Posted on 10/27/2021 7:41:28 PM PDT by SeekAndFind

For the past few weeks, the weekly survey of the American Association of Individual Investors (AAII) has offered unique insights into emotions and investor sentiment. To say the least, individual investors are nervous.

Every week since 1987, AAII conducts a survey. There’s just one question in the survey: Are you bullish, bearish or neutral about the next six months? The results provide useful insights into the current market environment.

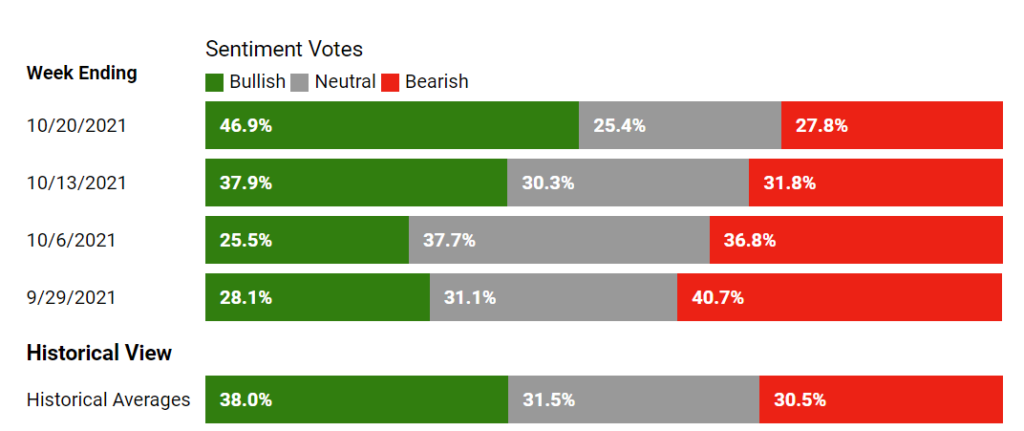

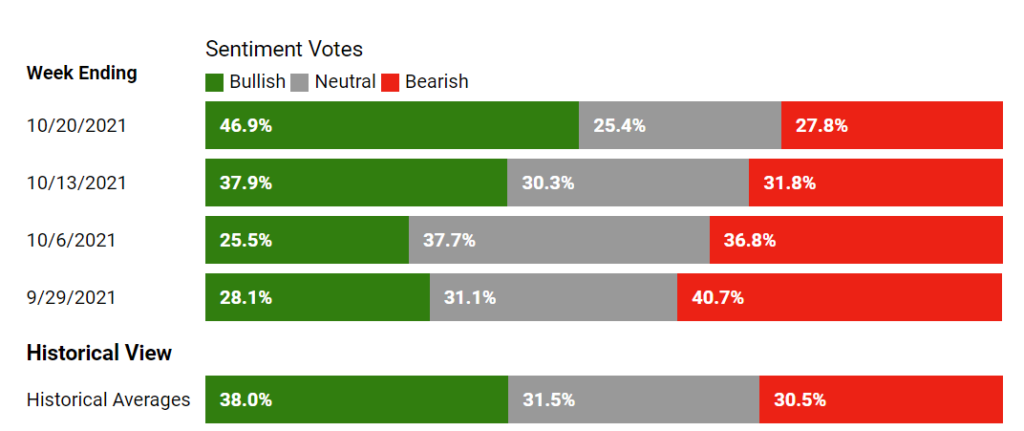

Over the long run, investor sentiment tends to be more bullish than bearish. This can be seen in the long-term average of the results. In a typical week, 38% of individuals are bullish, while less than 31% are bearish. Typically, almost a third are neutral and have no strong feelings either way.

Over the past month, we’ve seen a swing to a bearish extreme followed by a reversal to a bullish extreme.

In just two weeks, sentiment shifted more than 21%. That’s an unusually bullish shift.

The survey has been completed 1,784 times. A shift like the one we saw in the past two weeks has occurred just 24 times.

Usually, analysts scoff at the ability of individuals to time the market. They assume this group of investors will be wrong and interpret the data in a contrary manner. With so many bulls appearing recently, the contrarian approach sees that as a bearish indicator.

I view indicators through the lens of the data. Rather than assuming anything about what this means, I tested it. I found that the S&P 500 was higher about 60% of the time after this scenario. Over the next month, the average gain was three times the average gain in a typical month.

That makes sense. Individuals in this survey are likely to back their opinions with money. There are now bulls rushing into the market. This survey shows the average individual is now optimistic about the stock market, and their buying should push prices up.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance.

I’d like to think Bullish, but I do expect a day of reckoning

to take place after all that Biden has done to kill the economy.

I invest for now, but I’m keeping a very close eye on things

day to day.

Retired, 66yo, prior to election of SloJoe, I was 100% stocks. Quickly moved to 78% cash or cash derivatives after inauguration.

The Left is trying to destroy the Middle class so that they can ‘Build Back Better’ from the ruins. Of course they never reach Utopia. They don’t even get all the power they crave because they can never get enough.

Bullish sentiment is a bearish indicator....just sayin’....

Seems like cash is being eroded at a disturbing rate.

The sooner correction comes the better and the sooner a recession the better so far as I am concerned. Two Trillion in stimulus has been too. Spending it out of control, prices are sky high and people don’t have the good sense to say no to that.

Housing even here in small town heartland is becoming kalifornicated thanks to nationwide marketing and blanket worth estimates applied by the likes of zillow. Newsflash for the kiddies there and their screwed up algorithms that paint all property with the same price, heartland america is not san francisco. Doubling the estimated value of a house that just sold does not reflect the market but is fairy dust and manipulates expectations.

$80,000 for plumbing a large but not huge house? That is nuts. I’ve built small gas facilities for less than that. Building prices have doubled in the last year. That is just not realistic but it is a fact.

Too many dollars and too little sense chasing too few goods.

We won’t see the fed make a correction because they are hand in glove with treasury and this Brandone’d administration. They are all are terrified of what a couple of points would do to the deficit and the debt and the knock on affect to the Brandon social programs.

We expect gusts to 40 mph here today so I think I’ll go piss into the wind some more.

Those gullible people believe Fed Chairman Powell. That chart won't show much green this time next year.

I had noticed property values were rising significantly in

the Mid-West. Most people think of that area as a great

place to retire, because they could purchase a home for a

good price, and have money left over. Alas even that seems

to be vaporizing before our eyes.

Thanks for the mention. We live in uncertain times.

just evading the big dip which is inevitable

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.