Skip to comments.

Investment & Finance Thread (Apr. 20 edition)

Daily investment & finance thread ^

| 04/20/2014

| Freeper Investors

Posted on 04/20/2014 1:14:39 PM PDT by expat_panama

Here's what others are saying about what's going on--

Gold / Silver / Copper futures - weekly outlook: April 21 - 25

Investing.com - Gold prices ended the week sharply lower on Thursday, falling below the $1,300 level as indications that the U.S. economic recovery is progressing dampened safe haven demand for the precious metal.

Gold ends week below $1,300 level on stronger U.S. economic outlook

Gold ends week below $1,300 level on stronger U.S. economic outlook

On the Comex division of the New York Mercantile Exchange, gold futures for June delivery ended Thursday’s session at $1,294.90 an ounce. The precious metal ended the week down 2.34%. The Comex was closed for Good Friday.

Gold came under pressure after upbeat U.S. data on manufacturing and employment pointed to underlying strength in the economy.

The Labor Department reported the number of people filing for unemployment benefits edged up to 304,000, below analysts’ forecasts and not far from the six-and-a-half year low of 300,000 touched the previous week. [more here]

U.S. stocks ended a holiday-shortened week with the Standard & Poor’s 500 making its biggest weekly gain in nine months. For the four days, the S&P 500 added 2.7 percent and both the Dow Jones industrial average and the Nasdaq Composite advanced 2.4 percent.

The weekly result is worth noting because it marks a strong turnaround after six weeks of turmoil that primarily affected overpriced information technology, biotechnology and other issues, mostly in the Nasdaq Composite.

By the end of last week, the bursting of that bubble was showing an increasing tendency for the selling to spread to the broad market. That hasn’t happened, at least not yet. In its reversal from an oversold condition, the market benefited from several developments... [more here]

--and IBD still hasn't announced this correction's 'follow-thru-day', although fwiw if we get more consolidation it might be as early as Tuesday...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: financial; goldbugs; hr2847; randsconcerntrolls; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-72 next last

To: Lurkina.n.Learnin

—and this on a day that stocks seem to be pushing in to new highs. Like, the correction’s spent and we’re finally getting back into an uptrend...

To: expat_panama

Was the volume up enough to call it a follow thru ?

To: Lurkina.n.Learnin

To: expat_panama

Not yet

“But while the market rebound has been robust, there is still no clear confirmation of the current rally attempt. Market price and volume gains so far haven’t been strong enough to conclude that a shift in market direction has occurred.”

To: expat_panama

To: Lurkina.n.Learnin

a lot there, [bookmarking etfguide.com]

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: Lurkina.n.Learnin

Interesting article on inflation in today's article listing. Doesn't take too many rocket scientist to figure that one out. Just visit WMT on any successive weeks. Prices are consistently going up, or package sizes are shrinking.

I see this accelerating this year, and it will finally get some traction of the news outlets.

Doesn't do the DJIA much good to go up 5% during the year if the CPI is rising 5-10%. CPI isn't showing that yet, but look out. (or watch the government fudge the #'s)

28

posted on

04/23/2014 5:55:53 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: expat_panama

FUGLY new home sales numbers. Only a 9 standard deviation miss...

To: expat_panama

DAVID EINHORN: ‘We Are Witnessing Our Second Tech Bubble In 15 Years’

david einhorn

REUTERS/Brendan McDermid

David Einhorn.

Hedge-fund manager David Einhorn, who runs Greenlight Capital, says we’re seeing another tech bubble, CNBC reported, citing his fund’s quarterly investor letter.

“Now there is a clear consensus that we are witnessing our second tech bubble in 15 years. What is uncertain is how much further the bubble can expand, and what might pop it,” Einhorn wrote in the letter (PDF) posted online by @Levered_Hawkeye.

He continued: “In our view the current bubble is an echo of the previous tech bubble, but with fewer large capitalization stocks and much less public enthusiasm. Some indications that we are pretty far along include:

“The rejection of conventional valuation methods;

“Short-sellers forced to cover due to intolerable mark-to-market losses; and

“Huge first day IPO pops for companies that have done little more than use the right buzzwords to attract the right venture capital.”

In the letter, Einhorn writes that Greenlight is short some “high-flying momentum stocks” and “cool kid” companies that he’s dubbed the Bubble Basket.He explains that the basket approach allows him to make each individual short small in an effort to reduce risk.

The short positions weren’t disclosed in the letter.

However, the consensus on Wall Street continues to be that we are not in a tech bubble. Valuations aren’t as high, IPO activity isn’t as frenzied, and venture-capital funding isn’t exploding as it did a decade ago.

Earlier this month, Goldman Sachs put out a note giving six reasons we’re not in a tech bubble.

Unfortunately, it’s only after a bubble bursts that we realize we were in a bubble.

Einhorn, famous for his prediction of the Lehman Brothers collapse, also detailed a number of stocks in the letter that he’s long as well as some positions he exited during the first quarter of this year.

To: expat_panama

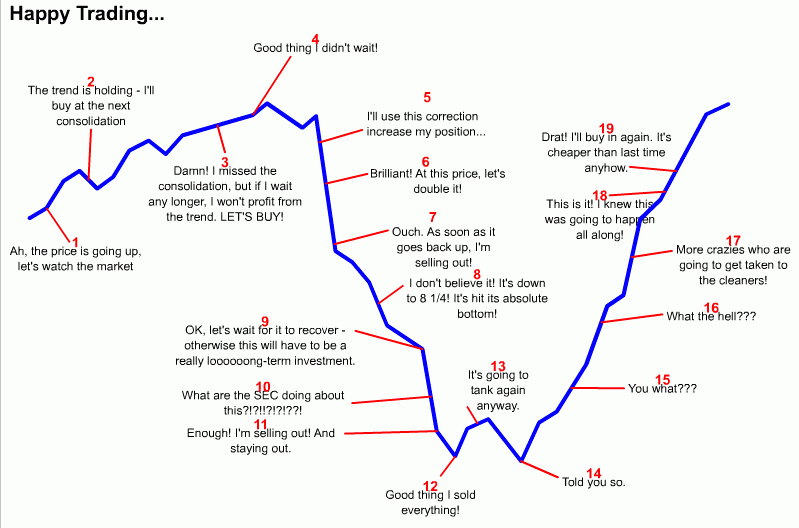

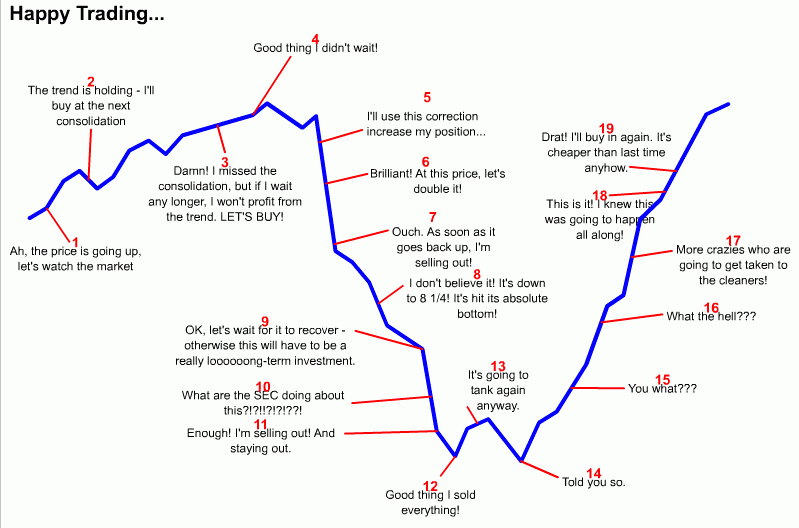

How not to invest (aka: FReepers saying the market is going to collapse as it rose 200%...)

To: Wyatt's Torch

...use this correction increase my position... Brilliant! At this price, let's double it!--which is exactly how I see the idea of buying 'on the dips'.

Short term price swings by themselves are far too chaotic for market timing, but looking at longer term trends along with volume, econ reports, political sentiment, sector trends, we get much more of a fighting chance. No way around it though, the pic does a darn good job of capturing a lot of common but avoidable market sentiment errors. The good news is that ease of entry and exit of the marketplace tends to encourage resistance to that unfortunate chain of attitudes.

To: Wyatt's Torch

Loved that graph. Actually know some day trading idiots who pretty much follow this creed to the letter. Their comment? The system is biased against me.

33

posted on

04/23/2014 9:23:27 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: Wyatt's Torch

I appreciate the graph as well.

To: All

Sold my SODA this morning. I’m happy. I’m looking at biotech for a spec.

To: catfish1957

One of my coffee buddies this morning related that very same sentiment. A 72 year-old-retiree, who was told years ago by someone that “the market is rigged,” and kept his money in CDs. As a result his nest egg of probably less than a million (which ain’t bad), would be valued many-fold that amount had he fifty years ago systematically invested in equities.

36

posted on

04/23/2014 11:25:58 AM PDT

by

abb

To: expat_panama

AAPL announces 7:1 stock split

To: Wyatt's Torch

gap up:

To: abb

Sounds a lot like my in-laws. they are quite a bit older than your coffee buddy, and lived through a small bit of the depression.

They did quite well, but I shudder at what they could have accomplished by even just moving 10% of their CD money to equities in the '50's to today.

And they are not alone. I am old enough to remember that 70-80% of those born at that time were ghastly afraid of the market, due to what happened in '29 and afterwards.

39

posted on

04/23/2014 2:31:22 PM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: Wyatt's Torch

Hmmmmm ..... kind of could see this coming, as the shine has come off the apple. This screams two issues. (1) Sales projections may be lagging due to innovation lag. (2) Issue one has created a slight capitalization void.

I know AAPL has boat loads of cash, but things like rumors of rumors can even jar a stock price this lofty.

I think the folks there are a little worried, and how better to shore the Market Cap by generating a stock price that is affordable to the masses. Just think what would happen if BRKa would do a 1000:1 split

40

posted on

04/23/2014 2:42:28 PM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-72 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson