Skip to comments.

For Wonks Only

Pimco ^

| September 2014

| William H. Gross

Posted on 09/07/2014 3:22:37 PM PDT by hripka

A credit-based financial economy (as opposed to pure cash) depends on an ever-expanding outstanding level of credit for its survival. Without additional credit, interest on previously issued liabilities cannot be paid absent the sale of existing assets, which in turn would lead to a vicious cycle of debt deflation, recession and ultimately depression. It is this expansion of private and public market credit which the Fed and the BOE have successfully engineered over the past five years, while their contemporaries (the ECB and BOJ) have until now failed, at least in terms of stimulating economic growth.

(Excerpt) Read more at pimco.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: banking; credit; debt; inflation

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-49 next last

1

posted on

09/07/2014 3:22:37 PM PDT

by

hripka

To: hripka

Dude...where ya’ been for the last two years?

2

posted on

09/07/2014 3:31:48 PM PDT

by

Repeal The 17th

(We have met the enemy and he is us.)

To: hripka

Wrong. A credit based economy where the generation of wealth funded with debt exceeds the true cost of that debt works. In fact, it works incredibly well.

Sadly, we don’t have that. We have a credit based economy where most of the borrowed money used to fund the fedgov goes to social programs that in fact destroy wealth. That is unsustainable.

It will get BAD.

3

posted on

09/07/2014 3:33:11 PM PDT

by

piytar

(The predator-class is furious that their prey are shooting back.)

To: piytar

He quietly skirted/skipped the part you mentioned, but he knows what is happening and how it is affecting the economy and the future.

4

posted on

09/07/2014 3:49:09 PM PDT

by

SaxxonWoods

(....Let It Burn...)

To: SaxxonWoods

5

posted on

09/07/2014 3:50:22 PM PDT

by

piytar

(The predator-class is furious that their prey are shooting back.)

To: hripka

“A credit-based financial economy (as opposed to pure cash) depends on an ever-expanding outstanding level of credit for its survival. Without additional credit, interest on previously issued liabilities cannot be paid absent the sale of existing assets, which in turn would lead to a vicious cycle of debt deflation, recession and ultimately depression.”

This is a central thesis of the book, “The Creature from Jekyll Island”.

One of the problems with an economy in which debt substitutes for actual money like ours (the stuff we circulate as money is actually debt - Federal Reserve Notes), is that when you pay back interest, you’re paying it back with some of the debt, debt that gets removed from the economy. If you pay back ALL debt, then there is no “money” left to circulate.

6

posted on

09/07/2014 4:17:06 PM PDT

by

catnipman

(Cat Nipman: Vote Republican in 2012 and only be called racist one more time!)

To: piytar

Thanks, you summed up the situation in a nutshell. I wonder whty supposedly smart guys like Gross don’t say the same?

7

posted on

09/07/2014 5:35:59 PM PDT

by

DaxtonBrown

(http://www.futurnamics.com/reid.php)

To: catnipman; hripka; Wyatt's Torch

economic growth depends on investment and a rejuvenation of capitalistic animal spirits – a condition which currently does not exist. iow, the economy sucks because nobody's investing and everyone's just sitting on cash. In the six decades of data before the '08 election, credit growth averaged 9% yearly, but since then it's been flat at 2% --about even w/ inflation. This is the elephant in the room, what little money supply growth we've seen has been because of the Fed's T-bill purchases and money velocity has tanked.

Central bankers are hopeful that fiscal policy (which includes deficit spending and/or tax reform) may ultimately lead to higher investment, but to date there has been little progress,

Everyone already's saying this, but the problem here is that pundits are telling politicians that it's got to be in the form of higher taxes and bigger govt. What's really needed is an end of Washington's war on private property.

The U.S. and global economy ultimately cannot be safely delevered with artificially low interest rates, unless they lead to higher levels of productive investment.

--which we're never going to see as long as investors are under siege.

To: expat_panama

“In the six decades of data before the ‘08 election, credit growth averaged 9% yearly, but since then it’s been flat at 2%”

Do you think any of that is due to higher reserve requirements imposed on the banks?

9

posted on

09/07/2014 6:27:35 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: hripka

"1. Cross your fingers, credit growth is a necessary but not sufficient condition for economic growth. Economic growth depends on the productive use of credit growth, something that is not occurring."

He did say it. Well said.

10

posted on

09/07/2014 6:29:30 PM PDT

by

familyop

(We Baby Boomers are croaking in an avalanche of corruption smelled around the planet.)

To: hripka

About "

70 million" people are receiving good incomes but are also steeped in debt, and most of them can't borrow more for big ticket items.

11

posted on

09/07/2014 6:31:14 PM PDT

by

familyop

(We Baby Boomers are croaking in an avalanche of corruption smelled around the planet.)

To: expat_panama

BTTT

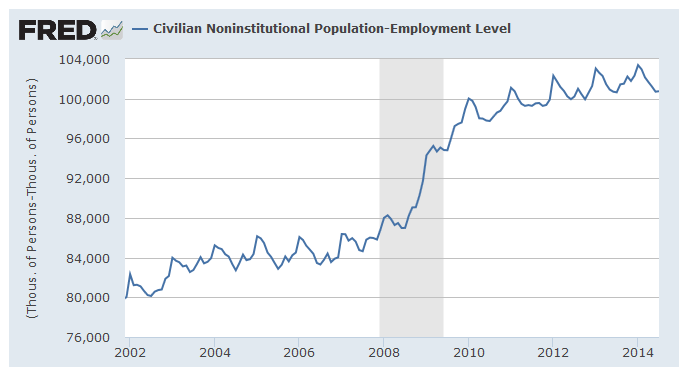

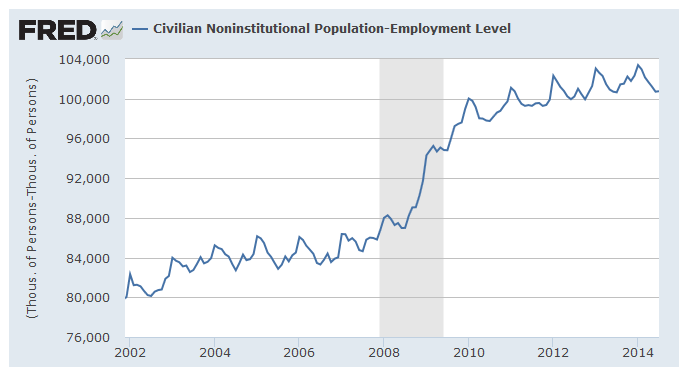

Money velocity has tanked because there are 92 million Americans not working or underemployed for whatever reason.

The turn to the left culturally eats at the work ethic and the American Spirit (Can do, why if I get free money?). The economic left turn hits the individual citizen's and small businessman's pocket book and bottom line, respectively.

12

posted on

09/07/2014 6:32:55 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Lurkina.n.Learnin

due to higher reserve requirements imposed on the banks?OK, to be honest I'd have to say that's as good as guess as any I've seen.

So much for honesty. Somehow it seems more accurate to believe that folks aren't borrowing because they don't want to go to all the trouble of building wealth only to hear the president say "you didn't build that" as he puts his heel to the business' throat.

To: Chgogal

92 million Americans not workingWe hear that number a lot, but when I subtract the total number of people w/ jobs from the total U.S. population over 16 not in jail--

--I get around 102 million and counting. That number was stable at just over 84 million during most of the previous decade, so we're now looking at an '08 election leap of 18 million. It's like saying the entire state of New York suddenly got laid off.

To: expat_panama

15

posted on

09/07/2014 7:31:57 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: hripka

why did i click on this thread again.

16

posted on

09/07/2014 7:44:15 PM PDT

by

CPT Clay

(Follow me on Twitter @Clay N TX)

To: expat_panama

“the economy sucks because nobody’s investing and everyone’s just sitting on cash”

Well, duuuuuhh! No one in their right mind is going to invest in economic growth in the U.S. as long as Marxists are in charge of the economy and any profits resulting from risk-taking are simply going to be stolen and “redistributed”.

17

posted on

09/07/2014 9:27:55 PM PDT

by

catnipman

(Cat Nipman: Vote Republican in 2012 and only be called racist one more time!)

To: expat_panama

18

posted on

09/07/2014 10:55:10 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Lurkina.n.Learnin; Wyatt's Torch

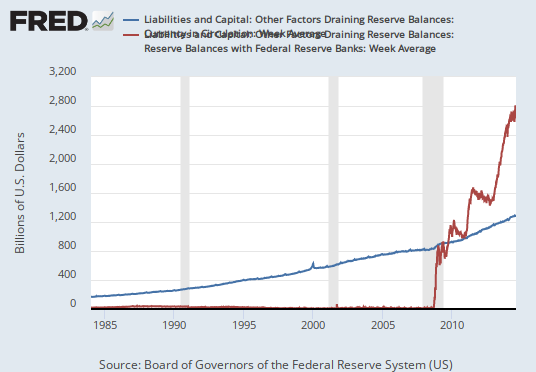

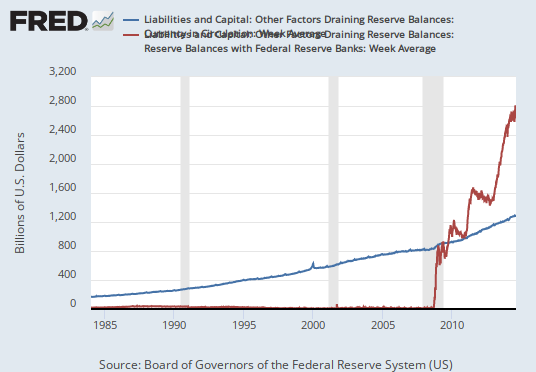

don’t know what it all means but reserves have skyrocketedYou're in very good company, seems that everyone who's working on this agrees that we all know reserves have skyrocketed and we admit we don't really know what it means, although in last weeks investor's thread Wyatt posted a Fed essay saying:.

The answer lies in the private sector’s dramatic increase in their willingness to hoard money instead of spend it. Such an unprecedented increase in money demand has slowed down the velocity of money, as the figure below shows.

And why then would people suddenly decide to hoard money instead of spend it? A possible answer lies in the combination of two issues:

A glooming economy after the financial crisis The dramatic decrease in interest rates that has forced investors to readjust their portfolios toward liquid money and away from interest-bearing assets such as government bonds

iow we all know reserves are up and velocity's down. You're guessing the reserves are the cause and the Fed econ. says the reserves are the result. Personally, I lean your way. I mean that I don't really know....

To: expat_panama; Lurkina.n.Learnin

Higher reserves explain part of it but can't explain all.

Another part is increased lending standards as well as "shadow standards" that banks impose above and beyond those that are required.

Part of it is related to lack of small business creation.

Part of it is related to companies not wanting to increase debt/leverage (although that is easing) due to environment (regs and legs) uncertainty.

All these things coupled with "hoarding" are driving the reserves and the consequent collapse in velocity.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-49 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson