Posted on 06/10/2009 11:22:41 AM PDT by mathprof

Government debt prices tumble as new debt is prepped for auction and Russia says it will sell some of its holdings.

Treasury yields soared to seven-month highs Wednesday as the government prepared to sell $19 billion in 10-year notes and Russia said it would reduce its share of U.S. debt.

The benchmark 10-year note fell 17/32 to 93-16/32, and its yield surged to 3.93% from 3.86% late Tuesday. The yield was at its highest levels since settling Nov. 3 at 3.96%.

Bond prices and yields move in opposite directions.

The 2-year note dipped 1/32 to 99-4/32, and its yield rose to 1.33%. The yield on the 3-month note held steady at 0.18%.

The 30-year bond sank 1-5/32 to 92-11/32, and its yield jumped to 4.73% from 4.65%.

Earlier in the session, the yield on the longbond reached as high as 4.73%. The last time the 30-year bond settled this high was nearly a year ago on June 19, 2008, when the yield ended the session at 4.76%.

Debt sale: The government continued to sell large amounts of debt to fund the stimulus aimed at boosting the economy.

(Excerpt) Read more at money.cnn.com ...

Very high interest rates, very high inflation...

Increase in interest rates for starters.

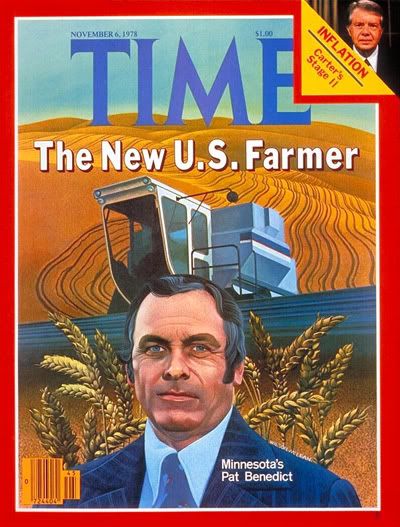

1978 redux on steroids.

mortgage rates 17+%?

I expect real inflation to average, with peaks and troughs, 10-15% per year over the next 10 years. What a “peak” could look like, and what might happen if public confidence completely collapses, is anybody’s guess. Can the Govt maintain the facade and keep general “confidence?”

General productivity gains in the economy may help somewhat reduce the impact of inflation, but otherwise, only through constant and high inflation can the Govt reduce its massive debt and reduce the burden of the massive unfunded liabilities of Soc. Sec. etc... that are looming. Remember, inflation is a tax - so your taxes will be rising regardless!

“soar”...that’s good, right? /s

I assume by your tag you can do the math, professor. Are you as worried as I am?

You bet I am. At least I have a fixed-rate mortgage. Also, I remember quite well the late 70s...

I'm coining the term in advance, "hyper-stagflation".

Also, read about the Weimar Republic to see what out-of-control spending can buy you:

http://en.wikipedia.org/wiki/Inflation_in_the_Weimar_Republic

Those with fixed, Low interest loans will be in the winners circle ...

Yes.

It won't touch the unfunded liabilities because those will be increased with cost of living adjustments and increased payments to doctors to keep them accepting Medicare. Just think of grandma and grandpa compaining that their billion dollar SS check not covering their bills with gasoline over five million dollars a gallon and you can't go out to dinner for less than ten million each.

As President Carter appeared on prime-time television last week to proclaim and explain the long-awaited Stage II of his campaign to slow the inflation that has reached an annual rate of 10%, his manner and delivery befitted the solemnity of his subject. Seated at his Oval Office desk and reading from a prompter, the President vowed to try "to arouse our nation to join me" in the long-range fight.

One problem in Carter's effort to dramatize his program was that much of it had already leaked out. There had been divisions within his Administration over how tough a stand to take, and when to take it. And as a decision was being reached, final work was repeatedly delayed, first by the Egyptian-Israeli talks at Camp David, then by the frenetic end of the congressional session.

Other leaks had sprung from the Administration's commendable efforts to brief key leaders in Congress, business and labor, as well as reporters, on what the program would require. The advance disclosures placed a large burden on Carter's capacity for rhetoric.

As one aide put it: "How the President sounds will be as important as anything we put into this program." The President is hardly a natural orator, but he made a good try. Through the typewriter of Chief Speechwriter James Fallows, Carter's text had undergone seven drafts.

Checking a tendency toward overstatement, Carter deliberately adopted a cautious, realistic, even humble, attitude toward his struggle with inflation.

"I do not have all the answers," he admitted. "Nobody does." He conceded frankly: "We have tried to control it, but we have not been successful."

His new policy, he said, "is almost certain not to succeed if success means quick or dramatic changes. A long-term disease requires long-term treatment." But he pleaded: "It is up to us to make the improvements we can, even at the risk of partial failure, rather than to ensure failure by not trying at all." Considering the complexity of both the problem and his plans to solve it, Carter's explanation was quite clear. He contended, perhaps a bit simplistically, that he faced only three alternatives:

1) to impose mandatory wage and price controls, which business and some union leaders abhor;

2) to induce a recession, which might reduce inflation but only at the cost of high unemployment and lower business profits; and

3) to set voluntary wage and price guidelines, with the Government using whatever levers of persuasion and economic pressure it can to see that they are observed.

Jimmie Carter November 1978, read and weep.....

We are in the early stages of "Carter on steroids" presently.

As the interest rates on the bonds go up, the Fed will get less money up front. Therefore, they will have to borrow more—and print money to pay it back. Rinse, and Repeat.

That will drive up the prime rate on mortgages and other “prime” customers. Those with lower credit ratings will not be able to get loans without usary level interest rates.

That will cause consumers and companies to put off making capital purchases. You will drive your car into the ground because it will be more expensive to buy one.

Savings will dwindle, because you will tend to buy your staples NOW rather than wait until next week, because the price will go up. 12% inflation means that your core baskets of goods will rise about 1% per month. So, consider your $200 shopping bill this month will be $212 next month. Gonna buy that 5 pound bag of sugar now, or wait?

Because savings have dwindled the banks have less to loan. This means production will drop, and you will have even more dollars chasing after fewer products.

Wages will rise, but not enough. Remeber the days of 12-15% raises every year?

Thats just the start, and its just the consumer side. The corporate world and state-economics will be worse.

And THAT’s why this is important.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.