[click pix to enlarge]

[click pix to enlarge]Posted on 10/19/2014 11:18:38 AM PDT by expat_panama

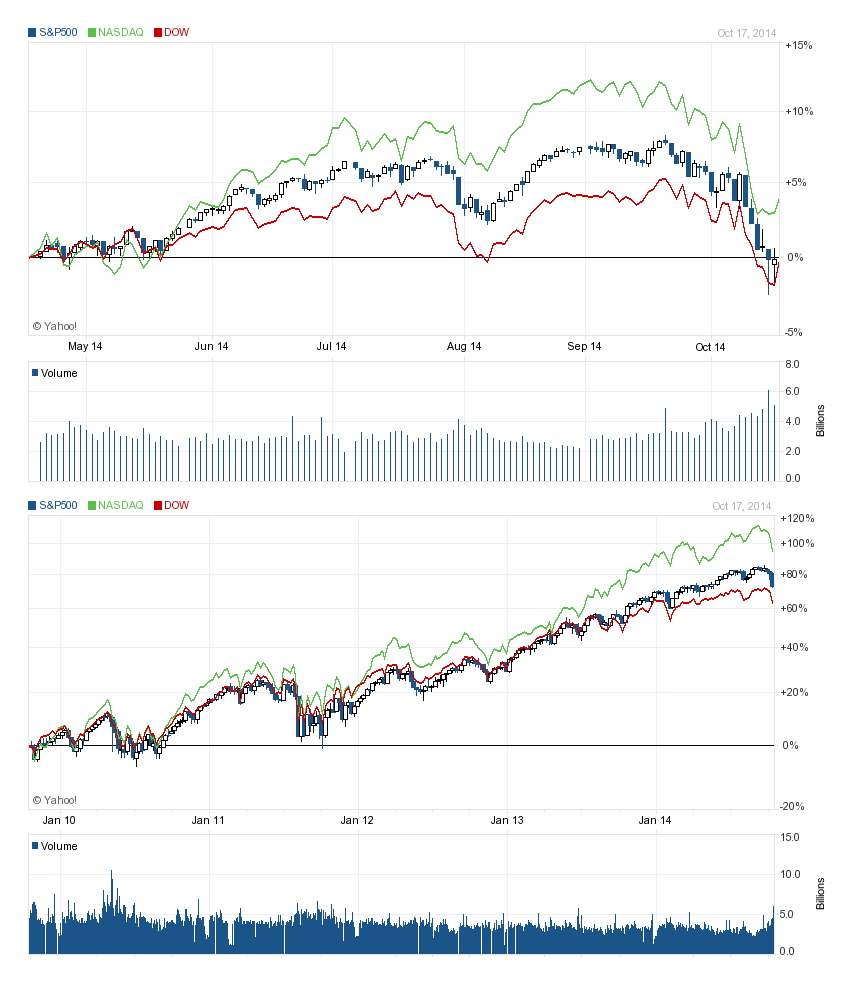

This past week saw upside reversals across the board coming out with prices holding steady in spite of the hammering we had over the past month or two.

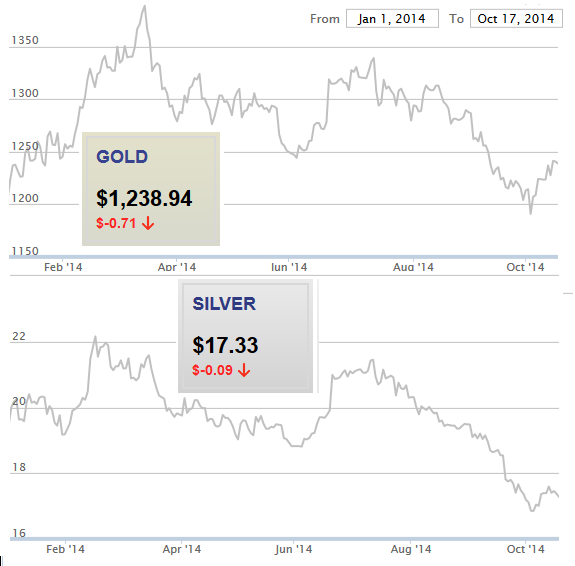

The October metals rally held on to its gains, in fact market prices show gold's just about clawed back to break-even for 2014. That's said, metals' role in price trends ahead is become increasingly controversial (re Gold And Silver - Financial World: House Of Cards Built On Sand) even while many see a bright tomorrow with other commodities (We Maintain Our Outlook For Higher Prices For Commodities).

Stocks. OK, so IBD won't call it an "uptrend" (the follow-through has got to be no earlier than the fourth day of the rebound or it ain't official), but the upside surge was led by leading stock leaders. They call them 'leading' stocks for a reason. Well, sometimes they call 'em 'bellwether' stocks but the term makes me nervous 'cause a bellwether is often the animal trained to lead the mindless unquestioning herd into the meat packing plant.

I digress.

So we've been in "market in correction" for a while and we punched down through the famous 200-day moving average, so for 2014 it really is a big deal. Maybe that says more about how spoiled we've been getting lately. I mean the earlier swings over the past half decade kind of make these past two years seem well, nice.

[click pix to enlarge]

The big question of course is whether stock indexes are right now 'over priced' or not, and for that I like to compare say, the S&P500 to total U.S. corp. net worth. Someone correct me if they see anything I don't but I honestly think they've been tracking together since the last decade's high. Not only that, but recent growth seems actually subdued --check out this 1950-2014 plot showing total corp networth and how the trend in raising business capital has been more and more turning away from bonds over into stocks.

Also on that note. Please forgive my broken record but it has got to mean something that historic American growth for corp net worth has always been over 7% yearly, but since 2007 growth has only averaged a paltry one percent.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

The return of market volatility sent the S&P 500 to a low of 1,820 last Wednesday, down 9.8% from its September 19 all-time high of 2,019.

There certainly hasn't been a shortage of concerns. The global economy has been slowing, commodity prices have been plunging, geopolitical tensions have been high, and the Ebola virus has been spreading. And all this came amid expectations that the Federal Reserve would soon tighten monetary policy.

But at 1,941 today, the market is now up a remarkable 6.6% in just five trading days.

"The question is this: "What changed so much in the macro picture since just four sessions ago when everyone was hitting the panic buttons??" NYSE floor governor Rich Barry asked. "Three things have changed:

"1) The Street is expecting the Fed to be slightly more dovish when they meet next week. Last Thursday, (perfect timing, I might add), St. Louis Fed President James Bullard said the Fed "should consider delaying the end of its bond purchase program to halt the decline in inflation expectations." As we said in this note, the market, up until that point, did not even think it was possible to delay the end of QE. Although nobody really expects them to keep the QE program going, there is a growing sense that the FOMC will push out the date for interest rate hikes.

"2) Oil (finally) has stopped its free-fall, and is now simply languishing in the low 80s. As a result, energy stocks have stabilized and are not weighing heavily on the indices.

"3) With a cautioned sigh of relief, we add that the Ebola concerns have eased. It was a huge relief when it was reported that 43 of the 48 people on the original watch list in Dallas had passed the 21-day incubation period and appear to be in the clear. We believe that the Ebola scare was a HUGE issue for the market. If the news continues to be positive, we believe this relief (short-covering) rally will continue."

The S&P is almost as close to its high as it is to its recent low. Which way do we go next?

IBD rates PG at 72 (out of 100) hampered by institutional selling and relative strenth v. the general market. WMT gets a meager 42 rating for a number of reasons. Thats all I can find out 'cause neither had come up on my radar.

If only pfizer could come up with an ebola cure.

Some folks do well on wild card medical stars but I've never gotten anywhere w/ volatile unknowns. Early last month I bot CELG @ $91, held it for a month and dumped at the same price because it went nowhere and the overall market trend was down. Now I read that it just soared to over $96 --close to its all time high on earnings news but I don't see any lesson there 'cause there were no signals.

Weird. I just looked at the CBPO I got yesterday and it's jumped 5% this morning...

Interesting, they’re talking about how after the Obama tax hikes revenue increased at what comes out to 7% more per year. They should mention that the Bush tax cuts made revenue increase by 11% yearly.

---and we'll keep hearing about how the market's a rigged house of cards. In the mean time the Dow will continue to double every decade like it's been doing for the past 80 years.

interesting; tx!

;Don’t know if this has anything to do with the change in Mrk direction but Ottawa don’t sound good

http://www.freerepublic.com/focus/news/3218183/posts?q=1&;page=281

yep

Thursday, October 23, 2014 |

||||

Markets |

|

yesterday |

|

today |

| metals | Rally faltering w/ gold at $1,244.40 & silver at $17.05 | Futures @ 3 hrs. before opening -0.45% | ||

| stocks | Early profit taking in lower volume; "Contrary to what the pessimists may have expected (or even wanted), the prior two sessions reflected more of a "two steps forward, one step back" cadence. The Nasdaq composite fell 0.8%, the S&P 500 0.7% ... " (from here) | Futures +0.56% | ||

Today's econ reports:

Initial Claims

Continuing Claims

FHFA Housing Price Index

Leading Indicators

Natural Gas Inventories

“Ee’s pinin fer the fjords”

Confirmed case of Ebola

http://www.freerepublic.com/focus/f-news/3218854/posts

And Loan Wolf ISIS Attack (perp had rabid islam facebook stuff)

http://www.nytimes.com/2014/10/24/nyregion/new-york-police-fatally-shoot-man-who-attacked-officer-with-a-hatchet.html

Happy Friday everyone! Yesterday stocks lept forward in mixed volume while metals took a hit, and this morning futures have metals going back up and stocks heading back down. New Home Sales comes out an hour and a half after opening bell, Busy day before the weekend:

Pfizer's $11 billion buyback plan deflates AstraZeneca bid hopes

Specter of no-inflation world looms over Fed's return to normal

Maybe I should start a new thread w/ that last one like w/ The dangers of deflation The pendulum swings to the pit...

Boy your up and at em early this morning.

” Markets Are Sinking (Ebola Fears).”

Oh yea. I’m overweight, don’t get enough exercise, eat red meat and still smoke. I’m OK with all that but this ebola thing is scaring the crap out of me. Do I need a sarcasm tag?

Wait a sec, futures are back up. Never mind, ebola went away.

We're all gonna die from from Global Warming Weather Change anyways.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.