Posted on 01/13/2022 5:10:48 PM PST by blam

During an interview with CNBC Thursday afternoon, Hayman Capital founder Kyle Bass joined Jeffrey Gundlach and other astute observers of the market by postulating that the Fed won’t be able to succeed with its planned 4 interest-rate hikes by the end of the year.

“Gundlach said that the Fed could get to 1.5% on the Fed funds rate, which might happen in the next 12 to 18 months. But that would trigger a recession,” he said.

But by the time the Fed gets to the second hike, markets will tank, forcing the central bank to backtrack.

Kyle Bass agrees with Gundlach (and the market): “The Fed can’t raise rates more than a 100-125 bps before they have to stop”

— zerohedge (@zerohedge) January 13, 2022

Speaking during his first CNBC interview of the year, Bass argued that there’s a “huge mismatch, I think, between policy and reality…when you look at the reality of hydrocarbon demand…the reality is that…we’ve been pulling CapEx out of the oil patch because we so desperately want to switch to alternative energy. The problem is you can’t just turn off hydrocarbons. It takes 40 or 50 years to switch fuel sources,” Bass explained.

And as the global economy shakes off the impact of the pandemic, Bass predicted that “the same forces that applied to bring oil below zero [back in April 2020] will apply on the upside. We will get the world reopened by the middle of the year…you can’t just flip on an oil well…the only people funding the oil patch are family offices.”

As demand for oil intensifies, the dynamic will send prices on front-month contracts “well above” $100/barrel”, Bass projected.

“There are so few people out there funding CapEx…if we reopen, you’re going to see numbers that people aren’t ready for.”

Bass’s interlocutors then opted to switch gears with some questions about China. After Wilfred Frost gently accused Bass of being a China bear, Bass insisted that he considers himself a “China realist” before launching into a discussion of China’s real-estate market.

As many investors may have learned from all the reporting about Evergrande and other deeply indebted China developers in recent months, roughly one-third of China’s economy is driven by real estate.

The surge in prices has contributed to China’s demographic nightmare, Bass said. “…the average birth rate of women in China fell below 1.2…you had an aggressive population decline because men can’t afford to buy homes because they’re priced at 20x to 30x their annual income.”

This has become a problem for China’s leaders.

“Xi needs real estate prices down and he needs them to stay down,” Bass said.

As for those who are betting on a bounce in Chinese stocks, Bass characterized this as “a fool’s game.”

As for whether or not he’d ever invest in Chinese stocks again, Bass replied:

“Fool me once but you’re not going to fool me twice…I feel like people who are investing in Chinese equities are breaking their fiduciary duty to their investors.”

Circling back to a discussion about the Fed, Bass pointed to Goldman’s call for 4 hikes this year. When the Fed does deliver on the rate hikes it has led the market to expect, “the curve is going to flatten, the long end of the curve will invert and the Fed” will likely need to throw it in reverse.

“My personal view is they can’t raise short rates more than 100-125 basis points before they have to stop,” Bass said.

Once this happens, a recession in the US will likely follow.

“I think they’re going to have to back away from that plan once they start hiking…that’s my view.

With all this in mind, “there’s no way the stock market goes up this year and it probably goes down pretty aggressively,” Bass concluded.

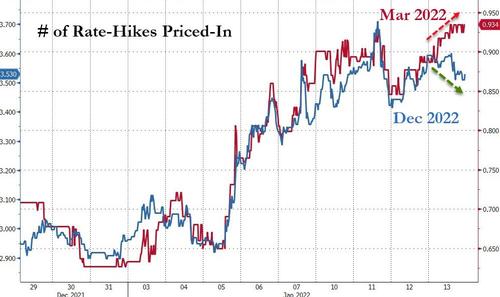

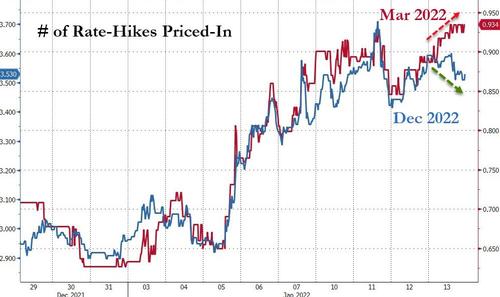

And once the Fed starts hiking rates, this, compounded by surging oil prices “will compound people’s inflation problems.” And that is already very modestly bring priced in… March rate-hike odds are rising to cycle highs but the odds of 4 rate-hikes by year-end are sliding…

So, after more than a decade of easy money policies, 2022 is shaping up to be a difficult year for American consumers.

Doesn't look like government debt to me.

Way back in post #37, I said....

"It's US Treasury debt and guaranteed MBS. Why is it toxic?"

Here's your chance, again. Why is guaranteed MBS toxic.

Yes. And some Ginnie Mae.

So would that count as “corporate”? Or are those still GSEs and considered quasi-government?

Page two says they were all gone by Sep 20, 2021.

could be

i assume that “income security” means welfare?

there’s so much ripoff fraud and abuse in that program, they should limit it to the genuinely disabled and be done with all the rest of that spending

So that guarantee essentially makes them Treasuries. I was just trying to decide if politicket had a point.

Yes.

He could have had a point, if he was talking about anything but the Treasuries and MBS.

I knew the Fed had talked about selling the corporate bonds, but I didn't know they were already gone 3 months ago, until just now.

“ If you unravel all debt to where it’s all paid off, then there would be no money.”

But there would be assets which would be exchanged for something. That something would be money in one form or another.

L

Typo.....

I meant to type that interest rates should be determined by the bank a person goes to, not a central bank.

These are the rates the Fed charges banks.

“Oil didn’t skyrocket in 2008.”

So what do you call it going to $140, earthrocketing?

He’s right about China crashing like Japan did at the end of the 80’s due to an insane real estate bubble.

I guess you have forgotten. I haven't.

https://www.macrotrends.net/1369/crude-oil-price-history-chart

The all-time high was in June of 2008. It was spiking out of control and OPEC couldn't due a THING about it. I think it was one of the catalyst for the financial collapse.

If you predicted $30 a barrel, you must have sold a LOT of newsletters. Because, NO ONE I ever knew was predicting that in the first half of 2008.

Almost sounds like Modern Monetary Theory.

As I understand MMT, disregard debt (you owe it to yourselves) print money until there’s inflation, then raise taxes to curb inflation. That’s kind of simplified. It’s what Bernie, AOC and others follow. Nearly every country is in debt, and their debt is growing. In that sense money is debt.

I’m aware.

I’m one of those that believes there should be no Federal Reserve. No central bank.

The banks have the money. Let them loan it.

Let them be responsible for their own actions.

Actually lost a lot of good friends - since I also wrote about how gold and silver would tank.

I found out that people get very angry when one has the audacity to make a prediction about precious metals that differs from the one that would tickle their ears.

“the money supply”

V of money is down. Period. Prices⬆ Costs of living⬆ D-Employment.

What I teach has nothing to do with that.

Money is not "printed" - it is created when new bank loans are created. It is also created when people make purchases with their bank credit cards, etc.

Money is destroyed every time debt is paid off.

How has the FED invested in equities?

How does the FED buy MBSs?

Does the FED itself have debt?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.