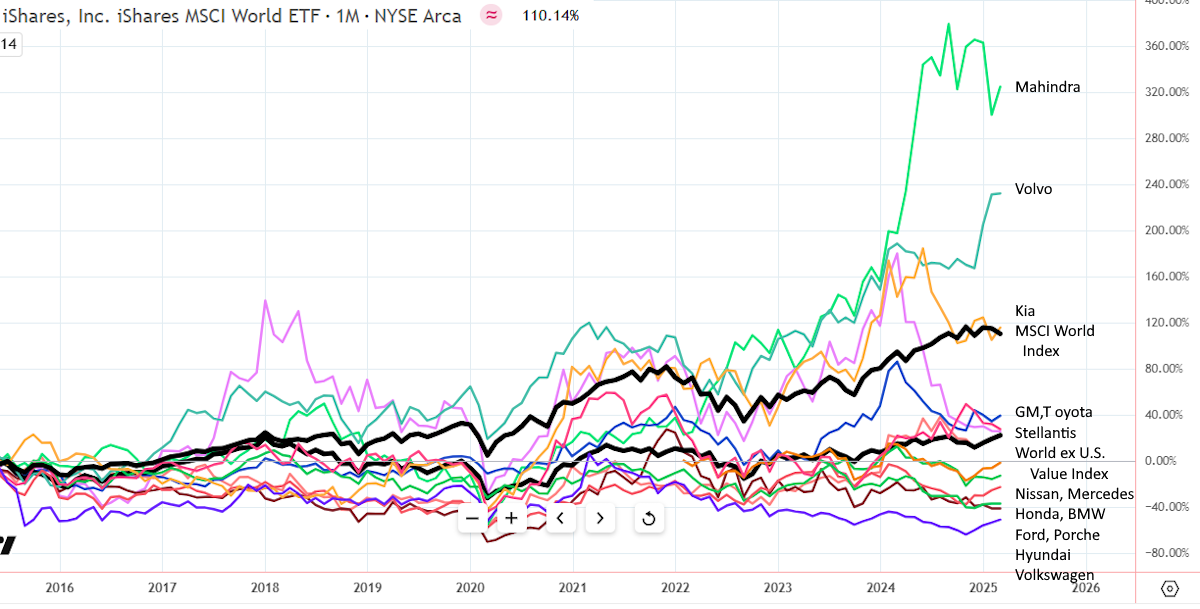

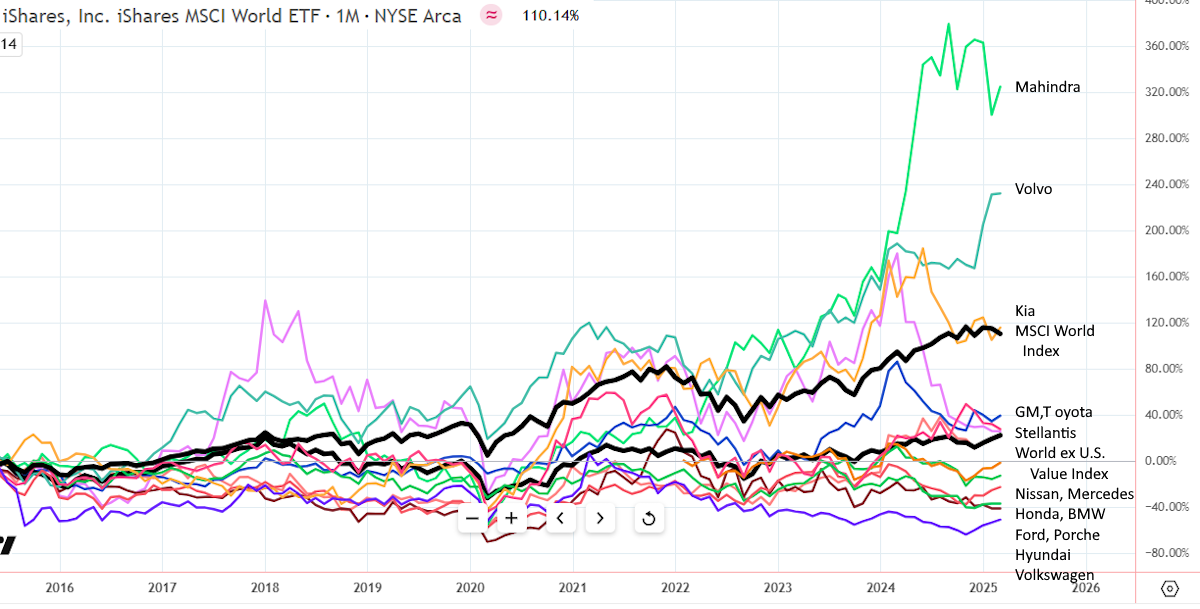

Legacy Automakers: 10-year price returns - TradingView (Performance data goes back 10 years, chart above goes back 6 years.)

Legacy Automakers: 10-year price returns - TradingView (Performance data goes back 10 years, chart above goes back 6 years.)Posted on 03/10/2025 9:17:26 AM PDT by SeekAndFind

Quote of the Week: "If I had asked people what they wanted, they would have said faster horses." - Henry Ford

Talk about chaotic markets. Donald Trump’s on-again off-again tariffs on imports from Canada and Mexico caused markets to see-saw last week.

Regardless of what happens next, the uncertainty could now weigh on markets until permanent trade deals are negotiated.

The auto industry is right in the crosshairs of these tariffs and is understandably under pressure. The outlook for automakers was already looking shaky with electric vehicle sales losing momentum and consumer spending beginning to slow.

On the other hand, pessimism creates opportunities. So we thought it would be a good time to take a look at the auto industry and check in on the latest developments for EVs, autonomous driving tech, and robotaxis.

Here’s a quick summary of what’s been going on:

📉 Atlanta Fed estimate for US GDP swings from growth to decline ( Barron’s )

🇩🇪 German bonds worst day since 1990 on €500 billion spending plans ( Bloomberg )

🛰️ Eutelsat share price rockets 650% on bid to replace Starlink in Ukraine ( Bloomberg )

🇪🇺 Some EU members propose extensions of gas storage targets until 2027 ( WSJ )

⛓️ Metal markets brace for supply chain shift after 'shocking' tariffs ( S&P Global )

📉 The market fears a recession ( Axios )

🇺🇸 Worries mount that Trump agenda is testing economy’s resilience ( WSJ )

The auto industry has always been challenging.

It’s estimated that nearly 2,000 automakers have existed in the US since 1895. That means a lot of companies have come and gone while trying to get their slice of the auto pie. A similar story has occurred in the US electric vehicle market in recent years, with plenty exiting the intensely competitive market.

That’s why Warren Buffett famously said the right trade in 1900 was to short horses rather than invest in automakers. While it was easy to see who the losers would be, choosing the winners was much harder.

Vehicle manufacturers have a unique set of challenges:

Over the last 10 years, very few automakers have delivered outstanding returns. Tesla’s share price is up 1,800% (down from 2,800% just two months ago), while BYD has gained 1,180%. In third place is Ferrari with a 792% return.

Amongst the legacy automakers, only three have beaten the MSCI World index over the last 10 years: Mahindra & Mahindra (name so nice you say it twice) and Volvo, and Kia.

If we use a Global value ex-US index as a benchmark, we can add Toyota, GM and Stellantis to the list of outperformers. But those three stocks only returned about 3.5% a year, excluding dividends.

Just about all the other legacy automakers are in negative territory over 10 years. Again, these returns don’t include dividends, but dividends for auto stocks aren’t as reliable as they are for other industries.

The bottom line is that amongst automakers, a handful of companies tend to stand out at any given time, while the majority can underperform. In particular, the once mighty German automakers are struggling to grow revenues profitably.

Like many global industries today, the vehicle manufacturing industry is incredibly complex.

The major brands are based in a handful of countries, but the manufacturing and assembly of vehicles often occur in different countries. Mexico, Spain, Brazil, and Thailand are just some of the countries that have large manufacturing and assembly industries even though they may not have their own auto companies.

Ironically, these industries are often set up when trade deals are signed.

This is why many vehicles sold in the US are manufactured in Mexico and Canada. Moreover, the components that go into vehicles assembled in the US are often manufactured in those two countries.

US Vehicle and Parts Imports by Country - Sherwood

Trump, apparently, wants to impose 25% tariffs on imports from Mexico and Canada to incentivize companies to move that manufacturing to the US.

However, as Bank of America analysts point out, there are two problems with that:

Many analysts also agree that tariffs will ultimately lead to higher vehicle prices, and that will cause lower sales numbers.

✨ The tariffs have once again been postponed by a month - but that doesn’t really help management teams who need to plan for the future. So it’s very likely that the uncertainty will weigh on the market until a permanent deal is made.

With the focus on Mexico and Canada, it’s also the US companies that are most affected. It’s still unclear if European and Japanese companies will face similar tariffs.

While most companies could manufacture vehicles in the US, one company that probably won’t is Ferrari. It has the widest margins in the industry - but famously manufactures all its vehicles in one factory, in Maranello, Italy.

The US is its biggest market, so it’s no surprise to see the share price down sharply despite strong earnings a few weeks ago.

Ferrari Revenue by Region - Simply Wall St

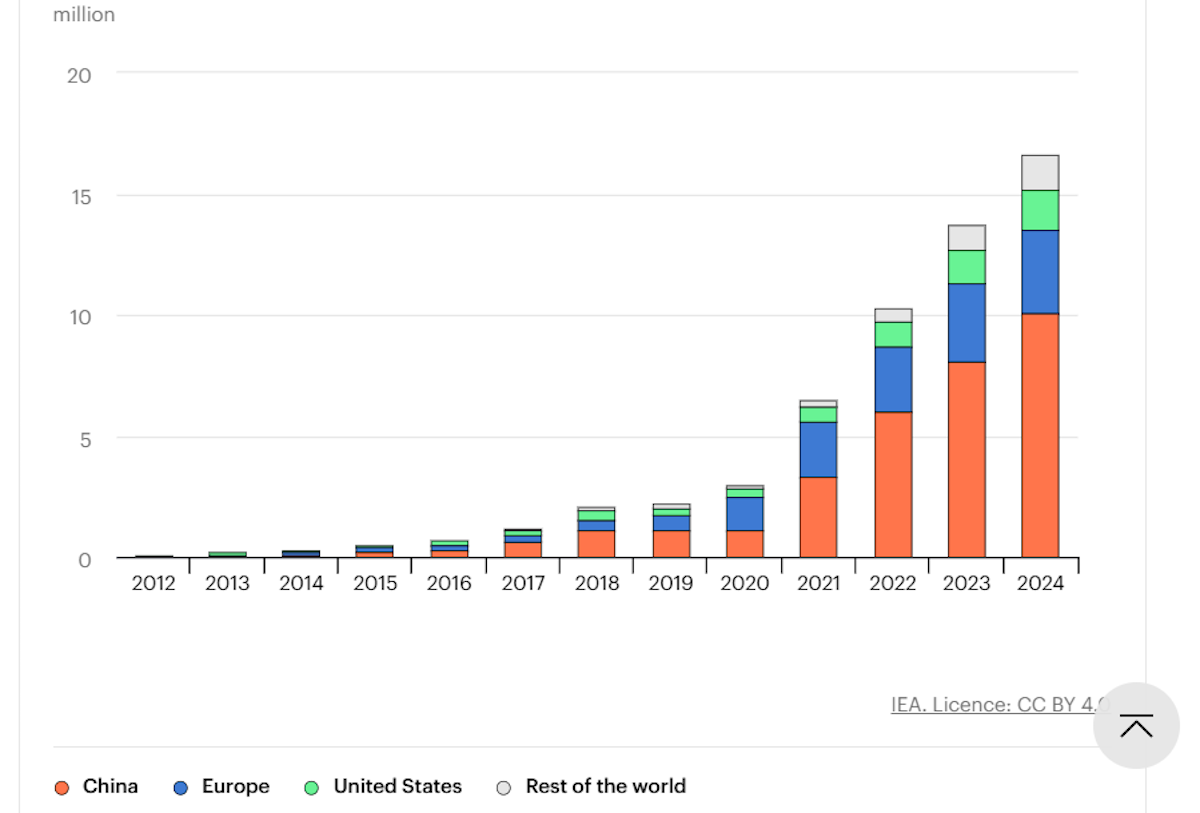

We previously covered electric vehicles in detail, just as the slowdown in sales was starting. Since then, global EV sales growth has slowed, but by less than anticipated. Most of the growth came from China, and notably BYD’s 33% increase in sales.

The surge in sales of PHEVs (plug-in hybrids) was a surprise last year, with their share of global EV sales rising from 30% to 38%.

Hybrid vehicles help address two challenges for consumers; the lack of charging infrastructure in some areas, and range anxiety. This extends the market to those consumers who were reluctant to fully commit to battery-only vehicles.

The other driver of sales has been subsidies in China (and elsewhere), which have helped companies bring prices down substantially. China recently extended the subsidies and incentives - and Europe responded by extending their subsidies.

Global EV Sales 2012 to 2024 - IEA

The EV subsidy issue is something to keep an eye on. One way or another, these are paid by governments, and they might not be affordable forever.

If governments are forced to reduce their deficits, those subsidies might be cut, which will hit demand. France has already cut its EV subsidies, and they are very likely to be cut in the US.

So that begs a question…

Most of the largest automakers in the US and Europe have scaled back their EV plans.

This has been partly in response to slowing sales - but it’s also a question of budgets. Many have seen overall vehicle sales slowing, while costs have increased. Some also had a very large range of EV models in development, while their EV units were still unprofitable.

There has also been a shift toward hybrid models following BYD’s success.

The entire auto industry is facing uncertainty, and staying solvent is a priority. Right now, their most important assets are a strong balance sheet and sustainable cash flows.

The automotive sector is likely to remain under pressure until there is more clarity on tariffs.

Even without this uncertainty, the broader outlook for most automakers is tepid at best. A quick scan of automakers on the platform reveals few auto companies with strong fundamentals, which just reinforces the industry's overall weakness.

However, if you want to get off this automaker seesaw we’re on, you might be more enticed by the brighter outlook of auto component manufacturers.

Unlike automakers, these companies are less exposed to shifting consumer preferences and the high-stakes competition that often results in "winner takes all" scenarios. Auto Components and Parts Companies with Good Future Prospects - Simply Wall St

Auto Components and Parts Companies with Good Future Prospects - Simply Wall St

Their business models tend to be more resilient, making them a more attractive option in the current environment for those who want stability.

While automakers face headwinds from potential tariffs and structural challenges, auto component companies could offer more stable opportunities.

Try to focus on businesses with consistent demand and lower exposure to unpredictable market dynamics. You’ll be able to assess that by looking at their past performance and future prospects on the platform, which we’ve added to the filters above.

The best part is that you can save this screener example we’ve made above, and then make your own changes to filter down to any finer details that you’re looking for, like dividend yield, low leverage, and plenty more.

NO comment, lol?!?!

Kind of a LOT of info. Why don’t you just post an accounting spreadsheet :)

I wonder what automakers, or any industry for that matter, could do to avoid the worry about tariffs?

No, Automakers Positioned Themselves In The Tariff Crossfire. And the freight is coming due.

“outlook for automakers was already looking shaky with electric vehicle”

Spare me on this topic, this is what happens when gummit gets involved and screws up a free market. The feds are the enemy here and not the market for new cars.

It is supposed to change behavior, not merely punish.

All of that prognostication is very short-sighted. Sure there will be near-term pain, but once we get all the dead wood out of government, move those people to productive jobs making things and services in the private sector, move government toward a balanced budget that doesn’t drag the economy down, and benefit from the massive direct foreign investments flowing into the USA, the economy will be on fire! (”fire” in the good way, not dumpster fire).

There seems to be an assumption that the 25% tariffs will be passed on to consumers. I think that’s wrong for at least a couple of good reasons.

1) Automakers will try to absorb tariffs in their profit margins in order to remain competitive.

2) consumers will simply not pay 25% more if there are other alternatives available, like tariff free US vehicles.

RE: consumers will simply not pay 25% more if there are other alternatives available, like tariff free US vehicles.

I guess that would include Japanese automakers that manufacture locally — Toyota and Honda for instance. Also Korean cars like Hyundai and KIA.

RE: Why don’t you just post an accounting spreadsheet :)

Spreadsheets don’t give explanations.

US automakers made a deal with Obama — they get a non-payable back loan (except for Tesla —they paid it back) so that that racist turd can claim he had mandated EV’s for everyone.

Yah made yer deal. Suck it up. Go ahead and die. Most car makers have.

“There seems to be an assumption that the 25% tariffs will be passed on to consumers.”

That is part of the fear mongering. Say our tariffs will henceforth identify as “carbon taxes” and those on the left worldwide won’t be able to complain about them.

Maybe build their stuff in America???

It’s a guess anyways

People are already turning their noses up at over priced cars and trucks. Raising the price higher won’t help them sell.

Auto tariffs are a big part of the gaslighting the left does on the subject.

Auto tariffs are mostly not passed along. Auto prices are not determined by costs - not even remotely. They are determined by competitive pressures. A BMW made in Mexico will sell for very close to the same price with or without tariff.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.