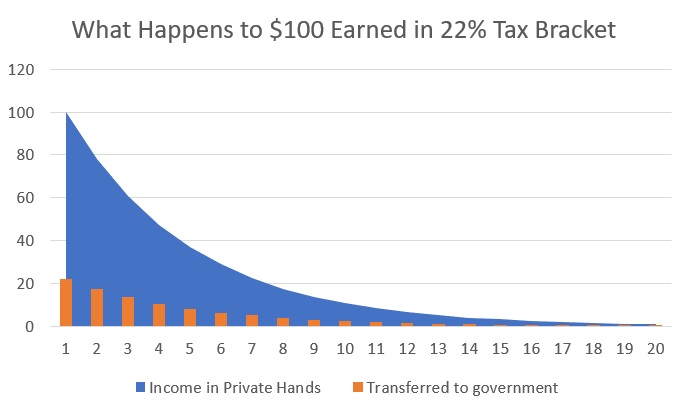

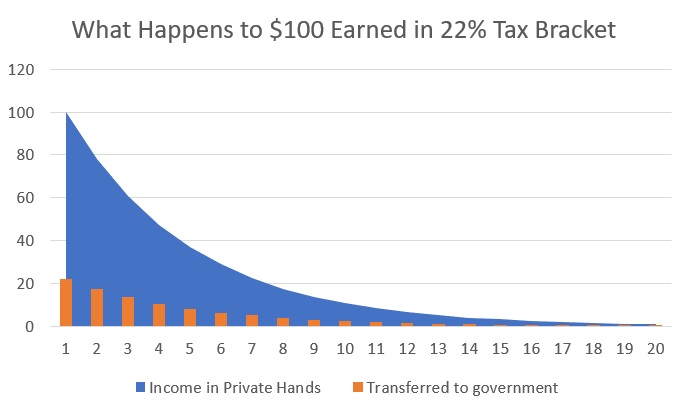

Left to right (bottom scale) represents number of taxable transactions between individuals in the 22% tax bracket.

Posted on 11/26/2022 2:32:48 PM PST by TigerClaws

The IRS on Tuesday shared tips for the upcoming tax season — including a reminder about the new $600 threshold for receiving Form 1099-K for third-party payments.

The change applies to payments from third-party networks, such as Venmo or PayPal, for transactions such as part-time work, side jobs or selling goods, according to the IRS.

Before 2022, the federal Form 1099-K reporting threshold was for taxpayers with more than 200 transactions worth an aggregate above $20,000. However, Congress slashed the limit as part of the American Rescue Plan Act of 2021, and a single transaction over $600 may now trigger the form.

More from Personal Finance: Biden administration extends payment pause on student loan debt 'The stakes are high.' Why there's a push to expand the child tax credit in 2022 Here's how to score a charitable tax break on Giving Tuesday

Aimed at closing the tax gap — a top priority of the Biden administration — the provision is estimated to bring in $8.4 billion from fiscal year 2021 to 2031, according to the Joint Committee on Taxation.

"It's going to be a new form for a lot of people," said Adam Markowitz, an enrolled agent and vice president at Howard L Markowitz PA, CPA in Windermere, Florida. "And the worst thing they can do is ignore it." Who may receive Form 1099-K for 2022

Companies file Form 1099-K, known as an "information return," annually to report credit card and third-party payments, with a copy going to taxpayers and the IRS.

Tommy Lucas, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo in Orlando, Florida, said the business income on your return must include what's reported on Form 1099-K. Otherwise, you may trigger an automatic IRS notice or even an audit, he said. The challenge with the new lower threshold amount of $600 for Form 1099-K is that personal payments and reimbursements could be incorrectly reported as taxable transactions. Justin Miller national director of wealth planning at Evercore Wealth Management

It's possible you'll receive Form 1099-K for transactions you don't expect, such as reselling Taylor Swift tickets at a profit, for example, warned Justin Miller, national director of wealth planning at Evercore Wealth Management in San Francisco.

But selling items at a loss, such as used furniture, may be less clear.

"Obviously, if you sell a $2,000 couch for $1,000, there's not taxable transaction there," Markowitz said. "You don't get a capital loss for it, and you don't have a gain." What happens if you get a 1099-K by mistake

Although the change aims to collect taxes on income, not personal transactions, experts say it's possible some filers may receive Form 1099-K by mistake.

"The challenge with the new lower threshold amount of $600 for Form 1099-K is that personal payments and reimbursements could be incorrectly reported as taxable transactions," Miller said.

A frequently asked questions page from the IRS says you shouldn't receive Form 1099-K for personal transfers, such as reimbursements for splitting meals, gifts or allowances.

However, if you receive the form for personal transactions, the agency says to contact the issuer for a correction. If the company doesn't fix the error, you can attach an explanation to your tax return while reporting your income correctly, the IRS says.

“Use ca$h...that is until they issue digital USD and stop circulating currency notes.”

Hard to do if your customers aren’t local.

Open to suggestions...?

The key is to not fill out your IRS forms, the tax is voluntary. Work for yourself, pay workers cash, take cash as pay for services ONLY. Piece of Cake.

People L O V E to work for cash, or you could just sell drugs in a major city to the homeless in their new fangled “Cabrini Greens”.

Both sides of the transaction need to file. So everyone with a babysitter or lawn guy will have to collect tax ID numbers or SSN’s.

They will need more than 87,000 new IRS goons to enforce this.

The 1099-K wasn’t in use before 2012.

True, in that I didn’t establish what the money was for.

Thanks for the link.

You will be filing form SE with your tax return.

Left to right (bottom scale) represents number of taxable transactions between individuals in the 22% tax bracket.

Penalties, interest, and potential criminal liability.

Everyone a criminal and then enforce it on whomever they deem with a low ‘social credit score.’

You will own nothing and you will be happy!

Of course, but they have lots of extra loot to pay accountants to utilize loopholes. You don't. That's the only difference.

Take cash as payment, write receipts for the camper for $100. It saves on tabs for the camper too for the buyer.

Yes, been doing that for 30+ hours.

The only currency to pay debts is the US Dollar. Take your money out of the bank on the first of the month in cash, drive around and pay bills or buy money orders and send them US Postal service.

Wait till they write a law against “structuring” your earnings. Throw you in jail for tax avoidance.

My consignment shop lets me stock my stuff and they process the sale. I get cash, or a check, which is recorded, monthly, from what sold.

My stuff is old items, surplus to me as part of cleaning up and paring down. I have no receipts. I suspect I will surpass $600 this year (that’s only $50 per month average). Sounds like I may get one of those 1099-K things. I will ask the shop owner if she is aware of this, and what does she think will happen.

Oh, I sold an old truck for over $1000. But that was cash, privately. Will the DMV provide the selling prices, which are disclosed for tax purposes at time of sale, to the IRS?

This is not good. Just the added layers of paperwork will stifle these small personal ‘economies.’

‘On that basis, there is no reason to report it.’

I don’t think you understand- they’ve already have the information. When you list something on Facebook Marketplace or eBay, the sites will demand your SS number and address. So, they’ve got the information and you get another piece of paper to add to your 1040 income.

Bottom line, this will kill a lot of online sellers on eBay and other sites like Etsy.

Will the DMV provide the selling prices, which are disclosed for tax purposes at time of sale, to the IRS?

That’s a good question, and possibly yes since they have that information. You can try and say you sold it for cheap but the your local tax assessor knows the market value and will likely slap that on it as the proper value.

And what about all the folks selling stuff to downsize; they aren’t a business, and are selling one batch of goods for less than they paid for it.

Why do you think they needed to hire 87,000 more agents? Not for the billionaires...

600 or over is the per —year— amount.

Sell a used dining set on eBay for 600?

Bam, 1099k issued.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.