Posted on 02/29/2020 10:33:56 AM PST by blam

One week ago, ahead of today’s Chinese data release which would for the first time capture the devastation from the coronavirus pandemic, we wrote that “to those who have been following our series of high-frequency, daily indicators of China’s economy, it will probably not come as a surprise that the world’s second biggest economy has ground to a halt, its GDP set to post the first negative print in modern history. To everyone else who is just now catching up, we have some news: it’s going to be bad.”

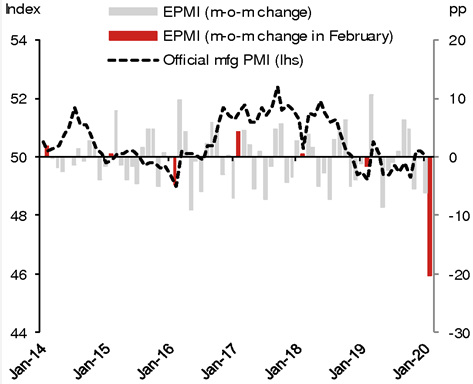

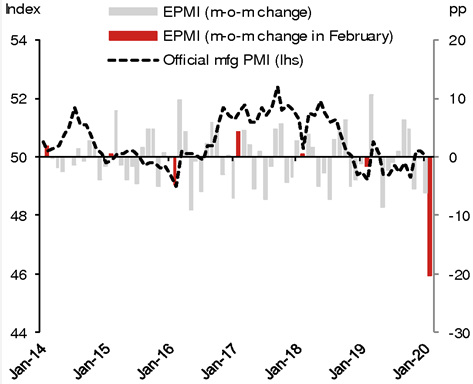

Specifically, we said that ahead of official Chinese economic data which will soon start capturing the period when the coronavirus crippled the country’s economy, Nomura’s Chief China economist Ting Lu pointed out that China’s Emerging Industries PMI (EPMI), which gauges momentum in the country’s high-tech industries and is closely correlated with official manufacturing PMI, slumped to 29.9 in February (from 50.1 in January!), its lowest-print on record, which was a “pure reflection of the devastating impact of the COVID-19 outbreak.”

What would this mean for the closely followed China manufacturing PMI? As Nomura added, "even adjusting for seasonality and expected progress in business resumption in the coming week, we estimate the official manufacturing PMI could drop to a range of 30-40 in Feb."

In retrospect, it turns out that Nomura's dire forecast was optimistic, because moments ago China's National Statistics Bureau reported the latest, February PMIs and they were absolutely catastrophic:

(snip)

(Excerpt) Read more at sgtreport.com ...

Interesting that I was debating someone here last night who said China is fine all the concern is overblown, etc...

Of course, they had no facts and they accused me of being paid to post concerns??

Anyway, thank YOU for posting actual data!

ZeroHedge had this yesterday, don’t know which source is original, or if they both got it from somewhere else.

The one “Don’t Be Evil” google maps showed as being 911 feet from the market? (It keeps moving it further and further away, 8.4 miles last I heard)...

Do not get your hopes up. There are multitude of other cheap labor countries which are eager to take over the business from China. The globalists and very rich people like Bloomberg are making tons of money by using cheaper labor in China and they are not suddenly going to feel patriotic and transfer their business to USA workers.

Yeah, I know, not exactly the same USA as it was during WW2. Now the enemy is here.

50% of the costs and 80% of time spent in new construction is wasted gaining "permissions" and "inspections", from local, county, state and national bureaucracies.

Native manufacturing was killed, simply by incremental and progressive infliction of more onerous government controls.

And now, everyone stands, innocently blinking, in the wreckage, and whines that, "It's the greedy corporations!"

I have no problem with a dozen countries each making a fraction of the world’s needs.

I’d like at least one of those companies to be on US soil.

A single source in a hostile country? That’s a problem...

During WW2, the japanese tried to firebomb the US west coast by floating incendiary balloons across the Pacific. The Chinese can try the same by virus bombing the West coast.

Well said!

Or they could just come here on vacation...

As someone that has been saying the wheels WILL fall off of the Chinese economy someday, and at the same time saying it will be a big economic blow to the rest of the world, let me say this won’t make that happen tomorrow or the next day.

This is an opportunity for Trump to quickly negotiate part 2 of a trade deal AND for companies to start diversifying from China.

Right on!!

A more excellent top choice would be the United States.

Thanks blam. Apple has reportedly reopened 80 percent of its stores in China and altered its own supply chain.

Also, as the Chinese return to work and shopping (besides streaming movies at home), each 10 percent is about the same as the return to activity of some entire countries in Europe.

> Rapid decoupling from China is a good thing!

Yep, and think of how much worse it would have been for the US if the present Administration hadn’t been leading the charge on decoupling over the last couple of years.

The time to have done it was about 2001. Now it's more like a liver transplant - with no suitable donors available.

O.K. fine.

But things will recover. The Cov-19 crisis is not a long term crisis caused by unsolvable events that are permanently fixed as to their results. The crisis is real, but temporary. Things will recover. The sky is not falling.

My investment managers have been selling some bonds and buying some stocks depressed by the panic. Before year end the portfolio will be showing greater than average returns.

A longshoreman I know works at LA and Long Beach, two very high volume ports for China trade.

He has had his hours cut down to two shifts a week. Traffic from China is down that dramatically.

The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting.

yep

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.