Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

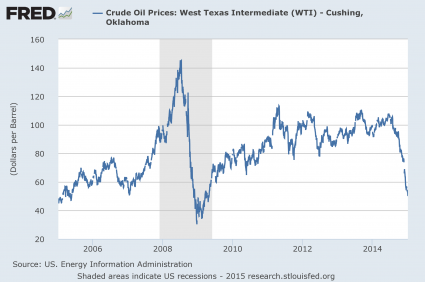

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

The energy companies owes banks Billions,

And so does EVERYONE else, when the Banks finish stripping the assets from the people as a result of this, the price will go back up. Then we will do it all over again,and again,again...

For years economists have been telling us low oil prices stimulated the economy. What changed?

So I guess if gas was $5.00/gal the “Global Economy” would be booming!

Yeah, whatever. The only thing booming would be oil profits. Everyone else would be paying 1/4 to 1/3 of their earnings for gas for their cars.

Any crash on the stock market will be the result of printing money like it was going out of style and dumping it in the market. Another government created disaster.

Derivatives need to die.

But.....

The banks will demand they get their loans back, and will put the brakes on further credit. That makes the Fed very, very nervous.

Falling oil prices hitting economic growth: Fed (7 hours ago)

I never thought I’d see the day people would be complaining about low gas prices...

Obama said that in every one of his speeches in the 2008 campaign. Then, when he failed to do anything about it except pass Porkulus, he said it was even worse than they'd thought, which, I suppose, means that it was the worst economy since the Black Plague.

Maybe not swinging from ropes but very broke!!! They pumped crude future prices just a tad too high! The chickens are coming home to roost.....

Because cost of leases, equipment, drilling and labor were also ridiculously low by today's standards. The cost of doing business was low by today's standards, thus were retail prices.

That's a lot of dying.

I never thought I'd see the day a guy from Kenya named Hussein would be re-elected POTUS with $4/gal gas, 8% unemployment (13% actual), surging food prices, and trillion dollar deficits.

Sadly America has changed profoundly....

It keeps moving down around here ... Tulsa at about $1.65 and Oklahoma City at about $1.55.

I believe there's been a tad bit of inflation since then. A scintilla, really.

...and the chilluns.

Do you think we can survive without the FED?

Gas prices went ballistic in the first 5 years that Obama was in office (from something like $1.85 to almost $4.00 for a time).

The banks and those who loaned money to energy companies loved it. Russia loved it. Iran loved it. Venezuela loved it. Energy stocks loved it.

If you or your spouse lost your job, or your wages were flat - you were largely screwed over, and then Obama's Bureau of Labor and Statistics told you that energy and food prices don't count towards inflation estimates - so there was no inflation! Life is grand!

Any crash on the stock market will be the result of printing money like it was going out of style and dumping it in the market. Another government created disaster.

Exactly.

I believe there’s been a tad bit of inflation since then. A scintilla, really.

_________________

thank you for that. Perhaps we need to teach a Freeper Econ course?

This looks like a lot of fear mongering about nothing. Some high yield bonds issued by some oil patch companies will default. Junk bonds are risky, that’s why they have a high yield in the first place.

I fail to see how that is going to bring down the world economy. The majority of the world doesn’t own high risk, high yield junk bonds but they do benefit from lower energy costs.

This is hardly comparable to the housing bubble when trillions of dollars of high risk paper was misleadingly rated AAA. Investors who bought the high yield energy sector junk bonds knew that they were taking a risk, this wasn’t the case during the housing bubble.

I liked it a lot.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.