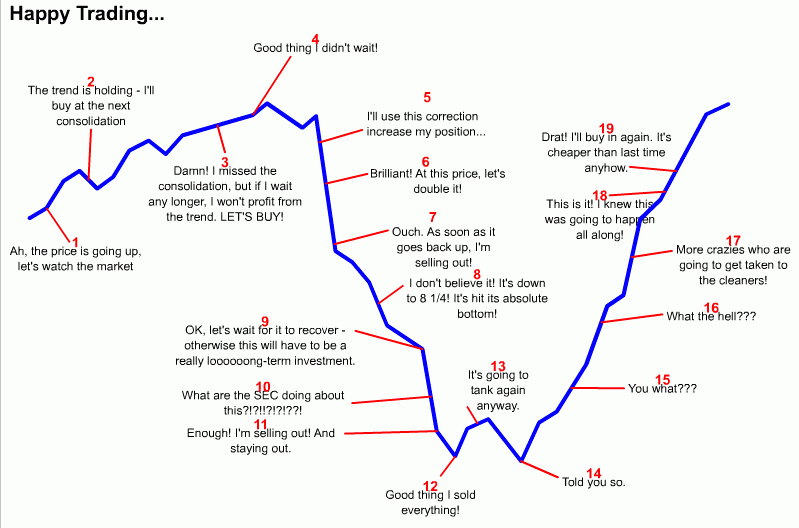

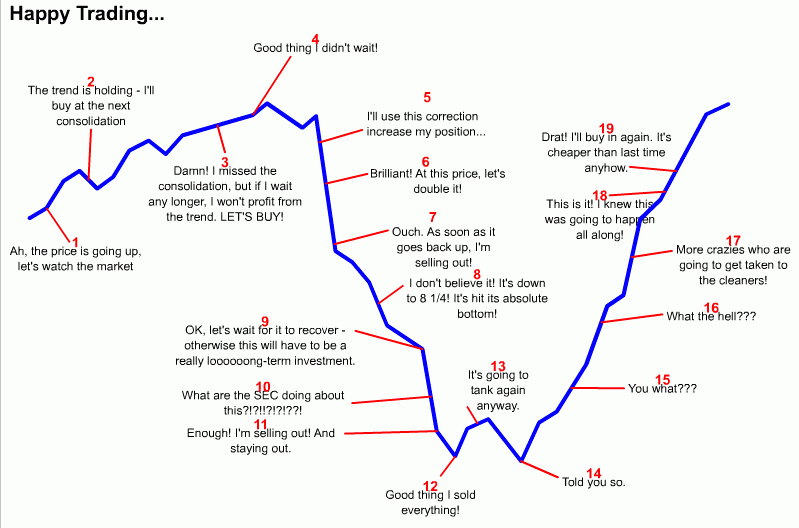

--which is exactly how I see the idea of buying 'on the dips'.

Short term price swings by themselves are far too chaotic for market timing, but looking at longer term trends along with volume, econ reports, political sentiment, sector trends, we get much more of a fighting chance. No way around it though, the pic does a darn good job of capturing a lot of common but avoidable market sentiment errors. The good news is that ease of entry and exit of the marketplace tends to encourage resistance to that unfortunate chain of attitudes.

Loved that graph. Actually know some day trading idiots who pretty much follow this creed to the letter. Their comment? The system is biased against me.

I appreciate the graph as well.

“the market is rigged,”

That was my take too at first, but now I'm thinking we're missing a bigger issue here. Namely, that there is no 'market' that's pulling a fast one but rather the fact that market prices are what people like you and I and the the day traders agree too. It's not the goofy comments that were reactions to market swings, but rather the market prices were swinging around because of the trader's attitudes.

Did you STEAL that from my personal diary??