Posted on 05/07/2013 6:41:42 AM PDT by blam

The US Economy Is The Envy Of The World Again, And Just Like That The Bears Have Been Annihilated

Joe Weisenthal

May 7, 2013, 4:44 AM

Just two and a half weeks ago, the bears were starting to feel good.

Markets around the world seemed to be rolling over. Commodities were falling. People were talking about deflation.

And then, the market turned, and then we got Friday's strong jobs report.

Now the market is back to making new highs again, and the market bears are crushed.

A new note from Olivier Korber at SocGen is titled "US payrolls annihilated 'sell in May.'" Basically, whatever temptation there was to dump risky assets starting in May (as the cliche goes) has been sapped.

Separately, Steven Englander of Citi wrote yesterday:

The implications of the payroll release for FX is that the US is back on track as an outperformer (admittedly modest, but still standing out) in a world of underperformance, From a Fed perspective labor market improvement since last year has been steady but clear, with household and payroll employment and aggregate hours converging to a 1.5% y/y gain (Figure 1, upper panel). This is probably at the low end of what the FOMC core would consider acceptable.

This idea of the US being the one country that you "must own" was a huge theme in markets during the first quarter. Everyone sensed that the US was going towards liftoff, and that regardless of whatever else, exposure to the US was a must.

The same takeaway was offered from trader Mark Dow, who tweeted yesterday.

For now, the US is back to being the envy of the world.

(Excerpt) Read more at businessinsider.com ...

You do realize that a company does not share in the increase of its stock price, unless it owns its own stock or it issues new stock. Neither of which is common.

Companies sell stock to raise money. Its a one time event. You cannot sell stock and own it at the same time. Nor can you issue new stock without depressing the price of current stocks.

If I sell $10 million in stock to build a factory, I no longer own that stock, nor do I really own the factory. I sold a future factory for current stocks. If those stocks go to $100 million in value, I haven’t made any profit from the stock increase, the stock holders have.

More ridiculous Joe Weisenthal happy talk. Why does anyone post this crap let alone read it.

Not just tariffs, if I recall correctly Cringing wants astronomical tariffs - like 100%. He basically doesn't believe in competition. We're it left up to Cringing, we'd all still be stuck with shoddy, union made, Detroit Big-3 crap to choose from.

His heart is in the right place, but his trade policies are basically the same as folks like Bernie Sanders (Socialist-VT), Ed Schultz (Idiot, Radio Host), etc.

Is that 1 to 2% with or without Bernanke's various pump and dumps? Look I get it too, if we really have something like 15% unemployment ( ShadowStats ), that means 85% are still buy soap, toliet paper, and maybe even a new car.

Those that make those products and are beholden to shareholders, have found a way to make money, regardless of Dodd-Frank, Obamacare and every other nightmare piece of legislation their various compliance departments now have to dance to these new tunes...

But at this point do you bet against the Fed, which has never been a way to make money in the markets, or do you still look at this with a www.zerohedge.com mindset and see in the grand scheme of things, none of this makes any sense...

Well unlike you people who continue to sell America down the river, I have made a (couple) of concrete suggestions to bring back American jobs.

I do so infrequently, because the how is not nearly as important as the decision to fix this.

Stock prices and economic performance are linked. Try the capital infusion is one time but the stock price is dependent upon the value of future cash flows. the chart was showing that changes in hiring behavior and stock prices were related (looks like stock prices led by 6-9 months). My company slashed workers when our volumes were falling. Not so coincidentally the stock price was also falling as were our earnings due to market factors. Now that our end markets have been recovering over the last 18 months out stock price has more than tripled and our hiring has increased because we have volume.

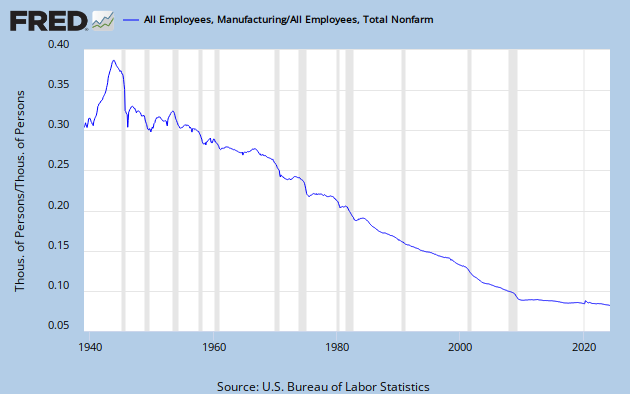

We don't live in a "Laverne and Shirley" world anymore, where "blue collar" types hang out on an assembly line for 7.45 hours a day (minus breaks) stamping bottle caps on bottles or hammering a widget into place as the product moves down the conveyor belts. Then they go home at night with an empty lunchpail where they sit in their chairs all "Archie Bunker" style while their spouse runs to the kitchen to get them a beer.

That America doesn't exist any more and never will again.

Knowledge or service workers are what is needed now and there are huge opportunities in both areas. All manufacturing has been outsourced so that they can be made more cheaply, without unions being in the way, and Americans can continue purchasing luxury items on more or less fixed wages.

It might not make any sense in the long run but in the shorter run the S&P is up 137% from the low in 2009. It will have a correction but in the meantime you’ve missed out on a lot of profits.

As far the the underlying economics, I do forecasting for my company and I have bearish tendencies (just ask our CEO). Things have been going pretty well the last 12-18 months. The vast majority of underlying stats (IP, Cap Util, employment, housing, Consumer spending, etc) have been trending positively. Could they be better? Sure. But ride it while you can. These things are always cyclical. You are missing out if you are a perma-bear waiting for the world to collapse.

And on the action of the Fed, I’ve said before that they are doing the exact right thing with QE. QE is the mechanism to inject liquidity into an economy starved for it (ie. Deflation). Given the monetary velocity stats one could argue that the fed hasn’t done enough. At best they are adding enough liquidity to just more than offset the constricting fiscal and regulatory environment. If you want to see a collapse, take away the liquidity. See Japan for the example of how that turns out.

Cringing, we make suggestions all the time when we respond to your comments. I think you maybe aren't reading them and just continue posting the same thing over and over. Your mostly posting slogans, not solutions.

The way to make America more competitive is pretty simple. Cut taxes, cut regulation, weaken unions through right to work legislation, reduce public dependence on government handouts, pass tort reform, etc. The recipe isn't all that complicated. Get government OUT of the way, make America THE place to come and do business. Be more like Texas and North Dakota and less like Illinois and California.

Bears annihilated = crash coming

You are a filthy Communist! How dare you suggest that we should protect our national economy and our own prosperity!

US Economy is the envy of the World - What country are you in? The Bears have been annihilated - right the Chicago Bears are losers in football. ( I know what is meant - the stock market - but the stock market is being boosted by the Feds to make it look better than it is really is) Look around more and more business are shutting their doors. Small towns are cutting services and more homes are being abandoned.

Yet industrial production for manufacturing is nearing an all time high:

The productivity of American manufacturing cannot be underestimated. My company manufactures almost 100% in the US (we run foundries) yet our automation and LEAN efforts have reduced the number of workers required to produce the volumes.

yes, i heard that on cavuto show. i think it is because of all the money being printed every day

Bingo.

Stock prices reflect a company’s prospects during normal times, when basic economics are at work.

What do you suppose happened to stock prices during the Weimar Republic’s QE folly? They went up exponentially.

Right now the Fed is creating $85 billion a month to inflate stock prices. Thus, stock prices are tied more to dollar speculation than any particular company’s prospects. There are a limited number of assets that you can convert, soon to be worthless, dollars into. Stocks are one of those assets.

We should hire everyone in the US to dig a tunnel to Hawaii using just spoons. That’s a concrete suggestion that will bring back the jobs, right?

If your heart really is in the right place you need to mentally differentiate between jobs and welfare.

Wealth is something useful - something that people need - that wasn’t there before you created it.

A worthwhile job is something that produces net wealth.

If a company can’t produce net wealth then it should sell its assets and the people involved should go do something else. Normally the action of the Free Market ensures that this is indeed what happens.

But these days if a company can’t produce wealth then it just yells for the Government to subsidize it in order to ‘save jobs’.

But these aren’t jobs anymore. Once a job requires a subsidy from the taxpayer it becomes a welfare scheme.

For instance: all those people at GM who create the GM Volt. Are they adding wealth to society?

They have ‘jobs’. They even have ‘American jobs’. But their cars are collecting dust on Government car-lots while they get to retire early on your dime. That isn’t a job. The people at GM are on welfare.

Should their ‘jobs’ be protected from reality even further by imposing tariffs? Should your countrymen be forced to buy Volts?

I've posted a thousand charts on various threads that bolster my case that things are improving. Here's yet another that shows why stocks are up. It's because earnings are up to record highs:

My company being up 300% in the last two years has zip to do with QE. Ditto for hundreds and hundreds of other companies. It's the fundamentals. Ignore them if you wish. Not my problem you are choosing to miss out.

You said it FRiend. The way to improve America is to reduce Government, reduce the horrendous burden of legal vulnerability hanging over all businesses, defund and defang the EPA - get rid of the barriers to wealth production.

So many seem to think Government should just mandate what people should do with their own capital - as if we were all the property of the state. But - as you say - the solution is not more government but less.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.