Posted on 08/17/2014 1:35:32 PM PDT by expat_panama

Alternate Title: UPTREND SPECIAL EDITION!

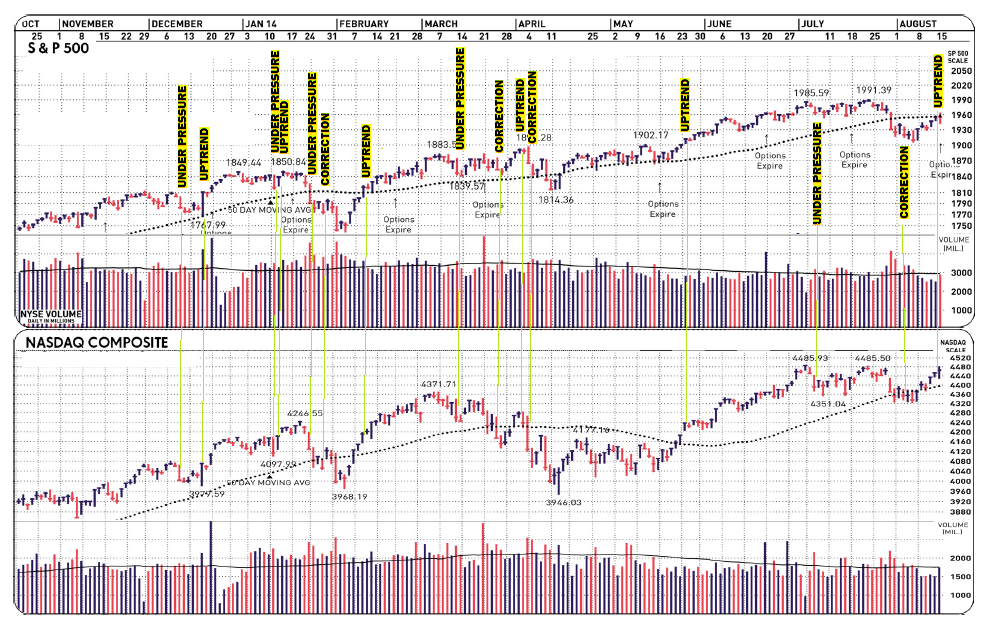

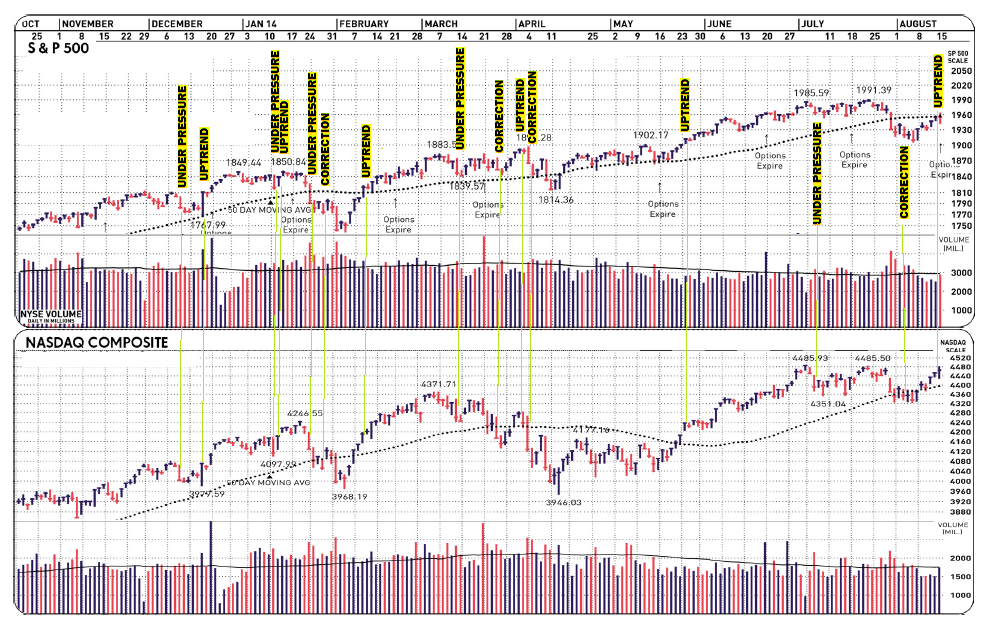

That's right, last Thursday IBD announced that NASDAQ had its "follow-through-day" so investors in the driver's seat just saw the light turn green. That said, we also know that nobody walks across a one-way street without looking both ways, and even though the signs say 'buy' here's what they've been saying so far this year--

--and this is the problem we got driving down the road while only being able to look out the back window.

Remember these market designations are not arbitrary, they're signals proven with decades of research. That said, we're still looking at a market where price trends have not yet proven themselves. We've gotten so many false signals this year that a person would've done better by buying on the 'corrections' and selling when uptrends begain.

Of course, if we're concluding that past patterns don't mean anything for seeing the future, then to be honest we'd also have to admit that simply being contrary promises nothing.

OK, so imho 'honesty' is highly over-rated.

Maybe our bottom line here is that it's IBD's job to show what usually has happened before when stuff looking like today's headlines popped up --and truth betold they do it superbly. When it comes to guarding our family's wealth and keeping the kids fed, well that's our job. It means we can still learn from folks like NEWSMAX/FINANCE, IBD, WSJ, but we also need to kick those guys around on this thread too...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

tx! I switched around the list to start an ETF sublist. I’m getting more and more comfortable w/ both ETF’s and individual stocks, the mix depending on market stability.

Is that a cloud or just fog?

Smoke actually :-)

What, no mirrors? OK seriously, we're lucky to have gotten past the bad old days of Greenspeak, where Fed Chariman Sir Alan would relish in a maze on convoluted rhetoric. I think I speak for everyone here when I celebrate Bernanke and Yellen's wont to cofascure the extradiction to eschew obfuscation.

Strictly, of course, from a hypothetical standpoint.

I messed that up.

Theoretically speaking, strictly of course, from a hypothetical standpoint.

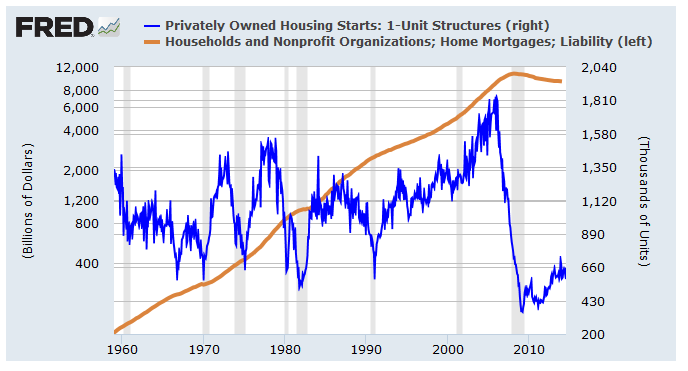

At first my impression was that we were looking at a repeat of a cycle that happens every couple decades and that all would be well soon. So I checked the record going back 60 years.

Seems that the current dislocation is truly unique, and that we've got another serious concern for our "why-the-economy-stinks" list. Sure, there's lots of items on the "why-the-economy's-just-fine" list but some how I keep having to staple more new pages onto the first one...

Good luck....

A lovely new morning to all as stock indexes continue an uptrend in thinner volume and metals settle. Bunch of reports this morning:

Initial Claims

Continuing Claims

Existing Home Sales

Philadelphia Fed

Leading Indicators

Natural Gas Inventories

News (CONFIRMATION BIAS ALERT):

Claims +298 vs 303 exp

So much for buying. The critical part is having sell rules, and this last correction my sell/buy timing cost me a half percent. Some timers say the money spent buys insurance against further declines, others say that reduced volatility is worth the cost, and still others say it’s always best to err on the side of caution.

I’d prefer not not err in the first place

[ adding to “the-econ’s-just-fine” list ]

Mfg PMI 58 vs 55.7 est

When I woke up today?

DJ Fut +33

S&P Fut +2.75

Conspiracy remains alive!

Maybe, they just don’t buy on days when the minutes are released???

;-)

S&P closing in on record high 1991.39

LOL. I saw that this morning and just laughed and shook my head :-)

S&P hit 1991.67

New home sales beat

Philly fed crushed it

This chart gives me mixed messages....

My first impression was: We suffered a major dislocation in the market due to the push by the idiot government to get EVERYONE in a home, whether they could afford it or not. We got WAY above the norm, corrected, and are now still well below the long term average. Which suggests that we will continue correcting toward the norm.

However, one can’t look at data like this without consider the affect of the demographic bubble that is the boomers. They are a LOT of people, moving to retirement, and downsizing to smaller homes and/or apartments or multi-family houses.

Plus, there seems to me to be an increase toward re-urbanization... with more and more people moving to apartments nearer city centers. So, maybe that continues to depress the single-family home numbers for awhile??

But...I think the first point is most likely the correct reading. Interesting that the numbers truly moved off norm in 2001, just a W was coming into office.

see? Now that you've been alerted, you will pick up on the trend too. :-)

--and that was a good thing. Houses being built and money loaned isn't something that should stay at a 'norm' because folks have kids and America grows. In the mid '00s the number of homes built topped the previous peak of three decades earlier by 20%, and during that time the U.S. population had increased by 50%. imho it's not economic growth ten years ago being problem, it's the econ collapse of '09 that needs to be fixed.

I don't think you can separate the two. Housing starts exploded largely because of the complete collapse of lending standards. Pizza delivery guys were getting jobs as mortgage brokers, and making GREAT money.

The build-up of bad debt was unprecedented, and eventually created a near complete collapse of the financial system. It was, IMO, very close to completely falling apart. Even GE couldn't get the daily credit needed to run their business.

That chart reflects how absurd things got... and, how severely it has corrected.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.