Skip to comments.

What Experts Say about This Past Week--Investment & Finance Thread Jan. 25

Weekly investment & finance thread ^

| Jan. 25, 2015

| Freeper Investors

Posted on 01/25/2015 10:11:11 AM PST by expat_panama

Considering the top headlines were about soft footballs this has to have been an easy no-brainer week for investments. Maybe; here's what he experts are telling us:

| [excerpt from Investors Business Daily At Davos, Hypocrites Tell Rest Of Us To Lower Expectations] Former Vice President Al Gore listens to singer Pharrell Williams...

[snip] ...talking, of course, about the annual confab at Davos, Switzerland, ... [snip]

"The purpose," said former vice president and climate-change entrepreneur Al Gore, standing with hip-hop star Pharrell Williams, "is to have a billion voices with one message, to demand climate action now."

OK, so how about you flying commercial, for a start?

This year's ration of ridiculousness and hypocrisy is so prominent, even the media have noticed.

It's pretty obvious that people who can pay $40,000 to attend Davos and fork over $43 for a hot dog, $47 for a burger or $55 for a Caesar salad — all actual prices at this year's World Economic Forum — would seem to be in a poor position to lecture the rest of us.

Even so, Bloomberg highlights remarks by subprime mortgage billionaire Jeffrey Greene that "America's lifestyle expectations are far too high and need to be adjusted so we have less things and a smaller, better existence. We need to reinvent our whole system of life."

Greene, according to Bloomberg, "flew his wife, children and two nannies on a private jet plane to Davos for the week." How's that for "less things"? His remarks are more than a little ironic, given one of the main themes of Davos this year: "Income inequality," or getting the rich to pay their "fair share." [snip]

|

|

[excerpt from Daily Finance Market Wrap: Stocks Fall on Miners, UPS; Indexes Up for Week] [excerpt from Daily Finance Market Wrap: Stocks Fall on Miners, UPS; Indexes Up for Week]NEW YORK -- U.S. stocks fell modestly Friday, pressured by underwhelming corporate news including guidance from economic activity bellwether UPS and as materials stocks fell after bearish notes.

Major indexes, however, rose for the first week in four, boosted in part by the European Central Bank's decision Thursday to further stimulate euro zone growth.

Materials shares weighed on the S&P 500, falling 1.6 percent after Goldman Sachs (GS) cut its price target on various miners including a 42 percent downward revision to Freeport McMoRan (FCX) stock to $18. Goldman separately slashed forecasts on commodity prices including aluminum, copper and nickel.

UPS (UPS) was among the largest drags on the S&P 500 after a gloomy outlook, alongside Exxon Mobil (XOM). On Friday Credit Suisse (CS) cut Exxon to "underperform."

Declines were capped by bullish investor sentiment after Thursday's move from the European Central Bank, which detailed a bigger-than-expected bond-buying program to lift the region's sagging economy and fight deflation.

"From where we're sitting, we're sensing continuation [from last year], the trend is still the upside," said Gordon Charlop, a managing director at Rosenblatt Securities in New York. "The corrections and the volatility will be a little more pronounced, a little more dramatic, but the trend remains intact."

The Dow Jones industrial average (^DJI) fell 141.38 points, or 0.79 percent, to 17,672.6,the Standard & Poor's 500 index (^GPSC) lost 11.33 points, or 0.55 percent, to 2,051.82 and the Nasdaq composite (^IXIC) added 7.48 points, or 0.16 percent, to 4,757.88.

For the week, the Dow rose 0.9 percent, the S&P gained 1.6 percent and the Nasdaq added 2.7 percent. [snip] |

| Related Threads:

|

|

...ECB's QE plans drive shift in sentiment...Even as earnings reporting season was in full swing, investor sentiment appeared to be driven in large part by macroeconomic concerns, and not even domestic ones. Reports that the European Central Bank (ECB) might announce a large quantitative easing (QE) program—buying long-term bonds in order to lower borrowing costs and spur growth and inflation—seemed to foster improved sentiment early in the week. U.S. and other global markets rallied on Thursday, when the ECB announced a program that was in fact much larger than what many investors had anticipated. T. Rowe Price's London-based sovereign credit analysts note that while the size of the program is roughly in line with the Fed's recent QE efforts, it should have a larger effect on the European bond market given the smaller amount of bonds available. ...but also drives up dollar, threatening overseas profits for U.S. multinationals T. Rowe Price analysts also expect the program to have a significant effect on the value of the euro relative to the U.S. dollar. Indeed, following the announcement, the dollar reached its highest level against a basket of other currencies since late 2003. While the strong dollar has some positive effects for the U.S. economy, it also threatens the profits of U.S. businesses earning revenues overseas. Earnings down for financial sector, but individual opportunities remain Threats to overseas revenues and declining oil prices have already weighed considerably on earnings expectations. Analytical and database firm FactSet now estimates that overall earnings for the S&P 500 will grow by only 0.25% in the fourth quarter of 2014. Profit expectations have declined significantly for financials firms, along with energy companies. Some better-than-expected bank earnings reported Thursday helped fuel the market's rally, however. [snip]

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: davos; economy; finance; financial; investing; investment; market; personalfinance; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-108 next last

To: expat_panama

...only tool they have is the printing press/QE*, which is designed to create "inflation" in order to stop the deflationary cycle. --and they did it, it seemed to work for a while, but now they're quitting and we're all watching the world's economy deflate, beginning now with negative interest rates. The problem (imho) is that w/ all the printing the money supply hasn't made any serious moves. Money's supposed to be created by econ activity and it's not there. We especially see it in the fact that money-velocity has gone AWOL

------------------------------------

And after all their efforts we are back to where we started except....

Money's supposed to be created by econ activity and it's not there

This is Keynes and it is a complete failure.

There have been only a handful of truly revolutionary, technological breakthroughs over the past 115 years. When those breakthroughs have occurred the money flooded into them at breakneck speed. It will happen again, but the fact that it hasn't happened since the last "Breakthrough", the Internet, is somewhat surprising to me. Even the internet or the "World wide Web" was just an extension of the real breakthrough, that being the "integrated circuit".

The money "Created" by the FED is in the hands of the big banks and institutions and we are going to see an increased effort on the part of Governments around the world to confiscate this money since they believe they can spend it better than the private sector.

Keynes part II.

Fascism.

21

posted on

01/25/2015 11:27:41 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: RegulatorCountry

There are some who seem to think they’d benefit from deflation. Perhaps so, assuming no debt, ample savings and cash reserves, and your financial institutions don’t fail. That’s the biggie, failing financial institutions. I think "Ample" is the key word.

As far as our financial institutions are concerned, I don't think they will get into trouble again, at least not for quite some time. They have sufficiently "de-leveraged" and are sitting on boat loads of cash.

22

posted on

01/25/2015 11:40:32 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: Gen.Blather

We still have coal plants that burn coal. The coal companies have been hurt, no doubt. Some may fail. If you buy, stick with the larger ones that will survive. I’ve bought some Console (CNX I think) to have some exposure.

To: Zeneta

Money's supposed to be created by econ activity and it's not thereThis is Keynes and it is a complete failure... ...money "Created" by the FED is in the hands of the big banks...

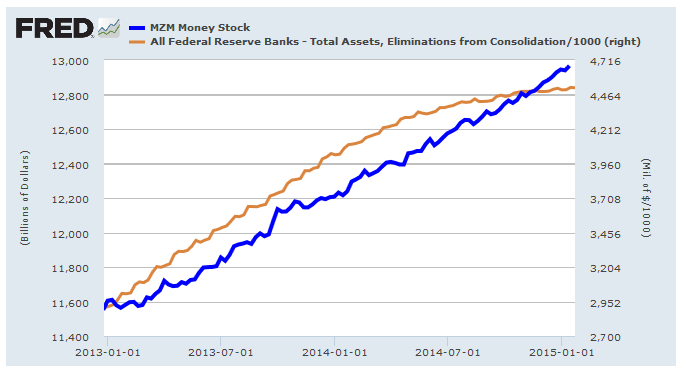

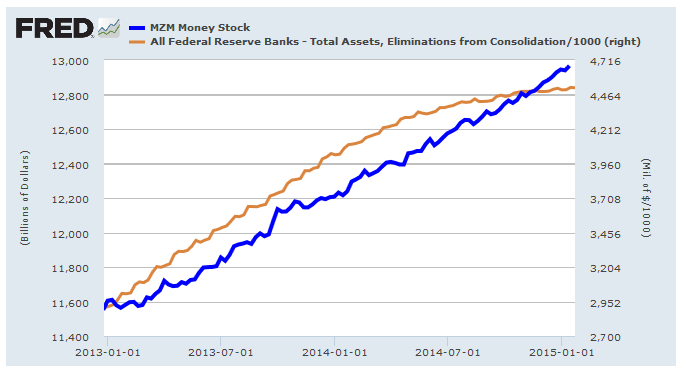

A nice thing about the U.S. economy is that the important amounts and receipts are public record; we can look at the money supply, see where the money came from and see where it went, but the impression I'm getting now is that it wouldn't make any difference to our conversation. In the mean time I need to thank you for inspiring me to look again at the numbers:

Total money supply is the blue line on the left scale, and the Fed money printing is the green on the right. What we got is that back in Jan '13 the economy was stalling so the Fed made money to buy T-bills on the open market. It was just in time, for over a year the private sector had dried up and almost all money supply growth was from the Fed. Half a year ago the Fed wound down and low'n'behold we're now creating money w/o the Fed's help. That's good! I mean, for the economy, not our conversation.

To: expat_panama

Nice wrap up of last week and start for the new one.

Thanks!

25

posted on

01/25/2015 5:41:11 PM PST

by

NonLinear

(Giving money and power to government is like giving whiskey and car keys to teenage boys.)

To: expat_panama; abb; All

26

posted on

01/25/2015 5:54:16 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

Size able layoffs in energy. The terrorist tom tom is on fire. Some body dropped a ton on shorts and lost their shorts. Metals and hard investments showing strength. Dollar very strong. EU QE is a big change. Anything can happen this week. I am watching CVX and COP to break 180 day lines down.

To: expat_panama

Next correction - six times larger than 2008. you have been warned.

28

posted on

01/25/2015 9:42:26 PM PST

by

cqnc

(Don't Blame ME, I voted for the American!)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: NonLinear

—you’re quite welcome. This stuff’s so much easier in a group.

To: Lurkina.n.Learnin

"...Crude Oil Is Getting Smoked Again..."

To: expat_panama

Just remember, you’ve been warned...

32

posted on

01/26/2015 4:11:41 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

LOL, and now snowmageddon is on deck.

33

posted on

01/26/2015 4:24:14 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

"...Crude Oil Is Getting Smoked Again..." Boing!

To: abb

Freepers have been warning of a market crash since the S&P was <700...

To: Wyatt's Torch

...been warning of a market crash since the S&P was <700...There are Marxists who are so loyal that when asked about the fact that none of Marx's predictions have come about they say that it only proves how very very far into the future he was able to see...

To: expat_panama

I need to make a correction.

Money's supposed to be created by econ activity and it's not there

I replied

This is Keynes and it is a complete failure... ...money "Created" by the FED is in the hands of the big banks...

After re-reading our posts and replies I realized an error.

Keynes actually says the opposite, Money flow creates economic activity. I missed the word "by" from your comment.

That said it doesn't change the fact that the FED is/was employing Keynesian economics to fuel economic growth.

This nor your chart changes my assertion that the money created is in the hands of the big banks.

The good thing is that at least the "money pump" is moving away from one source, the FED, to a few dozen, the big banks. The next phase would be for these banks to seek opportunities since what was once a guaranteed profit has been removed. There are still a lot of regulatory challenges the FED is placing on the banking industry via Dodd-Frank and the new consumer lending agency that need to be overcome.

Now some readers may think that this is still a Keynesian model, "Money Creating economic growth", but it is not.

Well, actually it is still Keynesian if the banks are controlled by the FED.

As the decision making becomes diffused from the FED to a dozen or so banks to a hundred or so other banks and institutions to thousands of businesses to hundreds of thousands of "ideas" among smaller businesses, real economic growth will follow. We are not there yet.

37

posted on

01/26/2015 4:42:52 PM PST

by

Zeneta

(Thoughts in time and out of season.)

To: expat_panama

The dice roll 24/7 whether we choose to or not.

38

posted on

01/26/2015 7:53:12 PM PST

by

1010RD

(First, Do No Harm)

To: abb

There is a very close association with poverty, crime and impulsivity.

39

posted on

01/26/2015 7:54:32 PM PST

by

1010RD

(First, Do No Harm)

To: Zeneta

There is no such thing as a nongovernmental deflationary spiral. Historical US deflations end naturally, unless government gets involved.

40

posted on

01/26/2015 7:57:16 PM PST

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-108 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

[excerpt from Daily Finance Market Wrap: Stocks Fall on Miners, UPS; Indexes Up for Week]

[excerpt from Daily Finance Market Wrap: Stocks Fall on Miners, UPS; Indexes Up for Week]