Skip to comments.

Average US Household Wealth Plunges to Only $656,039!! Details: Jan. 11 Investment & Finance Thread

Weekly investment & finance thread ^

| Jan. 11, 2015

| Freeper Investors

Posted on 01/11/2015 10:06:38 AM PST by expat_panama

| |

|

|

|

| |

Average U.S. |

|

| |

Household Wealth |

|

| |

|

|

|

| |

Real Estate |

$186,702 |

|

| |

Durables |

$44,374 |

|

| |

Deposits |

$81,497 |

|

| |

Stocks/Business |

$422,126 |

|

| |

Bonds |

$27,139 |

|

| |

Misc. |

$7,598 |

|

| |

|

____________ |

|

| |

Total Assets |

$769,435 |

|

| |

|

|

|

| |

Debts |

-$113,397 |

|

| |

|

_____________ |

|

| |

Net Worth |

$656,039 |

|

| |

|

|

|

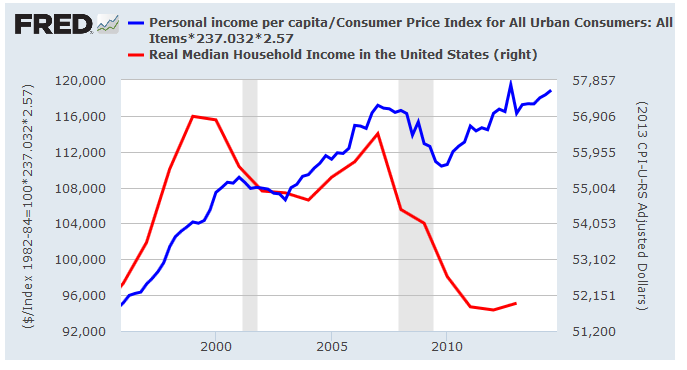

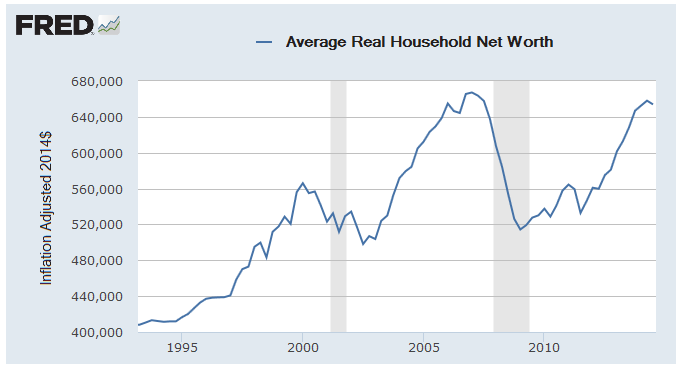

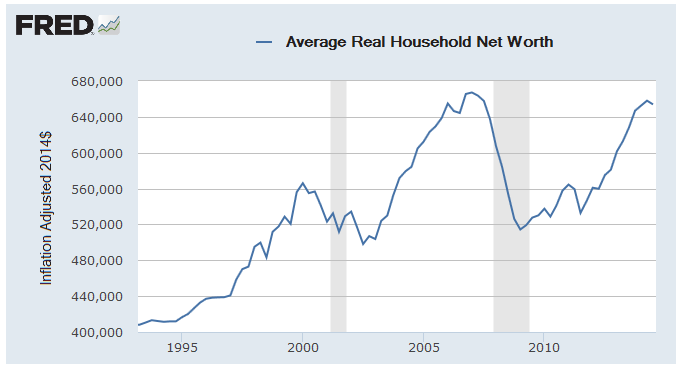

Something that snuck by me (and most people) last month was the Fed's quarterly Flow of Funds Report --their bigass number-dump that says where all America's money has gone. My favorite part is the one on household balances (Table B.100 page 117) and the big secret that the press has been hiding is the fact that that total private wealth actually dropped in the third quarter 2014! Ah yes, our unemployment rate's just 5.6% and a good time's being had by all-- yeah right.  Then we hear "aw jeeze guys, let's not forget America's wealth is steady --off less than 2/10ths of % of the previous quarter's all time high. So there. Time to stop and think about inflation and population growth --and we slam into the fact that real average household wealth is still less than it was before all the hope'n'change. What we got is that even after all the work Americans have been doing for the past seven years we've gotten nowhere --in fact we're worse off: the average American household has fallen to a mere ⅔ of a $million. Hmmm. A household w/ a over $113 grand in mortgages/debts on assets (mostly stocks'n'real-estate) totaling $769K. Off hand I don't remember my bank saying I got a balance of $81,497. |

|

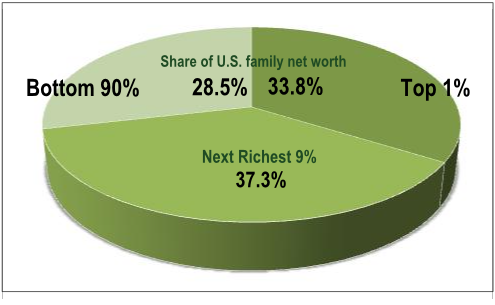

OK, y'all are probably way ahead of me saying that these are averages --all skewed by the fact that the vast majority of us are slogging away and that money-grubbing one percent has the overall numbers distorted way off from how the vast majority lives (more on average/mean incomes here). Maybe. |

|

| ↨ mandatory Occupy Wall Street income and wealth inequality graphics (click to enlarge)  |

The Fed stats picked up from the Census Bur. tell us that median real household income has fallen, but the Bureau of Economic Analysis that average real incomes are twice the median and are increasing. I mean, I can hate the over-achievers as much as the next guy but at some point we need to notice that somehow we left Numberland and we now find we've wandered over into the Fantasy Kingdom of the Political Hacks. |

* * * * * * * * * *

In the mean time I'm struggling to find a way to make do w/ only $656,039 to my name. Yeah, I know I don't have $80-some K in the bank but I got this really neat Sox baseball cap that I know I could get a half mil. on Ebay...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; householdwealth; networth; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-126 next last

To: expat_panama

Wow... That’s my profile, almost exactly...except with a bit less cash on deposit and NO bonds.

The IRS says I’m in the top 5% of wage earners....but, I don’t even feel close to being “wealthy”. I’m close enough to it to see it occasionally...enough to know that AIN’T me.

21

posted on

01/11/2015 10:39:57 AM PST

by

SomeCallMeTim

( The best minds are not in government. If any were, business would hire them!)

To: proxy_user

your heirs will sell it and spend the money!An old Persian saying: "saving money just makes your widow's new husband richer."

To: proxy_user

....”look at the cash flow statement”....

Well, as my son said...I’m in much better place then most as my cash flow is good and my debt is almost nothing.

23

posted on

01/11/2015 10:47:46 AM PST

by

caww

To: grania

A sensible statistician with no agenda would adjust for age of the head of household.

24

posted on

01/11/2015 10:52:09 AM PST

by

oblomov

To: expat_panama

The person who put this together is clueless about reading financial statements.

25

posted on

01/11/2015 10:52:12 AM PST

by

Kirkwood

(Zombie Hunter)

To: oblomov

a sensible statistician with no agenda would adjust for age of the head of the householdNot adjust...they're always adjusting instead of letting anyone interpret things for themselves. You make an excellent point.....it would be meaningful to see a breakdown according to age groupings.

26

posted on

01/11/2015 10:55:41 AM PST

by

grania

To: expat_panama

My wife and I are “above average” but we are a mere 20-25 years from retirement. It will take considerable capital by then to expatriate to Singapore or Costa Rica or whatever regime provides asylum to those escaping the closing world once called free.

27

posted on

01/11/2015 10:58:08 AM PST

by

oblomov

To: grania

Yes, its the leading explanatory variable in wealth variation- even more important than socioeconomic status.

28

posted on

01/11/2015 11:00:28 AM PST

by

oblomov

To: grania

29

posted on

01/11/2015 11:01:16 AM PST

by

oblomov

To: grania; expat_panama

The Survey of Consumer Finance (SCF) data actually does have age in the raw HH data. If I have time over the next week, I’ll generate a summary and post it here.

30

posted on

01/11/2015 11:03:40 AM PST

by

oblomov

To: cicero2k

Bill Gates walks into a bar. lol...

Funny.

Your serious point is well-taken though.

31

posted on

01/11/2015 11:07:00 AM PST

by

EternalVigilance

('To secure the Blessings of Liberty to Posterity.' It's ultimately what the Constitution is for.)

To: expat_panama

When I'm in a Walmart I feel pretty wealthy, but when I'm wandering around the marina in Palm Beach looking at the yachts I feel pretty darned poor.

So, I guess everything's relative, and perception is a lot of it all.

To: expat_panama

Well written with some excellent points. Measuring all of this is so tough to do, especially now with the growth of the black economy. Just measuring the actual GDP of cottage industries I suspect would significantly add to the overall total. Then again, we count salaries paid to ‘diversity coordinators’ & hyphenated American Studies instructors as though some economic activity, when in fact those endeavors are entirely wasteful, in my opinion.

33

posted on

01/11/2015 11:31:41 AM PST

by

MSF BU

(Support the troops: Join Them.)

To: expat_panama

Ed Hart (1922-1993), a credit markets reporter on the old Financial News Network used to say, “We’ll know in the fullness of time.”

He used to tell viewers not to use the term “worth.” His preferred term was “presently valued at.”

34

posted on

01/11/2015 11:32:30 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Oh, and where I am from there is no doubt in my mind real estate comprises the bulk of household wealth.

35

posted on

01/11/2015 11:34:56 AM PST

by

MSF BU

(Support the troops: Join Them.)

To: expat_panama

They’d have to move the decimal five spaces to the left for me.

36

posted on

01/11/2015 11:43:51 AM PST

by

bgill

(CDC site, "we still do not know exactly how people are infected with Ebola")

To: RetiredTexasVet

It’s not just the value of the stocks that’s misleading, because not many owners get to sell the stock at maximum prices. It’s the tax that has to be paid to attain that value. A sensible statistic would factor that in.

37

posted on

01/11/2015 11:46:14 AM PST

by

grania

To: CivilWarBrewing

You can’t take it with you! Heck, you can't even take it for yourself! Lots of this so-called wealth are only numbers on paper, because once you cash in stocks, bonds, and other deferred wealth, then the taxman takes a big cut before you can spend it (and then there are sales and wealth taxes on purchases).

When a "rich" person dies the taxman takes a big cut, so even your heirs can't take it for themselves.

38

posted on

01/11/2015 11:50:25 AM PST

by

roadcat

To: F15Eagle

Indeed, I was thinking I am way below average in household wealth. Glad folks are doing well.

39

posted on

01/11/2015 12:02:26 PM PST

by

Nuc 1.1

(Nuc 1 Liberals aren't Patriots. Remember 1789!)

To: expat_panama

I am concerned that most Americans are not going to have the net worth they need in order to retire when they are older.

A good indicator of the net worth you should have is your age x your gross salary. Divided by 10.

So if you are 50 years old and earning $120,000 a year, you should have a net worth of at least $600,000. If you don't, you run the risk of having to lower your standard of living when you retire, or worse, go on some sort of government assistance (outside of Social Security).

Now a lot of people artificially inflate their net worth by including their homes or their automobiles, or they even count silly stuff as assets such as a baseball card collection or antique furniture. Those that do this are only fooling themselves.

Let's take counting your house as part of your net worth. Now most people have a mortgage (including perhaps an equity line) and also have an unrealistic assessment of what their house would be worth.

An example would be somebody calculating a $250,000 net worth on their home because they assess the value of the house at $400,000 and have $150,000 left to pay on their mortgage.

Chances are however, if they decide to sell it, they are going to have to settle for substantially less than what THEY feel their house is worth. Most people have unrealistic opinion of how much their home is worth on the open market. More likely, they will get maybe $357,000 for that house and then they have to pay realtor fees and other closing costs and taxes. So suddenly, they are only coming out of the closing with a $185,000 check instead of the $250,000 they were counting on.

Now they have to find another place to live. And chances are, unless they are moving to an area of the country where home prices are much cheaper, they are going to have to sink that $185,000 right back into another house. They might even find themselves with a bigger mortgage then they had when they started!

Ditto with a car. You can sell your car at a profit, but now you are going to have to use that profit to buy another car. Unless you are going to live in the city and take public transportation everywhere.

So if you want to be honest with yourself, you calculate your net worth without including your home and automobiles. Or your stamp collection that you got from your uncle 20 years ago and has been sitting up in the attic ever since in a box with a pile of old newspapers on top of it (because you thought those newspapers would be worth money someday too.)

Guess what, most collectibles that people think is an investment is just a pile of junk that is virtually worthless. Those Reggie Jackson or Ted Williams rookie cards that supposedly fetch thousands of dollars online, good luck with that. Unless you are a professional curator that has these cards hermetically sealed in a climate controlled room like a museum, you are only going to get pennies on the dollar.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-126 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson