Skip to comments.

Average US Household Wealth Plunges to Only $656,039!! Details: Jan. 11 Investment & Finance Thread

Weekly investment & finance thread ^

| Jan. 11, 2015

| Freeper Investors

Posted on 01/11/2015 10:06:38 AM PST by expat_panama

| |

|

|

|

| |

Average U.S. |

|

| |

Household Wealth |

|

| |

|

|

|

| |

Real Estate |

$186,702 |

|

| |

Durables |

$44,374 |

|

| |

Deposits |

$81,497 |

|

| |

Stocks/Business |

$422,126 |

|

| |

Bonds |

$27,139 |

|

| |

Misc. |

$7,598 |

|

| |

|

____________ |

|

| |

Total Assets |

$769,435 |

|

| |

|

|

|

| |

Debts |

-$113,397 |

|

| |

|

_____________ |

|

| |

Net Worth |

$656,039 |

|

| |

|

|

|

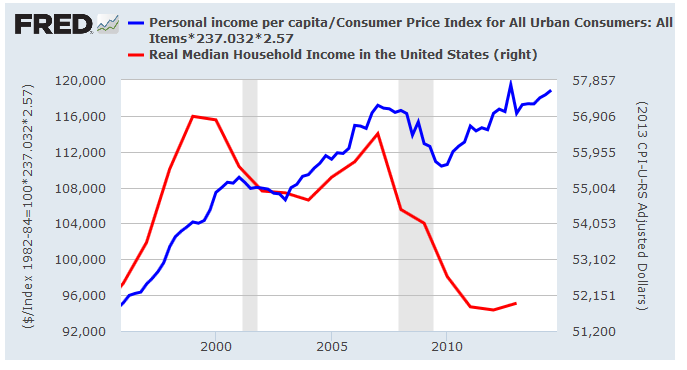

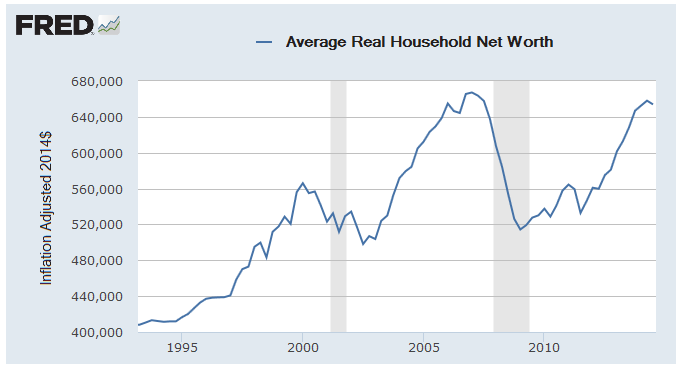

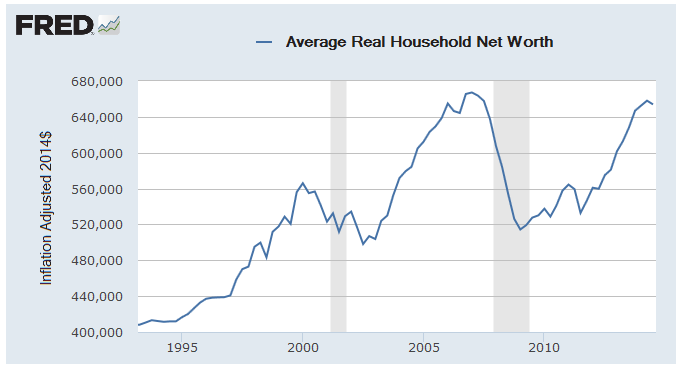

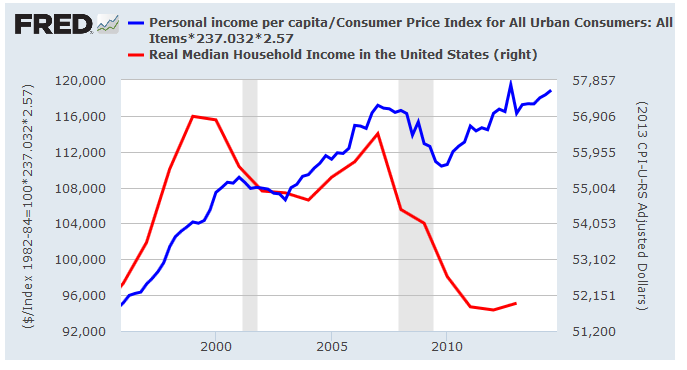

Something that snuck by me (and most people) last month was the Fed's quarterly Flow of Funds Report --their bigass number-dump that says where all America's money has gone. My favorite part is the one on household balances (Table B.100 page 117) and the big secret that the press has been hiding is the fact that that total private wealth actually dropped in the third quarter 2014! Ah yes, our unemployment rate's just 5.6% and a good time's being had by all-- yeah right.  Then we hear "aw jeeze guys, let's not forget America's wealth is steady --off less than 2/10ths of % of the previous quarter's all time high. So there. Time to stop and think about inflation and population growth --and we slam into the fact that real average household wealth is still less than it was before all the hope'n'change. What we got is that even after all the work Americans have been doing for the past seven years we've gotten nowhere --in fact we're worse off: the average American household has fallen to a mere ⅔ of a $million. Hmmm. A household w/ a over $113 grand in mortgages/debts on assets (mostly stocks'n'real-estate) totaling $769K. Off hand I don't remember my bank saying I got a balance of $81,497. |

|

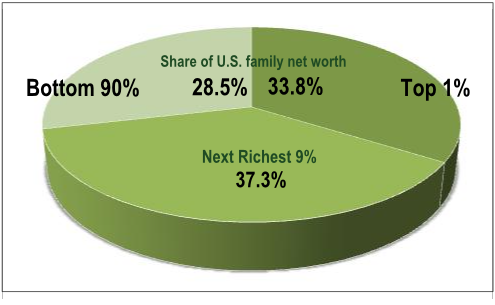

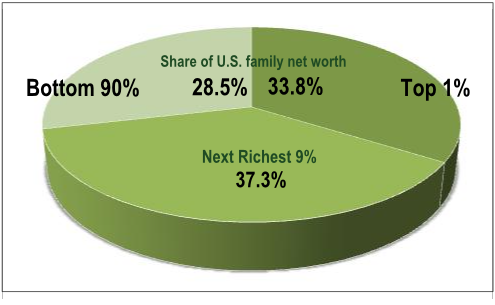

OK, y'all are probably way ahead of me saying that these are averages --all skewed by the fact that the vast majority of us are slogging away and that money-grubbing one percent has the overall numbers distorted way off from how the vast majority lives (more on average/mean incomes here). Maybe. |

|

| ↨ mandatory Occupy Wall Street income and wealth inequality graphics (click to enlarge)  |

The Fed stats picked up from the Census Bur. tell us that median real household income has fallen, but the Bureau of Economic Analysis that average real incomes are twice the median and are increasing. I mean, I can hate the over-achievers as much as the next guy but at some point we need to notice that somehow we left Numberland and we now find we've wandered over into the Fantasy Kingdom of the Political Hacks. |

* * * * * * * * * *

In the mean time I'm struggling to find a way to make do w/ only $656,039 to my name. Yeah, I know I don't have $80-some K in the bank but I got this really neat Sox baseball cap that I know I could get a half mil. on Ebay...

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; householdwealth; networth; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-126 next last

To: 1010RD; ConstantSkeptic

Most people have no capital to speak of. Labor is easier for them and a small businessIf a person doesn't have capital, just labor, what small business are they supposed to start?

Taxicabs, street vending, hair braiding, beauty care, construction trades, etc.

All those businesses take capital as well as labor --accept for maybe hair braiding we're talking five figures easy. For over a million years virtual all human procuction has required a mix of both labor and capital.

To: expat_panama; ConstantSkeptic

Even digging for roots takes capital, unless you have nails of iron. Can you imagine the carpenter without his hammer or the manager without his mental capital? That said, the discussion was on the ease with which a person can enter the labor market and use the excess capital earned there to invest in the stock market as a way to participate in a business. Felons and others have trouble getting that kind of job. Most of the American workforce is hand to mouth.

102

posted on

01/14/2015 6:45:33 PM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

You’ve heard of the Federal Tax Code? States have those, too. There are strict limits on investing as an individual via tax deferred accounts. I won’t list all the ways, but you can take it from here. Since I have a master's degree in business taxation, and my husband and I have invested in the stock market for 30 years, I know taxes and I know investing.

I have no idea about what strict limits you're talking about for individuals investing in a tax deferred account. There are a few prohibited assets such as life insurance and antiques and collectibles. But most folks will do fine with stocks, bonds, mutual funds, and ETFs in their tax deferred accounts. Personally, I highly recommend low cost index funds.

Moreover, you don't have to hold stock in a tax deferred account to get favorable federal tax treatment. Many people are in a low enough tax bracket so that, for federal tax purposes, they won't pay any tax on qualified dividends or long term capital gains. Shoot, I had $100K in long term capital gains in 2014, and I'll pay 15% federal tax on that.

So no - in no way, shape, or form does the US and state governments make stock ownership expensive. You're just wrong.

103

posted on

01/14/2015 8:51:48 PM PST

by

ConstantSkeptic

(Be careful about preconceptions)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Whoa, lots of neat things today! I mean, yesterday's plunge and bounce up was the day after that leap & big fall back --ok so stocks are further down under their 50-day moving averages in higher volume (distribution count 3 for S&P, 1 for NASDAQ), but stock futures today are STELLAR AT +0.91% and climbing. Metals futures may be soft (-0.12%) but they're hanging on to the new base; gold&silver now at $1,246.05 and $17.10. Yesterday's plunge was blamed on Retail Sales. IMHO the plunge was caused by falling prices but I digress, there's a big list of market trend excuses today too--

Initial Claims

Continuing Claims

PPI

Core PPI

Empire Manufacturing

Philadelphia Fed

Natural Gas Inventories

--and the headlines are goofy enough that we get a good laugh w/o even bothering to click the links:

The GOP's Rush to Court Wall Street - Harold Meyerson, Washington Post

Book: A Startling Defense of Economic Freedom - Harry Binswanger, RCM

Frustration the Real Reason For the Market Selloff - Kenny Polcari, CNBC

Five Things Investors Should Know For 2015 - John Waggoner, USA Today

5 Charts For Fully Invested Bears - Lance Roberts, StreetTalk Live

Market Madness Started With End Of QE - Jeff Cox, NetNet

To: 1010RD

Most of the American workforce is hand to mouth. By choice, I would suggest. The oilfield is a perfect example. Anyone who knows the biz knows that it is a vicious boom/bust industry. Always has been, and likely always will be. But when times are flush, you can make a lot of money in a hurry, even as semi-skilled labor.

But what happens in the real world? A 20 yr old kid with only a high school education begins making $30 to $50 an hour, and the first thing he does is go out and buy a $40K+ Ford F250 diesel pickup, all tricked out. All the while, the old-timers and his mamma and daddy telling him to "put some money up" for when times get lean.

Doesn't do a lick of good. Nine out of ten will do exactly the same thing, and one of ten will be thrifty. And when the bottom falls out, the grasshoppers will be S.O.L.

The only way to learn the hard economic lesson of "pay yourself first," also called "investing for the long term" is to experience hunger for a while.

105

posted on

01/15/2015 4:38:42 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD

the discussion was on the ease with which a person can enter the labor market and use the excess capital earned there to invest in the stock market as a way to participate in a business... ...Most of the American workforce is hand to mouth.Actually, most people own stocks:

-but most adults are not employed: Number of employees: 118,402,000 ÷ Civilian Noninstitutional Population over 16: 249,027,000 = 47% vs. 52% for stocks. More:

How many Americans have 401(k)s? In 2012, about 52 million American workers were active 401(k) participants, and there were about 515,000 401(k) plans.

(from here) There are nearly 15 million IRA accounts held by more than 11 million people with total assets of just over $1 trillion.

To: expat_panama

Mama's havin' a GOOD Day! :)

107

posted on

01/15/2015 6:00:06 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Diana in Wisconsin

Until this afternoon’s sell-off, LOL! :)

108

posted on

01/15/2015 6:02:44 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: expat_panama

"Buckle up Mav. We're going vertical!"

To: Wyatt's Torch; Diana in Wisconsin

Not to worry, things are seem to be starting out pretty good now so I figure like, what could possibly go wrong?

To: expat_panama

Please tell me one of you smart people had been long CHFEUR...

Wild day for WTI too.

To: expat_panama

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning & welcome to another "wild ride" w/ falling stock'n'metal futures (-0.33% and -0.23%). This after yesterday's upbeat futures ended in a selloff --my wife asked if today's futures mean soaring stocks and after thinking is that the only thing we really know for sure is that nobody knows anything. I think. At least we got these this morning:

CPI

Core CPI

Industrial Production

Capacity Utilization

Mich Sentiment

Net Long-Term TIC Flows

--and these FR threads:

To: Wyatt's Torch

anticipated lower exploration and production spending in 2015.--based on anticipated continuing lower oil prices in 2016. This is telling me that they're expecting a plunge to the low $20's and a longer term leveling off say @ $40. imho they very well may be right...

To: expat_panama

But then there’s this:

http://www.marketwatch.com/story/schlumberger-up-08-on-earnings-beat-dividend-hike-2015-01-15?siteid=yhoof2

Schlumberger up 0.8% on earnings beat, dividend hike

Published: Jan 15, 2015 4:36 p.m. ET

By Claudia Assis

Energy reporter

SAN FRANCISCO (MarketWatch) — Schlumberger Ltd. SLB, -2.25% on Thursday reported fourth-quarter earnings that beat Wall Street expectations on record revenue in North America due to efficiencies and new technology. The oil-field services giant said fourth-quarter adjusted earnings came to $1.50 a share, compared with consensus of $1.45 a share, according to FactSet, and earnings of $1.35 a share in the fourth quarter of 2013. Fourth-quarter sales rose 6% to $12.6 billion, in line with analyst expectations. The company said it will raise its dividend by 25%, paying 50 cents a share on April 10, 2015 to shareholders of record as of Feb. 11. Shares of the company rose 0.8% in after-hours, after ending Thursday down 2.3%.

115

posted on

01/16/2015 4:09:33 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

It’s about time. Since last July the company’s lost a third of its value —the share price fell from $117 to the current $77.

To: Wyatt's Torch

indexes now positive, futures trades scrambling...

To: expat_panama; Wyatt's Torch

SLB up $2.50 this morning. Evidently, they intend to stay in business, somehow, someway.

118

posted on

01/16/2015 7:01:15 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Definitely the right move for them. We have 10% of our business related to oil & gas (we are a supplier) and the word from down the supply chain is to prepare for 30% cuts in budgets.

To: Wyatt's Torch

This ain’t their first rodeo. To get to where they are in the industry, you have to know what you’re doing.

They do.

This is a buying opportunity.

120

posted on

01/16/2015 7:04:26 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-126 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson