[click pix to enlarge]

[click pix to enlarge]Posted on 10/19/2014 11:18:38 AM PDT by expat_panama

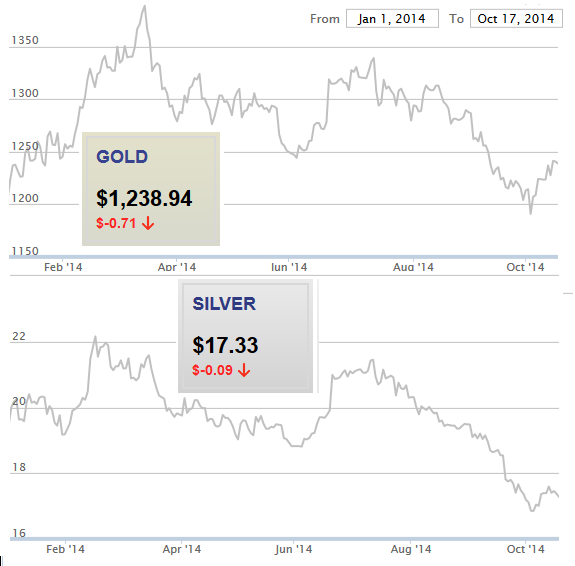

This past week saw upside reversals across the board coming out with prices holding steady in spite of the hammering we had over the past month or two.

The October metals rally held on to its gains, in fact market prices show gold's just about clawed back to break-even for 2014. That's said, metals' role in price trends ahead is become increasingly controversial (re Gold And Silver - Financial World: House Of Cards Built On Sand) even while many see a bright tomorrow with other commodities (We Maintain Our Outlook For Higher Prices For Commodities).

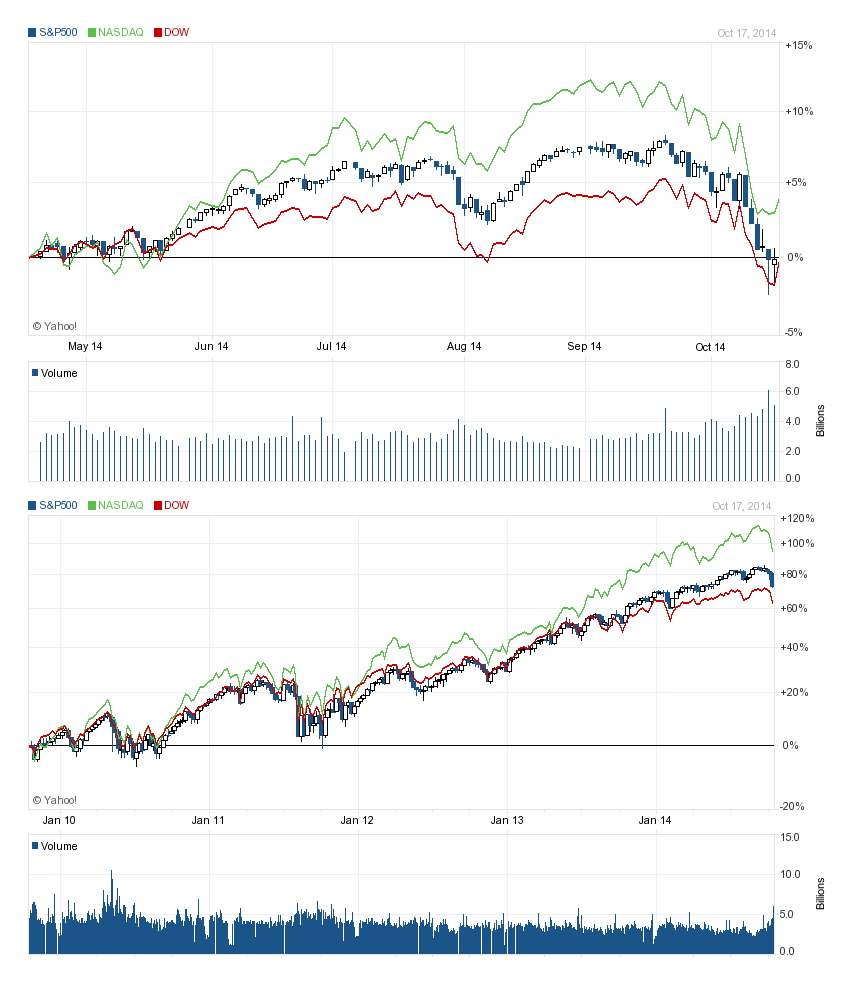

Stocks. OK, so IBD won't call it an "uptrend" (the follow-through has got to be no earlier than the fourth day of the rebound or it ain't official), but the upside surge was led by leading stock leaders. They call them 'leading' stocks for a reason. Well, sometimes they call 'em 'bellwether' stocks but the term makes me nervous 'cause a bellwether is often the animal trained to lead the mindless unquestioning herd into the meat packing plant.

I digress.

So we've been in "market in correction" for a while and we punched down through the famous 200-day moving average, so for 2014 it really is a big deal. Maybe that says more about how spoiled we've been getting lately. I mean the earlier swings over the past half decade kind of make these past two years seem well, nice.

[click pix to enlarge]

The big question of course is whether stock indexes are right now 'over priced' or not, and for that I like to compare say, the S&P500 to total U.S. corp. net worth. Someone correct me if they see anything I don't but I honestly think they've been tracking together since the last decade's high. Not only that, but recent growth seems actually subdued --check out this 1950-2014 plot showing total corp networth and how the trend in raising business capital has been more and more turning away from bonds over into stocks.

Also on that note. Please forgive my broken record but it has got to mean something that historic American growth for corp net worth has always been over 7% yearly, but since 2007 growth has only averaged a paltry one percent.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

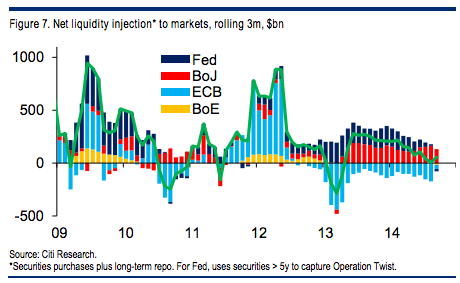

The AMOUNT of dollars they continue to fuse into the market is what has already, and is continuing to create inflation in the economy.

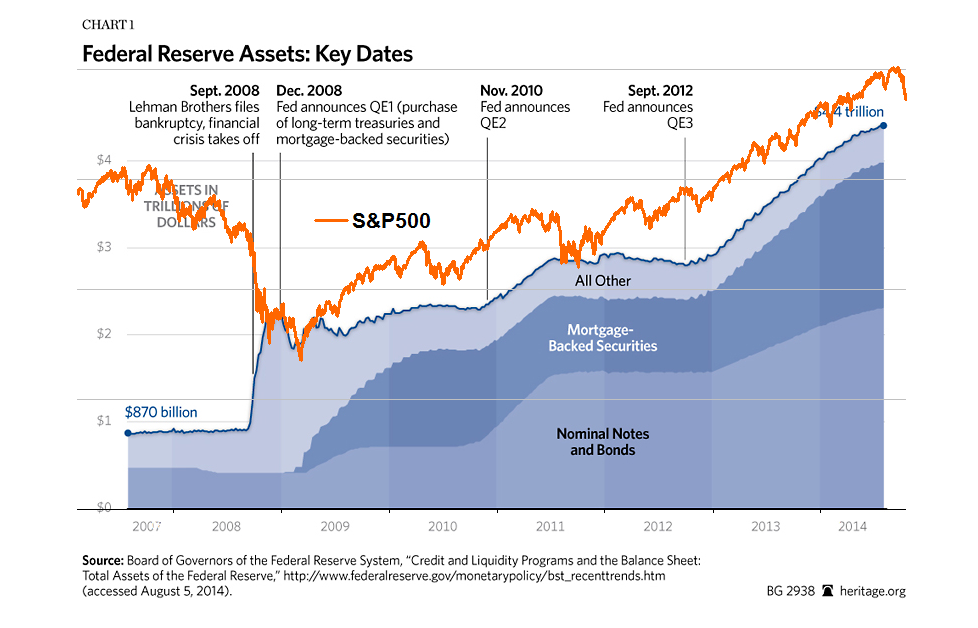

They have for two years now printed money that has been used to BUY 80 to 90 BILLION dollars worth of bonds and T-Bills a MONTH. They now have incurred a 4.5 TRILLION dollar deficit balance sheet doing this.

To put it simply: They have pumped this money into the stock market by buying these enormous amounts monthly and that is what has kept the market propped up.

This article from the Heritage Foundation from the Spring of this year pretty much shows the FED has painted themselves into a corner and has really NO choice other than to keep printing INFLATIONARY dollars to keep the "house of cards" standing.

Quantitative Easing, The Fed’s Balance Sheet, and Central Bank Insolvency

--and a happy Monday morning to all! While futures traders may be seeing most commodiites falling (grains are down a percent) they got metals up a tenth and stock indexes are up two tenths of a percent. Can't wait for the day to begin --no major econ reports today, I mean, what could possibly go wrong now?

http://www.businesswire.com/news/home/20141020005535/en/IBM-Reports-2014-Third-Quarter-Results

IBM Reports 2014 Third-Quarter Results

Diluted EPS from continuing operations:

GAAP: $3.46, down 8 percent;

Operating (non-GAAP): $3.68, down 10 percent;

Net income from continuing operations:

GAAP: $3.5 billion, down 17 percent;

Operating (non-GAAP): $3.7 billion, down 18 percent;

Consolidated results, including net loss on discontinued operations of $3.4 billion:

Net income: $18 million

EPS: $0.02

Gross profit margin from continuing operations:

GAAP: 48.6 percent, down 40 basis points;

Operating (non-GAAP): 49.2 percent, down 90 basis points;

Revenue from continuing operations: $22.4 billion:

Down 4 percent; down 2 percent adjusting for divested customer care outsourcing business and currency;

Monday’s futures were all green until about 7am EDT...now taking a big drop.

When was there a time the fed did not print money?

Before 1913?

Exactly! It does not make sense to think money printing that began over a hundred years ago suddenly caused the "rigged show" to begin a rally last Wednesday.

...pumped this money into the stock market by buying these enormous amounts monthly... ...http://www.heritage.org/research/reports/2014/08/quantitative-easing-the-feds-balance-sheet-and-central-bank-insolvency

The Heritage people did a great job of listing Fed's purchases of T-bills, mortgages, and bonds, no common stocks were purchased. Here's how the stock prices moved along w/ QE:

The idea that QE is 'rigging' stocks is just not there. In fact, it would be easier to argue that QE hurt stocks.

Huh. Metals are soaring and stocks are down a third of a %. What did you do?

All because of an IBM miss?!? Seems a bit melodramatic.

IBM is a Dow component. Any significant movement in it will necessarily influence the DJIA more than other stocks.

have a good and productive Monday!!!

Fracking is boosting the USD and US economy for the time being. But more important has been the Federal Reserve flooding the system with phony money since 2008. They have successfully pulled this off so far even with rising prices

This FR money torrent has driven the stock market and goosed housing in many areas. Phoney Obama/phony money/ but so far the hypnotizable sheeple are accepting both and chewing their cud peacefully. Only a black swan event will jolt them out of this hypnotic state, due to half of modern economics is the psychological state of consumer happiness and confidence due to our economy being a consumer driven one.

Note how the Dow is down, but the S&P and NASDAQ are up, at least for now.

yeah, the dust is settling. Let’s see what stirs things up next...

DJIA driven by the decline in IBM

Apple reports this afternoon.

http://www.nasdaq.com/earnings/report/aapl

As a side note I’ve preferred android but this Apple pay thing has me rethinking. If I understand it right when you use it it doesn’t give your credit card number it leaves a token similar to a purchase order. I like that. Seems like when you use your CC everyone feels compelled to put all your info in their database forever exposing you to them getting hacked at some point in the future. That’s why I don’t buy a lot of stuff online.

hmmm. That really does sound like the way things are going to have to be...

I believe what's being said is that pouring BILLIONS monthly in BONDS and T-Bills being bought by the FED is not necessarily "rigging" the market as much as it is keeping the "house of cards" standing and in business..

Take a look at the actual number of investors that have left the market as witnessed by the volume of trading.

Over a TRILLION dollars of personal worth has been lost in just the stock market in the last two weeks alone.

Exactly. Furthermore the details are stored on the phone and never hit the Apple servers or the merchants servers. I think it required touch id as well to use. Apple has agreements with the banks to process as “card present” which is lower fees than “card not present.” It’s pretty innovative and potentially disruptive.

Going by the indexes it's looking more like $0.54T over the past two weeks, but a $T is still close enough and bad enough. That's according to the market price of publically listed corporations, and while this line of thinking makes sense it also means that the 10% drop in the price of gold over the past year means that 18,000 tonnes of gold were destroyed. Some people would disagree.

the FED is... ...keeping the "house of cards" standing and in business.

If that's true then let's decide what we want and what we don't want. One thing we don't want is the Fed knocking everything down. We can blame the Fed for there being a house of cards in the first place but I'd prefer to blame the 51% of American voters that messed everything up.

Frankly, I honestly don't think American wealth creation is a house of cards in the first place. Americans are strong, powerful, and smart and historically, those who underestimated American power ended up losing big time.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.