Skip to comments.

Investment & Finance Thread (Apr. 20 edition)

Daily investment & finance thread ^

| 04/20/2014

| Freeper Investors

Posted on 04/20/2014 1:14:39 PM PDT by expat_panama

Here's what others are saying about what's going on--

Gold / Silver / Copper futures - weekly outlook: April 21 - 25

Investing.com - Gold prices ended the week sharply lower on Thursday, falling below the $1,300 level as indications that the U.S. economic recovery is progressing dampened safe haven demand for the precious metal.

Gold ends week below $1,300 level on stronger U.S. economic outlook

Gold ends week below $1,300 level on stronger U.S. economic outlook

On the Comex division of the New York Mercantile Exchange, gold futures for June delivery ended Thursday’s session at $1,294.90 an ounce. The precious metal ended the week down 2.34%. The Comex was closed for Good Friday.

Gold came under pressure after upbeat U.S. data on manufacturing and employment pointed to underlying strength in the economy.

The Labor Department reported the number of people filing for unemployment benefits edged up to 304,000, below analysts’ forecasts and not far from the six-and-a-half year low of 300,000 touched the previous week. [more here]

U.S. stocks ended a holiday-shortened week with the Standard & Poor’s 500 making its biggest weekly gain in nine months. For the four days, the S&P 500 added 2.7 percent and both the Dow Jones industrial average and the Nasdaq Composite advanced 2.4 percent.

The weekly result is worth noting because it marks a strong turnaround after six weeks of turmoil that primarily affected overpriced information technology, biotechnology and other issues, mostly in the Nasdaq Composite.

By the end of last week, the bursting of that bubble was showing an increasing tendency for the selling to spread to the broad market. That hasn’t happened, at least not yet. In its reversal from an oversold condition, the market benefited from several developments... [more here]

--and IBD still hasn't announced this correction's 'follow-thru-day', although fwiw if we get more consolidation it might be as early as Tuesday...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: financial; goldbugs; hr2847; randsconcerntrolls; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-72 last

To: BipolarBob

I bought UA and RTN this afternoon. I couldn’t pull the trigger on any bios at this time.

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Happy Friday everyone! Futures have metals up and stocks off this morning after yesterdays gains that could be called 'modest' (IBD used words like 'lackluster' and 'struggle'). Starting headlines:

To: BipolarBob

pull the trigger on any biosLot of poeple feel that way.

To: Wyatt's Torch

Don't get me wrong, AAPL is a fine company. I just don't think the phenomenal growth in stock price is sustainable. That is one reason why I see mgt. doing this 7:1 split. Again note (stuck deep in their quarterly report) the drop in same store sales.

Also there is a perception (right or not is up for debate) that the "innovation gap" has narrowed between AAPL and its competitors.

I'm an old guy now, who wants more "stability and divys" and less "growth with risk". If I was 25, I would have no problem socking some substantial money into this equity.

64

posted on

04/25/2014 4:50:13 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: catfish1957

Cook said directly on the earnings call that the split was to help bring in the retail investor. And no the law of large numbers prevents their growth rates from continuing.

To: expat_panama; Wyatt's Torch

In fwiw department, I rarely post on this thread, but almost always read it. Thanks.

5.56mm

66

posted on

04/25/2014 5:01:52 AM PDT

by

M Kehoe

To: expat_panama

KCG: THE LOOK…

April 25th, 2014

U.S. stock-index futures declined, indicating that equities will pare their second week of gains,

as Secretary of State John Kerry warned of costs to Russia’s economy unless it eases tensions in Ukraine.

Ford Motor Co. slipped 2 percent in early New York trading after posting earnings that trailed analysts’ estimates. Amazon.com Inc. dropped 2.1 percent after predicting a loss in the current quarter. Microsoft Corp. climbed 1.4 percent after posting quarterly profit that exceeded projections. Starbucks

Corp. added 1.6 percent after it forecast full-year earnings that beat estimates.

Futures on the Standard & Poor’s 500 Index expiring in June dropped 0.4 percent to 1,866.5 at 7:34 a.m. in New York. The equity benchmark has advanced 0.7 percent this week as companies from Apple Inc. to Netflix Inc. reported earnings that beat estimates. Dow Jones Industrial Average contracts decreased 70

points, or 0.4 percent, to 16,361 today.

“The situation in Ukraine seems to be getting more tense, making investors nervous,” said Jacques Porta, who helps oversee $780 million at Ofi Gestion Privee in Paris. “A war would be a disaster for everybody. I think they will find a deal. With the U.S. earnings season, we’re seeing some good surprises.”

Russian President Vladimir Putin has failed to meet commitments made at a meeting in Geneva a week ago to avoid an escalation of the crisis in Ukraine, Kerry said in Washington late yesterday. President Barack Obama plans to call European leaders today to discuss sanctions, following the resumption of

military drills by Russian troops along the country’s border with Ukraine.

“If Russia continues in this direction, it will not just be a grave mistake, it will be an expensive mistake,” Kerry said. “The window to change course is closing. If Russia chooses the path of de-escalation, the international community –- all of us –- will welcome it. If Russia does not, the world will make sure that the cost for Russia will only grow.”

European stocks fell, paring their fifth weekly gain in six weeks, as companies from Neste Oil Oyj

to Sandvik AB posted quarterly earnings that missed estimates and tensions escalated between the U.S. and Russia over Ukraine. U.S. index futures and Asian shares also dropped.

Neste Oil slid 5.8 percent, leading losses on the benchmark Stoxx Europe 600 Index, after also lowering its 2014 profit forecast. Sandvik lost 3.5 percent. Deutsche Bank AG declined 2.2 percent after a report that it may announce a capital increase. Electrolux AB rallied the most in 4 1/2 years after

posting earnings that beat estimates and increasing its forecast for European demand growth.

The Stoxx 600 slipped 0.5 percent to 334.49 at 1:02 p.m. in London. The gauge is heading for a weekly advance of 0.6 percent amid increased mergers-and-acquisitions activity. Standard & Poor’s 500 Index futures slid 0.3 percent today, while the MSCI Asia Pacific Index retreated 0.3 percent.

• Support:1871, 1863, 1850

• Resistance:1885, 1891, 1905

Facebook Inc. is showing the kind of accelerating revenue growth that Apple Inc. did three years earlier, which may help explain why the shares of the world’s largest social network failed to sustain gains yesterday.

The CHART OF THE DAY compares Facebook’s quarterly sales increases since the start of last year with adjusted revenue at Apple, the maker of iPhones and iPad tablet computers, from the first quarter of fiscal 2010 onward.

Apple’s sales growth peaked at 83 percent in the second quarter of fiscal 2011 after accelerating for six straight quarters, according to data compiled by Bloomberg. The company, based in Cupertino, California, benefited from surging demand for iPhones and the introduction of the iPad.

Facebook is going through a similar phase. Revenue at the Menlo Park, California-based company climbed 72 percent during the first quarter, up from 63 percent three months earlier. The increase was the fourth in a row. Sales of advertising aimed at iPhones, iPads and other mobile devices spurred the growth.

“Momentum continues to be undeniable strong,” Evan Wilson, an analyst at Pacific Crest Securities LLC in Portland, Oregon, wrote yesterday in a report. Yet sustaining the pace in the second half will be a “big test,” he added, as year-ago results get tougher to beat.

Wilson is one of nine analysts with a hold rating or an equivalent on Facebook, according to data compiled by Bloomberg. The stock has 43 buy recommendations. Shares of Facebook closed 0.8 percent lower yesterday after rising as much as 3.7 percent during the day.

To: expat_panama

Markets being hit hard today:

NSADAQ -66

S&P -15

DJIA -145

AMZN -33

NFLZ -15

Everything on my screen is red except VIX and commodities

To: expat_panama

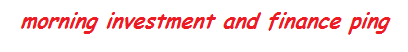

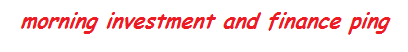

Interesting chart on the correlation between UST 10Y and S&P

To: expat_panama

The BEA is scheduled to release the advance estimate for Q1 Gross Domestic Product (GDP) next week on Wednesday, April 30th. The consensus forecast is for real GDP to increase 1.1% in Q1 (from Q4, annualized). Here are a few forecasts:

From Kris Dawsey at Goldman Sachs:

Despite GDP likely growing at an anemic rate of around 1.0% in Q1, we remain optimistic about the rest of 2014. The core narrative for a pickup in growth this year has not changed. The fiscal drag is still lower, consumer spending should still strengthen, and business investment seems poised for a comeback. We see the weakness in Q1 as mainly driven by temporary factors, including a large drag from weather and inventories. The recent encouraging dataflow—with the exception of some of the housing numbers—appears consistent with our forecast for a near-term pickup. For the remainder of 2014, 3%+growth remains our baseline. ...

We forecast 1.8% growth in real final sales in Q1 (GDP growth excluding the effects of the volatile inventories category). ... Inventory investment was a significant positive contributor to growth in 2013, adding 3/4 percentage point to growth over the four quarters of the year. ... In Q1, the rate of real inventory accumulation appears to have moderated based on the incoming data on manufacturing, wholesale, and retail inventories, which will be a drag on Q1 GDP growth.

emphasis added

From Merrill Lynch:

We think the first estimate of 1Q GDP will show sluggish growth of only 1.2% qoq saar. A large part of the weakness owes to the cold weather which held back economic activity in the beginning of the year. Inventories are also being drawn down, albeit gradually, as businesses were caught with excess stockpiles. We estimate that inventories will slice 0.6pp from growth, matching the drag to the economy from a wider trade deficit. Residential investment is also likely to contract, reflecting the decline in home sales and sluggish housing starts. ... We think momentum will improve in the spring, setting the stage for a rebound in 2Q with growth above 3.0%.

For the first release of 1Q GDP, we are looking for relatively soft readings on key inflation metrics in this report. Specifically, we expect both the GDP deflator and the core PCE deflator to rise 1.3% qoq saar for 1Q.

From Nomura:

Disregard the backward-looking Q1 GDP, April data should show the recovery taking off. ... Weather weighed on economic activity early in the year. This should be reflected in a markedly slower pace of GDP growth in Q1. We expect GDP to grow at an annualized rate of 0.9% in Q1, compared with 2.6% in Q4.

And on the April employment report to be released next Friday, the consensus is for 210 thousand payroll jobs added with Merrill forecasting 215 thousand and Nomura forecasting 225 thousand.

Read more at http://www.calculatedriskblog.com/2014/04/a-few-q1-gdp-forecasts.html#Bh4rjcAcufOOWDcV.99

To: Wyatt's Torch

Did you STEAL that from my personal diary??

71

posted on

04/25/2014 8:25:25 AM PDT

by

SomeCallMeTim

( The best minds are not in government. If any were, business would hire them!)

To: expat_panama

What do you think of this Foreign Account Tax Compliance Act (known as FATCA)? I’ve seen some on this before and wondered what the expat community thought of it.

The U.S. dollar will officially collapse on 1 July 2014 due to the implementation of H.R. 2847.

http://www.freerepublic.com/focus/f-news/3149277/posts

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-72 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson