets caught down to credit’s ongoing weakness today…

Source: Bloomberg

VIX rose modestly today but equity risk remains massively under-priced relative to credit risk…

Source: Bloomberg

As stocks puked, bond yields crashed with the long-end outperforming (30Y -11bps, 2Y -3bps)…

Source: Bloomberg

…signaling “growth scare” fears are rising (and thus stagflation… globally)

Source: Bloomberg

10Y tested 3.00% again and plunged…

Source: Bloomberg

And the yield curve flattened dramatically…

Source: Bloomberg

TINA is dead… there is an alternative…

Source: Bloomberg

The dollar managed a small rebound today after 3 down days…

,/A>

,/A>

Source: Bloomberg

Bitcoin broke back below $30k again today – remaining in the $29-$31k range…

Source: Bloomberg

Despite a sizable crude and gasoline inventory draw, oil prices tumbled along with the rest of the risk assets…

Gold managed gains today, holding above $1800…

Finally, as we noted earlier, don’t be fooled by (nominal) retail sales spending data…

After adjusting for inflation, the US consumer has hit the wall.

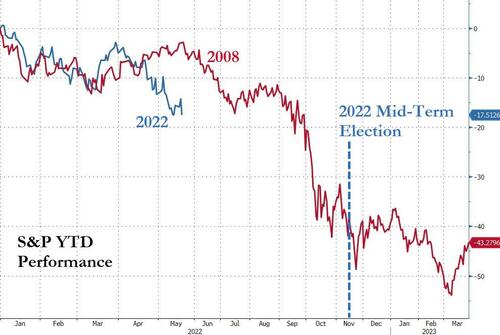

Still, things could get a lot worse yet…

Source: Bloomberg

Will Powell allow that? Will Biden allow Powell to allow that?

“My prediction.....PAIN.”

Clubber Lane

Biden is literally destroying every aspect of our country.

The Real Estate market is next.

The article handled the metrics correctly.

In an inflationary period it is critical to de-inflate all numbers for apples to apples comparison.

Otherwise you can scammed by “profit went up” or “wages went up” or “profits went up” when in fact they may have gone down when adjusted for inflation.

Biden is literally destroying every aspect of our country.

You mean 0bama and crew.

Whoever it is needs to be destroyed. It’s a matter of national security at this point and a violation of the oaths to not.

My prediction: Depression with a drop of 33 percent in gdp, inflation rates in the short to intermediate range of 33 per cent, 33 percent unemployment...wide spread scarcities...

perhaps a break up of the US as various sections decide to try and reconstitute themselves as new nation states expecting no fixes from D.C. Wide spread chaos and violence.

That’s what history and the numbers show. The Dems and their deep state Prog masters are statist but they cannot keep the nation together and while they are big on talk, they have no firm grip on our total enforcement mechanisms to push their tyrannies that they are emposing through the bureaucracy.(even military control is shaky...too many “non-shooters” as compared to combat persons and they have no confidence that state national guardsmen and women will allow themselves to be pressed into service against their own fellow citizens) Too many guns in the hands of patriots and too many areas in the USA that can be managed well apart from the central government as many areas still have basicaaly good law abiding people through which locally stabilized regions can maintain themselves...albeit at a more lower economic level.

The issue becomes for such “autonomous regions”, that desperate Democrat despots, trying to maintain control, might resort to nuclear tactical missile blackmail especially if a few willing generals and admirals are in agreement. Congressman Swalwell is in on record as threatening such.

Sorry for the gloom and doom but our generation just can’t fathom having to resort to revolution to throw the bastards out and many in our nation have no inner spiritual moral restraints to be good lawfully abiding citizens of a republic; which can only work if the vast majority of citizens are in moral agreement with one another. Many “good” people are in denial and they just can’t imagine just how evil many at the top are. Or they sense it but can’t imagine having to stir up their inner fire to rid themselves of such evil people because that might mean violence and death. Many of those would rather die and many of those “good people” will simply conform to what is evil just to maintain some sort of hope that it will all magically get “all better”. Many have kids and jobs and mortgages and things are “stable”...perhaps they feel they will escape the pain and loss.

Sometimes it’s our turn to embrace the “suck” of history!

Here in the back of my woods in TX gas ⛽️ is now $4.50!! I HATE THE VEGETABLE in chief!

This country runs on oil. And so does our military. The dameocrats deserve all the pain they get.

Your paycheck is larger, but now you can’t afford anything! Brilliant!

Buy the dip?

Sell the dip?

F-— the dip?

Don’t be too sure they are feeling the pain at the capital. If they were this nonsense about funding Ukraine $40 billion would have immediately been revoked. They don’t give a chit about the ordinary blue collar Americans on the contrary they hate us they hate our guts. The majority of those POS in DC cesspool are filthy rich because of the dirty money they have lined their pockets with. In other words prepare accordingly and each man to his own because we have arrived at that point.

Yes it does.

I am ready for retirement and I cannot explain the left.

I will probably not retire now.

Biden has decided to destroy the USA and its founding.

It’s interesting how the press has avoided talking about retirement accounts.

Retirement accounts are for those who’ve actually been productive, over the years. You know, like We the Deplorables.

Not so much the LSMedia base.

The millennial mushrooms mostly aren’t really into this kind of news.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.