(Source: Scholaroo)

(Source: Scholaroo)Posted on 05/11/2024 9:21:52 PM PDT by SeekAndFind

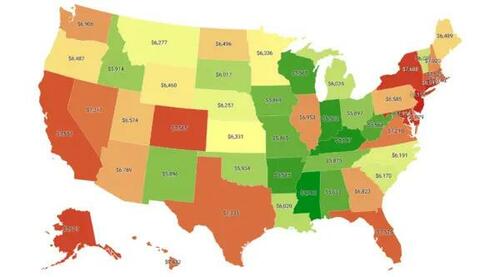

A just-released report from Scholaroo indicates that the U.S. national average for credit card debt has escalated to $6,555, with New Jersey residents leading the nation with an average debt of $8,155 per credit card. Scholaroo, a national firm matching college students with potential scholarships, surveyed more than 2,000 people across the United States during the final quarter of 2023.

Coming in at a close second is Connecticut, with an average debt of $8,011 per credit card, followed by Maryland, New York, and Alaska—all with average credit card debts of more than $7,600 per card. Rounding out the top 10 states are Colorado, California, Massachusetts, Florida, and Hawaii, all with average credit card debts in excess of $7,400.

“New Jersey residents’ debt surpasses the national average by 24 percent, while Mississippi has the lowest average credit card debt, with debtors owing just $5,186—20 percent less than the national average,” the report states.

Kentucky and Indiana also fell on the lower side, with an average of $5,295. (Source: Scholaroo)

(Source: Scholaroo)

Bruce McClary, senior vice president of membership and media relations for the National Foundation for Credit Counseling (NFCC), told The Epoch Times that amount of debt is not surprising as many people are forced to use their credit cards just to stay afloat. “Things are so much more expensive than they were three years ago,” he said. “The runaway inflation is affecting grocery prices, and we’ve seen a roller-coaster ride for gasoline prices. Many people don’t have the money in their budgets for these added expenses and so they’re using credit cards and making minimum payments each month.”

Based in Washington, the NFCC was founded in 1998 as a nonprofit credit-counseling source for people who need help in managing their debts. Its recently released Harris poll also surveyed 2,000 adults nationwide and found similar outstanding debt values. But the overall results were even more surprising: Nearly 32 percent of Americans are just getting by financially, while 62 percent fear that government instability will hurt their finances in the next 12 months.

“The biggest concern is that if people continue to carry that much debt from month to month, making only the minimum payments required, it could take years to pay it off, and they’ll find it extremely difficult to save any money,” Mr. McClary said.

The Harris poll also indicated that 31 percent of Americans don’t pay all their bills on time and that only 42 percent have a budget and keep track of spending. Almost 40 percent of those surveyed are concerned that the money they have or will save won’t last.

The poll found that the most affected groups are people who are single, rent instead of own, are parents of children under 18, and have incomes of $50,000 or less.

“Today’s higher rents may also be responsible for this credit card debt situation,” Mr. McClary said. “Most are paying way more than the recommended percent of their income toward rent, so now they’re faced with managing the rest of their expenses like groceries, utilities, gas, medical bills, and more. They’re finding they have to rely on the credit cards to help make ends meet.”

As a result, many have already been priced out of the ever-skyrocketing housing market.

“Ten years ago, Seattle was one of those cities considered to be affordable, but there’s been such a tremendous increase in rents there that many people are no longer able to afford buying or even renting there,” Mr. McClary said.

The Federal Trade Commission’s (FTC’s) Consumer Advice Department recommends that those having difficulty making even the minimum monthly credit card payments first talk with the company to ask for its help.

“Your goal is to work out a modified payment plan that lowers your payments to a level you can manage,” the FTC’s website states. “Creditors may be willing to negotiate with you even after they write your debt off as a loss, as you will still owe that debt.”

The NFCC also provides renegotiation services with credit card companies to reduce the monthly interest rates, which can sometimes be as high as 20 percent.

“What we try to do is help people regain control of their unmanageable debt by looking at their income and financial obligations and work out a livable budget,” Mr. McClary said. “It’s like a tire finally getting some traction after spinning in the mud for so long.” (Source: Scholaroo)

(Source: Scholaroo)

There seems to be no slowdown in Americans’ love of credit cards. According to the Scholaroo report, last year, almost 45.5 percent of the U.S. population opened at least one new credit card account, resulting in some 542.6 million new accounts by the end of 2023. While more than 50 percent of Americans prefer using debit cards for their day-to-day expenses, credit cards stand as the second most favored choice, with 36 percent of the population using them for their daily transactions.

Borrowing money at 21% interest.

Terrible, terrible idea.

You have to do this. Either you know where your money is and where it is going or it is waving bye bye.

Do they include people who buy everything on the card to get cash back or convenience and pay it off every month before interest comes due? Those cards will always carry a balance, and the credit agencies record as such, but no interest is paid.

>> Do they include people who buy everything on the card to get cash back or convenience and pay it off every month before interest comes due?

An excellent question. That strategy defines the Tick household to a “T”. We have $5K to $10K CC bill every month, and we pay it off in full. We have zero other debt.

The credit card interest on my cards are obscenely high and I do not care. I pay them all each month and do not accrue a penalty. In the credit card industry the call us “DEAD BEATS” because we pay our cards on time with no penalties.

In my Antique shop we always give a discount for those that pay cash or by a local check. They get what the credit cards company would have gotten by only shifting electrons in their payment system that cost them little. Actually, we give them more than the credit cost to us. It is good business. They come back later to buy more.

Banks are not your friend but a necessary evil, as most of our sales are by credit cards.

The really devious thing is to run up huge credit card debt, make the absolute minimum payment, file for bankruptcy, get all that debt wiped out and immediately get new credit cards and start the process all over again because an individual can file bankruptcy every 8 years I think

I'd then like to see these adjusted figures juxtaposed with political orientation / voting preferences in the given state.

Q: Are staunch conservatives truly more judicious in their spending habits than leftists?

Regards,

As you say, terrible idea. They're not forced to use them to stay afloat, they will likely sink into deeper debt. Best way to stay afloat is to force yourself to pay off any credit card debt immediately, and not carry debt with 21 to 29 percent interest charges on the carried debt!

I live in a low-property-tax state, but I still don’t like it when my property tax bill come in once a year. We have no mortgage, so this arrives like a bill, in the mail. I can pay it online in one or two installments.

Because I don’t particularly like paying property tax, I decided long ago to let the bank credit card issuers pay my property tax for me, every year.

And they have! I have not paid property tax for almost two decades. My plan continues to work perfectly.

This year, American Express and Chase will team up to pay it. I am most grateful to both banks. Wondering how? That’s right: credit cards, in combination with new bank accounts from those same banks. All it takes in my case is four to five big cash sign-on bonuses (Chase Ink, Amex Plat, $900 from Chase for savings+checking) and that bill, our biggest, is paid. And, where I go, my lovely wife follows, so every bonus we get we get twice. How can the banks give me so much money? They get it from the people in this article who pay interest and fees. It’s a transfer from those folks to people like us who are far more ‘affluent’. I recommend this method for everyone. Use your good credit score to your advantage. It really works.

Most people don’t pay the full balance each month.

And money habits seem to matter more than income level.

Some high-income earners carry CC debt from month to month.

Some low-income earners have no debt at all. (I’m in this group.)

Budgeting isn’t fun, but it’s necessary.

Paying interest is just throwing money away.

If I can’t pay something off within two to three months, I’m not buying it.

Just made my. monthly payment and my balance is now $135.00. I basically keep it alive if and when I ever really need to use it.

Somehow some way, responsible people with savings will be forced to pay off the debts of others.

I do use my credit card for some expenses, but pay off some of it with each paycheck so that I won’t have the debt piling up. Some people, unfortunately, cannot do even that. Thanks, Brandon.

Our first, and only, credit card for nine years was an American Express card. When we did get other cards we were in the habit of paying the balance every month.

I haven’t paid a penny of interest since we paid our house off years ago.

And who has a stake in credit card companies? the bidens

That amazes me. Less than half even make a budget or track their expenses???

Somebody needs to introduce them to the concept of zero based budgeting. Figure out what you HAVE TO spend money on - rent, utilities, food at the grocery store, gas, insurance, etc. Now how much of the rest can you strip out?

For most people its a good bit.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.