Posted on 01/16/2016 10:19:48 AM PST by SkyPilot

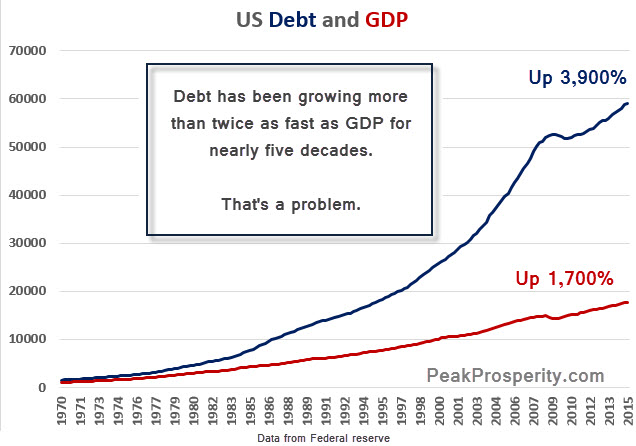

As we’ve been warning for quite a while (too long for my taste): the world’s grand experiment with debt has come to an end. And it’s now unraveling.

Just in the two weeks since the start of 2016, the US equity markets are down almost 10%. Their worst start to the year in history. Many other markets across the world are suffering worse.

If you watched stock prices today, you likely had flashbacks to the financial crisis of 2008. At one point the Dow was down over 500 points, the S&P cracked below key support at 1,900, and the price of oil dropped below $30/barrel. Scared investors are wondering: What the heck is happening? Many are also fearfully asking: Are we re-entering another crisis?

Sadly, we think so. While there may be a market rescue that provide some relief in the near term, looking at the next few years, we will experience this as a time of unprecedented financial market turmoil, political upheaval and social unrest. The losses will be staggering. Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder as measured against the recent past.

It’s nothing personal; it’s just math. This is simply the way things go when a prolonged series of very bad decisions have been made. Not by you or me, mind you. Most of the bad decisions that will haunt our future were made by the Federal Reserve in its ridiculous attempts to sustain the unsustainable.

(Excerpt) Read more at zerohedge.com ...

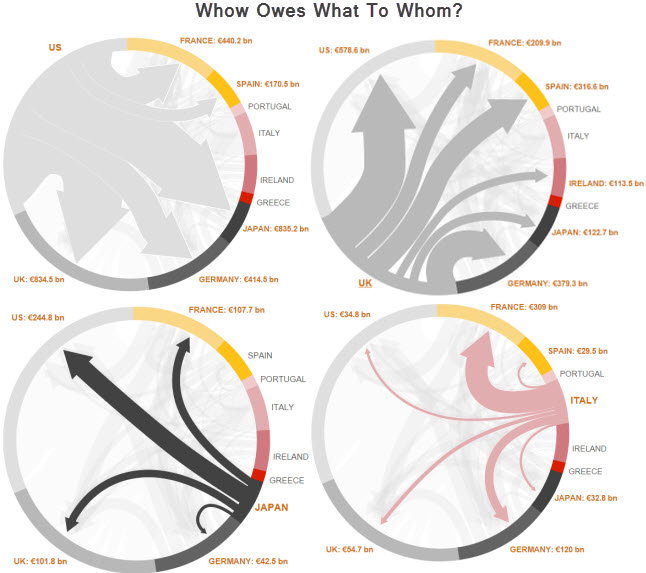

Very importantly, a mortgage lender may have made assumptions that depended on it, too -- like extending a $400k mortgage on a property that had an appraised value of $500k but an actual value of only $200k.

In this case, it's the lender that has the strongest incentive to prop up the value of the asset, not the borrower.

ZeroHedgers hasn’t been this excited since 2007.

They think they will rule with their little piles of gold when everything collapses.

They wish for suffering on a planetary scale and they will continue to be disappointed. There will be no collapse. There will be a slow sinking into a dark age with Islam eventually ruling the world by sheer force of numbers.

Their gold will not save them. Nothing will save them or the rest of us.

Bingo.

Welfare has destroyed the work ethic for too many here in the US.

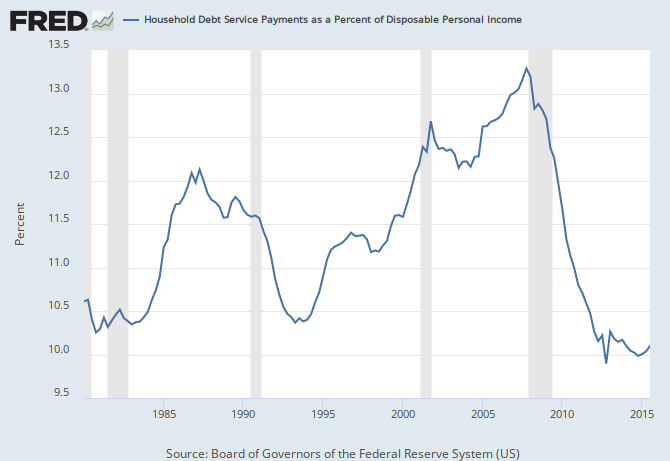

Inflation is a form of penalty. A tax is collected by the government, whereas inflation is collected by banks.

Obviously the government dictates a fair amount of inflation and gets a piece of the pie on income tax. But ultimately the financial markets and costs of goods and services themselves drive it.

The end result is also different. With a tax, we’re supposed to get some sort of benefit, whereas with inflation we don’t. Except for the rich elite that is.

Back around the last big crash I read of the M-something (don’t remember the number) which is the designation for the amount in dollars of printed physical money. It was a VANISHING fraction of the amount of the money people “have” in the bank. It was NOTHING really.

I like that analogy. Thanks for sharing!

Weirdly enough it was the market and subsequent economic collapse right prior to obama’s election that was most likely the issue that put obama over the top.

Same thing appears to be happening now. Looks like “the market” doesn’t want Hillary to be elected.

Because in the real world the room has 6 people and a bank. The bank has $100 and under the current reserve requirements is able to lend ~$95+ to each of the 6 guys. Voila, the “money supply” has just expanded by close to 6X...

“And if the $20,000 that I have in bank CDs buys more when the CDs mature, I won’t complain if I should be so lucky”

Indeed, we savers of cash would be king.

Deflation is really, really bad for an economy. I will say this, though. There has been a huge increase in the amount of cash in the economy since 2008. That (probably) indicates a thriving shadow economy. Outside of first world countries, most of the action is in the unofficial economy anyway. I think its changing here as well.

One of the most hilarious clips from South Park.

Stocks are supposed to be merely a means of buying future incomeExactly, a stake and share in the fruits of a producer. Not a "war chest" to hype up in value in order to facilitate borrowing egregious sums to conquer and cannibalize.

The actual data doesn't agree with your claim.

Banks can't lend out more than they take in.

Perhaps a similar but more severe 'crash' next summer will make it easier for Obama to stay in the saddle to 'save' us.

Or, in very simply terms, the bank opens for business, takes in a $5 deposit from the guy who just sold his corn, then lends out $100 with $95 of that bring created out of thin air by fractional reserve banking. Most of that is binary digits but a truck from NYC does bring by some currency that the corn farmer borrows to buy another corn field from his neighbor for cash.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.